The thought of an interview can be nerve-wracking, but the right preparation can make all the difference. Explore this comprehensive guide to Measurement and Valuation interview questions and gain the confidence you need to showcase your abilities and secure the role.

Questions Asked in Measurement and Valuation Interview

Q 1. Explain the difference between market value, fair value, and intrinsic value.

The terms market value, fair value, and intrinsic value, while related, represent different perspectives on an asset’s worth. Think of it like judging a painting: market value is what someone is willing to pay right now; fair value is a more objective measure of what it’s reasonably worth, considering all available information; and intrinsic value is your own, perhaps more subjective, assessment based on a deep understanding of the painting’s qualities.

- Market Value: This is the price an asset would fetch in a competitive, open market, based on current supply and demand. It’s the price you’d see if you were to sell a stock on a stock exchange today. It’s influenced by market sentiment, short-term factors, and can be volatile.

- Fair Value: A more objective estimate of an asset’s value, often determined using established valuation methods. It considers both market conditions and the asset’s fundamental characteristics. Fair value is often used in accounting and financial reporting to provide a consistent measure of value.

- Intrinsic Value: This is a long-term, fundamental measure of value that focuses on the asset’s inherent worth based on its future cash flows, growth potential, and risk profile. It’s the value a skilled investor would assign based on their own detailed analysis. It’s often used in investment decisions where long-term potential is prioritized over short-term market fluctuations. For example, a seasoned investor might determine a company’s intrinsic value through discounted cash flow analysis, while its market value fluctuates day-to-day based on investor sentiment.

Q 2. Describe the various valuation methods used for businesses.

Various valuation methods exist for businesses, each with strengths and weaknesses. The best approach depends on the specifics of the business and the available data. Common methods include:

- Discounted Cash Flow (DCF) Analysis: Projects future cash flows and discounts them back to present value using a discount rate that reflects the risk involved. This is considered a fundamental valuation method.

- Comparable Company Analysis (CCA): Compares the target company’s valuation multiples (e.g., Price-to-Earnings ratio, Enterprise Value-to-EBITDA) to those of similar publicly traded companies. It’s a relative valuation approach.

- Precedent Transactions Analysis: Analyzes the prices paid for similar companies in recent acquisitions or mergers. This is also a relative valuation method, relying on past transactions.

- Asset-Based Valuation: Determines the value of a company by summing up the fair market value of its assets, less its liabilities. This is particularly useful for companies with significant tangible assets.

- Liquidation Valuation: Estimates the value the company would realize if it were to be liquidated. Used primarily in distress situations.

Q 3. What are the key assumptions underlying discounted cash flow (DCF) analysis?

DCF analysis rests on several key assumptions, and their accuracy significantly impacts the valuation. Key assumptions include:

- Projected Free Cash Flows: Accurately forecasting future cash flows is crucial. This requires analyzing the company’s historical performance, industry trends, and management’s plans.

- Discount Rate (Weighted Average Cost of Capital – WACC): This reflects the risk associated with the investment. The WACC is calculated considering the company’s cost of equity and debt, weighted by their respective proportions in the capital structure. An inaccurate WACC can significantly distort the valuation.

- Terminal Growth Rate: This assumption defines the long-term growth rate of the company beyond the explicit forecast period. A reasonable and sustainable terminal growth rate is essential for accuracy.

- Tax Rate: The corporate tax rate directly impacts the net cash flows available to investors.

It’s important to consider sensitivity analysis to understand how changes in these key assumptions affect the overall valuation. For example, a 1% change in the discount rate could considerably alter the present value of future cash flows.

Q 4. How do you handle uncertainty and risk in a valuation model?

Uncertainty and risk are inherent in any valuation. Several techniques can be employed to handle them:

- Sensitivity Analysis: Examines how changes in key inputs (e.g., discount rate, growth rate) affect the valuation. This helps understand the range of possible outcomes.

- Scenario Analysis: Develops multiple scenarios (e.g., best-case, base-case, worst-case) based on different assumptions about the future. This provides a more comprehensive view of the potential outcomes.

- Monte Carlo Simulation: A sophisticated statistical technique that simulates thousands of possible outcomes by randomly sampling from distributions of inputs. This gives a probability distribution of possible valuations.

- Risk Premiums: Incorporate risk premiums into the discount rate to reflect the uncertainty and risk associated with the investment. A higher risk premium will lead to a lower valuation.

For instance, in valuing a start-up, we’d use scenario analysis to model different outcomes depending on product market fit and competitive landscape. A Monte Carlo simulation could then provide a probability distribution showing the likelihood of different valuations.

Q 5. What are the limitations of using comparable company analysis?

While comparable company analysis (CCA) is a widely used valuation method, it has limitations:

- Lack of Perfect Comparables: Finding companies truly comparable to the target is challenging. Differences in size, industry segment, and business model can lead to inaccurate comparisons.

- Market Sentiment: The market may overvalue or undervalue comparable companies, influencing the valuation multiples used in the analysis. This can lead to an inaccurate valuation of the target company.

- Financial Reporting Differences: Companies may use different accounting methods, making direct comparisons difficult. Standardization of financial statements is crucial.

- Small Sample Size: If only a few comparable companies exist, the results may not be statistically significant.

- Focus on Multiples: CCA relies heavily on valuation multiples. If these multiples don’t accurately reflect the underlying value drivers, the results can be unreliable.

For example, comparing a high-growth technology company to a mature, stable utility company can lead to misleading conclusions because their value drivers are different. Adjustments should be considered for size, industry stage and other factors.

Q 6. Explain the concept of beta and its role in the Capital Asset Pricing Model (CAPM).

Beta (β) in the Capital Asset Pricing Model (CAPM) measures the volatility of an asset’s returns relative to the overall market. Essentially, it quantifies systematic risk. A beta of 1 means the asset’s price will move with the market; a beta greater than 1 indicates higher volatility than the market, and a beta less than 1 suggests lower volatility.

CAPM is used to calculate the expected return of an investment based on its beta and the market risk premium. The formula is:

Expected Return = Risk-Free Rate + Beta * (Market Return - Risk-Free Rate)

The risk-free rate is the return on a virtually risk-free investment (e.g., government bonds). The market return is the expected return of the overall market. The difference between these two is the market risk premium, which compensates investors for taking on market risk.

In a valuation context, beta is used to determine the cost of equity for a company. This cost of equity is then a crucial component in calculating the weighted average cost of capital (WACC) used in discounted cash flow (DCF) analysis.

Q 7. How do you adjust for differences in capital structure when comparing companies?

When comparing companies with different capital structures (mix of debt and equity), adjustments are needed to ensure a fair comparison. The most common approach is to use unlevered free cash flow (FCF) or an adjusted measure of comparable multiples like EBITDA that is less affected by financing decisions.

Unlevering FCF removes the impact of financing decisions by calculating cash flow as if the company had no debt. This ensures that the valuation isn’t distorted by different levels of financial leverage. Then, once you have an enterprise value, you can lever it back up for a specific company by factoring in the target’s debt level. This allows consistent comparison of company valuations based on the underlying operational performance rather than financing choices.

Similarly, using EBITDA multiples (Enterprise Value/EBITDA) for comparable company analysis is preferable to using P/E ratios because EBITDA is pre-interest, making the multiple less sensitive to differences in capital structure.

Q 8. What are the different types of intangible assets and how are they valued?

Intangible assets are non-physical assets that provide economic benefits to a company. They contrast sharply with tangible assets like buildings or machinery. Valuation is crucial as these assets often represent a significant portion of a company’s value, particularly in knowledge-based industries. Different types of intangible assets require different valuation approaches.

- Patents and Trademarks: These are valued based on their future expected cash flows, often using discounted cash flow (DCF) analysis. This involves projecting the future royalties or licensing fees generated by the intellectual property. The risk associated with these future cash flows also significantly impacts the valuation.

- Copyrights: Similar to patents and trademarks, the value of a copyright is tied to its potential to generate revenue through sales, licensing, or other means. The remaining life of the copyright plays a crucial role.

- Brand Equity: This is arguably the most challenging to value, as it represents the intangible value associated with a company’s reputation and customer loyalty. Methods include the relief-from-royalty method (estimating what a company would pay to license a comparable brand), or a market approach (comparing the brand value of similar companies).

- Goodwill: This represents the excess of the purchase price of a business over the fair value of its identifiable net assets. It’s often the result of factors such as strong management, customer relationships, or an established market position. Goodwill is typically not amortized but tested for impairment annually.

- Software: Software can be valued using a variety of methods depending on the type and stage of development. This includes the cost approach (based on development costs), income approach (based on projected revenue), and market approach (comparing to similar software).

Choosing the appropriate valuation method depends heavily on the specific nature of the intangible asset, the availability of data, and the purpose of the valuation.

Q 9. Describe your experience with financial modeling software (e.g., Excel, Bloomberg Terminal).

I have extensive experience with financial modeling software, primarily Excel and Bloomberg Terminal. In Excel, I’m proficient in building complex financial models, including discounted cash flow (DCF) models, leveraged buyout (LBO) models, and merger and acquisition (M&A) models. I leverage Excel’s capabilities for data analysis, sensitivity analysis, scenario planning, and what-if analysis, crucial aspects of robust valuation. I use VBA (Visual Basic for Applications) for automation where necessary, speeding up repetitive tasks and enhancing model accuracy.

My experience with Bloomberg Terminal extends to utilizing its extensive financial data, including comparable company data, market indices, and industry benchmarks. This allows for a more robust market-based valuation approach. I regularly use the terminal for data gathering, screening, and for accessing industry reports to inform the assumptions within my models. For example, I recently used Bloomberg to identify comparable companies for a valuation of a tech startup, focusing on revenue multiples and growth rates. This ensured my valuation was grounded in relevant market data.

Q 10. How do you identify and mitigate valuation biases?

Valuation biases are pervasive and can significantly distort the results. Identifying and mitigating them requires a rigorous and disciplined approach.

- Anchoring Bias: This is the tendency to rely too heavily on the first piece of information received (the ‘anchor’). To mitigate this, I ensure a broad range of data points are considered, and I don’t rely solely on a single valuation method.

- Confirmation Bias: This involves seeking out information that confirms pre-existing beliefs. To avoid this, I actively seek out contradictory information and challenge my assumptions throughout the valuation process. Peer reviews and sensitivity analyses are key here.

- Optimism/Pessimism Bias: These biases lead to over- or under-estimation of future performance. I use realistic and well-supported projections, backed by market research and industry analysis, and test different scenarios to accommodate uncertainty.

- Availability Bias: This is the tendency to overemphasize readily available information. I ensure all relevant information is gathered, even if not readily apparent. This might involve extensive research and interviews with industry experts.

Employing multiple valuation methods, rigorous data validation, sensitivity analysis, and peer review are essential steps in identifying and mitigating valuation biases. Transparency in the assumptions and methodology is also paramount.

Q 11. What are the key factors influencing real estate valuations?

Real estate valuation is complex and depends on a multitude of interacting factors.

- Location: This is arguably the most significant factor. Factors such as proximity to amenities, schools, transportation, and employment opportunities significantly impact value.

- Property Characteristics: Size, age, condition, number of bedrooms and bathrooms, and overall quality of construction all influence value.

- Market Conditions: Supply and demand, interest rates, and overall economic conditions heavily influence market values. A booming market might lead to higher valuations, while a recessionary market might lead to lower valuations.

- Comparable Sales: Analyzing recent sales of similar properties in the same area is a cornerstone of real estate valuation. This provides market-based evidence of value.

- Highest and Best Use: This concept determines the most profitable and legally permitted use of the property, maximizing its potential value.

- Legal and Physical Constraints: Zoning restrictions, easements, and environmental concerns can significantly influence value.

Often, a combination of approaches, including the sales comparison approach, the income capitalization approach (for income-producing properties), and the cost approach (for newer properties), are used to arrive at a reliable valuation.

Q 12. Explain the concept of depreciation and its impact on asset valuation.

Depreciation reflects the decline in the value of an asset over time due to wear and tear, obsolescence, or other factors. It’s a crucial consideration in asset valuation, especially for tangible assets like machinery, buildings, and equipment.

There are several methods for calculating depreciation:

- Straight-Line Depreciation: This is the simplest method, where the asset’s cost is evenly distributed over its useful life. For example, if an asset costs $100,000 and has a useful life of 10 years, the annual depreciation expense would be $10,000.

- Declining Balance Depreciation: This method accelerates depreciation in the early years of an asset’s life, reflecting the higher rate of deterioration during that period.

- Units of Production Depreciation: This method calculates depreciation based on the actual use of the asset. For example, a machine might be depreciated based on the number of units produced.

The choice of depreciation method impacts the asset’s book value and, consequently, its overall valuation. Accurate depreciation calculations are essential for financial reporting, tax purposes, and determining the fair market value of assets. The failure to account for depreciation properly can lead to an overstated asset value.

Q 13. Discuss the importance of sensitivity analysis in valuation.

Sensitivity analysis is a crucial tool in valuation because it helps assess the impact of changes in key assumptions on the overall valuation. It reveals how sensitive the valuation is to variations in input parameters, highlighting areas of uncertainty and risk.

In practice, this involves systematically changing one or more input variables (e.g., discount rate, growth rate, revenue projections) while holding others constant. The results illustrate the range of possible outcomes and the magnitude of their impact on the final valuation. For instance, a sensitivity analysis on a DCF valuation might reveal that a 1% increase in the discount rate decreases the valuation by 10%, indicating a high sensitivity to interest rate risk.

By performing sensitivity analysis, we can identify the most crucial assumptions and focus our efforts on refining them. It helps to quantify uncertainty, provide a more robust valuation, and aids in better decision-making. It allows for a more comprehensive understanding of the range of potential outcomes, rather than relying on a single point estimate.

Q 14. How do you handle missing or incomplete data in a valuation exercise?

Missing or incomplete data is a common challenge in valuation. The approach to handling this depends on the nature of the missing data and the context of the valuation.

- Imputation: If data is missing for a few observations, it might be possible to impute values based on similar observations or using statistical techniques. For example, if sales data for a specific month is missing, it might be possible to estimate it based on sales in previous or subsequent months.

- Substitution: If data for a specific variable is unavailable, we might be able to substitute it with comparable data from similar assets or companies. For example, if cost data for a specific component is missing, data from a similar component might be used.

- Sensitivity Analysis: Assess the impact of different assumptions regarding the missing data on the overall valuation. This will provide a range of possible values and illustrate the uncertainty surrounding the missing data.

- Data Triangulation: Use multiple sources of data to validate and verify available information. If data from one source is inconsistent, consider using other data sources to determine a more reliable value. This cross-checking is critical.

- Qualitative Adjustments: In some cases, qualitative factors may be used to compensate for incomplete data. For example, if historical operating data is missing, qualitative insights from industry experts can help to inform the projections.

Transparency is key. Clearly document all assumptions and limitations due to missing data in the final valuation report. The goal is to present a valuation that is realistic and reflects the uncertainty caused by the data limitations.

Q 15. What are the ethical considerations in conducting a valuation?

Ethical considerations in valuation are paramount. They ensure objectivity, transparency, and the avoidance of conflicts of interest. A key principle is independence: the valuer must be free from any influence that could bias their judgment. This means disclosing any potential conflicts, such as prior relationships with the company being valued or holding a financial stake. Another crucial element is competence; the valuer must possess the necessary skills and experience for the specific valuation assignment. This might involve selecting appropriate methodologies or data sources based on the asset and market being assessed. Furthermore, integrity demands complete transparency in the valuation process and the methodology used, including assumptions and limitations. This ensures that the valuation is reproducible and verifiable by others. For example, if using a discounted cash flow (DCF) model, it’s critical to clearly state the discount rate used, the terminal growth rate assumptions, and the revenue and cost projections. Finally, confidentiality is crucial; protecting the sensitive financial information obtained during the valuation process is vital.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Explain the concept of terminal value and its significance in DCF analysis.

The terminal value in a Discounted Cash Flow (DCF) analysis represents the value of all cash flows beyond a specific forecast period. Imagine trying to predict a company’s cash flows for the next 50 years – practically impossible! The terminal value neatly encapsulates the value of these distant, hard-to-predict cash flows. There are two primary methods to calculate terminal value: the perpetuity growth method and the exit multiple method. The perpetuity growth method assumes a constant growth rate of cash flows indefinitely into the future. The formula is:

Terminal Value = (FCFn * (1 + g)) / (r - g)Where:

- FCFn = Free Cash Flow in the final year of the explicit forecast period

- g = perpetual growth rate of free cash flow

- r = discount rate

The exit multiple method values the firm at the end of the explicit forecast period using a multiple of a financial metric, such as EBITDA or revenue, based on comparable company transactions or market multiples. The terminal value is highly sensitive to both the discount rate and the growth rate (in the perpetuity method) or the chosen multiple (in the exit multiple method). Even small changes in these inputs can significantly impact the overall valuation. For example, a small change in the assumed perpetual growth rate can drastically alter the terminal value, making up a significant portion of the total enterprise value.

Q 17. How do you determine the appropriate discount rate for a valuation?

Determining the appropriate discount rate is critical, as it directly impacts the present value of future cash flows and, consequently, the valuation. The discount rate, often referred to as the Weighted Average Cost of Capital (WACC), represents the minimum return a company must earn on its investments to satisfy its investors. It’s a blend of the cost of equity and the cost of debt, weighted by the company’s capital structure. The cost of equity is typically calculated using the Capital Asset Pricing Model (CAPM):

Cost of Equity = Risk-Free Rate + Beta * (Market Risk Premium)Where:

- Risk-Free Rate: the return on a risk-free investment (e.g., government bonds)

- Beta: a measure of the company’s systematic risk relative to the market

- Market Risk Premium: the expected return of the market minus the risk-free rate

The cost of debt is the interest rate the company pays on its debt. The weights are determined by the proportion of equity and debt in the company’s capital structure. In practice, there is subjectivity involved in estimating inputs for the CAPM, such as beta and the market risk premium. This can lead to different discount rates, ultimately affecting the valuation. For example, if the beta is overestimated (meaning the company is perceived as riskier than it actually is), the cost of equity, and therefore the WACC, will be higher, leading to a lower valuation.

Q 18. What are the key drivers of value in a particular industry (e.g., technology, healthcare)?

The key drivers of value vary significantly across industries. In the technology sector, innovation, intellectual property (patents, trademarks, copyrights), network effects, and scalability are crucial value drivers. A company’s ability to develop and commercialize disruptive technologies, attract and retain talent, and build a strong brand reputation often determines its valuation. For example, a company with a proprietary algorithm or a large user base benefiting from network effects (like social media platforms) commands a high valuation. In the healthcare industry, value is driven by factors like regulatory approvals, intellectual property (new drugs, medical devices), market exclusivity (patents), and revenue streams associated with sales, licensing, and reimbursement rates. A drug with proven efficacy and a large target market will naturally attract a higher valuation than a drug with limited applicability. The strength of a pharmaceutical company’s research pipeline and intellectual property portfolio is also a key driver of market value.

Q 19. Describe your experience with different valuation approaches for private companies.

My experience with valuation approaches for private companies includes utilizing a variety of methods, selecting the most appropriate given the specific circumstances. These often include:

- Discounted Cash Flow (DCF) analysis: This is a fundamental method that projects future cash flows and discounts them back to their present value. For private companies, obtaining reliable financial projections can be challenging due to the lack of publicly available information. Careful analysis of historical performance, industry trends, and management’s projections is crucial.

- Precedent Transactions: This involves analyzing comparable acquisitions of similar private companies. Identifying truly comparable transactions can be difficult due to limited public data on private company acquisitions. Adjustment for differences in size, profitability, and market conditions is necessary.

- Public Company Comparables: This method uses the market multiples of publicly traded companies to estimate the value of a private company. Finding truly comparable public companies can be challenging, and adjustments are needed to account for the differences in size, risk, and growth prospects.

For instance, in valuing a privately-held software company, I might use a DCF analysis to project future cash flows based on management projections and industry benchmarks. I would supplement this with a precedent transaction analysis, comparing the company to recently acquired private software firms, and adjust the valuation based on any differences in size and revenue growth.

Q 20. How do you deal with non-recurring items when forecasting future cash flows?

Non-recurring items, such as one-time gains or losses, should be excluded from the forecast of future cash flows in a valuation. Including them would distort the picture of the company’s normal, recurring operating performance. The best approach is to identify these non-recurring items and adjust the reported financial statements to reflect the underlying, normalized performance. For example, if a company had a significant gain from the sale of an asset, this would be excluded from the projection of future cash flows, unless such transactions are expected to recur. The forecasted cash flows should represent the company’s sustainable earnings power, and therefore only include predictable and repeatable items. This ensures a more accurate assessment of the company’s intrinsic value. Documentation of these adjustments is essential for transparency and the reproducibility of the valuation.

Q 21. What are the strengths and weaknesses of the precedent transactions method?

The precedent transactions method, which involves analyzing comparable acquisitions of similar companies, has both strengths and weaknesses.

Strengths:

- Market-based approach: It directly reflects what actual buyers have paid for similar assets, providing a strong market-based rationale for the valuation.

- Relatively straightforward: It’s simpler to understand and apply than other methods like DCF, especially if sufficient comparable transactions exist.

Weaknesses:

- Data availability: Finding truly comparable transactions can be difficult, particularly for private companies or specialized industries. Limited data can hinder the analysis.

- Market conditions: The prices paid in precedent transactions are influenced by prevailing market conditions (e.g., economic cycles, investor sentiment). This can lead to inaccurate valuations if the market conditions at the time of the comparable transactions significantly differ from the current market.

- Deal specifics: Each transaction has unique characteristics (e.g., buyer-seller relationship, payment terms) that can affect the price paid. Controlling for these differences can be difficult.

- Lack of future outlook: Precedent transactions only reflect past values and don’t explicitly incorporate the future prospects of the company being valued.

It’s essential to carefully select comparable transactions, adjusting for any differences to arrive at a reliable valuation.

Q 22. How do you assess the credibility of your valuation?

Assessing the credibility of a valuation is paramount. It’s not just about arriving at a number; it’s about ensuring that number is reliable and defensible. I approach this through a multi-faceted process. First, I meticulously document every step of my valuation process, including the data sources, methodologies employed, and any underlying assumptions. Transparency is key. Second, I perform sensitivity analysis, systematically changing key inputs to understand how the valuation changes. This reveals the robustness of my findings and highlights areas of significant uncertainty. For example, if a small change in the discount rate drastically alters the valuation, it indicates a potentially unreliable result, prompting further investigation. Third, I compare my valuation to market data, industry benchmarks, and similar transactions, where appropriate. Any significant deviations require careful justification. Finally, a peer review by another qualified professional can provide an independent assessment of the valuation’s credibility and identify potential weaknesses. This ensures a robust and dependable valuation.

Q 23. How do you communicate complex valuation concepts to non-technical audiences?

Communicating complex valuation concepts to non-technical audiences requires clear, concise language and appropriate analogies. I avoid jargon and technical terms whenever possible, instead relying on plain English explanations and visual aids like charts and graphs. For instance, explaining discounted cash flow (DCF) analysis, I might compare it to the present value of a future inheritance. The further out the inheritance, the less it’s worth today, reflecting the time value of money. Similarly, I use real-world examples relevant to the audience. If I’m presenting to a board of directors, I might focus on how the valuation impacts strategic decisions, like mergers and acquisitions. If it’s a group of investors, I’ll emphasize the risk and return aspects. The key is to tailor the communication to the audience’s level of understanding and their specific needs.

Q 24. What is your experience with different valuation standards (e.g., IFRS, US GAAP)?

I possess extensive experience working with both IFRS (International Financial Reporting Standards) and US GAAP (Generally Accepted Accounting Principles). I understand the nuances of each standard and how they impact valuation methodologies. For instance, under IFRS, fair value is more prominently featured, often requiring a market-based approach. US GAAP, while also considering fair value, allows for other valuation methods depending on the asset type and circumstances. I’m proficient in applying the relevant standards to different valuation scenarios, ensuring compliance and consistency. My experience includes valuing assets ranging from intangible assets like patents and trademarks to financial instruments and businesses. This diverse experience allows me to adapt to different regulatory landscapes and industry practices.

Q 25. Discuss your understanding of option pricing models (e.g., Black-Scholes).

Option pricing models, like the Black-Scholes model, are crucial for valuing options and other derivative instruments. The Black-Scholes model uses several key inputs, including the current stock price, the strike price, the time to expiration, the risk-free interest rate, and the volatility of the underlying asset’s price. The model provides a theoretical price for the option based on these inputs and assumptions. Option Price = S * N(d1) - X * e^(-rT) * N(d2) This formula, while seemingly complex, provides a framework to determine the price. I understand the model’s limitations, including its assumptions about constant volatility and risk-free interest rates, which may not always hold true in the real world. Therefore, I use these models judiciously and often supplement them with other valuation techniques or adjust them based on market observations. Understanding the model’s underlying assumptions and limitations is critical for applying it effectively and interpreting its output.

Q 26. How do you evaluate the quality of earnings when performing a valuation?

Evaluating the quality of earnings is vital during a valuation. It involves examining the sustainability and reliability of a company’s reported earnings. I typically analyze several key areas. First, I examine the composition of earnings, separating recurring operating earnings from non-recurring items like gains or losses on asset sales. This helps determine the true underlying profitability. Second, I look at the accruals quality. High accruals, which represent earnings recognized without cash flows, can be a red flag, potentially indicating aggressive accounting practices. I use ratios and analytical procedures to identify unusual accrual patterns. Third, I assess the company’s cash flow generation. A strong cash flow profile often indicates sustainable earnings, even if reported net income is volatile. Finally, I analyze the company’s business model and the underlying economic drivers to understand the long-term sustainability of its earnings. By thoroughly analyzing these aspects, I can adjust my valuation to reflect the true economic reality of the company’s profitability.

Q 27. How do you incorporate macroeconomic factors into your valuation models?

Macroeconomic factors significantly influence valuations. I incorporate these factors into my models primarily through adjustments to the discount rate and growth rate assumptions. For example, rising interest rates generally increase the discount rate, reducing the present value of future cash flows. High inflation might impact projected revenue growth rates, leading to adjustments in the valuation. I use various economic indicators like GDP growth, inflation rates, interest rate forecasts, and unemployment rates to inform these adjustments. I also analyze industry-specific trends that are influenced by macroeconomic conditions. For instance, a sector-specific regulation change can drastically alter a company’s future prospects. This holistic approach helps account for the broader economic context within which the company operates, leading to a more realistic and credible valuation.

Q 28. Explain your approach to validating the assumptions of your valuation model.

Validating the assumptions of a valuation model is crucial. I use several approaches to ensure the robustness of my assumptions. First, I thoroughly research and document the basis for each assumption, citing relevant data sources and market observations. Second, I perform sensitivity analysis to determine how changes in critical inputs, such as growth rates, discount rates, and terminal value multiples, influence the overall valuation. This process assesses the sensitivity of the valuation to changes in assumptions. Third, I compare my assumptions to those used in comparable company analyses or precedent transactions. Any significant deviations require rigorous justification. Fourth, I engage in discussions with management and other stakeholders to gather insights and cross-validate my assumptions. By employing these techniques, I can assess the reasonableness of my assumptions and the overall reliability of my valuation.

Key Topics to Learn for Measurement and Valuation Interview

- Fundamental Valuation Principles: Understanding concepts like present value, future value, discounted cash flow (DCF) analysis, and relative valuation methods. Practical application includes valuing assets in different contexts (real estate, stocks, businesses).

- Financial Statement Analysis: Mastering the interpretation of balance sheets, income statements, and cash flow statements to extract key performance indicators (KPIs) and assess financial health. Practical application: Using financial statements to inform valuation models and identify potential risks and opportunities.

- Cost-Benefit Analysis: Evaluating the economic feasibility of projects and initiatives by comparing costs and benefits. Practical application: Justifying investment decisions based on robust quantitative analysis.

- Risk Assessment and Management: Identifying and quantifying various risks associated with investments and valuation exercises. Practical application includes incorporating risk factors into valuation models, using sensitivity analysis and scenario planning.

- Market Research and Industry Analysis: Understanding market dynamics, competitive landscapes, and industry trends relevant to the specific assets being valued. Practical application includes justifying valuation multiples based on comparable company analysis.

- Specific Valuation Methods: Deepening your understanding of different valuation techniques relevant to your target industry (e.g., comparable company analysis, precedent transactions, asset-based valuation). Practical application: Applying the appropriate methods to various situations and justifying your choices.

- Data Analysis and Modeling: Proficiency in using software (e.g., Excel, specialized financial modeling tools) to build valuation models and perform data analysis. Practical application: Creating clear and accurate models that support your valuation conclusions.

Next Steps

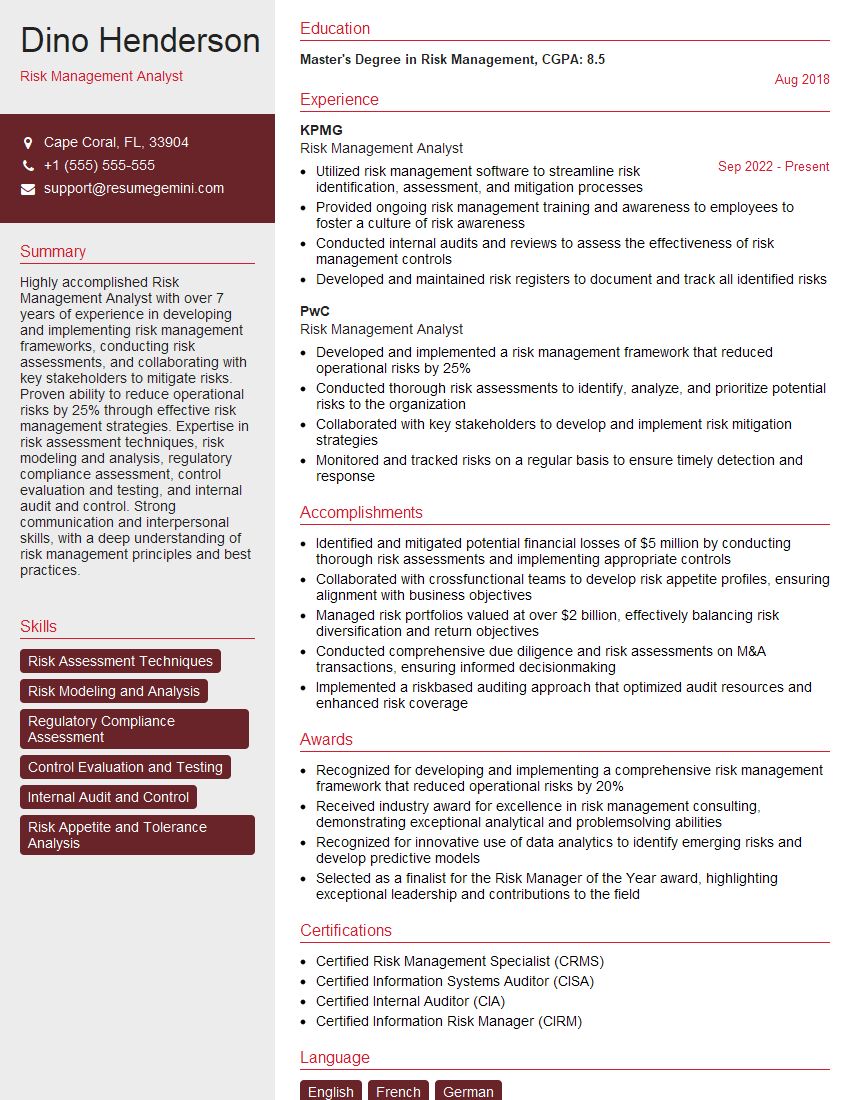

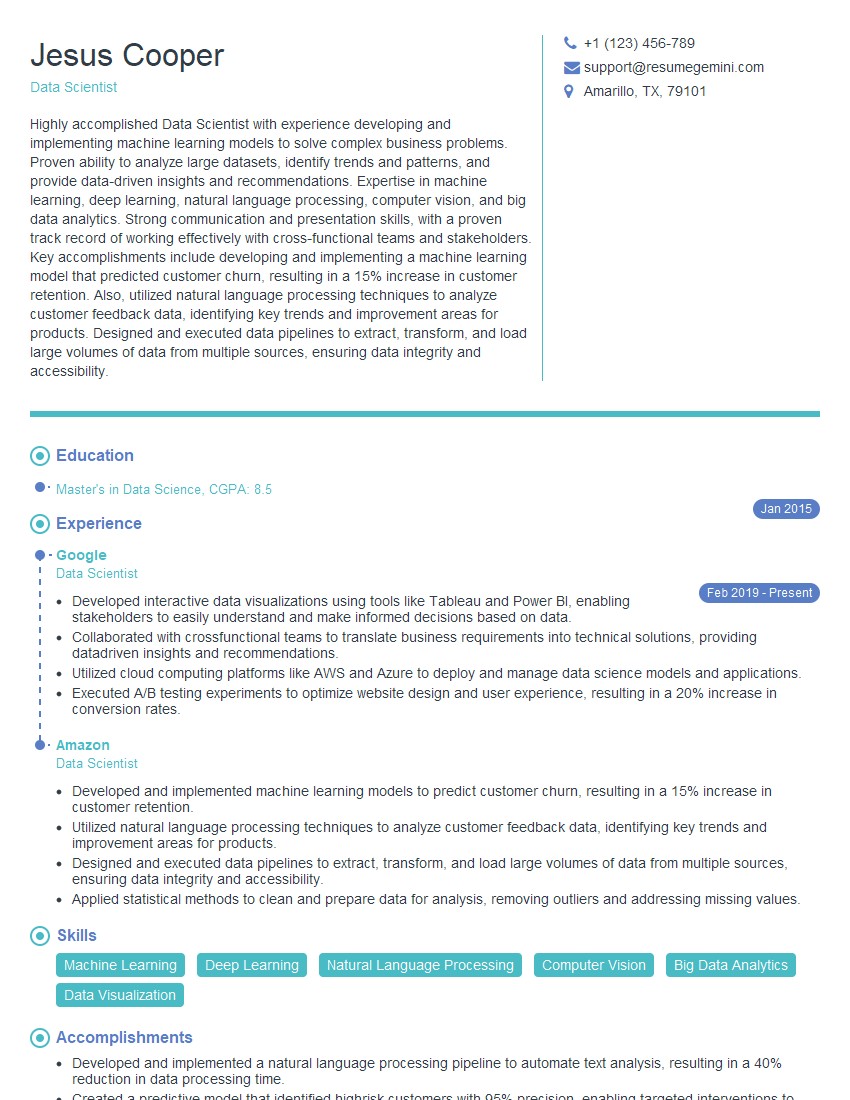

Mastering Measurement and Valuation is crucial for career advancement in finance, consulting, and various other quantitative fields. It demonstrates strong analytical and problem-solving skills highly sought after by employers. To significantly boost your job prospects, focus on crafting a compelling and ATS-friendly resume that highlights your relevant skills and experience. ResumeGemini is a trusted resource to help you build a professional and impactful resume. We provide examples of resumes tailored to Measurement and Valuation roles to guide you through the process.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Interesting Article, I liked the depth of knowledge you’ve shared.

Helpful, thanks for sharing.

Hi, I represent a social media marketing agency and liked your blog

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?