Every successful interview starts with knowing what to expect. In this blog, we’ll take you through the top Customer Success Metrics and Reporting interview questions, breaking them down with expert tips to help you deliver impactful answers. Step into your next interview fully prepared and ready to succeed.

Questions Asked in Customer Success Metrics and Reporting Interview

Q 1. Define Net Promoter Score (NPS) and explain its importance in Customer Success.

Net Promoter Score (NPS) is a metric that measures customer loyalty and satisfaction by asking customers how likely they are to recommend your company, product, or service to others. It’s scored on a scale of 0 to 10, with responses categorized as Promoters (9-10), Passives (7-8), and Detractors (0-6).

In Customer Success, NPS is incredibly important because it provides a leading indicator of future business growth. High NPS scores suggest strong customer relationships and a lower churn rate. Conversely, low NPS scores signal potential problems that need addressing before they lead to customer attrition and negative word-of-mouth. By regularly monitoring and analyzing NPS, Customer Success teams can proactively identify areas for improvement and prevent churn.

For example, a consistently low NPS in a specific customer segment might indicate issues with a particular product feature or a breakdown in communication. This allows the team to focus their efforts on addressing these problems, ultimately leading to improved customer retention and higher scores.

Q 2. How do you calculate Customer Churn Rate, and what actions can be taken to reduce it?

Customer Churn Rate is the percentage of customers who stop doing business with a company during a specific period. It’s a crucial metric that reflects the health of your customer base. The calculation is straightforward:

Churn Rate = (Number of Customers Lost During Period / Number of Customers at the Beginning of the Period) * 100

To reduce churn, a multi-pronged approach is needed. This might include:

- Proactive Customer Engagement: Regular check-ins, personalized support, and targeted communication to understand customer needs and address potential issues.

- Improved Onboarding: Ensuring new customers are effectively trained and understand how to utilize your product or service to its full potential. A smooth onboarding experience significantly reduces early churn.

- Product Improvement: Continuously iterating on your product based on customer feedback and market trends to ensure its continued relevance and value. Addressing bugs and implementing requested features are essential.

- Targeted Customer Segmentation: Identifying at-risk customers and deploying tailored interventions, such as offering incentives or additional support.

- Analyzing Churn Reasons: Conducting thorough exit interviews with departing customers to understand why they chose to leave and use this feedback to improve your processes.

For instance, if your churn rate is high among a particular customer segment, you might investigate their specific pain points and adapt your service or product to better meet their needs. This could involve offering specialized training, creating more tailored support documentation, or adapting your product features to their unique workflow.

Q 3. Explain the relationship between Customer Lifetime Value (CLTV) and Customer Acquisition Cost (CAC).

Customer Lifetime Value (CLTV) represents the total revenue a company expects to generate from a single customer throughout their entire relationship. Customer Acquisition Cost (CAC) is the total cost of acquiring a new customer. The relationship between these two metrics is critical for sustainable business growth.

Ideally, CLTV should significantly exceed CAC. A high CLTV/CAC ratio indicates that the cost of acquiring a customer is justified by the long-term revenue they generate. If CAC is higher than CLTV, it means the company is spending more to acquire customers than they are earning from them—an unsustainable model.

Think of it like this: If it costs $100 to acquire a customer (CAC) but that customer generates $1000 in revenue over their lifetime (CLTV), you have a healthy ratio (10:1). However, if CAC is $500 and CLTV is only $200, you have a problematic ratio, and the business needs to find ways to either reduce CAC or increase CLTV.

Q 4. What key metrics would you track to measure the health of a customer segment?

To measure the health of a customer segment, I would track a combination of quantitative and qualitative metrics. This holistic approach provides a more accurate and comprehensive understanding of customer health.

- Product Usage Metrics: How frequently are customers using the product? Are they utilizing key features? This indicates engagement and product adoption.

- Customer Satisfaction (CSAT) Scores: How satisfied are customers with your product or service? This measures their overall experience.

- Support Ticket Volume and Resolution Time: High ticket volumes and long resolution times might point to product issues or a need for better support resources.

- Feature Adoption Rate: Are customers adopting new features or upgrades? Low adoption can suggest usability issues or a lack of communication.

- Net Promoter Score (NPS): How likely are customers to recommend your product or service? This gives an indication of overall loyalty and satisfaction.

- Customer Churn Rate: What percentage of customers in this segment are canceling their subscriptions or contracts?

- Qualitative Feedback: Gathering feedback through surveys, interviews, and reviews allows for deeper insight into customer needs and pain points. This contextualizes the quantitative data.

By monitoring these metrics together, you gain a comprehensive understanding of the segment’s health and can identify potential problems early on. For example, a high CSAT score coupled with low product usage might suggest a mismatch between customer expectations and product functionality.

Q 5. Describe a time you had to identify and solve a problem related to inaccurate customer data.

In a previous role, we noticed inconsistencies in customer data across different platforms – our CRM, billing system, and support ticketing system. This led to inaccurate reporting and hindered our ability to effectively segment customers and personalize support.

To solve this, I first identified the root causes of the inaccuracies. We found that data entry errors, lack of data standardization, and a lack of integration between systems were the main culprits. My solution involved a multi-step approach:

- Data Cleansing: We conducted a thorough data cleansing process to identify and correct inconsistencies, duplicates, and outdated information. This involved using data cleaning tools and manual review.

- Data Standardization: We established clear data standards and formats for all customer attributes (e.g., address, contact information). This ensured consistency across all systems.

- System Integration: We implemented data integration tools to synchronize data across our CRM, billing system, and support ticketing system in real-time. This eliminated data silos and ensured data consistency.

- Data Governance Policy: We established a clear data governance policy to define roles, responsibilities, and processes for data management and quality control. This prevented future inaccuracies.

The result was a more accurate and reliable customer database, which improved the accuracy of our reporting, allowed for better customer segmentation and personalized outreach, and ultimately contributed to improved customer retention.

Q 6. How do you prioritize which customer success metrics to focus on?

Prioritizing customer success metrics depends on the business goals and current challenges. I typically use a framework that considers:

- Business Objectives: Align metrics with overall business goals. Are you focused on growth, retention, or profitability? This dictates which metrics are most important.

- Current Challenges: Identify areas needing immediate attention. Is customer churn high? Are specific customer segments struggling? Focus on metrics directly related to these challenges.

- Data Availability and Reliability: Prioritize metrics for which reliable and accurate data is readily available. Avoid metrics that rely on unreliable data.

- Actionability: Choose metrics that lead to actionable insights and tangible improvements. Avoid metrics that only provide descriptive information.

- Lagging vs. Leading Indicators: Balance both. Lagging indicators (like churn) tell you what happened; leading indicators (like NPS) predict future outcomes, allowing for proactive interventions.

For example, if a company is experiencing high churn, they should prioritize metrics like churn rate, customer satisfaction, and product usage, focusing on actionable steps to improve those areas. Conversely, a company focused on growth might prioritize CAC and CLTV.

Q 7. What are some common reporting tools you are familiar with (e.g., Tableau, Power BI)?

I’m proficient in several reporting tools, including Tableau and Power BI. Both are powerful business intelligence tools that allow for the creation of interactive dashboards and reports. Tableau excels in its ease of use for creating visually appealing and insightful dashboards. Power BI offers strong integration with Microsoft products and robust data modeling capabilities.

I’ve also worked with other tools like Google Data Studio (now Looker Studio), which is a great option for its accessibility and integration with Google services. The choice of tool often depends on the specific needs of the organization, the existing technological infrastructure, and the budget available. My expertise lies in leveraging these tools to effectively visualize and interpret customer success data, turning raw numbers into actionable strategies.

Q 8. How do you ensure data accuracy and reliability in your reporting?

Data accuracy and reliability are paramount in Customer Success. It’s the foundation upon which all strategic decisions are made. My approach is multifaceted, starting with data source validation. I meticulously check the integrity of each data source – whether it’s CRM, product usage analytics, or survey responses – to ensure data is consistently captured and correctly formatted. This involves regular checks for inconsistencies, missing values, and outliers.

Secondly, I implement robust data validation rules within the reporting systems themselves. This includes checks for data type conformity, range constraints, and logical consistency. For instance, a customer’s subscription status should always align with their payment history. Discrepancies trigger alerts, allowing for immediate investigation and correction.

Finally, I employ a process of regular reconciliation. This involves comparing key metrics from different sources to identify any discrepancies and investigate their root causes. For example, comparing churn rates calculated from the CRM with churn rates derived from product usage data helps identify potential data entry or reporting errors. Documenting these processes and the resolutions taken is crucial for maintaining long-term data quality and building trust in the reports generated.

Q 9. How would you present complex data to a non-technical audience?

Presenting complex data to a non-technical audience requires a shift in perspective. Instead of focusing on the technical details, I prioritize clear, concise storytelling using visuals. My go-to methods include:

- Visualizations: Charts and graphs (bar charts, line graphs, pie charts) are powerful tools. I carefully select the most appropriate chart type for the specific data and audience, avoiding overly cluttered or confusing visuals.

- Analogies and Metaphors: Relatable analogies help explain complex concepts. For example, I might explain customer churn using the analogy of water leaking from a bucket.

- Focus on Key Metrics: Instead of overwhelming them with every single data point, I focus on a small set of key performance indicators (KPIs) that provide the most important insights. This typically involves focusing on trends and patterns rather than granular details.

- Storytelling: I structure presentations narratively, using the data to support a clear and concise storyline. This makes the information easier to follow and remember.

For example, instead of showing a complex table of churn rates across different customer segments, I might present a simple bar chart showing the top three customer segments with the highest churn, highlighting the key trends and drawing actionable conclusions from these trends.

Q 10. Describe your experience with building dashboards and reports.

Throughout my career, I’ve extensively used various business intelligence (BI) tools to build dashboards and reports for Customer Success teams. I am proficient in tools such as Tableau, Power BI, and Google Data Studio. My process usually involves:

- Understanding the requirements: Collaborating with stakeholders to define the key performance indicators (KPIs) and the audience for the dashboards and reports.

- Data acquisition and cleaning: Gathering data from various sources, cleaning and transforming the data to ensure consistency and accuracy.

- Visualization design: Selecting appropriate charts and graphs to represent the data effectively and choosing a visually appealing layout.

- Dashboard development: Creating interactive dashboards that allow users to drill down into the data and explore different aspects of the business.

- Report automation: Automating report generation to ensure timely delivery of insights.

For instance, I once developed a dashboard that tracked customer health scores, usage metrics, and support ticket trends. This dashboard provided a holistic view of customer health, allowing the team to proactively identify at-risk customers and intervene before churn. The dashboard was highly interactive, enabling users to filter data by customer segment, product, and time period.

Q 11. What is the difference between leading and lagging indicators in Customer Success?

Leading and lagging indicators are crucial for proactive Customer Success management. They represent different stages in the customer journey and provide insights into future and past performance.

- Lagging indicators reflect past performance and are typically reactive. They show what *has* happened. Examples include customer churn rate, customer lifetime value (CLTV), and Net Promoter Score (NPS). These are valuable for understanding overall success but offer little in the way of predictive capabilities.

- Leading indicators predict future performance and are proactive. They show what *might* happen. Examples include product usage frequency, customer engagement scores, feature adoption rates, and the time to first value realization. Monitoring these allows us to identify potential problems early and take preventative actions.

Think of it like this: lagging indicators are the rearview mirror, showing where you’ve been; leading indicators are the navigation system, guiding where you’re going. Using both provides a comprehensive view, enabling both retrospective analysis and proactive strategies.

Q 12. How do you identify at-risk customers and what actions do you take?

Identifying at-risk customers is a continuous process. I utilize a multi-pronged approach that combines leading and lagging indicators.

Firstly, I set thresholds for key leading indicators. For example, if product usage drops below a certain level for three consecutive weeks, or if customer engagement scores consistently remain low, that customer is flagged as potentially at-risk. Secondly, I analyze lagging indicators like declining customer lifetime value or an increase in support tickets. These provide confirmation of a potential problem.

Once at-risk customers are identified, I take immediate action. This can involve personalized outreach from the Customer Success Manager (CSM), offering tailored support, training, or onboarding resources. It might also involve adjusting the customer’s plan to better fit their needs or proactively offering an upgrade. The specific actions taken depend on the root cause of the risk, which requires in-depth analysis using the available data points.

Q 13. Explain your approach to analyzing customer feedback.

Analyzing customer feedback is essential for continuous improvement. My approach is structured and involves several steps:

- Data Collection: I systematically collect feedback from various channels, including surveys (CSAT, NPS), in-app feedback forms, support tickets, and social media mentions. The goal is to capture a broad range of opinions.

- Qualitative and Quantitative Analysis: I analyze both quantitative data (e.g., average CSAT scores) and qualitative data (e.g., open-ended survey responses, support ticket comments). This allows a nuanced understanding of the feedback received.

- Sentiment Analysis: I use sentiment analysis tools to gauge the overall tone of the feedback, identifying positive, negative, and neutral sentiments. This helps prioritize issues based on their impact.

- Thematic Analysis: I look for recurring themes and patterns in the feedback, which often reveal key areas for improvement. For example, I may discover a recurring issue with a specific product feature.

- Actionable Insights: Based on the analysis, I generate actionable insights that can be used to inform product development, improve customer onboarding, or enhance customer support.

It’s not enough to simply collect feedback; understanding *why* customers feel a certain way is crucial. Connecting feedback to data points provides context and often pinpoints the root causes of issues.

Q 14. How do you measure the effectiveness of a Customer Success initiative?

Measuring the effectiveness of a Customer Success initiative requires clear objectives and carefully selected metrics.

First, I define specific, measurable, achievable, relevant, and time-bound (SMART) goals for the initiative. For example, “increase customer retention by 15% within six months.” Then, I choose relevant metrics to track progress towards these goals. This could involve monitoring changes in churn rate, customer lifetime value, NPS scores, or other relevant KPIs, depending on the initiative’s objectives.

Finally, I conduct a thorough post-initiative analysis, comparing the results against the baseline and the defined targets. This comparison provides quantitative evidence of success or identifies areas for improvement. Alongside the quantitative analysis, qualitative feedback (e.g., from customer surveys) provides additional context, helps in understanding the ‘why’ behind the numbers, and enhances the completeness of the evaluation.

For example, if an initiative aimed to improve onboarding, I would track metrics like time to first value, customer engagement in the first 30 days, and the number of support tickets raised during this period. Changes in these metrics would directly reflect the success or failure of the initiative.

Q 15. How do you use data to inform strategic decisions in Customer Success?

Data is the lifeblood of effective Customer Success. We use it to move beyond gut feelings and make data-driven decisions that directly impact customer retention, expansion, and overall business growth. For example, if we see a significant drop in product usage among a specific customer segment, we don’t just assume the problem; we investigate. We might analyze usage patterns, survey that segment, and even A/B test different onboarding strategies to identify the root cause and implement targeted interventions.

This process typically involves:

- Identifying Key Metrics: We pinpoint crucial metrics like Customer Lifetime Value (CLTV), Net Promoter Score (NPS), churn rate, and product adoption rates. These metrics give us a holistic view of customer health.

- Segmenting Customers: We group customers based on shared characteristics (e.g., industry, company size, product usage) to identify trends within specific segments and tailor interventions accordingly.

- Analyzing Trends & Patterns: We use data visualization tools and statistical analysis to identify correlations and potential problems. For instance, a correlation between low onboarding completion rates and high churn might indicate a need for improvements to our onboarding process.

- Developing Actionable Insights: The analysis provides insights that form the basis of strategic initiatives. For example, discovering a correlation between proactive outreach and higher customer satisfaction would justify investing more resources in proactive customer engagement programs.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe your experience with A/B testing in a customer success context.

A/B testing is crucial for optimizing our customer success strategies. In my previous role, we used A/B testing to improve our onboarding emails. We had two versions: one with a concise, task-oriented approach, and another with a more lengthy, feature-rich approach. We tracked metrics like email open rates, click-through rates, and onboarding completion rates. The results showed that the concise version significantly improved completion rates, leading to higher customer activation and reduced churn.

The process usually follows these steps:

- Define Hypothesis: Clearly state the expected outcome of the test (e.g., ‘A more concise onboarding email will lead to a higher completion rate’).

- Develop Variations: Create different versions of the element being tested (e.g., email copy, onboarding flow, in-app message).

- Implement & Monitor: Deploy the variations to randomly selected segments and track key metrics throughout the test duration.

- Analyze Results: Use statistical analysis to determine which variation performed significantly better. We ensure sufficient sample sizes to avoid drawing inaccurate conclusions.

- Implement Winner: Apply the winning variation across all customers.

Q 17. What is your experience with predictive analytics in Customer Success?

Predictive analytics allows us to anticipate customer behavior and proactively address potential issues. We leverage machine learning models to predict churn risk, identify at-risk customers, and forecast customer lifetime value. This proactive approach enables us to allocate resources effectively and prevent customer churn.

For instance, we might use a model that considers factors like product usage, engagement levels, support tickets, and customer feedback to predict the likelihood of a customer churning. This allows us to proactively reach out to at-risk customers with tailored support and engagement strategies, potentially preventing them from churning. This data is also critical for resource allocation – allowing us to focus our efforts on customers with the highest likelihood of churn or greatest potential for expansion.

Q 18. How do you handle conflicting priorities in your reporting responsibilities?

Handling conflicting priorities in reporting is a common challenge. My approach involves a structured prioritization process:

- Understanding Stakeholder Needs: I start by clearly understanding the needs and priorities of all stakeholders. This often involves direct communication and collaboration to align expectations.

- Prioritization Framework: I utilize a prioritization framework like the MoSCoW method (Must have, Should have, Could have, Won’t have) to rank reporting requests based on their urgency and importance to business goals.

- Resource Allocation: I assess the resources required for each reporting task (time, tools, data) and allocate them based on the prioritized list.

- Communication & Transparency: I maintain open communication with stakeholders, keeping them informed about progress, any potential delays, and the rationale behind prioritization decisions. Transparency is key to managing expectations.

- Iterative Approach: I may start with a minimum viable product (MVP) for a high-priority report, iteratively adding features based on feedback and available resources.

Q 19. How do you ensure alignment between Customer Success metrics and overall business goals?

Aligning Customer Success metrics with overall business goals is paramount. We ensure alignment by:

- Defining Key Business Objectives: We start by clearly identifying the company’s overarching business goals (e.g., revenue growth, market share expansion, brand building).

- Mapping Metrics to Objectives: We then map specific Customer Success metrics to these overarching goals. For example, if a primary goal is revenue growth, we might track metrics like customer lifetime value (CLTV), expansion revenue, and average revenue per user (ARPU). If customer retention is a key goal, churn rate and customer satisfaction become crucial metrics.

- Regular Review & Adjustment: We regularly review the alignment of metrics and goals, making adjustments as needed to reflect evolving business priorities. This is an iterative process, not a one-time task.

- Cross-functional Collaboration: Effective alignment requires close collaboration with other departments like Sales, Marketing, and Product. This ensures everyone is working towards common goals.

Q 20. What are some common challenges you face when working with large datasets?

Working with large datasets presents several challenges:

- Data Quality: Ensuring data accuracy and consistency is critical. This often involves data cleaning, validation, and transformation to handle missing values, inconsistencies, and outliers.

- Data Storage & Management: Efficiently storing and managing large datasets requires specialized tools and infrastructure, often cloud-based solutions.

- Data Processing & Analysis: Processing and analyzing massive datasets can be computationally intensive, requiring efficient algorithms and potentially distributed computing techniques.

- Data Visualization: Presenting insights from large datasets in a clear and understandable way can be a challenge. Effective data visualization techniques are needed to communicate key findings effectively.

- Scalability: The system and processes need to be scalable to handle ever-growing data volumes as the business grows.

To address these challenges, I leverage tools like cloud-based data warehouses, big data processing frameworks (like Spark or Hadoop), and data visualization platforms (like Tableau or Power BI).

Q 21. How do you stay up-to-date on the latest trends in Customer Success metrics and reporting?

Staying current in this rapidly evolving field requires a multifaceted approach:

- Industry Publications & Blogs: I regularly read industry publications, blogs, and research reports to stay informed about new metrics, methodologies, and trends.

- Conferences & Webinars: Attending industry conferences and webinars provides valuable insights and networking opportunities. It’s also a great way to learn from leading experts.

- Professional Networks: Engaging with professional networks and communities (online forums, LinkedIn groups) allows me to learn from peers and share best practices.

- Continuous Learning: I actively pursue continuous learning through online courses, workshops, and certifications to stay updated on the latest technologies and analytical techniques.

- Experimentation & Iteration: I view my own work as a continuous learning process. By implementing new metrics and techniques, analyzing results, and iterating based on feedback, I remain at the forefront of Customer Success best practices.

Q 22. Describe a time you had to explain complex data to executive leadership.

Explaining complex data to executives requires translating technical details into clear, actionable insights. I once needed to present a complex analysis of customer churn, showing its correlation with product usage and specific feature adoption. Instead of overwhelming them with raw numbers and graphs, I started with a high-level summary: ‘We’re seeing a concerning trend in churn, primarily impacting users who aren’t fully engaging with feature X.’ Then, I used a simple bar chart highlighting the correlation between feature X usage and churn rate. I followed this with a more detailed breakdown, but kept the focus on the key takeaways – the problem, its size, and potential solutions. This approach, focusing on the story and its implications rather than the methodology, ensured executive buy-in and productive action planning. We ultimately implemented targeted training and in-app prompts for feature X, resulting in a significant reduction in churn within the next quarter.

Q 23. How do you handle missing or incomplete data in your reporting?

Missing or incomplete data is a common challenge in reporting. My approach is multi-faceted. First, I investigate the root cause of the missing data. Is it a data entry issue? A system glitch? Understanding the source helps determine the appropriate handling strategy. For minor gaps, I might use imputation techniques like replacing missing values with the mean or median, provided it doesn’t significantly skew the results. I always clearly document these imputations within the report. For larger gaps or systematic data issues, I advocate for data quality improvements and work with the data team to resolve the underlying problem. Transparency is key – in the report, I explicitly state what data was missing and how I addressed it, ensuring the audience understands the limitations of the analysis. For example, if a key customer segment has incomplete data, I’ll note this limitation and perhaps offer a more conservative interpretation of the findings for that segment, rather than extrapolating unfounded conclusions.

Q 24. How do you measure customer satisfaction beyond NPS?

While Net Promoter Score (NPS) is a valuable metric, it provides a limited view of customer satisfaction. I supplement NPS with other qualitative and quantitative measures. For example, Customer Effort Score (CES) measures how easy it is for customers to interact with the company. Customer Satisfaction Score (CSAT) directly asks customers to rate their overall satisfaction. Beyond surveys, I analyze product usage data, support ticket volume and resolution times, and customer feedback from reviews and social media. Qualitative data, like verbatim comments from surveys or support interactions, offers crucial context and reveals the ‘why’ behind satisfaction (or dissatisfaction) scores. By combining quantitative data like NPS, CES, and CSAT with rich qualitative feedback, I build a much more complete and nuanced understanding of customer satisfaction.

Q 25. What is your experience with different types of customer segmentation?

Customer segmentation is crucial for targeted interventions and personalized experiences. I’ve worked with various segmentation strategies, including:

- Demographic Segmentation: Based on factors like company size, industry, location, and revenue.

- Behavioral Segmentation: Analyzing product usage patterns, feature adoption, and engagement levels.

- Firmographic Segmentation: Similar to demographic but focusing on company-specific attributes, like technology stack or business model.

- Health Segmentation: A risk-based approach categorizing customers by their likelihood of churn or expansion.

The best segmentation strategy depends on the business objectives. For example, a company focusing on reducing churn might prioritize health segmentation, while a company targeting expansion might leverage behavioral segmentation to identify high-potential customers.

Q 26. How would you design a customer success dashboard?

A customer success dashboard should provide a clear, concise overview of key health metrics. I would design it with three key sections:

- Health Overview: High-level summary of overall customer health, perhaps using a single, overarching score (a weighted average of relevant metrics) and a visual representation (like a heatmap) of customer segments. This shows overall trends and potential issues at a glance.

- Key Metric Tracking: Detailed view of individual metrics, such as churn rate, customer lifetime value (CLTV), expansion rate, NPS, and CES, using charts and graphs. This section would allow for deeper analysis into the performance of individual customers or segments.

- Actionable Insights: This section would showcase specific customers who need attention, flagging at-risk customers or those with high expansion potential. It might include links to relevant customer profiles or case management tools for quick action. Interactive elements, such as drill-down capabilities, would be valuable here.

The dashboard should be customizable to allow users to filter data by different segments and time periods. Clear, concise labeling and consistent visual design principles are crucial to facilitate quick understanding and decision-making.

Q 27. Explain your experience with data visualization best practices.

Data visualization best practices center around clarity, accuracy, and effective communication. I adhere to principles like:

- Choosing the right chart type: Bar charts for comparisons, line charts for trends, scatter plots for correlations, and heatmaps for visualizing matrices of data. The chart type should align with the data and the message being conveyed.

- Keeping it simple: Avoid clutter and unnecessary detail. Focus on the key message and use clear, concise labels.

- Using color effectively: Choose a consistent and accessible color palette. Color should enhance understanding, not distract from it.

- Maintaining data integrity: Ensure the data is accurately represented and avoid misleading visualizations.

- Accessibility: Consider users with visual impairments by providing alternative text for images and using sufficient color contrast.

For instance, instead of a complex 3D chart that obscures the data, a simple 2D bar chart will be much more effective in communicating a comparison between two sets of values.

Q 28. How do you contribute to the development of a Customer Success strategy?

I contribute to Customer Success strategy development by leveraging data-driven insights to inform decision-making. My role involves:

- Identifying key performance indicators (KPIs): Collaborating with stakeholders to define metrics that align with business objectives.

- Analyzing customer data: Uncovering trends, patterns, and areas for improvement.

- Developing customer segmentation strategies: Identifying distinct customer groups to tailor interventions.

- Proposing proactive strategies: Suggesting initiatives based on data insights to improve customer health and satisfaction.

- Measuring the impact of initiatives: Tracking the effectiveness of implemented strategies and making data-driven adjustments.

For example, by analyzing churn data, I might identify a specific customer segment with unusually high churn and recommend targeted onboarding improvements or proactive support for that group. Continuously iterating based on data analysis is vital for an effective customer success strategy.

Key Topics to Learn for Customer Success Metrics and Reporting Interview

- Defining Key Performance Indicators (KPIs): Understanding the various metrics used to measure customer success, such as Customer Satisfaction (CSAT), Customer Effort Score (CES), Net Promoter Score (NPS), and churn rate. Learn how to select the right KPIs based on business objectives.

- Data Analysis and Interpretation: Mastering the ability to analyze data from various sources (CRM, support tickets, surveys) to identify trends, patterns, and areas for improvement in customer success. Practice interpreting data visualizations and drawing actionable insights.

- Reporting and Dashboard Creation: Developing clear, concise, and visually appealing reports and dashboards to communicate customer success performance to stakeholders. Learn to tailor reports to different audiences and their needs.

- Predictive Analytics and Forecasting: Exploring techniques to predict future customer behavior and proactively address potential issues. This might include using historical data to forecast churn or identify at-risk customers.

- Customer Segmentation and Personalization: Understanding how to segment customers based on their needs and behavior to personalize the customer success strategy and improve outcomes. This includes tailoring communication and support based on segments.

- Attribution Modeling: Understanding how to attribute customer success outcomes to specific initiatives or programs. This is crucial for demonstrating the ROI of customer success efforts.

- Technology and Tools: Familiarity with common tools used in customer success metrics and reporting, such as CRM systems, data visualization platforms, and analytics software.

- Problem-Solving and Strategic Thinking: Developing the ability to identify challenges within customer success data, formulate solutions, and present recommendations to stakeholders. This involves both analytical and strategic thinking.

Next Steps

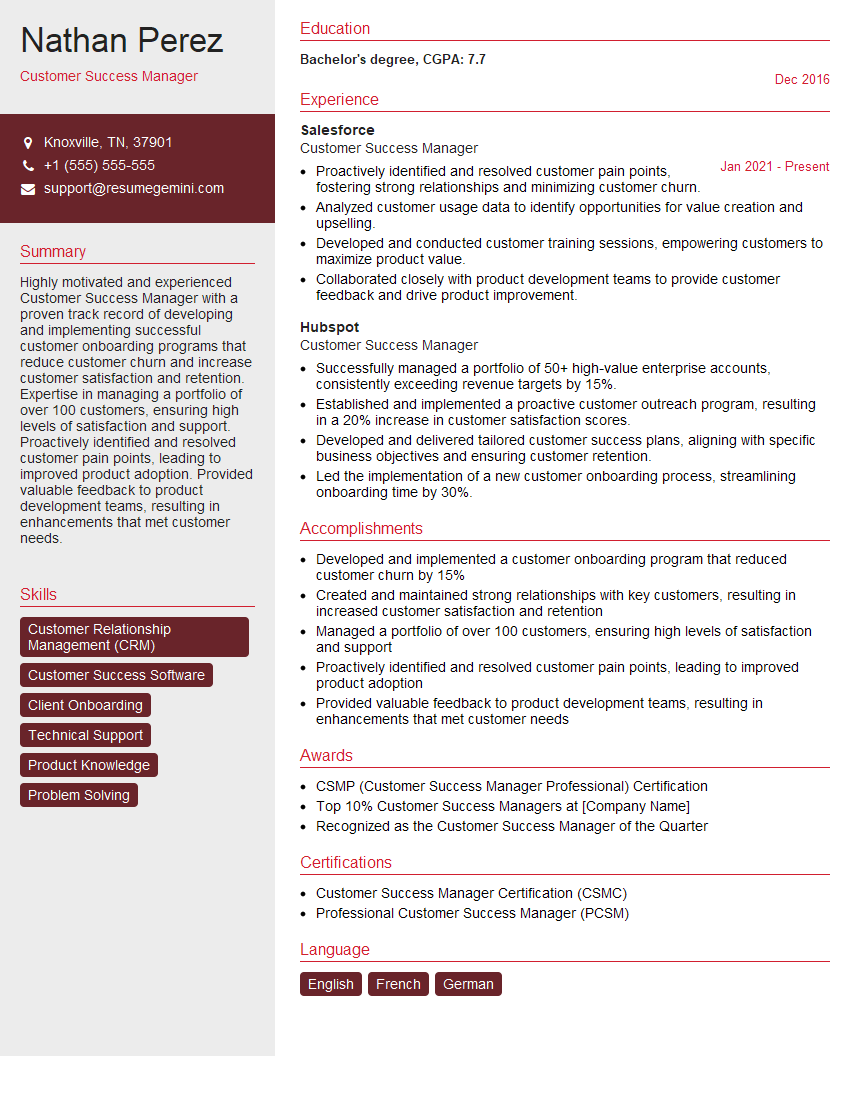

Mastering Customer Success Metrics and Reporting is crucial for career advancement in this rapidly growing field. It demonstrates your ability to drive strategic decision-making, improve customer relationships, and ultimately contribute significantly to business success. To maximize your job prospects, focus on creating a compelling and ATS-friendly resume that showcases your skills and experience effectively. ResumeGemini is a trusted resource to help you build a professional resume tailored to your specific career goals. We offer examples of resumes specifically designed for candidates in Customer Success Metrics and Reporting to help guide your resume creation. Take the next step toward your dream job – build your best resume today!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Interesting Article, I liked the depth of knowledge you’ve shared.

Helpful, thanks for sharing.

Hi, I represent a social media marketing agency and liked your blog

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?