Unlock your full potential by mastering the most common Proceeds of Crime Investigation interview questions. This blog offers a deep dive into the critical topics, ensuring you’re not only prepared to answer but to excel. With these insights, you’ll approach your interview with clarity and confidence.

Questions Asked in Proceeds of Crime Investigation Interview

Q 1. Explain the concept of ‘proceeds of crime’ and provide examples.

Proceeds of crime, simply put, are the financial or other material benefits derived from illegal activities. It’s not just the direct loot from a robbery; it encompasses anything obtained as a result of a crime, even if it’s been laundered or disguised. Think of it like tracing the ripples in a pond after a stone is thrown. The stone is the crime, and the ripples are the proceeds.

- Example 1: A drug trafficker uses profits from selling narcotics to buy a luxury yacht. The yacht is proceeds of crime.

- Example 2: A corrupt official receives bribes and invests the money in a seemingly legitimate business. The business, along with its assets, becomes proceeds of crime.

- Example 3: A fraudster uses stolen funds to purchase a house for their family. The house is proceeds of crime, even if the family was unaware of the origin of the funds.

Q 2. Describe the main stages of a Proceeds of Crime investigation.

A Proceeds of Crime investigation typically follows these stages:

- Intelligence Gathering: Identifying potential criminal activity and gathering information about suspects and their assets. This often involves analyzing financial transactions, surveillance, and working with informants.

- Investigation: This is where investigators build a case, tracing the flow of funds, identifying assets, and collecting evidence to prove a link between the assets and the criminal activity. Techniques include financial analysis, asset tracing, and interviewing witnesses.

- Legal Proceedings: Once sufficient evidence is gathered, the case is presented to the court. This may involve obtaining search warrants, freezing assets, and prosecuting the individuals involved.

- Confiscation/Forfeiture: If the court finds the assets to be proceeds of crime, they are seized and forfeited to the state. This can involve complex legal processes to ensure due process is followed.

- Asset Recovery & Management: Once confiscated, the assets are managed and liquidated. The proceeds are often used to fund crime prevention programs or compensate victims.

Q 3. What are the legal frameworks governing Proceeds of Crime investigations in your jurisdiction?

The legal frameworks governing Proceeds of Crime investigations vary by jurisdiction. However, many jurisdictions have legislation specifically designed to target proceeds of crime, often incorporating international conventions like the UN Convention against Transnational Organized Crime. These laws typically grant law enforcement agencies broad powers to investigate, seize, and forfeit assets suspected to be proceeds of crime. Specific legislation and case law in a particular jurisdiction would need to be consulted for precise details.

Q 4. Outline the key challenges in tracing and seizing assets obtained through criminal activity.

Tracing and seizing assets obtained through criminal activity presents several key challenges:

- Complex financial structures: Criminals often use complex financial instruments, shell companies, and offshore accounts to conceal the origins of their assets, making tracing difficult.

- International dimensions: Many criminal organizations operate across borders, complicating investigations and asset recovery efforts. International cooperation is crucial but often challenging.

- Sophisticated money laundering techniques: Money laundering techniques are constantly evolving, making it difficult to identify and trace illicit funds.

- Lack of resources: Proceeds of Crime investigations are resource-intensive, requiring specialized skills and expertise in areas like financial analysis and international legal frameworks. Funding limitations can hamper investigative efforts.

- Legal complexities: Navigating legal frameworks and proving the link between the assets and the crime can be complex and time-consuming. Burden of proof lies with the investigating authorities.

Q 5. Explain the role of financial intelligence in Proceeds of Crime investigations.

Financial intelligence plays a vital role. It’s the information collected and analyzed about financial transactions that may be linked to criminal activity. Financial intelligence units (FIUs) are crucial in this process. They receive, analyze, and disseminate financial information from various sources, including banks, financial institutions, and law enforcement agencies. This intelligence helps investigators identify suspicious patterns, trace the flow of money, and build cases against individuals involved in criminal activity. Think of it as the detective’s map to follow the trail of the money.

Q 6. How do you identify and analyze suspicious financial transactions?

Identifying and analyzing suspicious financial transactions involves using a combination of techniques:

- Transaction monitoring: Banks and other financial institutions monitor transactions for unusual patterns and report suspicious activity to FIUs.

- Data analysis: Sophisticated software is used to analyze large datasets of financial transactions, identifying anomalies and potential links to criminal activity. This might involve identifying unusual amounts, frequent transactions with high-risk entities, or complex layering schemes.

- Profiling: Investigators build profiles of individuals and organizations involved in suspected criminal activities. This profile guides the focus of further investigation.

- Network analysis: Mapping out financial networks helps visualize relationships and identify key players involved in money laundering or other financial crimes.

For example, a sudden influx of large cash deposits into an account with little or no previous activity would be a red flag.

Q 7. Describe different methods used to trace and recover assets.

Several methods are used to trace and recover assets:

- Tracing bank accounts and financial records: Following the trail of money through bank statements, credit card transactions, and other financial records.

- Identifying and tracing assets: Locating and identifying assets such as property, vehicles, businesses, or investments that may be linked to criminal activity.

- Freezing assets: Obtaining court orders to freeze assets to prevent their dissipation or transfer.

- International cooperation: Working with foreign law enforcement agencies to trace assets held in other jurisdictions.

- Asset recovery orders: Obtaining court orders to seize and forfeit assets deemed to be proceeds of crime.

- Mutual legal assistance treaties (MLATs): Utilizing formal agreements between countries to facilitate the exchange of information and evidence in cross-border investigations.

Q 8. What is the significance of the ‘Know Your Customer’ (KYC) principle in preventing money laundering?

The Know Your Customer (KYC) principle is fundamental in preventing money laundering. It’s essentially a due diligence process requiring businesses to verify the identity of their clients and understand the nature of their business relationships. This helps identify suspicious activity and prevents criminals from using businesses as conduits for illicit funds.

Think of it like this: a bank wouldn’t open an account for someone who refuses to provide identification or explain the source of their substantial funds. By rigorously applying KYC principles, financial institutions create a barrier to entry for money launderers, making it more difficult for them to blend dirty money with legitimate funds.

Effective KYC involves collecting and verifying information such as identification documents, proof of address, and source of funds. Continuous monitoring of customer activity is also crucial, flagging unusual transactions or patterns that might suggest money laundering.

Q 9. Explain the concept of layering and integration in money laundering schemes.

Layering and integration are two crucial stages in a typical money laundering process. They are used to obscure the origin of illicit funds and make them appear legitimate.

Layering involves making the money’s trail complex and difficult to trace. This is done through a series of transactions involving multiple accounts, shell companies, and jurisdictions. For example, the criminal might move money through a series of offshore accounts, using wire transfers and converting it into different currencies to obscure the original source.

Integration is the final stage where the laundered money is reintroduced into the legitimate financial system. This could involve investing in legitimate businesses, purchasing high-value assets like real estate, or making large cash deposits spread out over time to avoid suspicion.

Imagine a criminal who has earned $1 million through drug trafficking. Layering might involve moving that money through several offshore accounts, converting it to different currencies, and using multiple shell companies. Integration could then involve using that money to purchase a legitimate business or real estate, making it appear as though the money was earned legitimately.

Q 10. What are some common red flags indicating money laundering activity?

Numerous red flags can signal money laundering activity. These vary depending on the context, but some common indicators include:

- Large cash transactions: Deposits or withdrawals of unusually large amounts of cash, especially without a clear explanation.

- Structuring: Breaking down large transactions into smaller amounts to avoid reporting requirements.

- Unusual account activity: Sudden increases or decreases in account balances, frequent international wire transfers, or transactions with known high-risk jurisdictions.

- Complex or unusual transaction patterns: Transactions that lack a clear economic purpose or are unusually complex and convoluted.

- Clients who seem unwilling or unable to provide information about their source of funds: This is a critical KYC failure.

- Suspicious relationships between clients: Connections between individuals or entities involved in potentially illicit activities.

For instance, frequent small deposits totaling a significant amount over a short period could be a sign of structuring, while unexplained large transfers to offshore accounts are highly suspicious.

Q 11. How do you establish the link between criminal activity and the proceeds of crime?

Establishing a link between criminal activity and the proceeds of crime requires meticulous investigation. This often involves building a case using multiple forms of evidence, including financial records, witness statements, physical evidence, and intelligence gathered from various sources.

The process typically follows these steps:

- Identifying potential proceeds: Pinpointing assets or funds suspected to be derived from criminal activity.

- Tracing the assets: Tracking the flow of money or assets from the suspected criminal activity to the identified proceeds.

- Demonstrating the link: Providing sufficient evidence to prove a direct connection between the criminal activity and the assets. This may involve showing a direct correlation between the timing of the crime and the acquisition of the assets, or demonstrating the proceeds were used to fund a lavish lifestyle inconsistent with the suspect’s legitimate income.

- Quantifying the proceeds: Determining the exact value of the assets or funds that need to be recovered or seized.

For example, if a drug trafficking operation is identified, investigators might trace the profits from drug sales through bank accounts, real estate purchases, and other investments. By meticulously documenting these transactions and linking them back to the drug operation, a solid case can be built.

Q 12. What are the different types of financial instruments used in money laundering?

Money launderers use a variety of financial instruments to move and conceal illicit funds. These include:

- Bank accounts: Both domestic and international accounts are used to transfer and store money.

- Wire transfers: Electronic transfers of funds between accounts, often across borders.

- Credit cards and debit cards: Used to make purchases and withdraw cash.

- Money orders and cashier’s checks: These instruments can be purchased anonymously or with limited tracing information.

- Bearer instruments: Financial instruments, such as bearer bonds, that are payable to whoever holds them, thus obscuring the true owner.

- Cryptocurrencies: Digital currencies like Bitcoin offer a degree of anonymity and are increasingly used in money laundering schemes.

- Real estate: Property purchases are a common way to launder money, converting cash into a tangible asset.

The choice of instrument depends on several factors, including the amount of money being laundered, the level of anonymity desired, and the geographic reach of the laundering operation.

Q 13. Explain the role of international cooperation in Proceeds of Crime investigations.

International cooperation is absolutely crucial in Proceeds of Crime investigations. Money laundering often transcends national borders, requiring collaboration between law enforcement agencies and financial institutions across multiple countries.

International cooperation involves:

- Sharing information: Exchanging intelligence, financial records, and investigative findings between countries.

- Mutual legal assistance treaties (MLATs): Formal agreements between countries that allow for the legal exchange of evidence and the execution of requests for assistance in investigations.

- Joint investigations: Teams of investigators from multiple countries working together on a case.

- Extradition: The process of transferring a suspect from one country to another for prosecution.

Without international cooperation, it would be extremely difficult, if not impossible, to track and prosecute sophisticated money laundering schemes that often involve complex networks of individuals and entities operating in different jurisdictions.

For instance, tracking the movement of funds through offshore accounts requires collaboration with the relevant authorities in those jurisdictions to access financial records and initiate investigations.

Q 14. Describe your experience using financial databases and investigative tools.

Throughout my career, I’ve extensively used various financial databases and investigative tools to trace and analyze financial transactions. These tools are invaluable in identifying suspicious patterns and building compelling cases.

Some examples of databases I’ve utilized include:

- Financial transaction databases: These systems store vast amounts of financial data, allowing investigators to track the movement of funds across multiple accounts and jurisdictions. I’ve used these to identify unusual transaction patterns and connections between seemingly unrelated accounts.

- Company registration databases: These databases provide information on companies and their ownership structures, which are crucial for identifying shell companies and other entities used in money laundering schemes.

- Sanctions lists: Databases containing individuals and entities subject to financial sanctions, helping identify potentially suspicious relationships.

Investigative tools I’ve utilized include:

- Data analysis software: Programs that allow for the analysis of large datasets to identify patterns and anomalies.

- Network analysis software: Tools that visualize relationships between individuals and entities, assisting in the identification of complex networks involved in money laundering.

My experience with these tools has enabled me to effectively analyze complex financial data, uncover hidden connections, and build strong cases against individuals and organizations engaged in money laundering.

Q 15. How do you handle sensitive and confidential information in a Proceeds of Crime investigation?

Handling sensitive and confidential information in Proceeds of Crime investigations is paramount. It requires strict adherence to data protection laws and internal policies. We use a multi-layered approach.

- Access Control: Information is accessed on a need-to-know basis, with strict password controls and audit trails tracking every access attempt.

- Secure Storage: Sensitive data is stored in encrypted formats on secure servers, often with additional physical security measures in place.

- Data Anonymization: Wherever possible, we anonymize data to protect the identities of individuals not directly implicated in the crime, reducing the risk of unauthorized disclosure.

- Secure Communication: All communication regarding the investigation uses encrypted channels and adheres to strict protocols.

- Regular Training: All investigators undergo regular training on data protection and information security best practices. This ensures everyone understands their responsibilities regarding data handling.

For example, in one investigation, we used anonymized transaction data to build a case against a suspect, ensuring that innocent parties were not unnecessarily involved. This approach not only protects their privacy but strengthens the credibility of our investigation.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How do you build a strong case for asset forfeiture?

Building a strong case for asset forfeiture requires meticulous documentation and a clear chain of evidence linking the assets to the proceeds of crime. Think of it like building a brick wall – each piece of evidence is a brick, and together they form an irrefutable structure.

- Trace the Proceeds: This is the cornerstone. We meticulously trace the flow of money from the criminal activity through various transactions and accounts to the assets being targeted for forfeiture.

- Establish Ownership: We must prove beyond a reasonable doubt that the suspect either owns the assets or has a beneficial interest in them.

- Link to the Crime: Crucially, we must demonstrate a direct link between the assets and the proceeds of the crime. This could involve financial records, witness testimony, or other forensic evidence.

- Legal Compliance: All procedures must strictly adhere to the relevant legislation governing asset forfeiture. This ensures the admissibility of our evidence in court.

For instance, if we suspect proceeds from drug trafficking were used to purchase a property, we’d need to trace the payments used to purchase the property, ideally showing a clear link to bank accounts involved in the drug trafficking scheme. Witness testimonies and financial records would further strengthen the case.

Q 17. What are the ethical considerations in conducting Proceeds of Crime investigations?

Ethical considerations are central to Proceeds of Crime investigations. Our actions must be guided by fairness, integrity, and respect for human rights.

- Proportionality: The investigative methods employed should be proportionate to the alleged offence. Overly intrusive or aggressive tactics are unacceptable.

- Transparency: Individuals should be treated fairly and have the opportunity to understand the reasons for the investigation, provided it doesn’t compromise the investigation itself.

- Respect for Rights: We must uphold individuals’ rights, such as their right to privacy and due process.

- Impartiality: Investigations must be conducted impartially, avoiding bias and ensuring objectivity.

- Confidentiality: Maintaining the confidentiality of sensitive information is crucial to protect individuals and the integrity of the investigation.

Imagine a scenario where a suspect’s family is inadvertently implicated in the investigation. Ethical considerations would dictate that we carefully consider their privacy and ensure that we are not unduly impacting their lives without just cause.

Q 18. Describe a time you faced a complex challenge during a financial investigation. How did you resolve it?

I once faced a complex challenge involving a suspect who had meticulously layered their finances using shell corporations and offshore accounts. The trail was deliberately obfuscated to hide the source of funds.

To overcome this, we employed a multi-pronged approach:

- International Cooperation: We collaborated with law enforcement agencies in several jurisdictions to obtain information on the suspect’s offshore accounts and shell corporations.

- Financial Intelligence Unit (FIU) Support: We leveraged the FIU’s expertise and access to financial intelligence databases to identify suspicious transactions and patterns.

- Forensic Accounting Expertise: We engaged a forensic accountant to analyze complex financial records, uncover hidden transactions, and reconstruct the flow of funds.

- Data Analytics: We used data analytics techniques to sift through vast amounts of data, identify anomalies, and pinpoint key relationships.

Through this collaborative and multifaceted approach, we were eventually able to unravel the complex financial web, linking the suspect’s assets to the proceeds of their criminal activity.

Q 19. What are the limitations of using circumstantial evidence in Proceeds of Crime cases?

Circumstantial evidence, while valuable, has limitations in Proceeds of Crime cases. It can be suggestive but doesn’t directly prove a link between the assets and the crime.

Limitations include:

- Lack of Direct Evidence: It relies on inferences rather than direct proof. This makes it less compelling than direct evidence, such as bank statements directly linking assets to criminal proceeds.

- Multiple Interpretations: Circumstantial evidence can often be open to multiple interpretations, weakening its probative value in court.

- Potential for Bias: The interpretation of circumstantial evidence can be influenced by bias, either consciously or unconsciously, affecting its objectivity.

- Need for Corroboration: To be truly effective, circumstantial evidence often needs corroboration from other sources to increase its weight.

For example, finding a suspect’s expensive car doesn’t automatically prove it was bought with criminal proceeds. Other evidence, such as bank records showing large, unexplained deposits around the time of purchase, is needed to strengthen the case.

Q 20. What are the legal implications of using improperly obtained evidence?

Using improperly obtained evidence carries significant legal implications. The most crucial consequence is the inadmissibility of the evidence in court under the exclusionary rule.

This means:

- Evidence Suppression: The court will exclude the improperly obtained evidence from the trial, potentially crippling the prosecution’s case.

- Criminal Charges: In severe cases, investigators involved in obtaining the evidence illegally could face criminal charges for misconduct.

- Civil Litigation: The accused could pursue civil action against the investigators or the agency, claiming damages for violations of their rights.

- Reputational Damage: The agency involved could suffer severe reputational damage and a loss of public trust.

The consequences are far-reaching and can undermine the entire investigation. It is absolutely critical to ensure strict adherence to legal procedures during the investigation.

Q 21. Explain the difference between civil and criminal asset forfeiture procedures.

Civil and criminal asset forfeiture procedures differ significantly in their legal standards, burden of proof, and ultimate goals.

- Civil Forfeiture: This is typically a civil case initiated against the assets themselves, not the individual. The standard of proof is usually lower (preponderance of evidence), and the focus is on the connection between the assets and illegal activity. The government needs to show only a probable link between the property and the criminal activity. The owner of the property does not have to be found guilty of a crime.

- Criminal Forfeiture: This is part of a criminal prosecution. It is initiated against an individual convicted of a crime, and the standard of proof is much higher (beyond a reasonable doubt). The government must prove that the property was obtained as a direct result of the crime.

In essence, civil forfeiture focuses on the assets themselves and their link to illegal activity, while criminal forfeiture is a consequence of a criminal conviction. The legal ramifications and procedural requirements significantly differ between the two.

Q 22. What is your understanding of beneficial ownership and how it’s relevant to investigations?

Beneficial ownership refers to the natural person(s) who ultimately owns or controls a legal entity, such as a company, trust, or foundation. It’s crucial in investigations because it helps unravel complex ownership structures often used to conceal the true source of funds or assets involved in criminal activity. For example, a shell company might be registered in a tax haven with numerous layers of intermediaries. Tracing beneficial ownership reveals the individual(s) ultimately profiting from the company’s activities, potentially exposing money laundering, tax evasion, or other financial crimes. Identifying the beneficial owner allows investigators to freeze assets, seize proceeds of crime, and ultimately, bring the perpetrators to justice.

In practice, establishing beneficial ownership requires careful scrutiny of company registries, bank records, and other documents to identify the ultimate controller. This often involves analyzing complex corporate structures and trust arrangements, potentially requiring international cooperation.

Q 23. Explain your experience with financial statement analysis in the context of investigation.

Financial statement analysis is a cornerstone of proceeds of crime investigations. I’ve extensively used techniques such as horizontal and vertical analysis to identify inconsistencies, unusual transactions, and hidden assets. For instance, a significant increase in a company’s cash flow without a corresponding increase in revenue might indicate money laundering. Similarly, discrepancies between reported income and the individual’s lifestyle could point to tax evasion or other illicit activities. I’m proficient in identifying red flags like unusual account activity, sudden increases in assets, and inconsistencies in financial records.

I also utilize ratio analysis to assess the financial health of a company and to identify potential anomalies. For example, a high debt-to-equity ratio combined with unusual cash outflows might signal suspicious activity. The analysis is often complemented by trend analysis, comparing financial statements over several periods to identify patterns and anomalies.

Q 24. How do you validate the authenticity of financial documents?

Validating the authenticity of financial documents is paramount. My approach involves a multi-faceted strategy. First, I verify the source of the document—ensuring it’s obtained through legitimate channels and not forged. This includes checking the issuing authority’s legitimacy and comparing it to known authentic samples. Next, I scrutinize the document for inconsistencies or alterations, including examining the formatting, fonts, signatures, and watermarks. I use forensic accounting techniques to detect alterations or manipulations, and might employ specialized software for document analysis.

Furthermore, I cross-reference the information in the document with other supporting evidence, such as bank statements, tax returns, or witness testimony. If there are any discrepancies, I investigate further to ascertain the truth. This meticulous approach minimizes the risk of relying on fraudulent or manipulated financial records in the investigation.

Q 25. Describe your proficiency with data analysis and visualization software relevant to financial investigations.

I am highly proficient in several data analysis and visualization tools crucial for financial investigations. My expertise includes SQL for database querying, Python with libraries like Pandas and NumPy for data manipulation and analysis, and R for statistical modeling and visualization. I also leverage specialized software for fraud detection and financial crime investigation. These tools allow me to efficiently process large datasets, identify patterns and anomalies, and create compelling visualizations to present findings to colleagues and in court. For instance, I might use network graphs to visualize complex financial transactions, revealing hidden connections between individuals and entities involved in criminal networks.

Data visualization is key to effectively communicating complex financial information. I utilize tools like Tableau and Power BI to create interactive dashboards and reports that clearly showcase findings, making them easily understandable for a non-technical audience.

Q 26. What are your experiences using investigative techniques like surveillance and undercover operations (if applicable)?

While my primary focus is financial analysis, I have experience supporting investigative teams conducting surveillance and, on occasion, participating in controlled operations, particularly in cases requiring financial evidence collection. Surveillance can provide contextual information complementing financial data. For example, observing frequent meetings between suspects and known criminals corroborates financial transactions indicating illicit activities. My role involved providing analytical support to interpret surveillance data within the broader financial picture.

Undercover operations, while not a primary skillset, have been relevant in certain investigations where financial information had to be extracted through covert means. In such instances, my expertise lay in analyzing the financial information obtained through these operations and integrating it into the overall investigation.

Q 27. How familiar are you with various types of financial crimes, beyond money laundering?

My familiarity with financial crimes extends beyond money laundering to include a wide range of offenses. I possess in-depth knowledge of tax evasion, fraud (both accounting and securities), insider trading, embezzlement, and bribery. I understand the intricacies of each crime type, including the specific legal frameworks, investigative techniques, and evidentiary requirements. For example, in tax evasion cases, I’m skilled in identifying hidden assets and offshore accounts used to avoid tax obligations. In fraud investigations, I can detect falsified financial statements or manipulate accounting records.

Understanding these various crimes allows me to identify potential overlaps and build a comprehensive understanding of the criminal network involved. It’s often the case that different types of financial crime are intertwined, and recognizing these connections is crucial for a successful investigation.

Q 28. Describe your experience working with other law enforcement agencies or regulatory bodies.

I have a strong track record of collaboration with various law enforcement agencies and regulatory bodies, both domestically and internationally. This includes working closely with tax authorities, customs officials, and other investigative units, as well as international organizations specializing in combating financial crime. Effective collaboration is vital due to the transnational nature of financial crimes. Sharing information and coordinating investigative efforts is crucial to successfully dismantle criminal networks and recover stolen assets.

A recent example involved collaborating with a foreign agency to trace funds laundered through a series of shell companies registered in multiple jurisdictions. The successful outcome hinged on efficient information exchange and joint investigative efforts, highlighting the importance of international cooperation in combating financial crime.

Key Topics to Learn for Proceeds of Crime Investigation Interview

- Financial Investigations: Understanding money laundering techniques, tracing illicit funds through various financial instruments (bank accounts, cryptocurrencies, etc.), and applying investigative methodologies to uncover hidden assets.

- Asset Tracing and Recovery: Practical application of tracing techniques, including analyzing financial records, identifying hidden assets, and understanding legal frameworks for asset forfeiture and recovery. This includes experience with international cooperation in asset recovery.

- Legal Frameworks and Regulations: A thorough grasp of relevant legislation (e.g., anti-money laundering laws, Proceeds of Crime Acts) and their practical application in investigative processes. This includes understanding the burden of proof and legal standards.

- Investigative Techniques and Methodologies: Mastering interview techniques, surveillance methods, and data analysis strategies pertinent to financial investigations. Understanding the importance of building a strong case file.

- Intelligence Gathering and Analysis: Utilizing open-source intelligence, developing investigative leads, and interpreting complex financial data to identify patterns and connections. This includes experience with data visualization tools.

- Risk Assessment and Management: Identifying and mitigating risks associated with Proceeds of Crime investigations, including personal safety and maintaining the integrity of evidence.

- Report Writing and Presentation: Clearly and concisely documenting investigative findings, preparing compelling reports, and presenting complex information to a variety of audiences (including legal professionals and senior management).

- Ethical Considerations: Understanding and adhering to ethical guidelines and best practices in Proceeds of Crime investigations, ensuring fairness and due process.

Next Steps

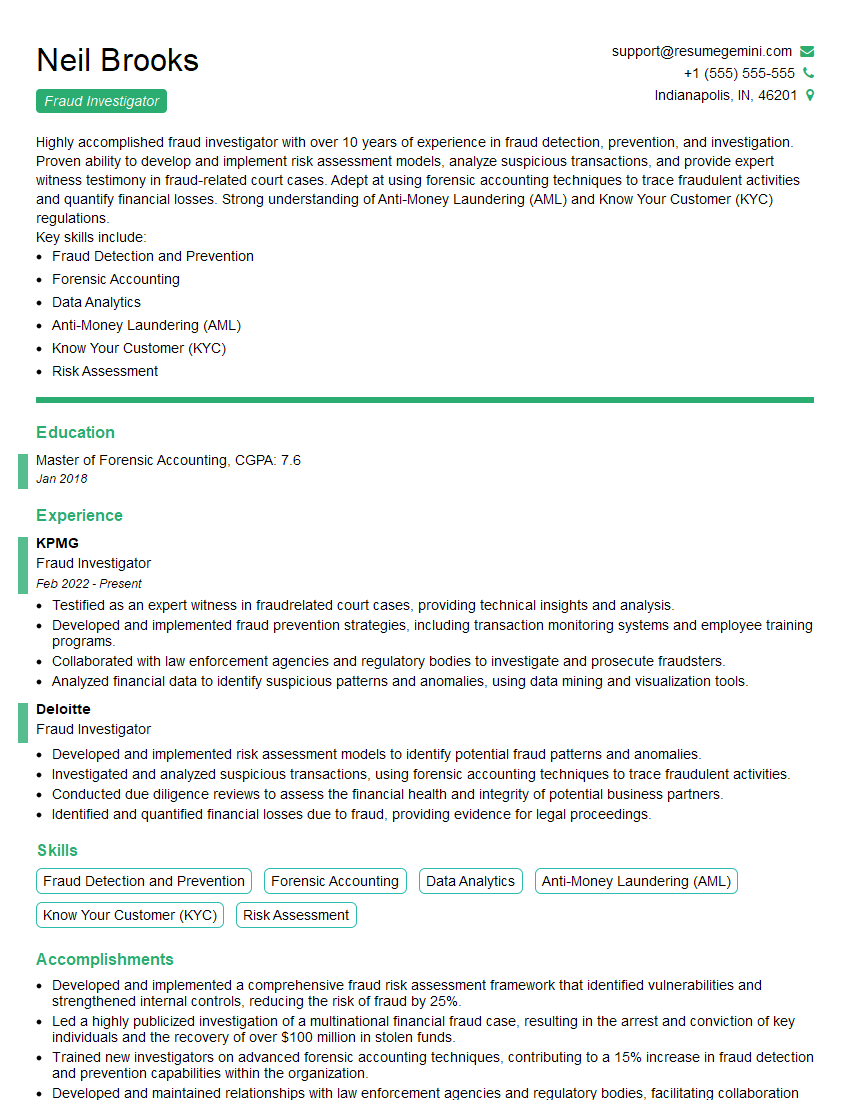

Mastering Proceeds of Crime Investigation opens doors to rewarding and impactful careers in law enforcement, financial crime units, and regulatory bodies. To maximize your job prospects, a well-crafted, ATS-friendly resume is essential. ResumeGemini is a trusted resource to help you build a professional resume that highlights your skills and experience effectively. ResumeGemini provides examples of resumes tailored to Proceeds of Crime Investigation roles, helping you present your qualifications in the best possible light. Take the next step in your career journey – create a compelling resume that gets you noticed!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Interesting Article, I liked the depth of knowledge you’ve shared.

Helpful, thanks for sharing.

Hi, I represent a social media marketing agency and liked your blog

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?