Interviews are opportunities to demonstrate your expertise, and this guide is here to help you shine. Explore the essential Regulations Awareness interview questions that employers frequently ask, paired with strategies for crafting responses that set you apart from the competition.

Questions Asked in Regulations Awareness Interview

Q 1. Describe your experience interpreting and applying relevant regulations.

Interpreting and applying regulations requires a meticulous approach. It’s not just about reading the text; it’s about understanding the intent and context. My experience involves thoroughly reviewing regulations, identifying key requirements, and then mapping them to specific organizational processes and activities. For instance, in my previous role at a financial institution, I was responsible for interpreting and applying KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. This involved analyzing the regulations themselves, understanding the associated guidance documents issued by regulatory bodies, and developing internal policies and procedures to ensure full compliance. I then trained staff on these procedures and conducted regular audits to ensure consistent adherence. Another example involves working with data privacy regulations, where I had to ensure our data handling practices aligned with GDPR and CCPA, which involved implementing data encryption, access controls and robust data breach response plans.

Q 2. Explain how you stay updated on changes in relevant regulations.

Staying updated on regulatory changes is crucial. I employ a multi-faceted approach. This includes subscribing to official regulatory newsletters and updates from relevant bodies (e.g., the SEC, FCA, etc.). I also leverage professional organizations and online legal databases that provide analysis and commentary on regulatory developments. Attending industry conferences and webinars is invaluable for networking and hearing about practical applications of new regulations. Finally, I actively monitor legal news sources and use RSS feeds to aggregate information. Think of it like this: regulations are constantly evolving, much like a living organism, so continuous monitoring is essential to stay ahead of the curve.

Q 3. How do you identify potential regulatory compliance risks?

Identifying potential regulatory compliance risks involves a proactive and systematic approach. It begins with a thorough understanding of the applicable regulations and their implications for the organization. I use risk assessment frameworks, often incorporating a combination of qualitative and quantitative analysis. This could involve reviewing internal processes, analyzing data flows, and identifying areas where non-compliance could occur. For example, in a healthcare setting, a risk assessment might focus on HIPAA compliance, examining data storage, access controls, and employee training procedures. A gap analysis comparing current practices against regulatory requirements is key. Identifying areas that don’t meet regulatory standards highlights potential risks. I also consider external factors such as changes in regulations or industry best practices. By anticipating potential problems, you can avoid costly and time-consuming remediation later.

Q 4. Describe your process for assessing regulatory compliance within an organization.

Assessing regulatory compliance within an organization is a multi-stage process. It starts with defining the scope – identifying all relevant regulations applicable to the organization’s activities. Next, I conduct a thorough review of existing policies and procedures to determine alignment with regulatory requirements. This usually involves interviews with staff, reviews of documents, and walkthroughs of processes. Then, I conduct a gap analysis, highlighting any discrepancies between current practices and regulatory expectations. Based on this analysis, a remediation plan is developed, including corrective actions, timelines, and responsible parties. Finally, I implement a monitoring and reporting system to track progress and ensure continued compliance. This could include regular audits, self-assessments, and management reporting. This whole process is iterative, much like building a house – each step requires careful consideration and coordination.

Q 5. How would you handle a situation where a regulation is unclear or ambiguous?

When a regulation is unclear or ambiguous, a structured approach is crucial. First, I carefully review the entire regulation, including any supporting guidance or interpretive materials. I also consult legal counsel to seek expert opinions on the interpretation. If necessary, I look for similar regulations or industry best practices to gain further context. Engagement with other professionals in the field is valuable – attending conferences, joining relevant associations can provide insight into how others have navigated similar ambiguities. Finally, I document the interpretation chosen and the rationale behind it, preserving a clear audit trail of the decision-making process. This approach reduces potential future disputes and demonstrates due diligence. Think of it as detective work – you carefully piece together the evidence to arrive at a reasonable conclusion.

Q 6. What is your approach to resolving regulatory compliance issues?

Resolving regulatory compliance issues requires a systematic and proactive approach. First, the issue is clearly defined and documented, along with any potential impact. Next, I investigate the root cause of the non-compliance to understand why it occurred. This frequently involves analyzing the processes and identifying any gaps in training, procedures, or resources. Then, a corrective action plan is developed, outlining specific steps to address the issue and prevent recurrence. This may involve updating policies, providing additional training, or implementing new control measures. Progress is closely monitored and documented, with regular updates to stakeholders. Finally, lessons learned are documented to inform future compliance efforts. Essentially, we follow the ‘five whys’ methodology to get to the core issue, fix it, and implement preventive measures.

Q 7. How do you ensure compliance with data privacy regulations (e.g., GDPR, CCPA)?

Ensuring compliance with data privacy regulations like GDPR and CCPA requires a comprehensive strategy. This begins with a thorough data mapping exercise to identify all personal data collected, processed, and stored by the organization. Then, we implement appropriate technical and organizational measures to protect this data, including data encryption, access controls, and data minimization techniques. Data protection impact assessments (DPIAs) are conducted for high-risk processing activities. We ensure that individuals have the right to access, rectify, erase, and restrict the processing of their data. A robust incident response plan is developed to handle data breaches promptly and effectively. Employee training is critical, raising awareness of data privacy regulations and organizational policies. Regular audits and monitoring help to ensure continuous compliance. Compliance with these regulations isn’t a one-time effort, it is a continuous journey requiring ongoing vigilance and proactive measures.

Q 8. Explain your understanding of Sarbanes-Oxley Act (SOX) compliance.

The Sarbanes-Oxley Act of 2002 (SOX) is a federal law enacted in response to major corporate accounting scandals. Its primary goal is to protect investors by improving the accuracy and reliability of corporate disclosures. This is achieved through a comprehensive set of regulations impacting corporate governance, financial reporting, and internal controls.

My understanding of SOX compliance encompasses several key areas:

- Internal Controls: SOX mandates the establishment and maintenance of robust internal controls over financial reporting (ICFR). This involves documenting processes, conducting regular audits, and remediating any identified weaknesses. Think of ICFR as a company’s financial ‘check engine light’ – constantly monitoring for errors.

- Financial Reporting: Companies must ensure that their financial statements are fairly presented, accurate, and compliant with Generally Accepted Accounting Principles (GAAP). This requires meticulous record-keeping and a rigorous review process.

- Corporate Governance: SOX strengthens corporate governance by increasing the responsibilities of senior management and the audit committee. Independent auditors play a critical role in assessing the effectiveness of internal controls.

- Section 302: This section requires the company’s CEO and CFO to certify the accuracy of the financial reports. This places significant personal responsibility on top executives.

- Section 404: This section outlines the requirements for management assessment and independent auditor attestation of the effectiveness of ICFR.

In practical terms, SOX compliance demands a culture of meticulousness and accountability within an organization. It’s not just about ticking boxes; it’s about embedding robust processes and a commitment to transparency.

Q 9. How familiar are you with HIPAA regulations?

I am very familiar with the Health Insurance Portability and Accountability Act of 1996 (HIPAA). It’s a complex legislation focused on protecting the privacy and security of Protected Health Information (PHI). PHI includes any individually identifiable health information, whether electronic, paper, or oral.

My understanding includes:

- Privacy Rule: This governs the use and disclosure of PHI, requiring organizations to obtain patient consent for most disclosures. Think of it as giving patients control over their medical information.

- Security Rule: This establishes national standards for the security of electronic PHI, covering administrative, physical, and technical safeguards. This is like building a secure vault for sensitive medical data.

- Breach Notification Rule: This mandates notification of individuals and authorities in the event of a data breach. This ensures transparency and enables prompt response to security incidents.

- Enforcement Rule: This specifies enforcement mechanisms, including civil monetary penalties for violations. The penalties can be substantial, underscoring the importance of compliance.

HIPAA compliance is crucial for healthcare providers, health plans, and business associates who handle PHI. Failure to comply can lead to significant fines, legal action, and reputational damage.

Q 10. How do you ensure compliance with industry-specific regulations?

Ensuring compliance with industry-specific regulations requires a multi-faceted approach. It begins with a thorough understanding of the applicable regulations. This often necessitates consulting legal counsel and leveraging specialized resources.

My approach involves:

- Regulatory Mapping: Identifying all applicable regulations relevant to the organization’s activities. This is like creating a detailed map showing the regulatory landscape.

- Risk Assessment: Evaluating the potential risks associated with non-compliance. This allows prioritization of efforts and resource allocation.

- Policy Development: Developing and implementing clear policies and procedures to ensure compliance. This is crucial for consistency and operational efficiency.

- Training and Education: Providing comprehensive training to all relevant employees. This ensures everyone understands their roles and responsibilities in maintaining compliance.

- Monitoring and Auditing: Regularly monitoring compliance through internal audits and self-assessments. This proactive approach identifies potential weaknesses early on.

- Documentation: Maintaining thorough documentation of compliance efforts. This is crucial for demonstrating compliance to regulators, if needed.

For example, in a financial institution, compliance with SOX, BSA/AML (Bank Secrecy Act/Anti-Money Laundering), and Dodd-Frank would be paramount. In a healthcare organization, HIPAA compliance is critical. The specific regulatory requirements vary depending upon the industry and the nature of the business activities.

Q 11. Describe a time you identified a potential regulatory violation.

During an internal audit of a financial reporting process, I discovered a discrepancy in revenue recognition. A significant number of transactions were being recorded in the wrong accounting period, potentially misrepresenting the company’s financial performance. This was a potential violation of SOX and GAAP.

The initial analysis revealed a lack of clarity within the accounting team regarding the specific revenue recognition criteria for certain types of contracts. It was not a malicious act, but a lack of clear processes and training.

Q 12. How did you address that violation and what was the outcome?

Addressing this potential violation involved a multi-step process:

- Immediate Action: I immediately reported my findings to the appropriate management personnel, detailing the nature of the discrepancy and its potential impact.

- Root Cause Analysis: We conducted a thorough root cause analysis to understand why the errors occurred. This included reviewing existing processes, interviewing staff, and analyzing transaction data.

- Corrective Action Plan: We developed a detailed corrective action plan, which included retraining the accounting team on revenue recognition principles, implementing revised internal controls to prevent similar errors in the future, and correcting the misstated financial records.

- Remediation: We thoroughly corrected the misstated financial records and reported the findings in the next quarterly report.

The outcome was successful. The errors were corrected, the underlying causes were addressed, and the internal controls were strengthened. This experience reinforced the importance of proactive auditing and thorough investigation in maintaining compliance. No regulatory action was required as the issue was resolved promptly and transparently.

Q 13. How do you communicate regulatory requirements to colleagues and stakeholders?

Communicating regulatory requirements effectively is vital. My approach involves a combination of methods tailored to the audience:

- Training Sessions: Conducting interactive training sessions to explain the regulations in a clear, concise manner, using real-world examples to illustrate the concepts.

- Written Materials: Developing easy-to-understand written materials, such as policies, procedures, and FAQs, to serve as ongoing references.

- Regular Updates: Providing regular updates on any regulatory changes to keep stakeholders informed of evolving requirements.

- Interactive Communication: Facilitating open communication channels to encourage questions and address concerns. Regular Q&A sessions are useful.

- Visual Aids: Using charts, diagrams, and flowcharts to simplify complex information and improve understanding.

By using a variety of methods, I ensure that the information is effectively communicated and understood by colleagues and stakeholders at all levels.

Q 14. What training have you undertaken to enhance your regulatory knowledge?

To enhance my regulatory knowledge, I have undertaken several training initiatives, including:

- Professional Certifications: I have pursued relevant certifications such as the Certified Information Systems Auditor (CISA) and the Certified in Risk and Information Systems Control (CRISC), to demonstrate a commitment to continuous professional development in this field.

- Industry Conferences and Webinars: I regularly attend industry conferences and webinars to stay current on emerging regulations and best practices.

- Formal Regulatory Training: I participate in formal training courses provided by leading regulatory bodies and educational institutions. This ensures a detailed understanding of regulatory frameworks and legal requirements.

- On-the-Job Experience: My years of practical experience in regulatory compliance have significantly enhanced my knowledge and understanding of real-world applications.

This continuous learning approach ensures that I am well-equipped to handle the evolving regulatory landscape and effectively advise others on compliance matters.

Q 15. Describe your experience conducting regulatory audits.

Conducting regulatory audits involves a systematic and rigorous examination of an organization’s practices to ensure compliance with relevant laws, regulations, and industry standards. This is not a simple checklist; it requires a deep understanding of the specific regulations governing the organization’s activities.

My approach involves several key steps: First, I identify all applicable regulations. This might involve reviewing government websites, industry publications, and internal documentation. Second, I develop an audit plan that outlines the scope, objectives, and methodology. This plan includes specific procedures for gathering evidence, such as reviewing documentation, interviewing personnel, and observing processes. Third, I execute the audit plan, meticulously documenting findings and any discrepancies. Fourth, I analyze the audit findings, identifying root causes of non-compliance and assessing the level of risk. Finally, I prepare a comprehensive report with recommendations for corrective actions. For example, in a recent audit of a pharmaceutical company, I discovered discrepancies in their record-keeping related to clinical trials. This led to recommendations for improved training and the implementation of a new, more robust electronic system for documentation.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you create and maintain a regulatory compliance program?

Creating and maintaining a robust regulatory compliance program is an ongoing process that requires a commitment from the entire organization. It’s like building a strong house – you need a solid foundation and consistent maintenance to ensure it remains structurally sound.

- Risk Assessment: Identify all potential regulatory risks by analyzing the organization’s activities and the applicable laws and regulations. This is critical for prioritizing efforts.

- Policy Development: Create clear, concise, and comprehensive policies and procedures that outline how the organization will comply with regulations. These should be readily accessible to all employees.

- Training and Education: Provide regular training and education to employees on relevant regulations and policies. This ensures everyone understands their responsibilities.

- Implementation and Monitoring: Implement the policies and procedures, then actively monitor compliance through audits, self-assessments, and key performance indicators (KPIs). Regular monitoring helps catch problems early.

- Documentation: Meticulously document all compliance-related activities, including training records, audit reports, and corrective action plans. This provides an audit trail and supports accountability.

- Continuous Improvement: Regularly review and update the compliance program to reflect changes in regulations and best practices. This is crucial in an ever-changing regulatory landscape.

For instance, in a financial institution, a comprehensive program might include specific policies on anti-money laundering (AML) and Know Your Customer (KYC) compliance, with regular training and audits to ensure adherence.

Q 17. How do you balance regulatory compliance with business objectives?

Balancing regulatory compliance with business objectives is a delicate act – it’s about finding the sweet spot where you minimize risk without hindering growth. Think of it as navigating a tightrope; you need to maintain your balance.

A key strategy is integrating compliance into the business strategy itself, not treating it as a separate entity. This involves proactively considering compliance implications in all major business decisions. For example, before launching a new product, we’d assess the potential regulatory hurdles and adjust plans accordingly, possibly even delaying launch if necessary to ensure full compliance. We also foster a culture of compliance, empowering employees to raise compliance concerns without fear of retribution. Regular communication between compliance, legal, and business units is critical, ensuring that compliance is viewed not as an obstacle, but as a crucial factor in enabling sustainable growth and mitigating potential financial and reputational damage. Ultimately, a strong compliance program helps avoid penalties and protects the organization’s reputation, which indirectly contributes to its success.

Q 18. Describe your understanding of the consequences of non-compliance.

The consequences of non-compliance can be severe and far-reaching, impacting an organization’s financial stability, reputation, and even its ability to operate. These consequences vary depending on the specific regulation violated and the jurisdiction.

- Financial Penalties: Organizations can face substantial fines and penalties for non-compliance. These can cripple even large corporations.

- Legal Action: Non-compliance can lead to lawsuits, injunctions, and even criminal charges.

- Reputational Damage: Public disclosure of non-compliance can severely damage an organization’s reputation, leading to loss of customer trust and market share.

- Operational Disruptions: Regulatory action can result in operational disruptions, such as suspension of licenses or cease-and-desist orders.

- Loss of Business Opportunities: Non-compliance can disqualify an organization from bidding on contracts or participating in certain markets.

For example, a company failing to comply with data privacy regulations (like GDPR) could face hefty fines and lose customer trust, leading to significant financial losses. Another example would be a manufacturing plant failing to meet environmental standards, which could result in costly cleanup operations and legal battles.

Q 19. How do you ensure the accuracy and completeness of regulatory reporting?

Ensuring the accuracy and completeness of regulatory reporting is paramount. It’s like submitting a perfectly crafted tax return; every detail counts. Inaccuracy or incompleteness can lead to severe penalties.

My approach involves a multi-layered process: First, we use data validation techniques to ensure the accuracy of the data used in the reporting process. This involves automated checks and manual reviews. Second, a clear reporting process with defined roles and responsibilities is essential. Everyone needs to know their role in ensuring accurate reporting. Third, we use reporting software and tools to streamline the process, minimize manual intervention, and reduce the risk of human error. This minimizes the potential for error. Fourth, we conduct regular reviews and audits of the reporting process, identifying and addressing weaknesses. Fifth, we implement a system for tracking and managing corrective actions. For example, in financial reporting, a robust system of internal controls, regular reconciliation, and independent audit reviews would be crucial to ensuring accuracy.

Q 20. How do you utilize technology to support regulatory compliance?

Technology plays a crucial role in supporting regulatory compliance. It’s like having a highly efficient assistant that handles the tedious tasks, freeing up time for strategic thinking.

- Compliance Management Software: These systems help organizations manage regulatory requirements, track compliance activities, and automate reporting.

- Data Analytics: Data analytics tools help identify patterns and anomalies that might indicate compliance risks.

- Workflow Automation: Automating workflows can reduce the risk of human error and improve efficiency.

- Document Management Systems: These systems help organizations securely store and manage regulatory documents.

- AI and Machine Learning: These technologies are increasingly used to monitor compliance, identify potential risks, and automate regulatory reporting.

For example, using a GRC (Governance, Risk, and Compliance) software can help track regulatory changes, automate compliance checks, and generate reports, significantly reducing manual effort and improving accuracy.

Q 21. What are the key challenges in ensuring regulatory compliance?

Ensuring regulatory compliance presents several key challenges. It’s like navigating a constantly shifting landscape with multiple variables.

- Keeping up with regulatory changes: Regulations are constantly evolving, requiring organizations to stay informed and adapt their practices accordingly. This requires ongoing monitoring and adaptation.

- Managing complex regulations: Organizations often face a multitude of regulations from different jurisdictions, which can be difficult to navigate and understand.

- Limited resources: Implementing and maintaining a strong compliance program can require significant resources, including personnel, time, and technology.

- Global compliance: Organizations operating internationally face the added challenge of complying with different regulations in multiple countries.

- Technology limitations: Technology can be an aid, but it also presents challenges – software can fail, data breaches can occur, etc.

- Culture of Compliance: Establishing a strong culture of compliance across the organization requires a commitment from leadership and effective communication to all employees.

For example, a multinational corporation needs to navigate different data privacy laws in Europe, the US, and Asia. Similarly, a small business may struggle to allocate enough resources to comply fully with all relevant regulations.

Q 22. How do you prioritize regulatory compliance tasks?

Prioritizing regulatory compliance tasks requires a structured approach. I utilize a risk-based methodology, combining elements of urgency and impact. This means I first identify the regulations with the highest potential for negative consequences (financial penalties, reputational damage, operational disruptions) if not met. Then, I consider the immediacy of the compliance deadline. For example, a looming deadline for submitting a crucial report will take precedence over a long-term project, even if the latter carries a higher potential risk.

- High Risk, High Urgency: These tasks are tackled immediately. Think of an impending audit or a critical data security vulnerability needing immediate remediation.

- High Risk, Low Urgency: These tasks are planned and scheduled in advance. Examples include annual compliance certifications or implementing a new security protocol.

- Low Risk, High Urgency: While less impactful, these tasks still require prompt attention to avoid minor penalties or delays. An example would be updating a minor form to meet a recent change in formatting requirements.

- Low Risk, Low Urgency: These tasks are generally handled proactively, but can be prioritized lower than more pressing issues. Updating internal documentation to reflect minor regulatory changes often falls into this category.

This matrix helps me allocate resources effectively and ensures that the most critical tasks are addressed first.

Q 23. How do you measure the effectiveness of your compliance efforts?

Measuring the effectiveness of compliance efforts is crucial. My approach is multifaceted and includes:

- Key Performance Indicators (KPIs): We track metrics such as the number of completed training modules, the rate of successful audits, the number of non-compliance incidents, and the time taken to resolve compliance issues. These provide quantifiable data on our performance.

- Audits and Self-Assessments: Regular internal and external audits help identify gaps in our compliance program and measure how effectively our controls are operating. A self-assessment is a critical component allowing for proactive identification of potential issues.

- Feedback Mechanisms: We solicit feedback from employees, stakeholders, and external auditors to understand their perceptions of our compliance program. This includes anonymous surveys and regular communication channels.

- Benchmarking: Comparing our performance against industry best practices and competitors allows us to identify areas for improvement and demonstrate our performance relative to our peers.

- Incident Reporting and Analysis: We track and analyze all compliance incidents, identifying root causes to prevent recurrence and refine our program. This is crucial for continuous improvement.

By regularly reviewing these metrics and using them to improve our strategy, we can demonstrate the effectiveness of our compliance program.

Q 24. Describe your experience working with regulatory bodies.

I have extensive experience interacting with regulatory bodies, including [mention specific regulatory bodies, e.g., the FDA, SEC, etc.]. This has involved:

- Responding to information requests: Providing timely and accurate responses to their queries concerning our compliance practices.

- Participating in audits and inspections: Actively collaborating with auditors, providing necessary documentation, and addressing any concerns raised.

- Negotiating compliance schedules: Working with regulators to develop reasonable and achievable timelines for addressing identified issues.

- Submitting reports and documentation: Ensuring all regulatory filings and reports are completed accurately and submitted on time.

- Proactive engagement: Regularly attending industry conferences and networking with regulatory representatives to stay updated on evolving regulations and best practices.

In one instance, I successfully negotiated an extended deadline for a major compliance project by demonstrating our proactive efforts and commitment to resolving identified issues. This fostered a positive working relationship with the regulatory body.

Q 25. How do you adapt to evolving regulatory landscapes?

Adapting to an evolving regulatory landscape is a continuous process. My approach includes:

- Continuous Monitoring: We subscribe to regulatory updates, newsletters, and alerts from relevant bodies to ensure we are aware of emerging regulations and changes.

- Technology and Data Analytics: Utilizing regulatory technology (RegTech) solutions and data analytics tools to monitor changes in legislation and assess their potential impact on our operations.

- Internal Communication: Keeping our employees informed about significant regulatory updates and their implications through training programs and regular communication.

- Scenario Planning: Regularly simulating potential regulatory changes and assessing their impact to proactively develop contingency plans.

- Collaboration with Legal and Compliance Professionals: Engaging with external legal and regulatory experts to gain insights and support in interpreting and implementing new regulations.

For instance, when GDPR came into effect, we proactively implemented new data privacy policies, updated our systems, and provided extensive training to our employees, ensuring a smooth transition.

Q 26. How do you ensure that your organization is prepared for regulatory inspections?

Preparing for regulatory inspections requires a proactive and well-organized approach. We maintain:

- Comprehensive Documentation: A meticulously organized system for all relevant policies, procedures, training records, audit reports, and other compliance-related documents.

- Regular Internal Audits: Conducting frequent internal audits to identify and address potential compliance gaps before an external inspection.

- Mock Audits: Simulating regulatory inspections to ensure our team is prepared and our processes are efficient.

- Designated Point of Contact: Having a clearly designated team responsible for coordinating the inspection and managing communication with the regulatory body.

- Accessible Data: Ensuring easy access to all relevant data and information required by the inspectors.

This ensures a smooth inspection process and minimizes the disruption to our operations. In essence, we aim to be so well-prepared that an inspection is more of a formality than a stressful event.

Q 27. Describe your experience in developing and implementing compliance training programs.

I have significant experience in developing and implementing compliance training programs. My approach focuses on creating engaging and effective programs tailored to the specific needs of our employees and the regulatory requirements. This involves:

- Needs Assessment: Identifying the specific compliance knowledge and skills gaps among employees through surveys, interviews, and performance reviews.

- Curriculum Development: Developing a comprehensive curriculum that covers all relevant regulations and incorporates interactive elements, such as scenarios, quizzes, and case studies.

- Delivery Methods: Utilizing a variety of delivery methods including online modules, workshops, and in-person training sessions to cater to diverse learning styles.

- Assessment and Evaluation: Regularly assessing the effectiveness of the training through post-training tests, feedback mechanisms, and tracking of employee compliance behaviors.

- Continuous Improvement: Continuously updating the training materials to reflect regulatory changes and incorporate lessons learned from past compliance incidents.

One example of a successful program I implemented was a multi-module training on data security, which resulted in a significant decrease in data breaches and improved employee understanding of data protection regulations.

Q 28. Explain your understanding of the role of risk assessment in regulatory compliance.

Risk assessment is foundational to regulatory compliance. It’s a systematic process of identifying, analyzing, and evaluating potential compliance risks. This involves:

- Identifying Potential Risks: Pinpointing areas where our operations may not fully comply with existing regulations. This might involve reviewing internal processes, analyzing existing controls, and considering potential vulnerabilities.

- Analyzing the Likelihood and Impact of Risks: Assessing the probability of each risk occurring and the potential severity of the consequences if it does. This is often done using qualitative or quantitative methods, ranking risks based on their potential impact and likelihood.

- Developing Mitigation Strategies: Designing and implementing strategies to reduce or eliminate the identified risks. This may involve implementing new controls, improving existing processes, or enhancing training programs.

- Monitoring and Review: Continuously monitoring the effectiveness of the mitigation strategies and reviewing the risk assessment on a regular basis to accommodate changes in the regulatory landscape or the business environment.

A well-executed risk assessment allows us to prioritize our compliance efforts, focusing resources on the most critical areas. It’s not just about avoiding penalties, but also about building a strong compliance culture and protecting the organization’s reputation.

Key Topics to Learn for Regulations Awareness Interview

- Understanding Regulatory Frameworks: Grasp the theoretical foundations of relevant regulations, including their purpose, scope, and limitations. Consider different regulatory bodies and their interactions.

- Practical Application of Regulations: Analyze real-world scenarios where regulations are applied. Practice identifying potential compliance risks and developing mitigation strategies. This includes understanding how regulations impact decision-making processes.

- Regulatory Change Management: Explore how organizations adapt to evolving regulations. Discuss methods for staying updated on regulatory changes and ensuring ongoing compliance.

- Risk Assessment and Mitigation: Develop a strong understanding of how to identify potential regulatory breaches and devise proactive mitigation strategies. This often involves understanding the potential consequences of non-compliance.

- Documentation and Record Keeping: Understand the importance of meticulous record-keeping to demonstrate compliance. Explore best practices for maintaining accurate and easily accessible regulatory documentation.

- Ethical Considerations in Regulatory Compliance: Discuss the ethical dimensions of regulatory compliance and the role of integrity in maintaining a strong compliance culture.

- Communication and Collaboration: Learn how to effectively communicate regulatory information to different stakeholders, fostering a culture of compliance across the organization.

Next Steps

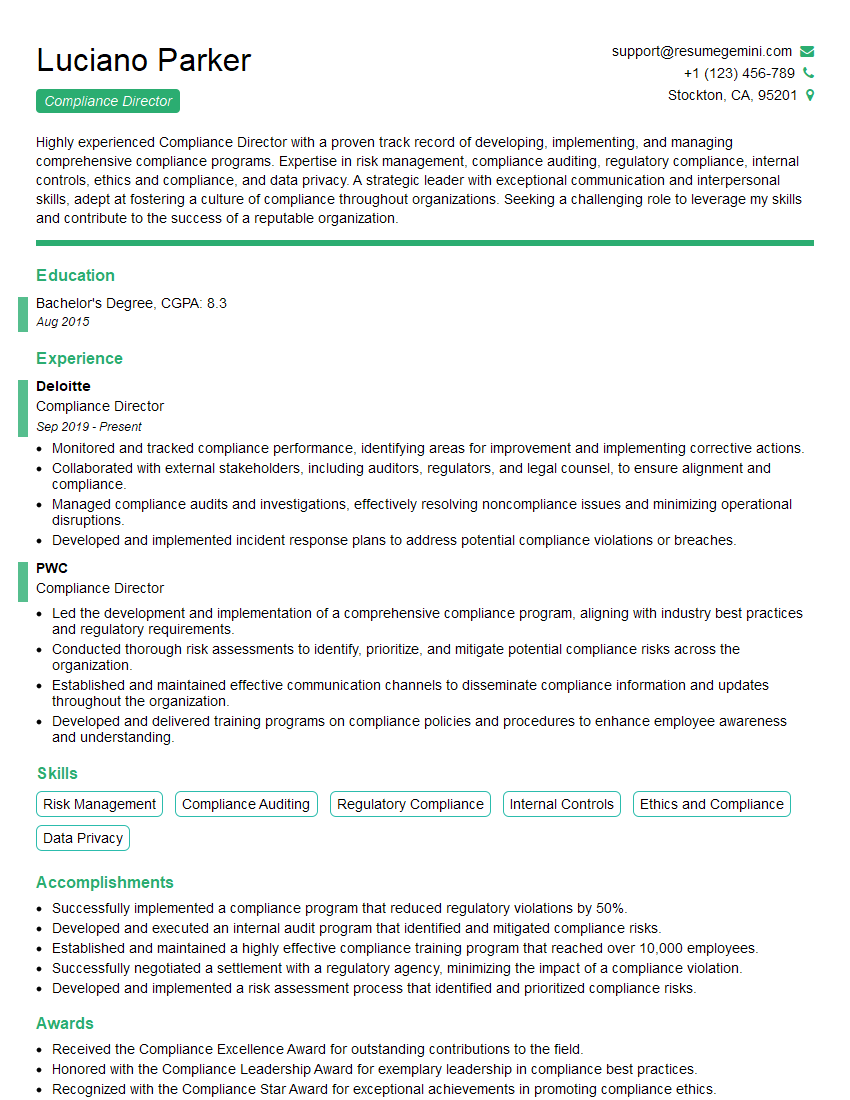

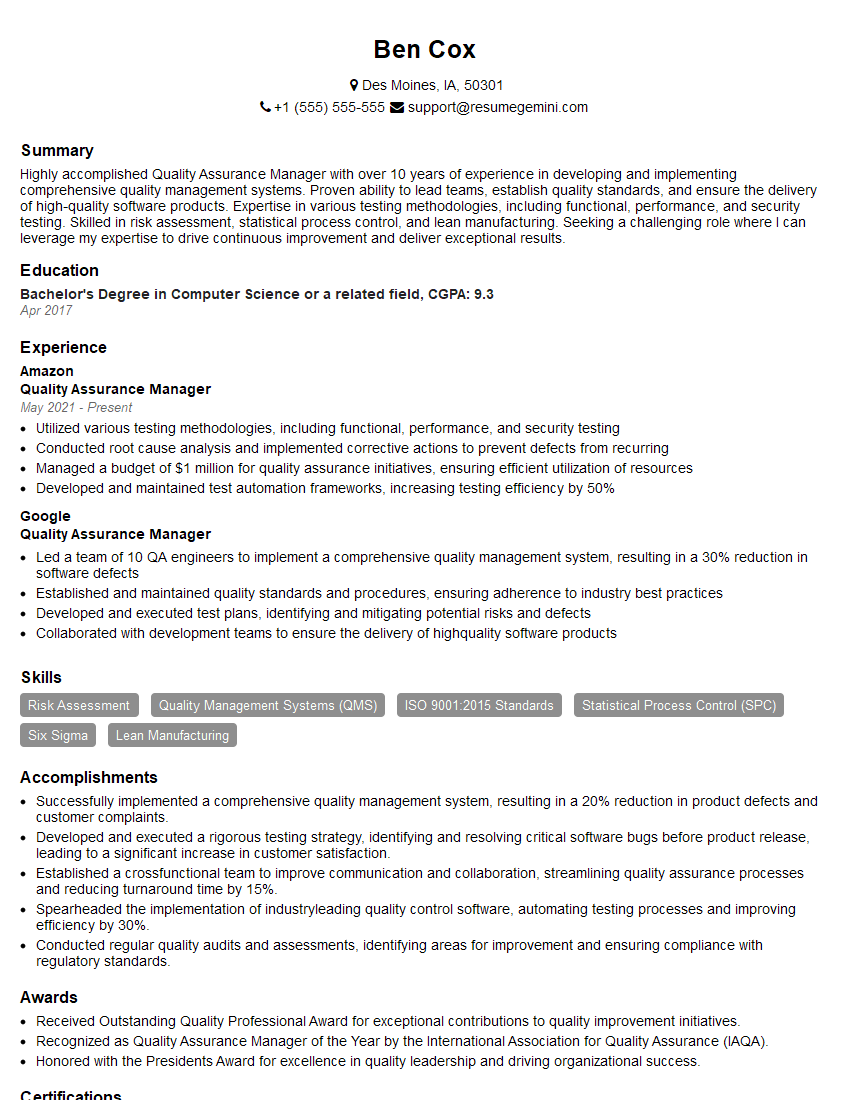

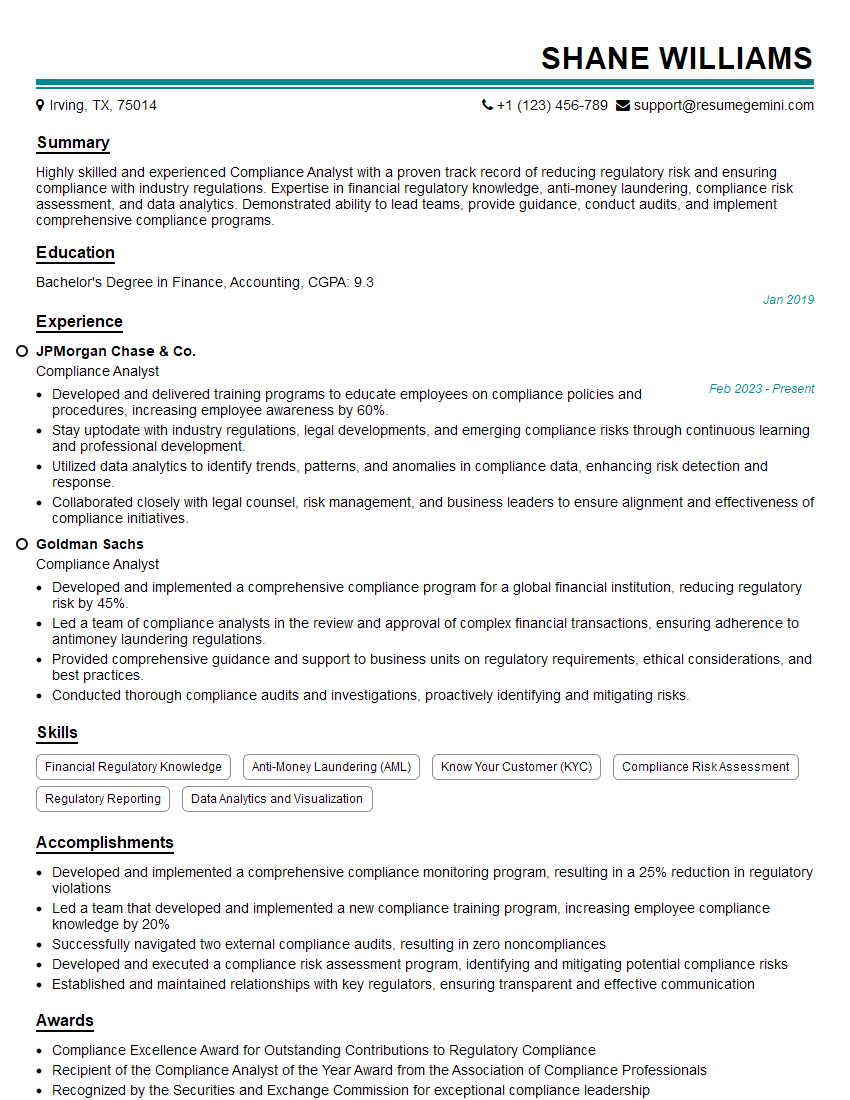

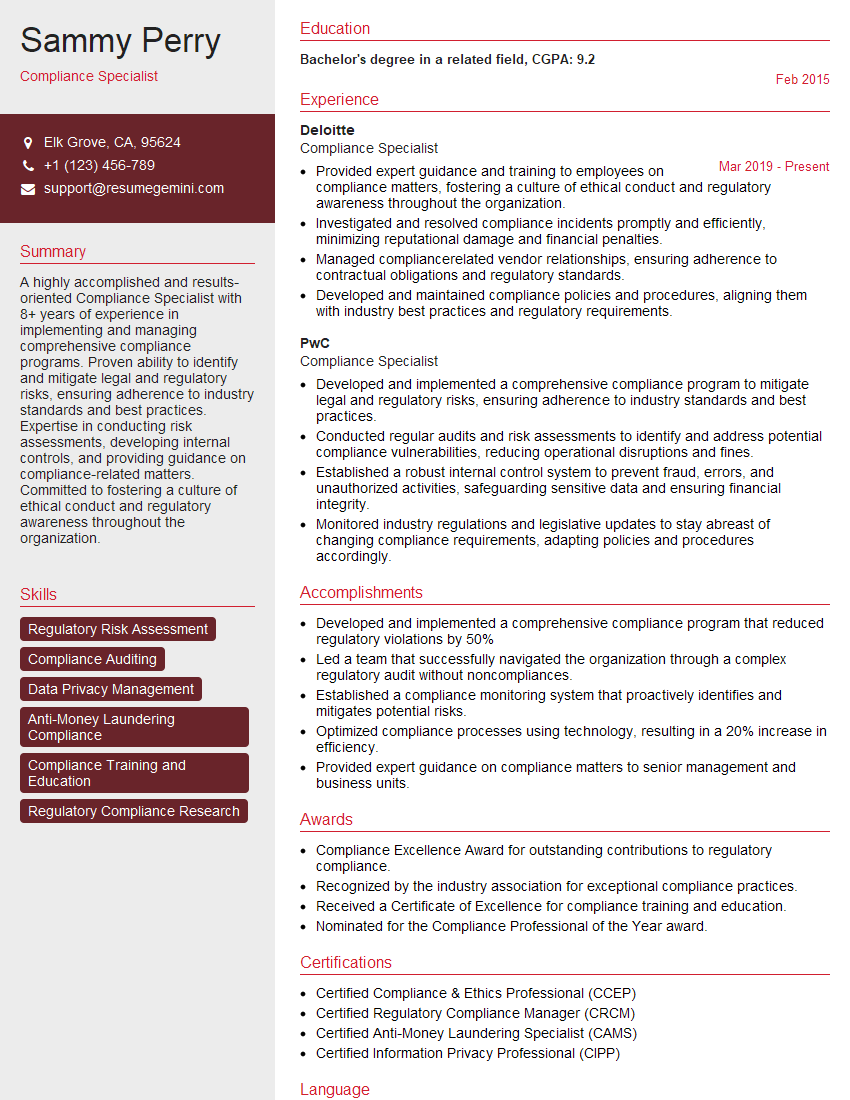

Mastering Regulations Awareness is crucial for career advancement in today’s complex regulatory landscape. It demonstrates your commitment to ethical practices and risk management, making you a highly valuable asset to any organization. To significantly enhance your job prospects, creating an ATS-friendly resume is essential. This ensures your qualifications are effectively communicated to hiring managers and Applicant Tracking Systems. We highly recommend using ResumeGemini, a trusted resource for building professional, impactful resumes. Examples of resumes tailored to Regulations Awareness are available to help you craft a compelling application that showcases your expertise.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Interesting Article, I liked the depth of knowledge you’ve shared.

Helpful, thanks for sharing.

Hi, I represent a social media marketing agency and liked your blog

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?