Are you ready to stand out in your next interview? Understanding and preparing for Fraud Investigations Management interview questions is a game-changer. In this blog, we’ve compiled key questions and expert advice to help you showcase your skills with confidence and precision. Let’s get started on your journey to acing the interview.

Questions Asked in Fraud Investigations Management Interview

Q 1. Explain the fraud triangle.

The Fraud Triangle is a model that explains the three factors that must be present for occupational fraud to occur: Opportunity, Pressure, and Rationalization. Think of it as a three-legged stool – if one leg is missing, the stool (and the fraud) collapses.

- Opportunity: This refers to the situation where an employee has access to assets or processes that can be exploited for personal gain. A weak internal control system, lack of oversight, or inadequate segregation of duties can create opportunities for fraud.

- Pressure: This is the internal or external force that motivates an individual to commit fraud. Examples include financial pressures like debt, gambling addiction, or the need to support a lavish lifestyle. Pressure can also stem from performance-related stress or fear of job loss.

- Rationalization: This is the mental justification an individual uses to convince themselves that their actions are acceptable. Fraudsters might rationalize their behavior by believing they are only borrowing the money, that the company owes them, or that they are simply correcting an injustice.

For example, a company with lax inventory controls (Opportunity), facing declining profits and potential layoffs (Pressure), might have an employee who rationalizes stealing inventory to sell on the side, believing it’s a way to ‘secure their future’ (Rationalization).

Q 2. Describe your experience with different fraud detection methodologies.

My experience encompasses a wide range of fraud detection methodologies, both preventative and detective. I’m proficient in using data analytics techniques to identify anomalies in financial transactions, leveraging tools like Benford’s Law analysis to uncover potential manipulations. I’ve also extensively used predictive modeling to identify high-risk areas and individuals within an organization.

Furthermore, I have significant experience with:

- Continuous Auditing: Implementing real-time monitoring systems to detect suspicious activities as they occur.

- Data Mining and Machine Learning: Employing advanced algorithms to identify patterns and outliers that may indicate fraudulent behavior. This has been particularly effective in detecting insurance fraud and credit card fraud.

- Network Analysis: Mapping relationships between individuals and entities to identify potential collusion or insider threats.

- Traditional Auditing Techniques: Conducting thorough document reviews, interviews, and walkthroughs to verify the accuracy and completeness of financial records.

In one case, using data analytics, I discovered a pattern of unusually large reimbursements submitted by a specific department. Further investigation revealed a sophisticated scheme of falsified expense reports.

Q 3. What are the key elements of a strong internal control system to prevent fraud?

A strong internal control system is crucial for fraud prevention. Key elements include:

- Segregation of Duties: No single individual should have complete control over a transaction from start to finish. This prevents one person from both initiating and approving a transaction, for example.

- Authorization and Approval Processes: Clear procedures for authorizing transactions and expenditures, with appropriate levels of approval based on the transaction amount and risk.

- Independent Verification and Reconciliation: Regularly verifying the accuracy of records and reconciling accounts to identify discrepancies early.

- Physical Controls: Safeguarding assets through physical security measures such as access controls, surveillance systems, and secure storage.

- Strong IT Controls: Implementing robust security measures for IT systems, including access controls, encryption, and regular security audits. This is vital to protect sensitive data from unauthorized access or manipulation.

- Regular Audits: Conducting both internal and external audits to evaluate the effectiveness of the internal control system and identify weaknesses.

- A Strong Ethical Culture: Fostering an environment of honesty and integrity, with clear codes of conduct, reporting mechanisms (whistleblowing systems), and employee training on ethics and fraud prevention.

Imagine a scenario without segregation of duties: a single employee controlling inventory, sales, and cash handling. The opportunity for theft and manipulation is exceptionally high.

Q 4. How do you identify and assess fraud risk?

Identifying and assessing fraud risk is an ongoing process. It involves a combination of qualitative and quantitative methods:

- Risk Assessment Workshops: Gathering input from various departments and levels of management to identify potential fraud risks and vulnerabilities.

- Fraud Risk Surveys and Questionnaires: Assessing employee awareness of fraud risks and gathering information on potential indicators of fraud.

- Data Analysis: Analyzing financial and operational data to identify unusual patterns or anomalies. Techniques such as Benford’s Law analysis, outlier detection, and trend analysis are helpful.

- External Benchmarking: Comparing the organization’s fraud risk profile to that of similar organizations to identify potential areas for improvement.

- Reviewing Previous Fraud Cases: Studying past incidents to understand the causes, patterns, and vulnerabilities.

After identifying potential risks, I use a risk scoring model to prioritize them based on their likelihood and potential impact. This allows me to focus resources on addressing the most significant threats first. For instance, a high likelihood of customer credit card fraud would receive a higher priority than a low likelihood of vendor collusion.

Q 5. What are some common red flags that indicate potential fraud?

Numerous red flags can signal potential fraud. Some common indicators include:

- Unexplained Assets or Lifestyle Changes: A sudden increase in an employee’s wealth or lifestyle that is not consistent with their known income.

- Unusual Transactions or Accounting Entries: Transactions that are unusually large, frequent, or complex, especially those lacking proper documentation or authorization.

- Discrepancies in Financial Records: Inconsistencies between different sets of records or missing documentation.

- Conflicts of Interest: Situations where an employee has personal interests that conflict with their professional responsibilities.

- Weak Internal Controls: Inadequate oversight, lack of segregation of duties, or ineffective authorization processes create opportunities for fraud.

- Complaints from Customers or Vendors: Negative feedback from external parties can indicate fraudulent activity.

- Changes in Employee Behavior: Secretive behavior, defensiveness, or reluctance to cooperate with audits are potential red flags.

- Tip-offs: Anonymous tips or whistleblowing reports from employees or other individuals can provide valuable information.

For example, if an employee suddenly starts driving a luxury car and taking lavish vacations without a plausible explanation, it might raise a red flag.

Q 6. Describe your experience investigating financial statement fraud.

My experience in investigating financial statement fraud involves meticulous review of financial records, identifying inconsistencies in revenue recognition, cost of goods sold, and asset valuation. I use various analytical procedures, including ratio analysis, trend analysis, and common-size financial statements to uncover potential manipulations. I also interview key personnel to understand their roles and responsibilities, focusing on areas where discrepancies exist.

One case involved a company that had overstated its revenue by using fictitious sales transactions. Through detailed analysis of sales invoices, shipping records, and customer accounts, I was able to identify the fraudulent activity and quantify the extent of the misstatement. This required detailed forensic accounting techniques and collaboration with legal counsel.

Q 7. How do you handle interviewing witnesses and suspects in a fraud investigation?

Interviewing witnesses and suspects in a fraud investigation requires a structured and methodical approach.

- Preparation:Thorough preparation is key. I carefully review all available evidence, including documents, emails, and other relevant information. I develop a clear interview plan with specific questions designed to elicit information and identify inconsistencies.

- Building Rapport: I aim to establish a rapport with the individual, creating a comfortable environment that encourages open communication. I start with general questions before moving to more sensitive topics.

- Open-Ended Questions: I prefer open-ended questions, encouraging the individual to provide detailed narratives rather than simple “yes” or “no” answers.

- Active Listening: Pay close attention to their verbal and nonverbal cues. Inconsistencies or evasiveness can indicate deception. Body language, tone of voice, and hesitation are all important observation points.

- Documentation: I meticulously document the interview, including the date, time, location, individuals present, and a detailed record of the conversation. This ensures accurate record keeping and helps maintain the integrity of the investigation.

- Legal Counsel: In cases involving suspects, I work closely with legal counsel to ensure the interview process complies with all legal and ethical standards.

It’s crucial to remain impartial and objective throughout the process, allowing the evidence to speak for itself.

Q 8. What is your experience with data analysis techniques in fraud investigations?

Data analysis is the backbone of modern fraud investigations. My experience encompasses a wide range of techniques, from basic descriptive statistics to advanced predictive modeling. I’m proficient in using tools like SQL, Python (with libraries like Pandas and Scikit-learn), and specialized data analytics platforms to identify anomalies and patterns indicative of fraudulent activity. For instance, I’ve used SQL queries to detect unusual transaction volumes or amounts, and Python to build predictive models that flag high-risk accounts based on historical data. I also leverage visualization tools to effectively communicate complex findings to both technical and non-technical audiences.

Specifically, I’m experienced with techniques such as:

- Benford’s Law analysis: Identifying inconsistencies in the leading digits of numerical data, a common indicator of manipulation.

- Regression analysis: Modeling relationships between variables to uncover hidden correlations and predict fraudulent behavior.

- Anomaly detection: Using statistical methods and machine learning algorithms to identify outliers and unusual patterns in transaction data.

- Network analysis: Visualizing relationships between individuals or entities to detect collusion and complex fraud schemes.

My approach always prioritizes accuracy and interpretability. I ensure data quality through rigorous validation and cleaning processes, and focus on presenting findings in a clear, concise manner that facilitates informed decision-making.

Q 9. Explain your understanding of forensic accounting principles.

Forensic accounting principles are the foundation of my investigative work. They involve applying accounting knowledge and investigative skills to unravel financial crimes. This includes meticulously documenting financial transactions, reconstructing financial records, and analyzing financial statements to detect irregularities and discrepancies. It’s crucial to follow a strict chain of custody for all evidence and maintain a detailed audit trail of all actions taken.

Key principles I adhere to include:

- Professional skepticism: Approaching every investigation with a questioning mind and critically evaluating all information.

- Due diligence: Conducting thorough and comprehensive investigations, leaving no stone unturned.

- Independence and objectivity: Maintaining impartiality and avoiding conflicts of interest.

- Evidence-based conclusions: Drawing conclusions solely on verifiable evidence and sound accounting principles.

For example, in a case involving suspected asset misappropriation, I would use forensic accounting techniques to trace the flow of funds, identify hidden assets, and reconstruct the financial records to determine the extent of the fraud.

Q 10. How do you document and present your findings in a fraud investigation?

Documentation and presentation are critical for successful fraud investigations. I meticulously document every step of the process, including the initial complaint, investigative steps, interviews conducted, evidence collected, and analysis performed. This detailed documentation forms the basis of my findings and is essential for legal proceedings and audits.

My reports are structured to be clear, concise, and easy to understand, even for non-technical audiences. They typically include:

- Executive Summary: A brief overview of the investigation’s key findings.

- Methodology: A detailed explanation of the investigative techniques used.

- Evidence: Presentation of all collected evidence, including supporting documentation and analysis.

- Findings: A clear statement of the investigator’s conclusions, supported by evidence.

- Recommendations: Suggestions for preventing future fraud.

I frequently utilize visual aids such as charts, graphs, and timelines to make complex information more accessible. Furthermore, I’m proficient in using presentation software to deliver findings effectively in a courtroom or boardroom setting.

Q 11. What is your experience with regulatory compliance related to fraud?

Regulatory compliance is a paramount concern in fraud investigations. My experience includes working with various regulations, such as the Sarbanes-Oxley Act (SOX), the Foreign Corrupt Practices Act (FCPA), and industry-specific compliance standards. I understand the legal and ethical implications of conducting investigations and ensure that all activities are compliant with applicable laws and regulations.

I’m familiar with the requirements for documenting and reporting fraud, including internal reporting procedures and external regulatory filings. I also understand the importance of preserving evidence in a manner that is legally admissible. This includes understanding and applying legal holds on data and ensuring the chain of custody is maintained throughout the entire process.

Staying current with evolving regulations is a continuous process. I actively participate in professional development activities and stay informed about changes in legislation and best practices to maintain the highest levels of compliance.

Q 12. Describe a challenging fraud case you investigated and the outcome.

One particularly challenging case involved a complex scheme of vendor fraud within a large multinational corporation. The perpetrators, a group of employees colluding with external vendors, inflated invoices and diverted funds through a series of shell companies. The initial investigation proved difficult due to obfuscated financial records and a lack of clear audit trails.

To overcome this, I utilized a combination of data analytics techniques, including network analysis to visualize the relationships between the employees and vendors, and Benford’s Law analysis to identify anomalies in the invoice data. I also conducted extensive interviews with employees and reviewed internal controls. The investigation revealed a sophisticated scheme involving millions of dollars in losses. The perpetrators were identified, and the company recovered a significant portion of the misappropriated funds. The case resulted in significant internal control improvements and the implementation of enhanced fraud detection measures.

Q 13. How do you maintain confidentiality and integrity throughout an investigation?

Maintaining confidentiality and integrity is paramount in fraud investigations. I adhere to strict protocols to protect sensitive information and ensure the ethical conduct of the investigation. This includes:

- Confidentiality agreements: Signing agreements with all involved parties to protect sensitive information.

- Secure data storage: Storing all evidence and investigative materials in secure locations, both physical and digital.

- Limited access: Restricting access to sensitive information to only authorized personnel.

- Data encryption: Employing encryption techniques to protect electronic data.

- Ethical considerations: Adhering to a strict code of ethics and avoiding any conflicts of interest.

I treat all information obtained during the investigation with the utmost care and respect for the privacy of individuals involved. My commitment to confidentiality extends beyond the investigation itself, and I ensure that all information is handled according to legal and ethical standards.

Q 14. What are your strengths and weaknesses in fraud investigation?

My strengths lie in my analytical abilities, attention to detail, and ability to communicate complex information effectively. I am highly organized and methodical in my approach, ensuring that all aspects of an investigation are thoroughly addressed. My experience in diverse methodologies allows me to tailor my approach to the specifics of each case, ensuring optimal outcomes. I also possess excellent interpersonal skills which are vital for conducting interviews and building rapport with witnesses and stakeholders.

One area I am continually working to improve is my fluency in certain specialized software packages, specifically those related to advanced predictive modelling. While my current skills are sufficient, staying abreast of advancements in this area would further enhance my capabilities. I am actively pursuing training opportunities to strengthen my skills in this area.

Q 15. How do you stay updated on the latest fraud schemes and techniques?

Staying ahead of evolving fraud schemes requires a multi-faceted approach. I regularly subscribe to and actively read industry publications like the Journal of Forensic Accounting and publications from organizations like the Association of Certified Fraud Examiners (ACFE). These resources provide in-depth analysis of emerging trends and case studies of recent fraud investigations. I also actively participate in professional development opportunities, attending webinars, conferences, and workshops to learn from experts and network with other professionals in the field. This ensures I’m aware of the latest techniques used by fraudsters, such as sophisticated phishing scams leveraging AI, or the use of cryptocurrency for money laundering. Finally, I maintain a network of contacts within law enforcement and regulatory agencies, receiving updates on their observations of current fraud trends. This combination of formal learning and informal networking helps maintain a high level of awareness.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What software or tools are you proficient in for fraud detection and investigation?

My proficiency spans various software and tools crucial for fraud detection and investigation. I’m highly skilled in using data analytics platforms like ACL (Audit Command Language) and IDEA for data mining and analysis, allowing me to identify anomalies and patterns indicative of fraudulent activities. I’m also experienced with various forensic accounting software for reconstructing financial records and tracing assets. These tools help to sift through vast datasets to quickly locate relevant data. For example, using ACL, I can easily perform Benford’s Law analysis on accounting data to identify potential falsifications. Furthermore, I’m proficient in using case management software for efficiently organizing and tracking investigations, and communication tools to coordinate effectively with the investigation team and stakeholders. My experience includes using specialized forensic imaging software for securing and analyzing digital evidence and network monitoring tools for detecting suspicious network activity.

Q 17. Explain your understanding of different types of fraud (e.g., asset misappropriation, financial statement fraud).

Fraud encompasses a broad spectrum of illegal activities, and understanding their nuances is crucial. Asset misappropriation involves the theft or misuse of an organization’s assets, ranging from petty cash to large-scale embezzlement. This could be something as simple as an employee stealing office supplies, or as complex as a sophisticated scheme involving shell companies to divert funds. Examples include employee theft, expense reimbursement fraud, and inventory theft. Financial statement fraud, on the other hand, manipulates a company’s financial records to misrepresent its financial health. This can include inflating revenue, understating liabilities, or hiding losses. Examples include revenue recognition fraud, fictitious revenue, and understating expenses. Other significant categories include corruption (bribery, extortion), and customer fraud (identity theft, insurance fraud). Each type requires a different investigative approach, tailored to the specific nature of the fraudulent activity and the evidence available.

Q 18. How do you handle conflicting evidence or information during an investigation?

Handling conflicting evidence requires a methodical and objective approach. I start by meticulously documenting all evidence, regardless of its apparent consistency or conflict. I then critically evaluate each piece of evidence, considering its source, reliability, and potential biases. This might involve verifying information from multiple sources, interviewing witnesses again with clarifying questions, or consulting with forensic experts to analyze physical or digital evidence. In cases of irreconcilable conflicts, I carefully weigh the credibility of the different sources and present all findings transparently, clearly outlining areas of uncertainty and the reasoning behind my conclusions. It’s vital to avoid drawing premature conclusions and ensure the final report reflects a balanced consideration of all available information. I might employ techniques like creating a timeline of events to identify inconsistencies and potential points of manipulation.

Q 19. What is your experience with presenting your findings to senior management or legal authorities?

I have extensive experience presenting findings to senior management and legal authorities. My presentations are structured to be clear, concise, and easily understandable, even for those without a deep understanding of forensic accounting. I typically begin with a summary of the investigation’s scope and methodology, followed by a presentation of key findings supported by concrete evidence. I use visual aids like charts and graphs to illustrate complex data and maintain a professional and objective tone. I always anticipate potential questions and prepare answers that are well-reasoned and supported by the investigation’s findings. During presentations to legal authorities, I ensure compliance with all legal and regulatory requirements, focusing on facts and evidence that are admissible in court. I’ve found that clear and concise communication, using plain language and focusing on the most impactful findings, is crucial to effectively communicate complex information.

Q 20. Describe your experience with conducting interviews and interrogations.

Conducting interviews and interrogations is a crucial aspect of my work. I begin by building rapport with the interviewee, creating a comfortable environment to encourage open communication. I use a structured approach, starting with general questions before moving towards more specific inquiries. I carefully document all responses, paying attention to both verbal and nonverbal cues. In situations requiring more formal interrogations, I follow established legal procedures, ensuring the interviewee’s rights are protected and the interview is conducted ethically and professionally. I adapt my approach based on the individual, and I always remain calm and professional, even when faced with challenging responses or evasiveness. For instance, if an interviewee is hesitant to provide information, I might use a gradual approach, starting with less sensitive questions before proceeding to more critical areas. This meticulous approach ensures that accurate and reliable information is obtained.

Q 21. How do you prioritize multiple investigations simultaneously?

Prioritizing multiple investigations requires a robust case management system and a clear understanding of each case’s urgency and potential impact. I typically use a prioritization matrix, considering factors such as the potential financial loss, the legal ramifications, and the time sensitivity of each case. High-priority cases involving significant financial risk or imminent legal deadlines receive immediate attention. I delegate tasks effectively to my team members and regularly monitor progress to ensure timely completion of all investigations. Clear communication and regular updates are key to keeping all stakeholders informed and managing expectations. Effective time management techniques, like the Eisenhower Matrix (urgent/important), are essential for maintaining productivity and ensuring that all cases are handled efficiently and effectively.

Q 22. What is your experience with report writing and documentation?

Report writing and documentation are fundamental to a successful fraud investigation. My experience encompasses crafting comprehensive reports that are clear, concise, and legally sound. This includes detailing the investigative process, findings, evidence collected, and conclusions. I utilize a structured approach, often following a standardized template to ensure consistency and completeness. For example, I meticulously document each interview, noting the date, time, location, individuals present, and a verbatim transcript (or detailed summary) of the conversation. Similarly, any evidence, whether digital or physical, is meticulously cataloged and referenced in the report. I’m proficient in using various software and platforms for report generation and securely storing documents, maintaining a detailed audit trail throughout the process.

Beyond the formal report, I also create concise executive summaries for stakeholders who may not require the complete detail. This tailored approach ensures everyone receives the information they need in a digestible format. I’ve presented my findings in various formats, including presentations, briefings, and written testimonies, adapting my communication style based on the audience’s knowledge and level of technical expertise.

Q 23. How do you determine the scope of a fraud investigation?

Determining the scope of a fraud investigation requires a systematic approach. It begins with a clear understanding of the initial allegation or suspicion. This might be a whistleblower report, an internal audit finding, or a discrepancy detected in financial statements. The next step involves identifying the potential parties involved, the timeframe of the suspected activity, and the potential types of fraud involved (e.g., embezzlement, bribery, accounting fraud).

I use a preliminary investigation to gather initial data and evidence. This might include reviewing relevant documents, conducting interviews with key personnel, and analyzing financial records. Based on this preliminary phase, I define the scope, specifying the objectives, resources required, and a realistic timeline. For example, if the initial suspicion is about a specific department’s expense reports, the scope might be limited to that department’s activities within a defined period. However, if the initial investigation uncovers broader systemic issues, the scope would be expanded accordingly, with proper documentation and approval from relevant stakeholders. This iterative process ensures the investigation remains focused and efficient while being thorough enough to uncover all relevant facts.

Q 24. What is your understanding of the legal aspects of fraud investigation?

A deep understanding of legal aspects is crucial for conducting ethical and legally compliant fraud investigations. This includes familiarity with relevant laws and regulations such as the Sarbanes-Oxley Act (SOX), the False Claims Act, and the Foreign Corrupt Practices Act (FCPA), as well as state and local laws. I understand the importance of preserving evidence according to legal standards, ensuring chain of custody is maintained, and respecting the legal rights of individuals involved. For instance, I am mindful of the Fourth Amendment rights concerning search and seizure, ensuring that all evidence collection is conducted legally and ethically.

Moreover, I understand the importance of obtaining necessary legal counsel when required and following established legal procedures for data collection and disclosure. This includes adhering to strict confidentiality protocols and ensuring all actions are taken within the legal framework. I understand the implications of various types of evidence (e.g., hearsay, circumstantial evidence, documentary evidence) and their admissibility in legal proceedings. My knowledge ensures investigations are legally sound, protecting the organization and preventing legal challenges.

Q 25. Describe your experience working with law enforcement or regulatory bodies.

I have extensive experience collaborating with law enforcement and regulatory bodies. This includes working with agencies such as the FBI, state police, and regulatory commissions. These collaborations typically involve sharing information, providing expert testimony, and coordinating investigative efforts. For example, in a case involving large-scale financial fraud, I worked closely with the FBI to provide them with detailed financial data and analysis, helping them build a strong case for prosecution.

The collaboration process involves careful documentation and communication to maintain transparency and legal compliance. I’ve learned to navigate the different protocols and procedures of various agencies, ensuring a smooth and efficient exchange of information. My experience has shown that effective communication and a clear understanding of each party’s roles are crucial for a successful collaboration, enabling a joint effort to achieve justice and deter future fraudulent activities.

Q 26. How do you manage the stress and pressure associated with fraud investigations?

Fraud investigations can be highly stressful and demanding, often involving long hours, complex data analysis, and high-stakes situations. I manage stress by employing several strategies. Firstly, I prioritize meticulous planning and organization, breaking down complex investigations into manageable tasks. This helps to prevent feeling overwhelmed and maintain a sense of control.

Secondly, I maintain a strong focus on self-care. This includes maintaining a healthy work-life balance, engaging in regular exercise, and utilizing mindfulness techniques to manage stress. Thirdly, I rely on my team and network of colleagues for support and guidance when needed, fostering a collaborative environment where open communication and mutual support are encouraged. Recognizing the high-pressure nature of the work and proactively managing my well-being are essential to avoid burnout and ensure continued effectiveness.

Q 27. Explain your experience with using data analytics tools to identify fraudulent transactions.

Data analytics is an indispensable tool in modern fraud investigations. I’m proficient in using various data analytics tools, including SQL, Python (with libraries like Pandas and Scikit-learn), and specialized fraud detection software. These tools allow me to analyze large datasets quickly and efficiently, identifying anomalies and patterns that may indicate fraudulent activity. For instance, I’ve used SQL queries to identify unusual transactions based on factors such as transaction amount, frequency, and location.

SELECT * FROM transactions WHERE amount > 10000 AND location = 'Unusual Location'

This query would identify large transactions from an unusual location, potentially flagging suspicious activity. I also employ statistical analysis techniques to identify outliers and patterns indicative of fraud. Furthermore, machine learning algorithms can be used to develop predictive models that flag potentially fraudulent transactions in real-time. My expertise lies in leveraging these tools to uncover hidden connections and patterns that would be impossible to detect through manual review alone.

Q 28. How do you ensure the objectivity and impartiality of your investigations?

Maintaining objectivity and impartiality is paramount in fraud investigations. I achieve this through several key strategies. Firstly, I adhere to a strict code of ethics, ensuring that all actions are transparent, fair, and unbiased. This includes avoiding preconceived notions and basing conclusions solely on evidence.

Secondly, I meticulously document every step of the investigation, ensuring transparency and accountability. This detailed documentation serves as a reference point for review and helps avoid any potential bias or misinterpretation. Thirdly, I seek diverse perspectives by involving other team members and consulting with experts when needed. This ensures that various viewpoints are considered, preventing any individual bias from affecting the outcome. Finally, I regularly review my own processes to identify and mitigate potential sources of bias, ensuring the investigation remains fair and impartial throughout.

Key Topics to Learn for Fraud Investigations Management Interview

- Fraud Schemes & Typologies: Understanding common fraud schemes (e.g., financial statement fraud, asset misappropriation, corruption) and their variations. This includes recognizing red flags and indicators of fraudulent activity.

- Investigative Techniques: Mastering interview techniques, document analysis, data analytics, and forensic accounting procedures to gather and analyze evidence effectively. Consider practical applications like using data visualization to present findings.

- Regulatory Compliance & Legal Frameworks: Familiarity with relevant laws, regulations, and industry best practices (e.g., SOX, FCPA). Understanding the legal implications of investigations and how to navigate ethical considerations.

- Risk Assessment & Prevention: Proactive identification and mitigation of fraud risks through internal controls, risk assessments, and developing a strong fraud prevention program.

- Data Analysis & Technology: Utilizing data analytics tools and techniques to identify anomalies, patterns, and trends indicative of fraud. Consider exploring specific software or methodologies used in fraud detection.

- Reporting & Communication: Effectively communicating findings through clear, concise, and persuasive reports and presentations to various stakeholders, including management and law enforcement.

- Case Management & Documentation: Organizing and managing investigations efficiently, maintaining meticulous documentation, and adhering to established protocols throughout the investigative process.

Next Steps

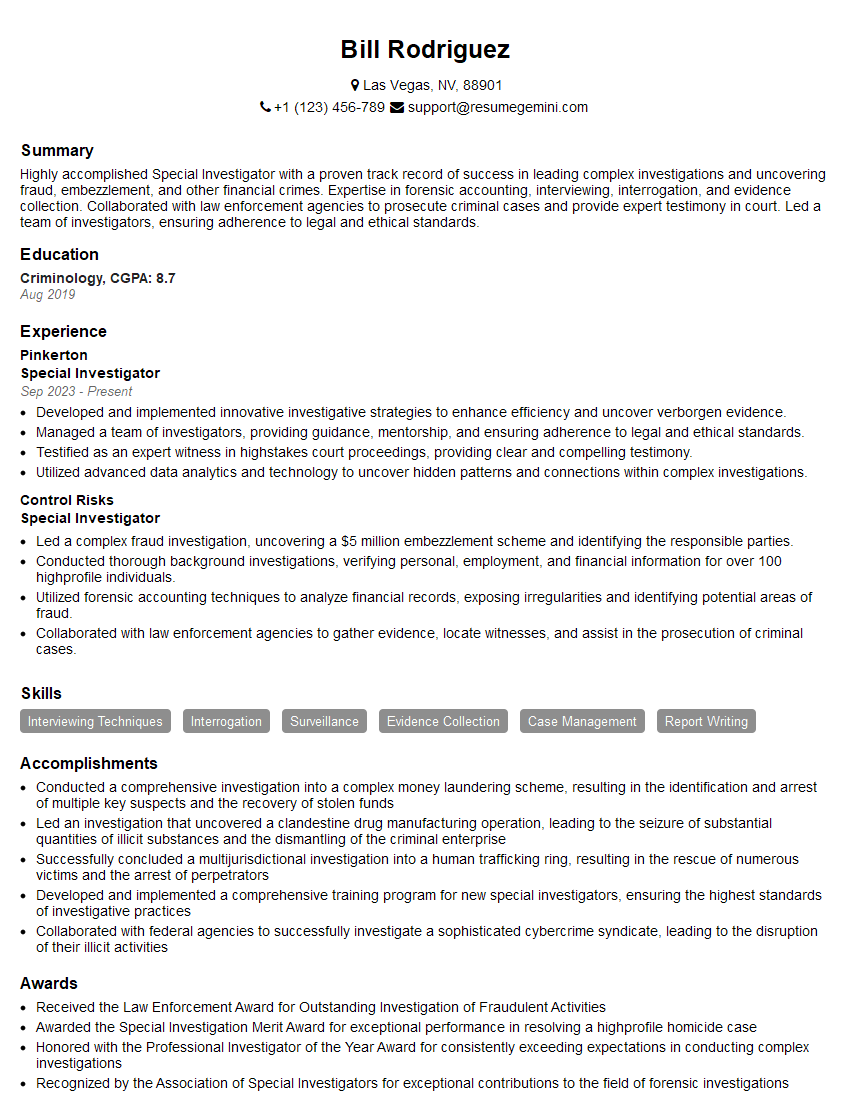

Mastering Fraud Investigations Management opens doors to exciting career opportunities with significant growth potential in a high-demand field. To maximize your job prospects, it’s crucial to present your skills and experience effectively through a well-crafted, ATS-friendly resume. ResumeGemini can help you build a professional resume that highlights your expertise and catches the attention of recruiters. We offer examples of resumes tailored specifically to Fraud Investigations Management to guide you through the process. Invest in your future – create a compelling resume that showcases your potential.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Live Rent Free!

https://bit.ly/LiveRentFREE

Interesting Article, I liked the depth of knowledge you’ve shared.

Helpful, thanks for sharing.

Hi, I represent a social media marketing agency and liked your blog

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?