The thought of an interview can be nerve-wracking, but the right preparation can make all the difference. Explore this comprehensive guide to Fraud Detection Tools and Techniques interview questions and gain the confidence you need to showcase your abilities and secure the role.

Questions Asked in Fraud Detection Tools and Techniques Interview

Q 1. Explain the difference between rule-based and machine learning-based fraud detection systems.

Rule-based and machine learning-based fraud detection systems differ fundamentally in how they identify fraudulent activities. Rule-based systems rely on pre-defined rules created by human experts. These rules specify conditions that, if met, flag a transaction as potentially fraudulent. Think of it like a set of ‘if-then’ statements. For example, a rule might be: ‘If the transaction amount exceeds $10,000 and originates from a different country than the cardholder’s registered address, flag it as suspicious.’

Machine learning (ML) systems, on the other hand, learn patterns and anomalies from historical data. They use algorithms to identify relationships and predict fraudulent behavior without explicitly programmed rules. They are more adaptable to evolving fraud patterns and can uncover subtle indicators that rule-based systems might miss. Imagine a detective learning to recognize a criminal’s subtle mannerisms over time, rather than relying solely on a mugshot.

The key difference lies in flexibility and adaptability. Rule-based systems are easier to implement and understand initially, but they struggle to keep up with new fraud schemes. ML systems require more data and computational power but can adapt to emerging threats and detect more sophisticated fraud patterns. Often, a hybrid approach combining both methods yields the best results, leveraging the strengths of each.

Q 2. Describe your experience with common fraud detection tools (e.g., Splunk, ArcSight, etc.).

I have extensive experience working with several leading fraud detection tools, including Splunk, ArcSight, and also more specialized solutions like those offered by NICE Actimize and SAS. My work with Splunk, for instance, involved leveraging its powerful search capabilities to analyze large volumes of security logs and transaction data to identify suspicious activities. We used Splunk’s dashboards to visualize key metrics, allowing us to quickly identify trends and potential fraud indicators. This included correlating data from various sources like network logs, application logs, and databases to build a comprehensive picture of potential threats.

ArcSight, similarly, provided a strong Security Information and Event Management (SIEM) platform for aggregating and analyzing security data. Here, my focus was on developing and refining custom rules and correlation engines to detect anomalies and suspicious patterns within the data. I worked with ArcSight’s reporting capabilities to generate comprehensive reports that helped to track key performance indicators and assess the effectiveness of our fraud detection strategies.

In both cases, I played a crucial role in configuring, optimizing, and maintaining these systems, ensuring their accuracy and efficiency. My experience extends to data integration, alert management, and the creation of custom reports to meet specific business needs. I’m also proficient in utilizing the reporting and visualization capabilities within these tools to present actionable intelligence to stakeholders.

Q 3. How would you identify and investigate a potential case of credit card fraud?

Investigating credit card fraud involves a systematic approach. First, I would analyze the transaction details looking for red flags. This includes verifying the location of the transaction against the cardholder’s known location, checking for unusual transaction amounts or frequency compared to the cardholder’s typical spending patterns, and verifying the merchant category code (MCC) to ensure it aligns with the cardholder’s spending habits. For example, a sudden large purchase at a jewelry store from someone who typically only buys groceries would raise suspicion.

Next, I would review the cardholder’s recent account activity for any other suspicious transactions. A series of small, unauthorized transactions could precede a larger one, indicating a compromised account. I’d also review the card’s transaction history for any patterns of suspicious activity, which could indicate a breach. Then I would contact the cardholder to verify the legitimacy of the transactions. In the case of confirmed fraud, I’d immediately block the card to prevent further losses, and initiate a full investigation working with relevant authorities and potentially external forensic specialists to track down the origin and culprits of the fraud.

Depending on the complexity, evidence might include transaction details from various sources, merchant statements, IP addresses, geographical data, and any communications the fraudster might have engaged in, all needing careful documentation and preservation for potential legal proceedings.

Q 4. What are some common types of financial fraud, and how would you detect each?

Financial fraud encompasses a wide range of activities. Here are a few common types and how I would detect them:

- Credit Card Fraud: As discussed earlier, this involves unauthorized use of a credit card. Detection involves analyzing transaction patterns, locations, and amounts as outlined previously. Machine learning models can also be particularly effective in identifying unusual spending behavior.

- Check Fraud: This involves forging, altering, or stealing checks. Detection often relies on comparing check details (account number, signature) against database records. Advanced techniques include image analysis to detect alterations.

- Identity Theft: This involves using someone else’s personal information to open accounts or commit fraud. Detection relies on verifying identities through multiple sources (SSN, address, date of birth) and comparing them against databases. Anomaly detection in application patterns can reveal inconsistencies.

- Money Laundering: This involves disguising the origins of illegally obtained money. Detection involves identifying large, unusual transactions, especially those involving multiple accounts or shell companies. Network analysis techniques are crucial here to uncover hidden relationships.

- Insurance Fraud: This involves filing false insurance claims. Detection involves analyzing claims against historical data, looking for inconsistencies or patterns of fraudulent behavior among certain individuals or groups.

The detection methods often overlap and require a combination of rule-based systems, machine learning models, and human investigation to effectively identify and mitigate these threats.

Q 5. What are the key performance indicators (KPIs) you would use to evaluate the effectiveness of a fraud detection system?

Evaluating a fraud detection system’s effectiveness requires tracking several key performance indicators (KPIs). These KPIs should provide a balanced view, considering both accuracy and business impact.

- Fraud Detection Rate (FDR): Percentage of actual fraudulent transactions successfully identified by the system. A higher FDR is better but needs to be balanced with the false positive rate.

- False Positive Rate (FPR): Percentage of legitimate transactions incorrectly flagged as fraudulent. A high FPR leads to increased operational costs and customer dissatisfaction.

- Precision: Proportion of correctly identified fraudulent transactions out of all transactions flagged as fraudulent. High precision ensures that investigations are focused on actual fraud.

- Recall: Proportion of correctly identified fraudulent transactions out of all actual fraudulent transactions. High recall is crucial to minimize undetected fraud.

- Average Time to Detection: The average time taken to identify a fraudulent transaction. Faster detection minimizes losses.

- Cost of Fraud: The actual monetary loss incurred due to undetected fraudulent activities. This is a critical business metric.

- Operational Costs: Costs associated with running the fraud detection system (including personnel, infrastructure, and investigation).

By monitoring these KPIs, we can assess the system’s performance, identify areas for improvement, and justify investments in enhancing the system’s capabilities.

Q 6. Describe your experience with anomaly detection techniques in fraud detection.

Anomaly detection is a crucial technique in fraud detection. It involves identifying unusual patterns or outliers that deviate significantly from established norms. These anomalies often signal fraudulent activities. I have experience implementing various anomaly detection methods, including statistical methods like Z-score and clustering techniques like K-means.

For example, using Z-scores, we can identify transactions whose amounts are significantly different from the average transaction amount for a given account. Similarly, K-means clustering can group transactions based on similar characteristics, and outliers falling outside these clusters could be flagged for further investigation. More advanced methods, such as One-Class SVM (Support Vector Machine) or Isolation Forest, can learn the normal behavior of legitimate transactions and identify deviations as potential fraud. These techniques are particularly powerful in dealing with evolving fraud patterns, which traditional rule-based systems might struggle with. The selection of a suitable method depends on the specific data and the characteristics of the fraud being detected.

My experience includes not only selecting the right algorithm but also pre-processing the data to ensure its suitability for anomaly detection, and managing the computational resources required for these algorithms.

Q 7. How do you handle false positives in a fraud detection system?

False positives, where legitimate transactions are incorrectly flagged as fraudulent, are an unavoidable challenge in fraud detection. Handling them effectively is crucial to maintaining customer trust and minimizing operational costs. A multi-pronged approach is typically employed.

Firstly, I would focus on refining the fraud detection models or rules to improve their accuracy. This might involve adjusting thresholds, adding new features, or using more sophisticated algorithms. For example, adjusting the threshold on a transaction amount might reduce false positives triggered by legitimate high-value transactions. Secondly, implementing a robust case management system with clear escalation paths for reviewing flagged transactions is essential. Human review of flagged transactions is often necessary to make the final determination of fraud, as complex scenarios might demand nuanced decision-making exceeding the capabilities of algorithms alone. This review process should involve clear guidelines and training to minimize inconsistencies.

Finally, it is crucial to incorporate feedback from investigations into the model refinement process. The analysis of both false positives and false negatives can improve the system’s overall accuracy over time. This iterative process of continuous learning and improvement is critical in building a highly accurate and effective fraud detection system.

Q 8. What is your experience with network security tools used in fraud detection?

My experience with network security tools in fraud detection is extensive. I’ve worked with a range of technologies, from intrusion detection systems (IDS) and intrusion prevention systems (IPS) to Security Information and Event Management (SIEM) systems and network flow analyzers. These tools are crucial for identifying suspicious network activity indicative of fraudulent behavior. For example, an IDS can detect unusual login attempts from geographically dispersed locations, a key indicator of credential stuffing attacks. Similarly, a SIEM system can correlate events from various security sources to uncover complex fraud schemes involving multiple attack vectors. I’m proficient in analyzing network logs to pinpoint anomalies like unusually large data transfers or connections to known malicious IP addresses. My expertise extends to configuring and managing these tools, optimizing them for performance and minimizing false positives.

Specifically, I have experience with tools like:

- Snort (IDS/IPS)

- Elastic Stack (ELK) – for SIEM and log analysis

- Wireshark (network protocol analyzer)

- Various vendor-specific SIEM platforms

The effective use of these tools requires a deep understanding of networking protocols and common attack patterns. I regularly utilize this knowledge to build effective security monitoring solutions that proactively detect and respond to fraudulent activities.

Q 9. Explain your understanding of Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are critical in preventing financial crimes. KYC refers to the process of identifying and verifying the identity of clients. This involves collecting and verifying information such as identification documents, addresses, and sources of funds. The goal is to prevent individuals from using false identities to conduct illicit activities. AML regulations, on the other hand, focus on preventing the movement of illegally obtained money through financial systems. This involves monitoring transactions for suspicious activity, reporting suspicious activity to relevant authorities, and implementing measures to prevent money laundering.

My understanding encompasses the nuances of these regulations across various jurisdictions. For example, I’m aware of the differences in KYC/AML requirements between the US (with its BSA/OFAC regulations), the EU (with its 5th and 6th AML Directives), and other global regulatory bodies like the Financial Action Task Force (FATF). I understand the importance of maintaining accurate and up-to-date customer information, conducting ongoing monitoring of client activities, and implementing robust transaction monitoring systems. Failure to comply with these regulations can lead to significant penalties and reputational damage.

In practice, this involves working with KYC/AML compliance teams to ensure all processes are adhering to the latest regulations. It also means understanding the risks associated with various customer segments and adapting our fraud detection strategies accordingly.

Q 10. How do you stay updated on the latest fraud trends and techniques?

Staying updated on the latest fraud trends and techniques is paramount in the fight against financial crime. I achieve this through a multi-pronged approach:

- Industry Publications and Research Reports: I regularly read publications from reputable sources such as the Association of Certified Fraud Examiners (ACFE), Gartner, Forrester, and other specialized fraud detection journals. These publications often feature in-depth analyses of emerging threats and best practices.

- Conferences and Webinars: Attending industry conferences and webinars allows me to learn from leading experts and network with other professionals in the field. These events often offer valuable insights into the latest fraud schemes and detection methodologies.

- Online Communities and Forums: Engaging in online communities and forums dedicated to fraud detection and cybersecurity helps me stay informed about current trends and share knowledge with fellow professionals. This can include participating in discussions on platforms like Reddit or specialized security mailing lists.

- Threat Intelligence Feeds: Subscribing to threat intelligence feeds provides real-time alerts about newly discovered vulnerabilities and attack vectors. This allows for proactive mitigation strategies and rapid response to emerging threats.

- Collaboration with Law Enforcement: Maintaining contact with law enforcement agencies involved in investigating financial crimes can provide valuable insight into current trends and emerging threats.

By combining these approaches, I ensure I maintain a comprehensive understanding of the evolving threat landscape and adapt my strategies accordingly.

Q 11. Describe your experience with data mining and analysis in the context of fraud detection.

Data mining and analysis are at the heart of effective fraud detection. My experience involves leveraging various techniques to identify patterns and anomalies in large datasets that indicate fraudulent activities. I’m proficient in using tools like SQL, Python (with libraries such as Pandas, Scikit-learn, and TensorFlow), and various data visualization tools to extract meaningful insights from transactional, customer, and network data.

For instance, I’ve used clustering algorithms to identify groups of transactions exhibiting unusual behavior, such as unexpectedly high transaction volumes from a single IP address. I’ve also applied anomaly detection techniques, such as one-class SVM, to pinpoint deviations from established baselines, thereby flagging potentially fraudulent transactions. Regression modeling has been used to predict the probability of fraud based on various risk factors. Finally, I utilize data visualization techniques to communicate findings effectively to both technical and non-technical audiences, facilitating better decision-making.

One specific example: In a previous role, I utilized a combination of SQL queries to identify unusual transaction patterns and Python’s Scikit-learn to build a Random Forest model for predicting fraudulent insurance claims. This model achieved a significant reduction in false positives and improved the overall accuracy of fraud detection.

Q 12. How would you investigate a case of insider fraud?

Investigating insider fraud requires a meticulous and systematic approach. It’s crucial to maintain confidentiality and follow established protocols to avoid further damage or compromising evidence. My approach typically involves the following steps:

- Gathering Evidence: This involves collecting all relevant data, including financial records, access logs, communication records (emails, instant messages), and any other potentially relevant documents. This phase often involves working closely with IT security teams to access and secure necessary data.

- Identifying Patterns and Anomalies: Analyzing the collected data to identify unusual patterns or deviations from established norms. This might involve looking for unusual access patterns, unexplained transactions, or inconsistencies in reported work hours or expense claims. Tools like SIEM systems and data analytics platforms are crucial in this phase.

- Interviewing Witnesses: Conducting interviews with relevant individuals to gather information and corroborate findings. This needs to be done carefully, ensuring the integrity of the investigation process.

- Forensic Analysis: If necessary, conducting forensic analysis of computer systems and data to identify evidence of tampering or data manipulation. This phase requires specialized skills and tools.

- Documentation: Maintaining detailed records of all findings, interviews, and analysis throughout the investigation. This is crucial for potential legal proceedings.

- Reporting Findings: Presenting a comprehensive report outlining the findings, conclusions, and recommendations to relevant stakeholders. This might involve internal audit teams, legal counsel, or law enforcement.

Throughout this investigation, maintaining data integrity and chain of custody is critical to ensuring the legal admissibility of any evidence.

Q 13. What is your experience with building and deploying fraud detection models?

I have significant experience in building and deploying fraud detection models. This involves a combination of data preparation, model selection, training, validation, and deployment. My experience spans various model types, including:

- Rule-based systems: Defining specific rules based on known fraud patterns. This approach is simple to implement but can become cumbersome to maintain as fraud patterns evolve.

- Statistical models: Utilizing models such as logistic regression, support vector machines (SVM), and decision trees to predict the probability of fraud based on various features. These models are adaptable and can handle a large number of variables.

- Machine learning models: Employing advanced machine learning techniques, such as Random Forests, Gradient Boosting Machines (GBM), and Neural Networks, to identify complex patterns and improve predictive accuracy. These models require significant data preparation and careful tuning.

My deployment experience includes integrating models into existing systems, ensuring seamless integration and minimal disruption to existing workflows. This often involves working with development teams to build robust APIs and data pipelines. Post-deployment, I focus on monitoring model performance, retraining as needed, and making necessary adjustments to adapt to evolving fraud patterns. Model explainability is also a key focus, ensuring we understand how the model arrives at its predictions.

I use tools like Python’s Scikit-learn, TensorFlow, or Keras for model development and deployment platforms like AWS SageMaker or Azure Machine Learning for scaling and managing models.

Q 14. Explain your understanding of statistical analysis techniques used in fraud detection.

Statistical analysis techniques are fundamental to fraud detection. They enable us to identify anomalies, quantify risks, and build predictive models. Some common techniques I utilize include:

- Descriptive Statistics: Summarizing data using metrics such as mean, median, standard deviation, and percentiles to identify unusual patterns or outliers.

- Inferential Statistics: Using hypothesis testing to determine if observed differences between groups are statistically significant. For example, comparing the average transaction value of fraudulent transactions to legitimate ones.

- Regression Analysis: Modeling the relationship between various predictor variables and the likelihood of fraud. This allows for risk scoring and prediction of future fraud events.

- Time Series Analysis: Analyzing transaction data over time to identify seasonal patterns or trends that may indicate fraudulent activities.

- Anomaly Detection: Using statistical methods to identify unusual deviations from established baselines, such as using Z-scores or other outlier detection algorithms.

Understanding these techniques is crucial to interpret data effectively, build accurate models, and communicate findings clearly. Choosing the appropriate statistical technique depends on the nature of the data, the specific fraud detection problem, and the desired level of accuracy. For example, in one case, I used time series analysis to detect a spike in unusual ATM withdrawals during off-peak hours, leading to the uncovering of a significant card fraud ring.

Q 15. How do you prioritize fraud alerts and investigations?

Prioritizing fraud alerts and investigations is crucial for efficient resource allocation. It’s not feasible to investigate every single alert; a strategic approach is needed. I typically use a multi-layered prioritization system. First, I leverage the fraud detection system’s built-in scoring mechanism. Alerts with higher risk scores, indicating a greater probability of fraud, naturally get prioritized. Second, I consider the potential financial impact. Larger transaction values or those involving many accounts immediately warrant attention. Third, I analyze the alert’s characteristics, paying close attention to patterns or anomalies that suggest organized fraud rings. For instance, multiple alerts originating from the same IP address or involving similar transaction details may indicate a coordinated attack. Lastly, I factor in the type of fraud. For example, account takeover attempts are often given higher priority than low-value card-not-present fraud because of the potential for widespread damage. This layered approach helps to efficiently manage investigations, focusing resources where they’re most needed.

For example, imagine a scenario with three alerts: A low-value transaction with a slightly suspicious pattern, a large transaction flagged by our system as high risk, and multiple smaller transactions from the same IP address. I would investigate the high-risk large transaction first, followed by the multiple transactions from the same IP address, due to the potential for wider impacts. The low-value transaction, while worth noting, would be investigated later or put in a queue for a less immediate review.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What are some common challenges in fraud detection, and how do you overcome them?

Common challenges in fraud detection include: data imbalance (far more legitimate transactions than fraudulent ones), evolving fraud techniques (fraudsters constantly adapt their methods), data quality issues (incomplete, inconsistent, or inaccurate data), and competing priorities (balancing fraud prevention with customer experience).

To overcome these: We address data imbalance through techniques like oversampling minority classes (fraudulent transactions) or using cost-sensitive learning algorithms. We combat evolving fraud by implementing adaptive machine learning models that can learn and adjust to new patterns in real-time, monitoring emerging trends and adjusting rules and models accordingly. We mitigate data quality issues through rigorous data cleaning and preprocessing, implementing data validation rules, and using robust feature engineering techniques. Finally, we balance fraud prevention and customer experience through careful rule tuning, focusing on minimizing false positives (legitimate transactions flagged as fraudulent) and implementing user-friendly processes for resolving disputed cases. We may incorporate behavioral biometrics, or even use human-in-the-loop systems for challenging cases.

Q 17. What is your experience with fraud detection in specific industries (e.g., banking, e-commerce)?

My experience spans both banking and e-commerce fraud detection. In banking, I’ve worked extensively on identifying and preventing account takeover, credit card fraud, and money laundering. This often involves analyzing transaction data, account activity, and customer demographics to identify suspicious patterns. For example, unusual login attempts from unfamiliar locations or unusually large withdrawals are strong indicators of potential fraud. In e-commerce, I’ve focused on detecting fraudulent orders, including those involving stolen credit cards, fake accounts, and chargebacks. Here, the focus is often on analyzing transaction details, shipping addresses, and customer purchase history. For instance, a sudden spike in orders from a new customer or orders shipped to unusual locations would raise red flags. In both industries, a strong understanding of regulatory compliance (like KYC/AML) is crucial.

Q 18. Describe your experience with different types of fraud detection algorithms (e.g., decision trees, neural networks).

I have extensive experience with various fraud detection algorithms. Decision trees are excellent for creating easily interpretable models, providing a clear path to understanding why a transaction is flagged. However, they can be less accurate for complex fraud patterns. Neural networks, particularly deep learning models, are powerful tools for capturing intricate relationships in data and achieving high accuracy. However, their complexity makes interpretation challenging. I’ve used both types successfully, selecting the appropriate algorithm based on the specific problem and data characteristics. For instance, for a simpler case with relatively clean data and a need for interpretability, a decision tree might be the right choice. For complex fraud involving many subtle indicators, a neural network often performs better, even if the output is a bit less easy to directly interpret. I also have experience with other algorithms, including support vector machines (SVMs) and gradient boosting machines (GBMs), often using ensemble methods which combine multiple algorithms to improve predictive accuracy and robustness.

Q 19. How would you evaluate the accuracy and efficiency of a fraud detection model?

Evaluating a fraud detection model involves assessing both its accuracy and efficiency. Accuracy is measured using metrics like precision, recall, and F1-score. Precision tells us the proportion of correctly identified fraudulent transactions among all transactions flagged as fraudulent (minimizing false positives). Recall measures the proportion of actual fraudulent transactions correctly identified (minimizing false negatives). The F1-score balances precision and recall. Efficiency is measured by considering factors such as the model’s processing time, resource consumption, and the ability to scale to large datasets. I would use techniques like A/B testing to compare different models or versions, tracking key metrics to measure improvements and choose the optimal model for implementation. Regular performance monitoring and retraining are also vital to maintain model accuracy and efficiency as fraud patterns evolve.

Q 20. What is your experience working with large datasets for fraud detection?

I have extensive experience working with large datasets for fraud detection, often using distributed computing frameworks like Spark or Hadoop to handle the massive volume of data. This involves techniques like data partitioning, parallel processing, and efficient data storage solutions. Experience with large datasets also demands proficiency in data sampling and dimensionality reduction techniques to manage the computational complexity and improve model training speed without significantly sacrificing accuracy. Furthermore, optimizing data pipelines for efficient processing, including ETL (Extract, Transform, Load) processes is critical for managing these large volumes of transactional data. For example, I may use techniques to aggregate data or focus on specific, high-risk features of transactions, optimizing storage and processing time without impacting the ability to detect fraud.

Q 21. Explain your understanding of data visualization techniques used in presenting fraud detection findings.

Data visualization plays a crucial role in presenting fraud detection findings clearly and effectively. I use a variety of techniques, depending on the audience and the type of information being conveyed. For example, dashboards showing key performance indicators (KPIs) such as the number of fraud attempts, the value of losses prevented, and the false positive rate help communicate the overall effectiveness of the fraud detection system. Network graphs can visually represent relationships between suspicious entities, revealing potential fraud rings or patterns. Geographical maps can display the location of fraudulent activity, revealing geographical hotspots. Time series plots can track trends in fraud over time, identifying seasonal patterns or sudden surges. Finally, interactive dashboards enable users to explore the data in detail and gain a deeper understanding of complex patterns. The choice of visualization depends on the specific need; simple bar charts can efficiently illustrate counts or proportions, while complex heatmaps or network graphs may show intricate relationships between different data points.

Q 22. How do you ensure the privacy and security of sensitive data during fraud investigations?

Protecting sensitive data during fraud investigations is paramount. We employ a multi-layered approach centered around data minimization, anonymization, and robust access controls. This means we only access and process the minimum necessary data to conduct the investigation, often employing techniques like data masking to protect personally identifiable information (PII). We strictly adhere to data privacy regulations like GDPR and CCPA. Access to sensitive data is restricted based on the principle of least privilege, ensuring only authorized personnel with a legitimate need to know can access it. Furthermore, all data is encrypted both in transit and at rest, and regular security audits are performed to identify and address any vulnerabilities. Think of it like a high-security vault – only authorized individuals with the right key can access the contents, and even then, only what is absolutely necessary.

For example, instead of using a customer’s full name and address, we might use a unique identifier or hash, rendering the data unusable outside of the investigation. All activities are logged and monitored to maintain a complete audit trail, allowing for accountability and ensuring compliance.

Q 23. What is your experience with collaborating with other teams (e.g., legal, compliance) during fraud investigations?

Collaboration is critical in fraud investigations. I have extensive experience working with legal, compliance, and other relevant teams. This involves regular communication updates, sharing findings in a timely and transparent manner, ensuring legal and regulatory compliance is maintained at every stage. My experience includes coordinating with legal teams to ensure all investigations adhere to legal standards and to prepare evidence for potential litigation, and with compliance teams to report any detected violations and to implement corrective measures. For instance, during one investigation, I worked closely with the legal team to interpret regulations surrounding data privacy and ensure our investigation methods were fully compliant. This collaborative process ensures a holistic approach, preventing potential legal issues and achieving the most effective outcome.

Q 24. Describe your experience using SQL or other database querying languages for fraud detection.

SQL is an indispensable tool in my fraud detection arsenal. I’m proficient in writing complex queries to extract, analyze, and visualize data from various databases. My expertise extends to optimizing queries for performance and efficiency. I frequently use SQL to identify unusual patterns, anomalies, and potential fraud indicators within large datasets. For example, I might use a query like SELECT COUNT(*) FROM transactions WHERE amount > 10000 AND transaction_time BETWEEN '2023-10-26 00:00:00' AND '2023-10-26 23:59:59' GROUP BY customer_ID to identify customers with unusually high transaction volumes within a specific timeframe, which could indicate fraudulent activity. Beyond SQL, I am also experienced with NoSQL databases and other data querying languages as needed, adapting my approach based on the specific data structure and the type of analysis required.

Q 25. How would you communicate complex technical findings to non-technical stakeholders?

Communicating complex technical findings to non-technical stakeholders requires a clear, concise, and visually engaging approach. I avoid technical jargon, focusing instead on storytelling and using analogies to simplify complex concepts. I often use dashboards, charts, and graphs to visually represent findings, making them easily understandable. For example, instead of saying “anomaly detection algorithm flagged a significant deviation in transaction patterns,” I’d say something like “our system detected unusual spending habits that could indicate fraudulent activity.” I always frame my explanations in the context of the business impact, focusing on the potential financial losses or reputational damage the fraud could cause. This ensures the message is relevant and compelling for the audience. Ultimately, clear communication is essential for stakeholders to understand the severity of the fraud and take appropriate action.

Q 26. What is your experience with implementing and managing fraud detection policies and procedures?

I have significant experience in implementing and managing fraud detection policies and procedures. This involves developing and maintaining comprehensive policies covering various fraud types, risk assessments, investigation procedures, and reporting mechanisms. I’ve also been involved in designing and implementing fraud prevention controls, such as authentication measures, transaction monitoring systems, and data loss prevention tools. My experience includes overseeing the regular review and update of policies and procedures to adapt to evolving fraud tactics and ensure their continued effectiveness. The goal is to create a robust system that not only detects fraud but also prevents it from happening in the first place, creating a proactive rather than reactive approach.

Q 27. Describe a time you identified a previously unknown fraud scheme.

During an investigation into unusually high chargeback rates on a particular online platform, I noticed a pattern of seemingly legitimate transactions followed by immediate chargebacks. Initial analysis focused on common fraud indicators, but the transactions appeared genuine. However, closer examination of the customer IP addresses revealed a concentrated cluster of transactions originating from a single geographical location known for fraudulent activities. Further investigation revealed a ring of individuals using stolen credit card details to purchase high-value goods and immediately initiating chargebacks. This previously unknown scheme was only identified by combining transaction data analysis with geolocation information, highlighting the importance of employing a multi-faceted approach and going beyond standard fraud detection methods.

Q 28. How would you design a fraud detection system for a new product or service?

Designing a fraud detection system for a new product or service requires a phased approach. First, we must define the potential fraud risks specific to the product or service. This involves considering the nature of the product, its target market, and potential vulnerabilities. Next, we select appropriate data sources and build a data pipeline to collect and process relevant information. This might include transactional data, user behavior data, geolocation data, and device information. Then, we would employ various machine learning techniques, such as anomaly detection and rule-based systems, to identify potentially fraudulent activities. The system would be designed to continuously learn and adapt to new fraud patterns, utilizing feedback loops to improve its accuracy and effectiveness. Finally, comprehensive monitoring and alerting mechanisms would be put in place to ensure timely detection and response to fraud attempts, constantly evolving alongside the product and the evolving landscape of fraud techniques.

Key Topics to Learn for Fraud Detection Tools and Techniques Interview

- Rule-Based Systems: Understanding the design, implementation, and limitations of rule-based fraud detection systems. Practical application: Designing rules to identify suspicious transactions based on predefined criteria.

- Machine Learning in Fraud Detection: Exploring various machine learning algorithms (e.g., anomaly detection, classification) used for fraud detection. Practical application: Evaluating the performance of different models and selecting the most appropriate one for a given dataset.

- Data Preprocessing and Feature Engineering: Mastering techniques for cleaning, transforming, and selecting relevant features from large datasets for effective model training. Practical application: Handling missing values, outliers, and creating new features to improve model accuracy.

- Network Analysis Techniques: Understanding how network graphs can be used to identify fraudulent patterns and relationships between entities. Practical application: Analyzing transaction networks to detect money laundering or collusion.

- Anomaly Detection Methods: Exploring different anomaly detection algorithms and their applications in identifying unusual patterns indicative of fraud. Practical application: Tuning anomaly detection parameters to balance sensitivity and false positives.

- Fraud Investigation and Case Management: Understanding the investigative process, including evidence gathering, analysis, and reporting. Practical application: Developing a strategy for investigating suspicious activity and documenting findings.

- Regulatory Compliance and Best Practices: Familiarizing yourself with relevant regulations and industry best practices in fraud detection and prevention. Practical application: Implementing measures to ensure compliance with relevant regulations.

- Explainable AI (XAI) in Fraud Detection: Understanding the importance of interpretability in fraud detection models and techniques for explaining model predictions. Practical application: Using XAI techniques to build trust and transparency in fraud detection systems.

Next Steps

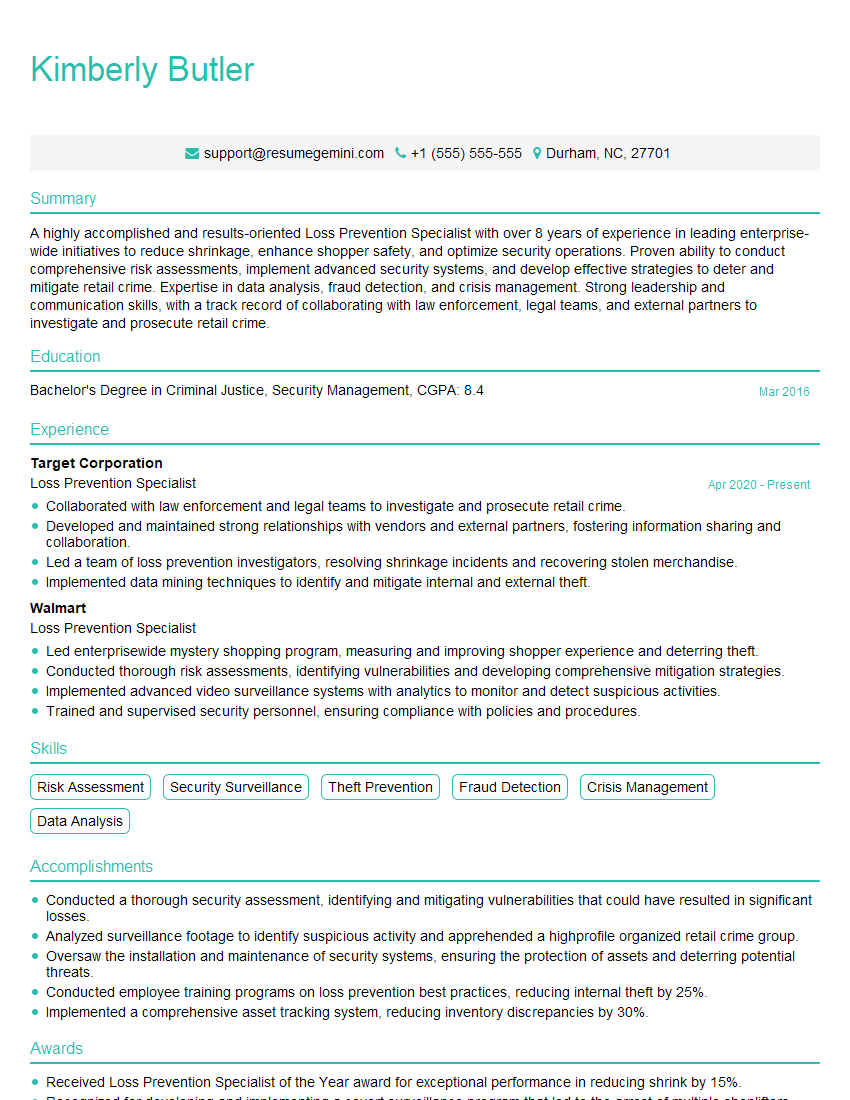

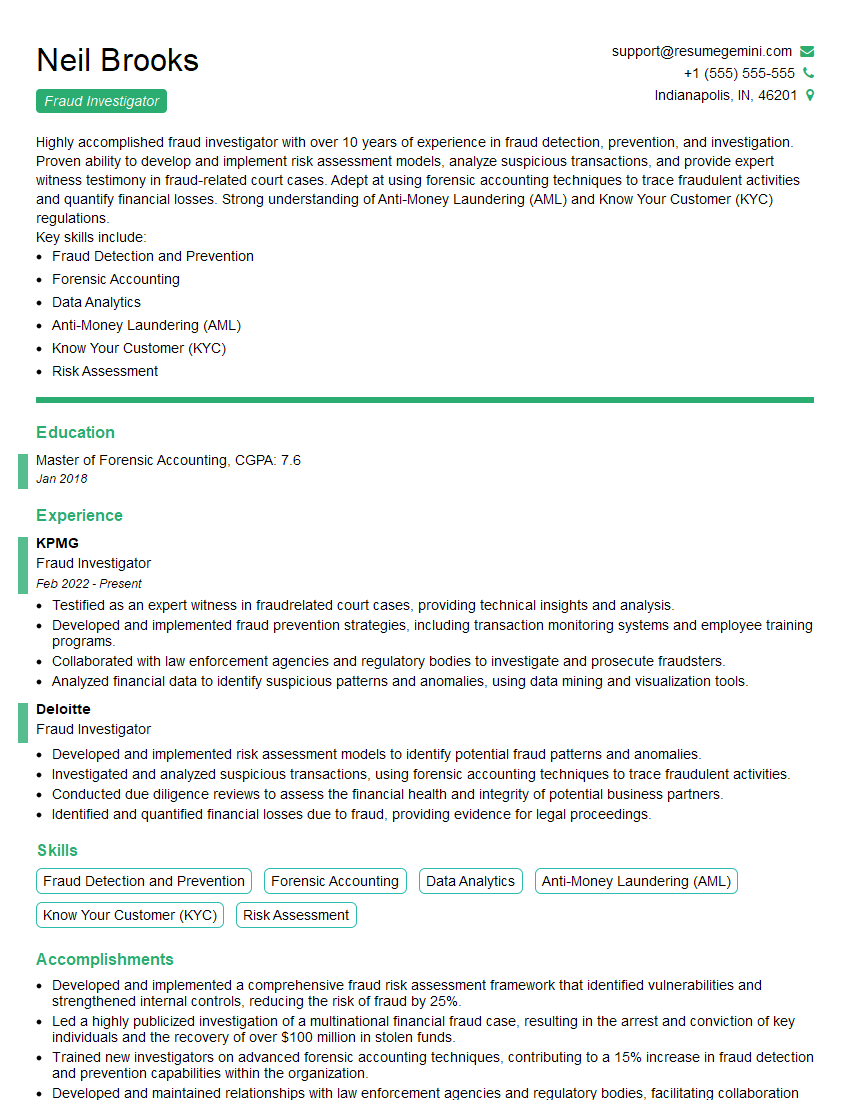

Mastering Fraud Detection Tools and Techniques is crucial for a successful and rewarding career in a rapidly evolving field. Proficiency in these areas significantly enhances your marketability and opens doors to exciting opportunities with high growth potential. To maximize your job prospects, it’s essential to present your skills effectively. Creating an ATS-friendly resume is paramount. ResumeGemini is a trusted resource that can help you build a professional and impactful resume tailored to highlight your expertise. Examples of resumes specifically designed for candidates specializing in Fraud Detection Tools and Techniques are available to guide you. Invest in your resume – it’s your first impression.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Live Rent Free!

https://bit.ly/LiveRentFREE

Interesting Article, I liked the depth of knowledge you’ve shared.

Helpful, thanks for sharing.

Hi, I represent a social media marketing agency and liked your blog

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?