Every successful interview starts with knowing what to expect. In this blog, we’ll take you through the top Ability to develop and manage program budgets interview questions, breaking them down with expert tips to help you deliver impactful answers. Step into your next interview fully prepared and ready to succeed.

Questions Asked in Ability to develop and manage program budgets Interview

Q 1. Explain the different budgeting methods you’re familiar with (e.g., zero-based budgeting, incremental budgeting).

Budgeting methods vary depending on the organization’s needs and goals. Two common approaches are incremental budgeting and zero-based budgeting. Incremental budgeting, also known as line-item budgeting, starts with the previous year’s budget as a baseline and adjusts it based on anticipated changes – inflation, projected growth, etc. It’s simple and efficient but can perpetuate inefficiencies if not carefully reviewed. Think of it like adding to a recipe: you start with a basic recipe and adjust ingredients based on what you have available or want to add. Zero-based budgeting (ZBB), on the other hand, requires justifying every expense from scratch each year. Every line item is examined, and its necessity and cost-effectiveness are assessed. This process is more time-consuming but can lead to more efficient resource allocation, identifying areas for potential cost savings that might be missed in the incremental approach. Imagine building a house from scratch – each material, each contractor, and each task requires careful justification and cost analysis. Another method is Activity-Based Budgeting (ABB), which focuses on the activities required to achieve program goals and allocates resources based on those activities’ costs. This is ideal for complex programs with multiple activities.

Q 2. Describe your experience with variance analysis and how you address budget deviations.

Variance analysis is crucial for monitoring budget performance. I regularly compare actual expenditures against the budgeted amounts to identify deviations. For example, if the projected cost for software licenses was $10,000 but the actual cost was $12,000, that’s a $2,000 unfavorable variance. Investigating such variances involves identifying the root causes: were there unexpected price increases? Did we purchase more licenses than anticipated? Once the reasons are understood, I develop corrective actions. This might involve renegotiating contracts, implementing cost-saving measures, or adjusting future budget projections. Addressing significant deviations often involves collaboration with relevant stakeholders – project managers, department heads – to find mutually agreeable solutions. For example, if marketing costs exceeded the budget, we might discuss alternative strategies that achieve the same results for less.

Q 3. How do you forecast program costs accurately?

Accurate cost forecasting requires a multi-faceted approach. First, I meticulously review past performance data, identifying trends and patterns in spending. This forms the basis of my initial projections. Then, I incorporate external factors – inflation rates, market conditions, and potential changes in regulations – into my forecast. I also conduct detailed activity analysis. This involves breaking down program activities into smaller tasks, estimating the resources (labor, materials, etc.) required for each, and calculating the total cost. Finally, I apply contingency buffers. This involves adding a percentage to the total cost to account for unforeseen events or cost overruns. For instance, if the total projected cost is $50,000, a 10% contingency buffer would add $5,000, bringing the total to $55,000. Contingency allows flexibility in case of unexpected changes.

Q 4. What software or tools have you used for budget management?

Throughout my career, I’ve used a variety of software and tools for budget management. These include Microsoft Excel for detailed spreadsheets and data analysis, budgeting software like Adaptive Insights or Anaplan for complex, multi-year projects, and project management tools like Jira or Asana for tracking tasks and associated costs. The choice of tools depends on the complexity of the program and the organization’s infrastructure. I’m also proficient in using data visualization tools like Tableau or Power BI to present budget data in clear and concise reports that facilitate quick understanding of the financial status of programs.

Q 5. Explain your process for developing a program budget from scratch.

Developing a program budget from scratch involves a structured process. I begin by clearly defining the program objectives and scope. This step is crucial because it determines the activities required and the resources needed. Next, I conduct a detailed work breakdown structure (WBS), breaking down the program into smaller, manageable tasks. Each task is then analyzed, identifying resource requirements – personnel, materials, equipment, travel, etc. I estimate the cost of each resource and calculate the total cost for each task. These individual task costs are aggregated to provide a total program budget. Regular reviews and revisions are an essential part of the process; it’s a dynamic document that needs adjustments as the program progresses.

Q 6. How do you prioritize spending within a constrained budget?

Prioritizing spending within a constrained budget necessitates a clear understanding of program goals and a systematic approach. I start by aligning each spending item with the overall program objectives. Then, I evaluate the return on investment (ROI) for each item, considering both its impact on achieving goals and its cost. This involves considering factors such as risk and the potential impact of funding cuts. I often employ a prioritization matrix, such as a MoSCoW method (Must have, Should have, Could have, Won’t have), to categorize spending items based on their importance and feasibility. This matrix helps to make informed decisions on which items to fund and which to defer or eliminate.

Q 7. Describe a time you had to make significant budget cuts. What was your approach?

In a previous role, we faced unexpected budget cuts mid-project due to a corporate restructuring. My approach involved a collaborative, data-driven process. First, I gathered the project team and transparently explained the situation, emphasizing the need for immediate action. We then analyzed the project’s WBS, identifying tasks that were critical to success and those that were less essential. We prioritized the ‘must-have’ tasks, identifying areas where we could scale back or eliminate less critical components without compromising project objectives. This involved renegotiating contracts, exploring alternative, lower-cost solutions, and delaying certain non-critical tasks. Open communication with stakeholders throughout this process was vital, ensuring everyone understood the rationale behind the changes and collaborated effectively. The result was a revised budget that met the reduced funding while still delivering a substantial portion of the original project deliverables.

Q 8. How do you handle unexpected budget shortfalls?

Unexpected budget shortfalls are a reality in project management. My approach involves a multi-step process. First, I conduct a thorough review of the budget, identifying areas where expenses can be trimmed without compromising project goals. This might involve negotiating better rates with vendors, postponing non-critical tasks, or exploring alternative, cost-effective solutions. Second, I analyze the shortfall’s impact and prioritize essential project elements. Not every aspect of a project is equally critical; focusing resources on core objectives ensures maximum value delivery. Third, I engage stakeholders in open communication, explaining the situation transparently and collaboratively exploring potential solutions. This could involve seeking additional funding, adjusting the project scope, or re-negotiating timelines. Finally, I implement the chosen solution, carefully monitoring its effectiveness and adjusting as needed. For example, in a previous project, we faced a 15% budget shortfall due to unexpected vendor cost increases. By renegotiating contracts, streamlining processes, and deferring some less critical deliverables, we successfully navigated the shortfall with minimal impact on the project’s core objectives.

Q 9. How do you ensure budget transparency and accountability?

Budget transparency and accountability are paramount. I ensure this through several methods. Firstly, I utilize a robust budgeting and tracking system, typically a software solution that allows for real-time monitoring of expenditures and provides clear reports. This data is easily accessible to authorized personnel. Secondly, I regularly communicate budget updates to all stakeholders through reports, meetings, and visual dashboards. These updates provide a clear picture of the project’s financial health, including actuals versus planned spending and potential risks. Thirdly, I adhere to strict internal control procedures and maintain meticulous documentation of all budget-related transactions. This audit trail ensures that all financial decisions are justified and verifiable. Finally, I actively encourage feedback and questions from stakeholders, fostering a culture of open communication and collaboration. Think of it like a shared financial roadmap – everyone needs to understand the route, the milestones, and the progress to ensure a successful journey.

Q 10. How do you integrate program budget management with overall organizational financial planning?

Program budget management is intrinsically linked to overall organizational financial planning. I ensure this integration through several key practices. First, the program budget is developed in alignment with the organization’s strategic goals and overall financial plan. This ensures that program initiatives contribute to the larger organizational objectives. Second, I regularly communicate program budget performance to senior management, providing them with insights into the program’s financial health and its impact on the overall organization. This allows for proactive adjustments and decision-making. Third, I utilize the organization’s financial planning and analysis tools and systems to manage the program budget, ensuring consistency and integration with other organizational financial processes. For instance, I might utilize the company’s forecasting model to predict future program expenses and ensure that the program remains aligned with the organization’s overall financial targets. Essentially, the program budget isn’t an isolated entity; it’s a vital component of the bigger financial picture.

Q 11. How do you communicate budget information effectively to stakeholders?

Effective communication of budget information is key to successful budget management. I utilize a variety of methods tailored to the audience and the message. For executive summaries, I utilize concise reports highlighting key performance indicators (KPIs) and variances from the budget. For project teams, I use more detailed reports that provide granular information on expenditure and progress. For stakeholders requiring regular updates, I implement visual dashboards that provide real-time insights into the program’s financial status. I also utilize regular meetings and presentations to discuss budget performance and answer any questions. Simplicity and clarity are paramount; avoiding jargon and using visual aids ensures that everyone understands the information regardless of their financial expertise. The goal is not just to share data, but to create a shared understanding of the program’s financial health.

Q 12. What are some key performance indicators (KPIs) you track in budget management?

Key Performance Indicators (KPIs) are essential for monitoring budget performance. I track a variety of KPIs, including:

- Budget Variance: The difference between actual and budgeted spending, highlighting overspending or underspending areas.

- Cost Per Unit: The cost of delivering a specific unit of output (e.g., cost per training hour, cost per software license).

- Return on Investment (ROI): A measure of the program’s profitability, comparing the program’s cost to its benefits.

- Cost Performance Index (CPI): A measure of the cost efficiency of the project, calculated as earned value divided by actual cost.

- Schedule Performance Index (SPI): A measure of how well the project is progressing against the schedule.

Q 13. How do you manage multiple projects or programs with differing budget constraints?

Managing multiple projects with varying budget constraints requires a structured approach. I utilize a portfolio management framework, prioritizing projects based on strategic alignment and potential ROI. This allows me to allocate resources effectively, ensuring that high-priority projects receive the necessary funding. I use a centralized budget tracking system that allows me to monitor the performance of all projects simultaneously, identifying potential conflicts or risks early on. I also establish clear communication channels between project managers to facilitate collaboration and resource sharing. For instance, if one project is underspending, funds could be reallocated to a project facing a shortfall, optimizing the overall resource allocation. This integrated approach allows for flexibility and adaptability while ensuring overall financial responsibility.

Q 14. Describe your experience with budget reporting and analysis.

My experience with budget reporting and analysis is extensive. I’m proficient in preparing various reports, including budget summaries, variance analysis reports, and forecasts. I use data visualization techniques to present complex financial information in a clear and concise manner. I’m experienced with various software tools, including (mention specific software you are familiar with, e.g., Microsoft Excel, budgeting software, financial planning and analysis tools) for data analysis and reporting. My analytical skills allow me to identify trends, patterns, and anomalies in budget data, enabling me to proactively address potential problems. For example, in a previous role, I identified a recurring overspending trend in a particular project phase by analyzing historical budget data. This analysis led to the implementation of cost-saving measures, resulting in significant budget improvements.

Q 15. How do you identify and mitigate potential budget risks?

Identifying and mitigating budget risks is a crucial aspect of program management. It involves proactively identifying potential issues that could impact the budget and developing strategies to minimize their impact. This begins with a thorough risk assessment, considering both internal and external factors.

- Internal Risks: These include factors within the control of the project team, such as scope creep (unforeseen additions to the project), resource allocation issues (understaffing or skill mismatches), and inefficient processes. For example, if we underestimate the time needed for a specific task, it could lead to cost overruns due to extended labor costs.

- External Risks: These are factors beyond the team’s direct control, such as economic downturns affecting funding, changes in regulatory requirements causing delays or added costs, or unexpected supplier price increases. For example, a sudden increase in the cost of raw materials could significantly impact a manufacturing project.

Mitigation strategies involve developing contingency plans. This includes setting aside a contingency fund (typically 5-10% of the total budget) to cover unforeseen expenses and building flexibility into the schedule to accommodate delays. Regular monitoring and reporting are essential to track progress and identify potential deviations early on. For instance, using a burn-down chart to track spending against planned expenditure helps us identify potential issues proactively.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. How familiar are you with different accounting principles (e.g., accrual accounting, cash accounting)?

I’m very familiar with various accounting principles, particularly accrual and cash accounting. Understanding these methods is vital for accurate budgeting and financial reporting.

- Accrual Accounting: This method recognizes revenue when earned and expenses when incurred, regardless of when cash changes hands. This provides a more holistic view of financial performance over time. For example, if we sell a product on credit, we recognize the revenue even though we haven’t received the payment yet. This is better for long-term financial planning and decision-making.

- Cash Accounting: This method records revenue and expenses only when cash is received or paid. It provides a simpler, more immediate picture of cash flow. It’s often favored by small businesses or projects with short lifecycles. For example, if we receive payment for a service, only then do we recognize the revenue.

Choosing the appropriate method depends on the specific needs of the program and the reporting requirements. Often, a combination of both methods offers the most comprehensive view of financial health.

Q 17. Explain your experience with financial modeling and forecasting.

I have extensive experience with financial modeling and forecasting. I leverage various tools and techniques to create realistic and reliable projections. My process typically involves:

- Data Gathering: Collecting historical data, market research, and relevant economic indicators.

- Model Development: Using spreadsheet software (like Excel) or specialized financial modeling tools to build a model that reflects the program’s financial aspects. This includes creating formulas for revenue projections, expense estimations, and profit calculations.

- Scenario Planning: Developing multiple scenarios (best-case, worst-case, and most likely) to assess the impact of various factors on the budget. For example, one scenario might assume a 5% increase in material costs, while another assumes a 10% decrease in sales.

- Sensitivity Analysis: Examining how changes in key variables affect the overall financial outcome. For instance, we can determine the impact of a 10% change in labor costs on the overall project profitability.

- Forecasting: Utilizing the model to project future financial performance, providing insights for decision-making.

I’ve used these methods extensively, for example, in predicting the ROI of a new software implementation by forecasting the cost savings from automation and increased efficiency.

Q 18. What is your process for monitoring and controlling budget spending?

Monitoring and controlling budget spending is an ongoing process that requires consistent attention to detail. My approach involves:

- Regular Reporting: Creating regular reports (weekly or monthly) that track actual spending against the budget. These reports highlight variances and identify areas needing attention.

- Variance Analysis: Investigating significant deviations between actual and planned spending to understand the underlying causes. For example, a large variance in travel expenses might indicate a need to re-evaluate travel strategies.

- Budgetary Controls: Implementing controls to prevent overspending, such as requiring approvals for purchases exceeding a certain threshold or implementing robust tracking systems for expenses.

- Performance Monitoring: Tracking key performance indicators (KPIs) to assess the efficiency of resource utilization and identify areas for improvement. For example, tracking the number of billable hours against the projected number helps ensure our resources are being utilized effectively.

- Corrective Actions: Taking prompt corrective actions to address any identified issues, such as renegotiating contracts or adjusting resource allocation.

Through this continuous cycle of monitoring, analysis, and corrective actions, I ensure that the project stays within budget and delivers its goals efficiently.

Q 19. How do you ensure compliance with budgetary regulations and policies?

Ensuring compliance with budgetary regulations and policies is critical to maintain financial integrity and avoid penalties. My approach is multifaceted:

- Understanding Regulations: Thorough understanding of all applicable rules and regulations, including government guidelines, company policies, and industry standards.

- Documentation: Maintaining meticulous records of all financial transactions and ensuring that all supporting documentation is readily available for audits.

- Internal Controls: Implementing strong internal controls to prevent fraud, errors, and non-compliance. This includes segregation of duties and regular internal audits.

- Training: Providing training to the project team on relevant budgetary regulations and procedures to ensure everyone understands their responsibilities.

- Regular Audits: Facilitating and cooperating with both internal and external audits to ensure compliance and identify areas for improvement.

By adhering to these practices, I ensure that the program’s financial activities are transparent, accountable, and fully compliant.

Q 20. Describe your experience with budget review and approval processes.

Budget review and approval processes are fundamental to ensuring fiscal responsibility. My experience includes participation in various stages of this process, from initial budget development to final approval.

- Budget Development: Collaborating with stakeholders to develop a comprehensive and realistic budget that aligns with program goals and objectives. This usually involves detailed cost estimations, resource planning, and risk assessments.

- Documentation: Creating clear and concise budget documentation that includes justifications for key expenditures and anticipated risks and mitigation strategies.

- Review and Approval: Presenting the budget to relevant stakeholders for review and approval, addressing any concerns or questions they may raise.

- Revisions and Updates: Making necessary revisions and updates based on feedback from the review process. This is a collaborative effort to ensure that the budget is acceptable and viable.

- Final Approval: Securing final approval from the designated authority to allow for the commencement of the program.

I’ve successfully managed many budget approval processes, adapting my approach to the organizational structure and approval workflows of different organizations.

Q 21. How do you use data analytics to inform budget decisions?

Data analytics plays a significant role in informing budget decisions. I use data-driven insights to optimize resource allocation, enhance forecasting accuracy, and improve overall program efficiency.

- Data Collection and Analysis: Utilizing various data sources (financial records, performance metrics, market data) to analyze spending patterns, identify trends, and predict future needs.

- Performance Monitoring: Using data analytics tools to track KPIs and identify areas of strength and weakness in the budget. For example, analyzing sales data against marketing spend can identify effective marketing channels.

- Predictive Modeling: Leveraging advanced analytics techniques to build predictive models for forecasting future expenses and revenues, improving the accuracy of budgeting forecasts.

- Resource Optimization: Using data-driven insights to optimize resource allocation, ensuring that resources are used efficiently and effectively.

- Decision Support: Providing data-backed recommendations to stakeholders based on data analysis and predictive modeling, supporting informed budget decisions.

For example, using regression analysis on past project data helped me forecast resource requirements for a new project with much greater accuracy than traditional methods, resulting in a more efficient and cost-effective budget.

Q 22. How do you adapt your budgeting approach to different types of programs or projects?

My budgeting approach is highly adaptable and depends heavily on the program’s nature. For instance, a research and development project necessitates a different approach than a marketing campaign. For R&D, I’d prioritize a phased budgeting approach, allocating funds based on projected milestones and anticipated risks. This might involve a larger upfront investment in research and prototyping, followed by smaller, more targeted budgets for development and testing. The success metrics would focus on deliverables and technological advancements. Conversely, a marketing campaign requires a more granular budget breakdown across different channels (digital, print, events, etc.), with a strong emphasis on ROI and measurable marketing KPIs. I use a combination of top-down and bottom-up budgeting techniques, depending on the project’s complexity and available data. For smaller projects, a simpler top-down approach might suffice, while larger, more complex ones benefit from a detailed bottom-up approach to ensure accuracy and resource allocation.

In essence, I tailor my methodology – from the budget structure to the reporting mechanisms – to align seamlessly with the program’s specific goals and characteristics.

Q 23. How do you collaborate with other departments to manage the program budget?

Collaboration is crucial. I foster strong relationships with other departments, initiating early and frequent communication. For example, before finalizing a budget, I’d engage in detailed discussions with the procurement department to ensure realistic cost estimates for materials and services, and with the HR department for accurate salary and benefit projections for personnel. Regular meetings and shared spreadsheets using collaborative tools (e.g., Google Sheets) ensure everyone is informed and aligned. Transparent communication and clear expectations prevent budget overruns and disputes. I view my role as a facilitator, helping departments understand the budget constraints and ensuring their needs are balanced with the overall program objectives.

Q 24. How do you measure the success of your budget management efforts?

Measuring the success of budget management goes beyond simply staying within budget. I use a multi-faceted approach. Firstly, I track actual spending against the budget, calculating variances and identifying areas of over or under-spending. Secondly, I evaluate the program’s achievement of its objectives. Did we deliver on time and within budget? Were the key performance indicators (KPIs) met? Finally, I analyze the efficiency of resource allocation. Were resources used optimally? Could we have achieved the same outcomes with fewer resources? I regularly produce reports, utilizing both financial metrics (e.g., cost savings, ROI) and operational metrics (e.g., project completion rates, customer satisfaction), to provide a holistic assessment of my budget management effectiveness. This data is used for continuous improvement in future projects.

Q 25. What are your strengths and weaknesses in budget management?

My strengths lie in my meticulous planning and analytical skills. I’m adept at developing detailed budgets, forecasting accurately, and identifying potential risks. I’m also a highly effective communicator, able to translate complex financial information into easily understandable terms for diverse audiences. However, a weakness I’m actively working on is delegation. While I’m capable of handling significant detail, I’m learning to trust and empower team members to take on more responsibility, improving overall efficiency and workflow.

Q 26. Describe a situation where you had to make a difficult budget decision. What factors influenced your decision?

In a previous role, we faced unexpected cost increases mid-project. A key supplier increased their prices substantially, threatening to derail the project. I had to make a difficult decision: either reduce the project’s scope to fit the revised budget or seek additional funding. Several factors influenced my decision. First, I assessed the impact of scope reduction on the project’s overall goals. Would compromising certain features significantly compromise the final product? Second, I explored the feasibility of securing additional funding. This involved presenting a compelling case to upper management, highlighting the project’s value and the potential negative consequences of delay or failure. Ultimately, I opted for seeking additional funding, successfully presenting a revised budget and securing the necessary resources. This approach, while riskier, preserved the project’s integrity and long-term value.

Q 27. How do you stay current with best practices in program budget management?

I stay current by actively engaging in professional development activities. This includes attending industry conferences and webinars, participating in online courses on budgeting and financial management, and reading industry publications and journals. I also actively participate in professional organizations related to project management and finance. Furthermore, I continuously research and evaluate new budgeting software and techniques, striving to adopt and adapt those that can improve my efficiency and accuracy. Staying abreast of the latest best practices is critical for optimizing budget management in a rapidly evolving landscape.

Q 28. What are your salary expectations for this role?

Based on my experience and the requirements of this role, my salary expectations are in the range of [Insert Salary Range]. However, I am open to discussing this further based on the complete compensation package and the specific responsibilities of the position.

Key Topics to Learn for Ability to Develop and Manage Program Budgets Interview

- Budget Forecasting and Planning: Understanding different forecasting methods, developing realistic budget projections based on historical data and future projections, and justifying budget requests.

- Budget Development and Allocation: Creating detailed budget breakdowns, allocating resources effectively across various program components, and prioritizing spending based on strategic goals.

- Budget Monitoring and Control: Tracking actual spending against the budget, identifying variances, and implementing corrective actions to stay within budget constraints. This includes understanding and using key performance indicators (KPIs).

- Cost Analysis and Variance Reporting: Analyzing cost drivers, identifying areas for potential cost savings, and preparing regular reports to communicate budget performance to stakeholders.

- Financial Reporting and Communication: Presenting budget information clearly and concisely to both technical and non-technical audiences, using visualizations and data storytelling techniques.

- Risk Management and Contingency Planning: Identifying potential budget risks, developing contingency plans to mitigate those risks, and adjusting the budget as needed to address unforeseen circumstances.

- Software and Tools: Familiarity with budget management software (e.g., budgeting and financial planning tools) and proficiency in using spreadsheets for data analysis and reporting.

- Ethical Considerations: Understanding and adhering to ethical guidelines related to budget management, transparency, and accountability.

Next Steps

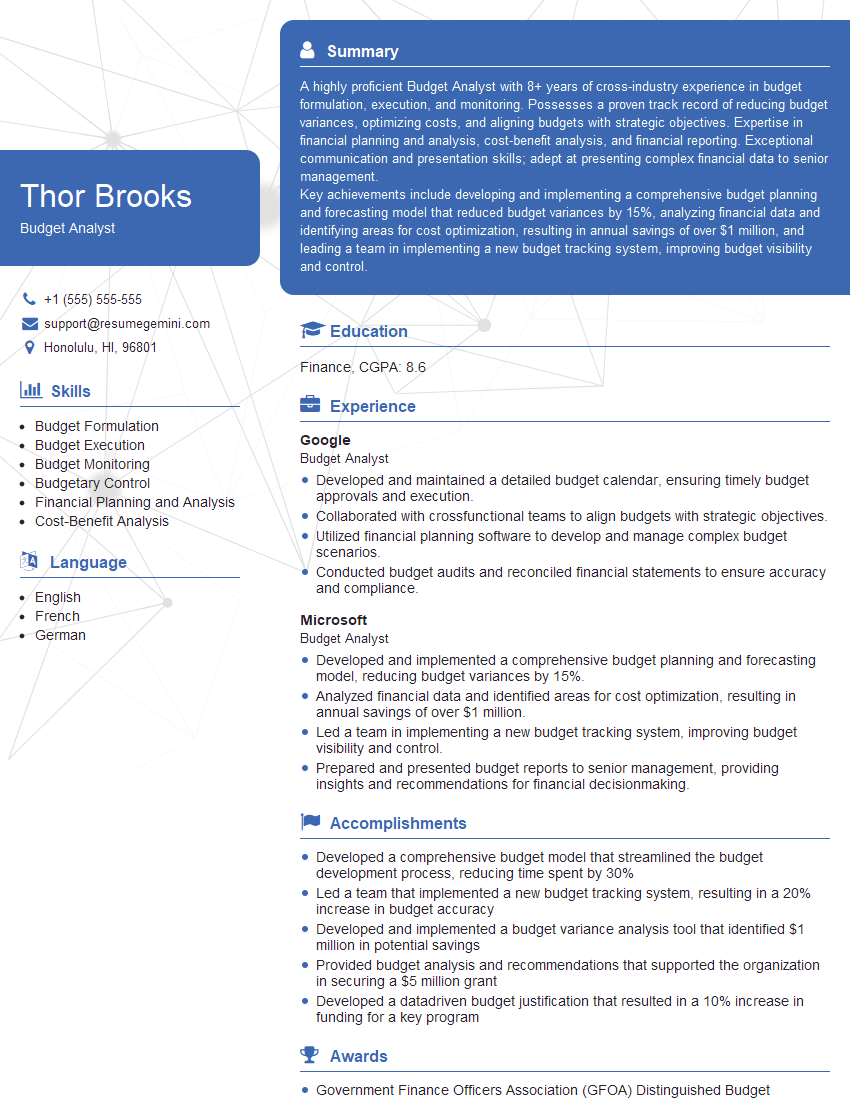

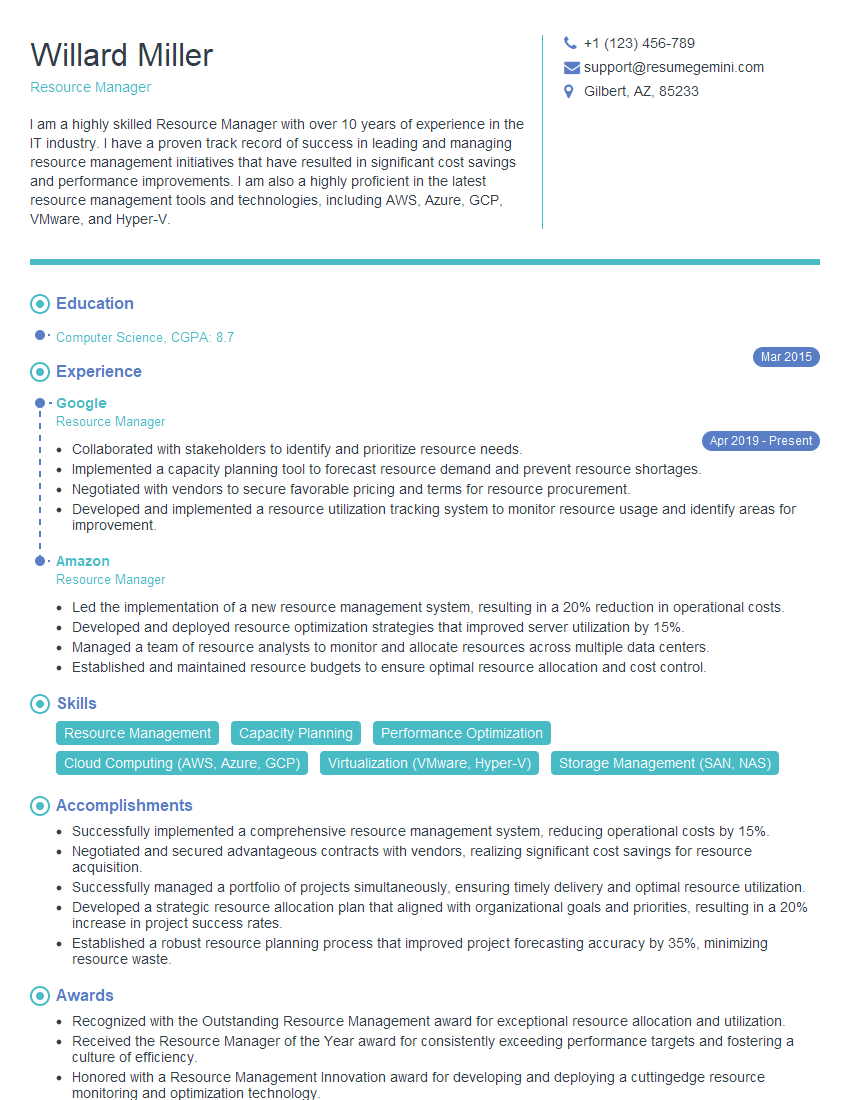

Mastering the ability to develop and manage program budgets is crucial for career advancement in any organization. It demonstrates your financial acumen, strategic thinking, and ability to contribute significantly to organizational success. To maximize your job prospects, creating a strong, ATS-friendly resume is essential. ResumeGemini can help you craft a compelling resume that highlights your skills and experience in this critical area. We provide examples of resumes tailored to showcase expertise in developing and managing program budgets to help you get started. Take the next step towards your dream job – start building your resume with ResumeGemini today!

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

These apartments are so amazing, posting them online would break the algorithm.

https://bit.ly/Lovely2BedsApartmentHudsonYards

Reach out at [email protected] and let’s get started!

Take a look at this stunning 2-bedroom apartment perfectly situated NYC’s coveted Hudson Yards!

https://bit.ly/Lovely2BedsApartmentHudsonYards

Live Rent Free!

https://bit.ly/LiveRentFREE

Interesting Article, I liked the depth of knowledge you’ve shared.

Helpful, thanks for sharing.

Hi, I represent a social media marketing agency and liked your blog

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?