Cracking a skill-specific interview, like one for Healthcare Financial Management, requires understanding the nuances of the role. In this blog, we present the questions you’re most likely to encounter, along with insights into how to answer them effectively. Let’s ensure you’re ready to make a strong impression.

Questions Asked in Healthcare Financial Management Interview

Q 1. Explain the revenue cycle in healthcare.

The healthcare revenue cycle is the process of managing patient services from initial registration to final payment. Think of it as a carefully orchestrated dance involving many steps, each crucial for getting paid for the care provided. It begins with patient access and scheduling, followed by patient registration and verification of insurance coverage. Next comes the provision of healthcare services, after which accurate and timely charge capture is paramount. Then comes the crucial billing process, where claims are submitted to payers. After that, we have accounts receivable management, following up on outstanding balances and resolving denials. Finally, the cycle concludes with payment posting and reconciliation.

Example: Imagine a patient admitted for a heart procedure. The revenue cycle starts with scheduling their admission. The process continues through their treatment, with every service documented and coded for billing. Then, claims are sent to their insurance company. Following this, our team manages denials and outstanding balances, ultimately securing reimbursement for the hospital.

- Patient Access: Scheduling appointments, pre-registration.

- Registration & Insurance Verification: Collecting patient demographic and insurance information, verifying eligibility.

- Charge Capture: Accurate recording of all services provided.

- Billing & Claim Submission: Submitting claims to insurance companies and government payers.

- Accounts Receivable Management: Following up on outstanding payments, managing denials and appeals.

- Payment Posting & Reconciliation: Recording payments, reconciling accounts.

Q 2. What are the key financial statements used in healthcare, and how do they differ from those in other industries?

Key financial statements in healthcare include the balance sheet, income statement, statement of cash flows, and the statement of changes in equity. These are similar to those used in other industries but with some key differences. For example, while the income statement in manufacturing might focus on cost of goods sold, in healthcare, we’re more concerned with patient service revenue, expenses associated with providing care (salaries, supplies), and bad debt expense. The balance sheet will highlight the significant investments in medical equipment and property, plant, and equipment (PP&E) typical of healthcare organizations.

Key Differences:

- Revenue Recognition: Healthcare revenue recognition is complex due to various reimbursement methodologies (DRGs, capitation etc.), requiring specific accounting standards.

- Bad Debt Expense: A significant line item reflecting the substantial amount of uncollectible patient bills.

- Regulatory Compliance: Healthcare financial reporting is heavily regulated, demanding strict adherence to standards like GAAP and specific government regulations.

- Focus on Cost Centers: Detailed cost accounting of individual departments (e.g., cardiology, oncology) is vital for operational efficiency and reimbursement analysis.

Example: A hospital’s income statement might show a high revenue from patient services, offset by substantial expenses like physician salaries, nursing staff costs, and medical supplies. Analyzing this statement in the context of payer mix and cost center performance allows for more comprehensive financial health assessment.

Q 3. Describe your experience with healthcare reimbursement methodologies (e.g., DRGs, APC, capitation).

My experience encompasses a wide range of healthcare reimbursement methodologies. I’ve worked extensively with Diagnosis-Related Groups (DRGs), Ambulatory Payment Classifications (APCs), and capitation models. DRGs, used in inpatient hospital settings, bundle payments for specific diagnoses. APCs are similar but for outpatient procedures, where payment is based on procedure codes. Capitation, on the other hand, is a fixed payment per patient per month, regardless of services rendered, shifting the risk from the payer to the provider.

Experience with DRGs: I’ve been involved in optimizing coding accuracy to maximize DRG payments while ensuring proper compliance. This includes working with coders to ensure accurate assignment and appealing denials based on documentation discrepancies.

Experience with APCs: I’ve analyzed APC payment rates and developed strategies to improve the efficiency of outpatient services, focusing on reducing costs while maintaining quality of care.

Experience with Capitation: In capitation models, I’ve focused on population health management strategies, predictive analytics, and preventive care to control costs and maintain profitability while achieving positive health outcomes.

Example: In one case, we reviewed medical records to identify instances where upcoding or downcoding might have led to payment errors under the DRG system. We identified several instances and implemented stricter protocols to avoid such errors.

Q 4. How do you analyze and interpret healthcare financial data?

Analyzing healthcare financial data requires a multifaceted approach. It involves using various tools and techniques, combining qualitative and quantitative analysis. We begin by gathering data from various sources, including financial statements, patient accounting systems, cost reports, and operational data. This data is then cleaned and prepared for analysis, often using tools like spreadsheet software and data visualization tools. After that, we conduct ratio analysis to assess financial performance, profitability, liquidity, and solvency. Trend analysis helps us understand the performance over time. We then use benchmarking techniques to compare our performance against similar organizations.

Techniques:

- Ratio Analysis: Calculating key ratios like operating margin, liquidity ratios, and debt-to-equity ratios to assess financial health.

- Trend Analysis: Analyzing data over time to identify trends and patterns.

- Benchmarking: Comparing performance against industry averages or high-performing organizations.

- Cost Accounting: Analyzing the cost of providing specific services or in different departments.

- Variance Analysis: Investigating discrepancies between budgeted and actual results.

Example: By comparing our hospital’s operating margin to the average for similar-sized hospitals, we can identify areas needing improvement. If we find a lower-than-average operating margin, we can delve deeper to pinpoint which departments are underperforming and develop strategies for improvement.

Q 5. What are the common challenges in healthcare financial management?

Healthcare financial management faces unique challenges. These include:

- Reimbursement complexities: Navigating the intricacies of various payment models (DRGs, APCs, capitation) and government regulations.

- High operating costs: Managing substantial expenses related to staffing, technology, and pharmaceuticals.

- Unpredictable patient volumes: Dealing with fluctuating demand, particularly in emergency services.

- Bad debt and charity care: Addressing the significant portion of uncollectible patient bills.

- Regulatory compliance: Meeting stringent federal and state regulations for billing, coding, and reporting.

- Technology advancements: Keeping up with rapidly evolving technologies and their financial implications.

- Increasing healthcare costs: Balancing the need to control costs with the desire to provide high-quality care.

Example: A hospital might face a significant increase in bad debt due to changes in insurance coverage, impacting their revenue and profitability.

Q 6. How do you manage budget variances?

Managing budget variances requires a systematic approach. The first step is to identify the variance, analyzing the difference between budgeted and actual figures. We then investigate the causes of the variance. This might involve reviewing operational data, speaking with department managers, or examining billing and coding practices. Once the root cause is determined, we develop corrective actions to mitigate future variances. These actions might include adjusting staffing levels, improving operational efficiencies, or revising pricing strategies. We also implement regular monitoring to track the effectiveness of the implemented actions and make necessary adjustments.

Example: If we notice a significant increase in the cost of medical supplies, we might investigate whether this is due to price increases from suppliers, increased usage, or inefficiencies in inventory management. If it’s due to increased usage, we might examine whether there are opportunities for cost savings by negotiating better pricing or utilizing alternative, cost-effective supplies.

Q 7. Explain your experience with financial forecasting and budgeting in a healthcare setting.

My experience in financial forecasting and budgeting in healthcare involves using various methods, including statistical modeling, historical data analysis, and trend projections. We work collaboratively with department heads to gather input and develop realistic budgets that align with the organization’s strategic goals. The budget is then broken down into detailed line items, allowing for close monitoring of performance against targets. We use financial modeling software to develop various scenarios and stress test the budget under different conditions. Regular monitoring and reporting provide valuable insights into performance, allowing us to adjust projections as needed. This ensures the organization remains financially sound and achieves its objectives.

Example: I’ve developed financial models that forecast patient volumes and revenue based on historical trends, demographic data, and market analysis. These models provided valuable insights, allowing us to adjust staffing levels and allocate resources efficiently.

Q 8. Describe your experience with cost accounting in healthcare.

Cost accounting in healthcare is the process of tracking, analyzing, and controlling the costs associated with providing healthcare services. It’s crucial for understanding profitability, identifying areas for improvement, and making informed financial decisions. This goes beyond simply tracking expenses; it involves assigning costs to specific services, departments, or patient populations.

In my experience, I’ve utilized various cost accounting methods, including activity-based costing (ABC) and traditional cost accounting. ABC, for example, allows for a more precise allocation of overhead costs by identifying the activities that drive those costs and assigning them accordingly. This is especially valuable in a complex healthcare setting where many different activities contribute to the overall cost of care. I’ve used this to analyze the true cost of procedures, leading to more accurate pricing and better resource allocation. For instance, I helped a hospital identify that a seemingly inexpensive procedure was actually quite costly when indirect costs like sterilization and operating room time were factored in. This led to streamlining those processes and reducing overall costs.

I also have extensive experience with variance analysis, comparing budgeted costs to actual costs to pinpoint areas of overspending or inefficiency. This analysis is crucial for proactive cost management. I’ve used this to identify staffing inefficiencies in specific departments, resulting in cost savings and improved productivity.

Q 9. How do you ensure compliance with healthcare regulations (e.g., HIPAA, Stark Law)?

Compliance with healthcare regulations is paramount. My approach is multifaceted and proactive. It involves a deep understanding of relevant legislation such as HIPAA (Health Insurance Portability and Accountability Act) and the Stark Law (which prohibits certain referrals to gain financial benefits).

To ensure HIPAA compliance, I implement robust data security protocols, including encryption, access controls, and employee training on privacy best practices. We regularly conduct audits to identify and address any vulnerabilities. Think of it like securing a bank vault – multiple layers of protection are crucial. In one instance, we implemented a new data encryption system that significantly reduced our risk of a HIPAA violation.

For Stark Law compliance, we maintain meticulous records of all physician referrals and financial relationships. We have clear policies and procedures to ensure that all referrals are medically necessary and free from any improper financial inducements. Regular internal reviews are conducted to ensure adherence to these policies. One example is the implementation of a robust system for tracking physician compensation, ensuring transparency and adherence to Stark Law provisions.

Beyond HIPAA and the Stark Law, we maintain up-to-date knowledge of all applicable state and federal regulations and engage legal counsel when necessary to navigate complex legal landscapes.

Q 10. What are your strategies for improving revenue cycle efficiency?

Improving revenue cycle efficiency requires a systematic approach that targets multiple areas of the process. My strategies focus on optimizing each stage, from pre-authorization to payment posting.

- Streamlining Pre-Authorization: Implementing automated pre-authorization systems reduces delays and improves the likelihood of successful claim submissions.

- Enhancing Charge Capture: Implementing comprehensive charge capture processes minimizes lost charges and ensures accurate billing.

- Improving Claims Processing: Employing electronic claims submission reduces processing time and manual errors.

- Accelerating Payment Posting: Automating payment posting speeds up cash flow and reduces manual labor.

- Effective Denial Management: Establishing a robust denial management system allows for timely identification and resolution of denied claims.

For instance, in a previous role, we implemented a new electronic health record (EHR) system with integrated billing capabilities. This significantly streamlined the entire revenue cycle, reducing the days in accounts receivable (A/R) by over 20% and improving overall cash flow. Another successful strategy involved implementing a dedicated denial management team, focusing on analyzing denial reasons and developing strategies to prevent future denials. This involved training staff on correct coding and documentation procedures.

Q 11. How do you identify and mitigate financial risks in healthcare?

Identifying and mitigating financial risks in healthcare requires a proactive and comprehensive approach. It involves understanding the unique vulnerabilities within the healthcare industry and developing strategies to address them.

Key areas of risk include:

- Reimbursement Changes: Changes in government regulations or payer contracts can significantly impact revenue. We address this through scenario planning and financial modeling to predict the impact of potential changes and develop contingency plans.

- Bad Debt: Uncollectible patient accounts represent a significant financial risk. We mitigate this risk through robust patient billing and collection processes, including proactive communication with patients and utilizing collection agencies when necessary.

- Cybersecurity Threats: Data breaches can have significant financial and reputational consequences. Implementing strong cybersecurity measures, including regular security audits and employee training, is crucial. Regular penetration testing helps identify vulnerabilities proactively.

- Operational Inefficiencies: Inefficient processes can lead to increased costs and decreased profitability. This is addressed through continuous process improvement initiatives and performance monitoring.

A successful example involved identifying a potential shortfall in revenue due to an upcoming change in reimbursement rates for a particular service. Through proactive financial modeling and negotiations with payers, we were able to secure a new contract that mitigated the potential financial impact.

Q 12. Describe your experience with financial modeling in healthcare.

Financial modeling in healthcare is essential for strategic planning, budgeting, and forecasting. I have extensive experience developing and using various financial models, including discounted cash flow (DCF) analysis, sensitivity analysis, and break-even analysis.

For example, I’ve used DCF analysis to evaluate the financial viability of new service lines or capital investments. This involves projecting future cash flows and discounting them back to their present value to determine the net present value (NPV) of the investment. A positive NPV suggests a financially sound investment.

Sensitivity analysis helps assess the impact of changes in key variables on the financial outcomes. For instance, we might use sensitivity analysis to determine how changes in patient volume or reimbursement rates would affect the profitability of a new clinic. This helps identify the most critical variables and develop strategies to mitigate potential risks.

Break-even analysis helps determine the level of volume needed to cover costs and achieve profitability. This is especially important when launching new services or programs. Using these models, I’ve successfully supported strategic decisions related to facility expansion, new technology adoption, and service line development.

Q 13. How do you handle denials and appeals in the healthcare revenue cycle?

Handling denials and appeals is a critical component of revenue cycle management. My approach involves a systematic process that focuses on timely identification, analysis, and resolution of denied claims.

The process begins with identifying denied claims through regular reports and monitoring of key performance indicators (KPIs). Next, each denied claim is thoroughly analyzed to determine the reason for denial. Common reasons include incorrect coding, missing documentation, or lack of pre-authorization. Once the reason for denial is identified, an appropriate appeal strategy is developed. This might involve correcting coding errors, submitting additional documentation, or negotiating with the payer.

I’ve implemented a system that utilizes specialized software to track denials, analyze trends, and identify areas for improvement in claim submission processes. A dedicated team is responsible for managing appeals, ensuring that all appeals are submitted in a timely manner and following up on the status of each appeal. In one instance, by identifying a pattern of denials due to a specific coding issue, we implemented a training program for coding staff, resulting in a significant reduction in denials related to that issue.

Q 14. Explain your understanding of different healthcare payment models (e.g., fee-for-service, value-based care).

Understanding different healthcare payment models is crucial for financial planning and strategic decision-making. The two most common models are fee-for-service (FFS) and value-based care (VBC).

Fee-for-service (FFS) is a traditional model where providers are paid for each service rendered. This can incentivize a higher volume of services, regardless of their necessity or effectiveness. It’s simple to understand and administer but can lead to higher overall healthcare costs.

Value-based care (VBC) focuses on rewarding providers for the quality and efficiency of care, rather than just the quantity. This model encourages preventative care and improved patient outcomes. VBC models often involve risk-sharing arrangements, where providers share in the financial gains or losses based on the performance of their patient population. Examples include bundled payments and accountable care organizations (ACOs).

Other models include capitation (providers receive a fixed payment per patient per period), and global payment (a single payment for all services related to a specific episode of care). Understanding the nuances of these models allows for informed decisions regarding pricing strategies, resource allocation, and strategic partnerships. For example, a transition from FFS to a VBC model requires a significant shift in operational processes and a focus on data analytics to track and measure quality metrics.

Q 15. How do you assess the financial viability of a new healthcare program or initiative?

Assessing the financial viability of a new healthcare program or initiative requires a thorough, multi-faceted approach. It’s not just about looking at the potential revenue; we need to consider all aspects of cost and potential risk.

My process typically involves these steps:

- Market Analysis: Understanding the need and demand for the program. This includes analyzing the target population, competitor offerings, and potential market size. For example, if we’re launching a new telemedicine service, we’d examine the local demographics to determine the number of patients who might benefit and the prevalence of internet access.

- Cost-Benefit Analysis: A detailed breakdown of all anticipated costs (staffing, equipment, supplies, marketing, etc.) compared to projected revenue. This often involves creating financial models with various scenarios (best-case, worst-case, most-likely) to account for uncertainty.

- Resource Allocation: Determining if the organization has the necessary resources (financial, human, technological) to support the program effectively. This might involve securing funding through grants, fundraising, or reallocating existing budgets.

- Risk Assessment: Identifying potential risks (e.g., low patient enrollment, regulatory changes, technological failures) and developing mitigation strategies. This might include building in contingency plans or insurance policies.

- Sensitivity Analysis: Testing the model’s robustness by changing key assumptions (e.g., patient volume, reimbursement rates). This helps determine how sensitive the project’s viability is to changes in these variables.

Ultimately, a sound financial projection, supported by strong market research and risk mitigation plans, forms the basis for deciding whether to proceed with a new initiative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience with performance improvement initiatives in healthcare finance.

I’ve been involved in numerous performance improvement initiatives, focusing on areas like revenue cycle management, cost reduction, and improving operational efficiency. One successful project involved streamlining the billing process at a large hospital system.

We implemented a new electronic health record (EHR) system integrated with the billing system, leading to a significant reduction in claims denials and faster payment turnaround times. We also used data analytics to identify bottlenecks in the billing process and implemented process improvements to address these issues. This resulted in a significant improvement in Days in Accounts Receivable (DAR) – a key metric reflecting how quickly we collect payments.

In another instance, we conducted a comprehensive review of supply chain management, identifying opportunities for cost savings through bulk purchasing and contract negotiations with vendors. These efforts delivered substantial cost reductions without compromising the quality of care.

Q 17. What are your key performance indicators (KPIs) for evaluating financial health in a healthcare organization?

My key performance indicators (KPIs) for evaluating the financial health of a healthcare organization are multifaceted and depend on the specific goals and context. However, some consistently crucial metrics include:

- Operating Margin: This shows profitability after accounting for operating expenses. A healthy margin indicates efficient operations.

- Net Income/Loss: The bottom line, reflecting overall profitability after all expenses and taxes.

- Days in Accounts Receivable (DAR): Measures the efficiency of the revenue cycle. Lower DAR indicates faster payment collection.

- Debt-to-Equity Ratio: Assesses the organization’s financial leverage and risk.

- Cash Flow: Tracks the movement of cash in and out of the organization, vital for short-term financial stability.

- Patient Satisfaction Scores: While not strictly financial, these scores correlate strongly with patient volume and revenue.

- Return on Investment (ROI): Measures the return on investments in new programs or equipment.

The specific weighting of these KPIs would be adjusted based on the organization’s strategic priorities. For example, a hospital focused on expanding services might prioritize ROI on new investments, while one facing financial distress might focus on improving cash flow and reducing debt.

Q 18. How do you manage cash flow in a healthcare setting?

Managing cash flow in a healthcare setting is a critical function, requiring a proactive and multi-pronged approach. It’s all about ensuring enough cash is available to meet the organization’s obligations while maximizing returns on available funds.

- Accurate Forecasting: Developing realistic and detailed cash flow projections is essential. This involves anticipating revenue inflows (patient payments, insurance reimbursements) and outflows (salaries, supplies, debt payments).

- Effective Revenue Cycle Management: Streamlining billing processes, minimizing claims denials, and accelerating collections are key to improving cash flow.

- Inventory Management: Optimizing inventory levels to reduce storage costs and minimize waste. Just-in-time inventory strategies can be particularly effective.

- Negotiating Favorable Payment Terms: Working with suppliers to secure extended payment terms can improve short-term cash flow.

- Short-Term Financing: Utilizing lines of credit or other short-term financing options to bridge temporary cash flow gaps.

- Investment Strategies: Investing surplus cash in short-term, low-risk investments to earn returns.

Regular monitoring and analysis of cash flow are crucial to identify and address potential issues proactively. This often involves using cash flow dashboards and reporting tools to track key metrics and deviations from forecasts.

Q 19. What software or tools have you used for healthcare financial management?

Throughout my career, I’ve utilized a variety of software and tools for healthcare financial management. These include:

- Epic Systems: A comprehensive EHR system with robust billing and financial management capabilities.

- Meditech: Another widely-used EHR system with integrated financial modules.

- Blackbaud Financial Edge: A financial management system designed for non-profit healthcare organizations.

- Microsoft Excel/Power BI: For financial modeling, data analysis, and report generation.

=SUM(A1:A10)(a simple Excel formula for summing values). - Various Budgeting and Forecasting Software: Specific software packages dedicated to creating and managing budgets and financial forecasts.

My proficiency extends beyond just using these tools; I understand how to extract meaningful insights from the data they generate to support strategic decision-making. The choice of software depends heavily on the size and type of healthcare organization.

Q 20. Explain your experience with financial reporting and analysis.

Financial reporting and analysis are fundamental to my work. My experience encompasses all aspects of the process, from data collection and analysis to report preparation and presentation.

I regularly prepare various financial statements, including balance sheets, income statements, and cash flow statements. I then analyze these statements to identify trends, anomalies, and areas for improvement. This involves using various financial ratios and metrics to assess the organization’s financial health and performance. For example, I might compare the organization’s performance to industry benchmarks or historical data to identify areas for improvement.

I also prepare variance analyses, comparing actual results to budgets or forecasts, explaining any significant deviations. These reports are critical for informing management decisions, identifying potential risks, and driving improvements in financial performance. I have extensive experience presenting these findings to both financial and non-financial stakeholders, ensuring clarity and actionable insights.

Q 21. Describe your experience with healthcare mergers and acquisitions.

I have significant experience in supporting healthcare mergers and acquisitions (M&A). This involves a complex interplay of financial, operational, and legal considerations.

My role typically includes:

- Financial Due Diligence: Thoroughly reviewing the target organization’s financial records to assess its financial health, identify potential risks, and determine its fair market value. This might involve analyzing financial statements, reviewing contracts, and assessing the revenue cycle.

- Financial Modeling: Creating financial projections for the combined entity post-merger, considering factors like revenue synergies, cost savings, and integration expenses.

- Valuation: Applying various valuation methodologies (e.g., discounted cash flow analysis) to determine the appropriate purchase price.

- Integration Planning: Developing a comprehensive plan for integrating the financial systems and operations of the two organizations, minimizing disruptions and maximizing efficiency. This might involve consolidating financial systems, harmonizing billing processes, and streamlining operations.

- Post-Merger Integration Support: Providing ongoing financial support during the integration process, ensuring the combined entity achieves its financial goals.

Successful M&A requires a deep understanding of healthcare finance, a keen eye for detail, and strong analytical skills. I have consistently delivered value to clients by ensuring a smooth financial integration process and maximizing value creation after the transaction.

Q 22. How do you evaluate the financial impact of new technologies or medical equipment?

Evaluating the financial impact of new technologies or medical equipment requires a thorough cost-benefit analysis. We need to go beyond just the initial purchase price. Think of it like buying a car – you consider the purchase price, but also fuel costs, maintenance, insurance, and potential resale value. Similarly, with medical technology, we look at several key factors.

- Capital Costs: This includes the purchase price, installation costs, and any necessary infrastructure upgrades.

- Operating Costs: These are ongoing expenses like maintenance contracts, repairs, staff training, and consumable supplies (e.g., reagents for lab equipment).

- Revenue Generation: Does the technology lead to increased procedure volume, improved patient outcomes (potentially leading to higher reimbursement rates), or new service offerings? This is crucial to understanding the return on investment (ROI).

- Efficiency Gains: Will the technology improve workflow, reduce staffing needs, or shorten patient wait times? These indirect cost savings are often overlooked but significant.

- Risk Assessment: We must factor in potential risks like equipment downtime, obsolescence, and liability. We might use sensitivity analysis to model how these uncertainties could impact the overall financial outcome.

For example, consider a new MRI machine. While the initial investment is substantial, we’d analyze the potential increase in diagnostic imaging services, the potential for attracting more patients, and the reduced need for external referrals. We’d compare the projected revenue increase against the total cost of ownership over its lifespan to determine if the investment is financially sound.

Q 23. What is your experience with data analytics in healthcare finance?

Data analytics is indispensable in modern healthcare finance. My experience encompasses leveraging data to optimize resource allocation, improve revenue cycle management, and enhance cost control. I’m proficient in using various analytical tools and techniques, including:

- Predictive modeling: Forecasting patient volumes, resource needs, and potential revenue streams.

- Cost accounting: Analyzing departmental costs, identifying areas for improvement, and benchmarking against industry standards.

- Revenue cycle analysis: Identifying bottlenecks in billing and collections, optimizing claims processing, and improving reimbursement rates.

- Performance dashboards: Creating interactive dashboards to monitor key financial indicators (KPIs) in real-time and provide actionable insights to leadership.

In a previous role, I used predictive modeling to forecast patient admissions based on historical data, seasonality, and community health trends. This allowed us to optimize staffing levels and resource allocation, resulting in significant cost savings and improved patient care. We also utilized data analytics to identify and address denials in our billing process, leading to an improvement in our overall collection rate.

Q 24. How do you communicate complex financial information to non-financial stakeholders?

Communicating complex financial information to non-financial stakeholders requires clear, concise, and visually appealing communication. Think of it like translating a scientific paper into everyday language – you need to remove the jargon and focus on the key takeaways.

- Visual Aids: Charts, graphs, and infographics are far more effective than lengthy reports filled with numbers. A simple bar chart illustrating revenue growth is far more impactful than a table of raw data.

- Storytelling: Frame financial information within a narrative that relates to the organization’s goals and strategic priorities. For example, instead of just presenting a budget, discuss how the budget supports the organization’s mission to improve patient care.

- Analogies and metaphors: Use relatable examples to explain complex concepts. For example, explaining the concept of net present value (NPV) using a simple loan example makes it easier to grasp.

- Interactive sessions: Engaging stakeholders in interactive sessions, answering their questions directly and transparently, fosters understanding and trust.

For example, when explaining budget cuts to clinicians, I would focus on how reallocating resources to high-priority areas improves patient outcomes instead of solely presenting numbers. We would show the impact of the changes using simple graphs and discuss how these changes help the organization stay fiscally sound.

Q 25. Describe your experience with improving financial processes and workflows.

Improving financial processes and workflows often involves streamlining operations, automating tasks, and implementing better technology. I have experience with various process improvement methodologies, including Lean and Six Sigma.

- Streamlining the Revenue Cycle: I have implemented electronic health records (EHR) integration to improve billing accuracy and speed up the claims submission process. This resulted in a significant reduction in days in accounts receivable (DAR).

- Automating Accounts Payable: I’ve overseen the transition from manual to automated accounts payable processing, leading to greater efficiency and reduced errors. This also freed up staff time for more strategic tasks.

- Implementing Budgeting and Forecasting Tools: I’ve successfully implemented advanced budgeting and forecasting software which enabled the organization to perform more accurate financial projections and enhance resource allocation decisions.

- Process Mapping and Optimization: Through process mapping, we can identify and eliminate bottlenecks in various workflows, increasing efficiency and reducing operational costs.

In one instance, we redesigned our billing process using Lean principles. By eliminating unnecessary steps and automating tasks, we reduced the time it took to process a claim by 30%, leading to improved cash flow and reduced administrative costs.

Q 26. What is your approach to problem-solving in healthcare finance?

My approach to problem-solving in healthcare finance is systematic and data-driven. I employ a structured approach using frameworks like the DMAIC (Define, Measure, Analyze, Improve, Control) methodology from Six Sigma.

- Define the problem: Clearly articulate the problem and its scope. Gather data to quantify the issue.

- Measure the problem: Collect relevant data to understand the magnitude of the problem and identify key performance indicators (KPIs).

- Analyze the root causes: Use data analysis techniques to identify the underlying causes of the problem. Tools like Pareto charts and root cause analysis are helpful here.

- Improve the process: Develop and implement solutions based on the analysis. This might involve technological solutions, process re-engineering, or staff training.

- Control the solution: Monitor the implemented solution to ensure its effectiveness and identify any necessary adjustments. Regular reviews and tracking KPIs are essential.

For example, when dealing with a high denial rate, I would first define the problem (e.g., high percentage of claims denied due to coding errors), then measure the extent of the issue using data from the billing system. Next, I’d analyze the root causes (e.g., lack of coder training, outdated coding guidelines), implement training programs or upgrade coding software, and then monitor the denial rate to measure the impact of the solution.

Q 27. What are your salary expectations?

My salary expectations are in line with my experience and the market rate for a healthcare finance professional with my qualifications and expertise in this specific region. I’m open to discussing a competitive compensation package that reflects the value I bring to your organization.

Key Topics to Learn for Healthcare Financial Management Interview

- Revenue Cycle Management: Understanding the entire process from patient registration to payment collection, including billing, coding, and claims processing. Practical application: Analyze a scenario involving delayed payments and propose solutions to improve efficiency.

- Cost Accounting and Budgeting: Developing and managing budgets, analyzing cost drivers, and identifying areas for cost reduction within a healthcare setting. Practical application: Explain how to use variance analysis to identify and address budget overruns.

- Financial Statement Analysis: Interpreting balance sheets, income statements, and cash flow statements to assess the financial health of a healthcare organization. Practical application: Analyze key financial ratios and explain their implications for decision-making.

- Healthcare Reimbursement Methods: Understanding various payment models such as Medicare, Medicaid, and commercial insurance, and their impact on revenue and profitability. Practical application: Compare and contrast different reimbursement methodologies and their effects on a healthcare provider’s financial strategy.

- Healthcare Regulations and Compliance: Familiarity with relevant laws and regulations (e.g., HIPAA, Stark Law) and their impact on financial operations. Practical application: Discuss the financial implications of non-compliance with healthcare regulations.

- Performance Improvement and Data Analytics: Utilizing data analytics to identify trends, improve efficiency, and enhance financial performance. Practical application: Describe how data analysis can be used to optimize resource allocation and improve operational efficiency.

- Capital Budgeting and Investment Analysis: Evaluating the financial viability of capital projects and investments within a healthcare setting. Practical application: Explain the process of conducting a cost-benefit analysis for a proposed capital expenditure.

Next Steps

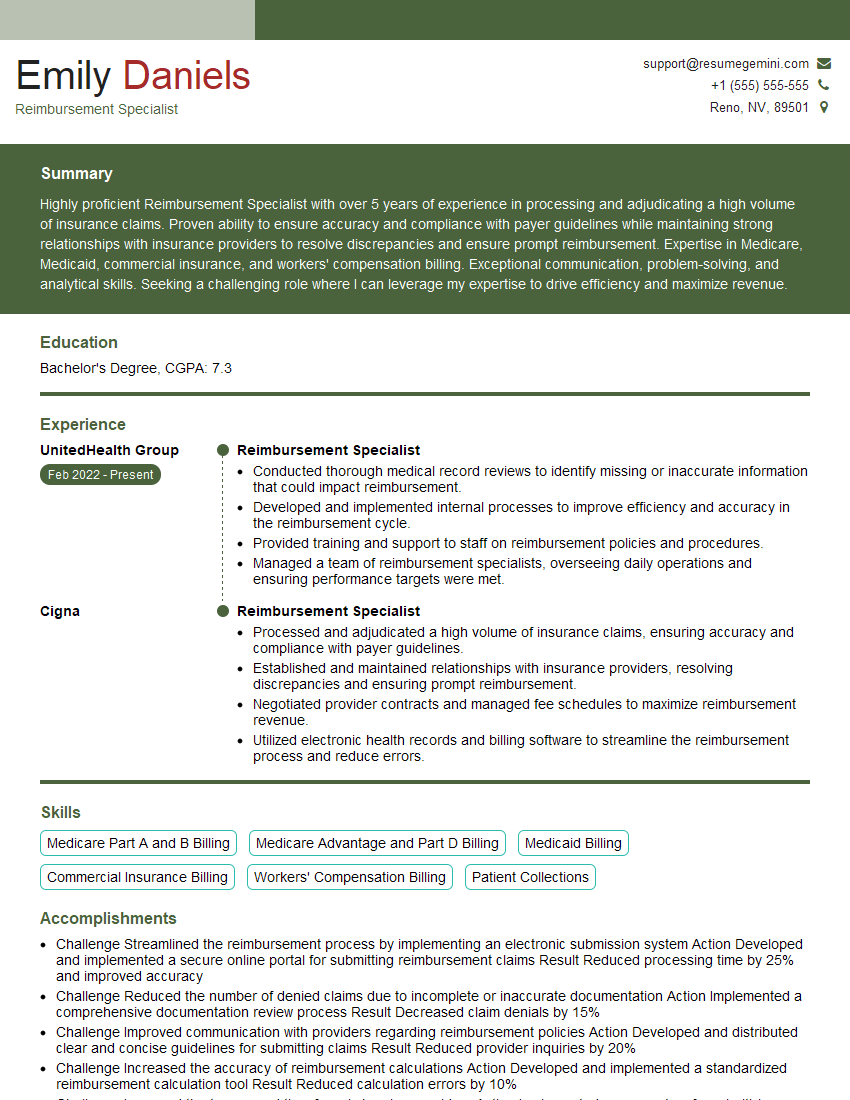

Mastering Healthcare Financial Management is crucial for advancing your career in this dynamic and rewarding field. A strong understanding of these concepts will significantly enhance your interview performance and open doors to exciting opportunities. To maximize your job prospects, creating an ATS-friendly resume is paramount. ResumeGemini is a trusted resource to help you build a professional and impactful resume that highlights your skills and experience effectively. ResumeGemini provides examples of resumes tailored to Healthcare Financial Management to guide you in creating your own compelling application materials. Invest time in crafting a strong resume; it’s your first impression to potential employers.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Interesting Article, I liked the depth of knowledge you’ve shared.

Helpful, thanks for sharing.

Hi, I represent a social media marketing agency and liked your blog

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?