Warning: search_filter(): Argument #2 ($wp_query) must be passed by reference, value given in /home/u951807797/domains/techskills.interviewgemini.com/public_html/wp-includes/class-wp-hook.php on line 324

Are you ready to stand out in your next interview? Understanding and preparing for Handling Cash and Credit Card Transactions interview questions is a game-changer. In this blog, we’ve compiled key questions and expert advice to help you showcase your skills with confidence and precision. Let’s get started on your journey to acing the interview.

Questions Asked in Handling Cash and Credit Card Transactions Interview

Q 1. Explain the process of balancing a cash drawer at the end of a shift.

Balancing a cash drawer is a crucial end-of-shift procedure ensuring accuracy and accountability. It’s like solving a financial puzzle, making sure all the pieces – cash received, cash paid out, and the starting amount – add up perfectly.

The process typically involves these steps:

- Count the cash: Carefully count all bills and coins in the drawer, separating them by denomination. Use a cash counting machine if available for efficiency and accuracy.

- Record the count: Document the exact amount of each denomination on a designated form or in the Point of Sale (POS) system. This creates an auditable record.

- Reconcile with the POS system: Compare the physical cash count with the total sales recorded by the POS system. This is the core of the balancing process. Any discrepancies need immediate investigation.

- Account for discrepancies: If a difference exists, review transactions carefully. Common reasons for discrepancies include incorrect change given, voids, or missing sales receipts. If an error is identified it should be corrected. If the discrepancy remains, immediately report it to the supervisor to initiate a thorough investigation.

- Prepare the deposit: Once balanced, secure the cash in a deposit bag according to company procedures and prepare it for deposit in the bank.

Example: Let’s say you started your shift with $100 in the drawer. Your POS system shows $500 in cash sales. After counting your drawer, you have $600. This is balanced: $100 (starting) + $500 (sales) = $600 (ending).

Q 2. Describe your experience with different types of credit card payment processing systems.

I have extensive experience with various credit card processing systems, from traditional point-of-sale (POS) terminals to integrated online payment gateways. Each system has its strengths and weaknesses, impacting efficiency and security.

- Traditional POS Terminals: These are the standard countertop machines that swipe, dip, or tap cards. They usually connect to a merchant services provider via phone line or internet. I’m proficient with various brands and models, understanding their specific functionalities and troubleshooting any connectivity or processing issues.

- Integrated POS Systems: These are sophisticated systems where the payment processing is integrated directly into the main POS software. This streamlines operations and provides real-time sales data. I’ve worked with systems that integrate inventory management, customer relationship management (CRM), and reporting tools.

- Mobile Payment Processors: These systems use mobile devices (smartphones or tablets) with card readers to process payments. They offer flexibility but require secure connectivity and adherence to data security standards. I have experience with several mobile payment apps, understanding their unique features and limitations.

- Online Payment Gateways: These are crucial for e-commerce. They securely process online credit card transactions, often integrated with shopping cart software. I understand the importance of PCI compliance and secure coding practices in this domain.

My experience spans different payment types, including debit cards, credit cards (Visa, Mastercard, American Express, Discover), and contactless payment methods (Apple Pay, Google Pay).

Q 3. How do you handle a customer dispute regarding a credit card transaction?

Handling customer disputes regarding credit card transactions requires a calm, professional, and systematic approach. It’s crucial to de-escalate the situation while ensuring accurate resolution.

My approach involves:

- Listen empathetically: Begin by actively listening to the customer’s concerns, showing understanding and validating their frustration.

- Gather information: Carefully review the transaction details, including date, time, amount, and any supporting documentation (receipt, authorization code).

- Review security footage: If available, security footage can help confirm details of the transaction.

- Check for errors: Look for processing errors, double charges, or discrepancies in the amount.

- Contact the credit card company: If the issue is beyond my immediate ability to resolve (fraudulent transaction or dispute with card issuer), I’ll initiate a chargeback process by contacting the credit card company with all supporting documentation.

- Keep detailed records: Maintain comprehensive records of the dispute, including all communication with the customer and the credit card company.

- Follow company protocol: Adhere to established company policies and procedures for handling disputes.

Example: A customer disputes a charge claiming it’s fraudulent. I’d review the transaction record, check security footage, and compare it to the customer’s statement. If the transaction appears fraudulent, I would guide the customer through reporting it to their credit card company and providing them with our internal documentation of the incident.

Q 4. What are some common security procedures you follow when handling cash and credit cards?

Security is paramount when handling cash and credit cards. My procedures emphasize safeguarding both the business’s assets and customer data.

- Secure cash handling: Cash is always kept in a locked drawer or safe, with regular reconciliation and deposits. I would never leave cash unattended.

- Proper credit card processing: I always follow PCI DSS (Payment Card Industry Data Security Standard) guidelines to protect cardholder data. This includes never writing down card numbers, immediately processing transactions, and securely storing sensitive data.

- Surveillance: I’m aware of and utilize security cameras to deter theft and monitor transactions.

- Employee accountability: Strict procedures are followed for opening and closing cash drawers, including a second person counting the money at the end of shift for higher amounts.

- Regular audits: I would be comfortable with regular audits of cash handling practices to ensure compliance.

- Data encryption: All sensitive transaction data is encrypted to prevent unauthorized access.

Example: During a busy period, if I need to briefly leave the register, I would always secure the cash drawer and inform my supervisor.

Q 5. How do you reconcile cash and credit card transactions at the end of the day?

Reconciling cash and credit card transactions at the end of the day is a critical step to ensure financial accuracy. It’s like balancing a detailed financial equation.

The process usually involves:

- Count and record cash: This involves carefully counting all cash in the drawer and recording the totals.

- Obtain electronic transaction records: Download reports from the POS system showing all credit card transactions.

- Compare physical cash with POS data: The total cash count should match the cash sales recorded in the POS system. Discrepancies need investigation.

- Reconcile credit card transactions: Verify that the electronic records of all credit card transactions match the total sales shown in the POS system.

- Prepare deposit slips: Create deposit slips for both cash and credit card payments.

- Identify and resolve discrepancies: Any discrepancies between the physical cash count and POS system data, or between electronic and physical credit card records, need to be thoroughly investigated. Common causes include errors in data entry, missing receipts, or voids.

Example: If the POS system reports $1000 in credit card sales and the bank statement shows a deposit of only $950, I’d investigate the $50 discrepancy by checking for any rejected transactions, processing errors, or accounting irregularities.

Q 6. What measures do you take to prevent fraud when processing transactions?

Preventing fraud in transaction processing demands a multi-layered approach, combining technology with rigorous procedures.

- Card verification: Using methods like CVV2 and address verification systems helps authenticate credit card transactions.

- Fraud detection systems: Utilizing POS systems with built-in fraud detection alerts helps identify suspicious activity in real time.

- Regular security updates: Ensuring that all software and hardware are up-to-date with the latest security patches is essential.

- Employee training: Employees should be trained to recognize signs of fraudulent activity, such as suspicious cardholders or unusual transaction patterns.

- Secure data storage: Storing sensitive transaction data securely, adhering to PCI DSS standards, is critical.

- Regular audits: Regular internal audits and external security assessments help detect vulnerabilities and prevent fraud.

- Limit cash transactions where possible: Encouraging the use of credit cards and other electronic payment methods reduces cash handling and the risk of cash theft.

Example: If a customer attempts to use a credit card with a reported loss or theft, I would decline the transaction and follow company procedures for handling such situations.

Q 7. Describe your experience with handling large sums of cash.

Handling large sums of cash requires meticulous attention to security and accuracy. It’s akin to managing a high-value asset requiring specialized procedures.

My experience includes:

- Secure transport: Utilizing armored vehicles or secure delivery services for transporting large sums of cash to the bank.

- Multiple counts: Conducting multiple cash counts with different people to ensure accuracy and accountability.

- Surveillance: Increased security measures, such as additional cameras and security personnel during high-cash transactions.

- Detailed documentation: Maintaining meticulous records of all cash transactions, including the source, destination, and time of transport.

- Deposit procedures: Following strict bank procedures for depositing large sums of cash, including proper authorization and verification.

- Internal controls: Having a system of checks and balances to prevent any unauthorized access or loss of cash.

Example: While working at a casino, I was responsible for the secure transport of high-value chip sales to the vault, employing strict security protocols including two authorized personnel accompanying the cash.

Q 8. How do you deal with a malfunctioning POS system?

A malfunctioning POS (Point of Sale) system can significantly disrupt business operations. My first step is to identify the nature of the malfunction. Is it a network issue, a software glitch, or a hardware problem?

For example, if the system is frozen, I would try the basic troubleshooting steps: restarting the system, checking network connectivity, and ensuring the power supply is stable. If the issue persists, I’d consult the POS system’s troubleshooting guide or contact technical support immediately.

In the meantime, to avoid disrupting customer flow, I’d implement a contingency plan. This might involve manually processing transactions using a backup system, if available, or offering a temporary alternative payment method like cash. Accurate record-keeping during this period is crucial, so I’d meticulously note all transactions, ensuring they are reconciled later with the POS system once it’s functional.

Q 9. What is your experience with different payment methods (e.g., debit cards, mobile payments)?

I have extensive experience handling various payment methods, including debit cards, credit cards (Visa, Mastercard, American Express, Discover), mobile payments (Apple Pay, Google Pay, Samsung Pay), and contactless payments. I’m proficient in processing transactions through different POS systems and understanding the nuances of each payment type. For example, I’m aware of the differences in processing times and potential security protocols associated with each method.

My experience includes verifying card information, ensuring proper authorization, and handling potential errors or declines. I’m also familiar with the security features and fraud prevention measures associated with each payment type. Working with mobile payments requires extra attention to ensuring a secure connection and adherence to data protection policies.

Q 10. How do you handle a declined credit card transaction?

A declined credit card transaction can be frustrating for both the customer and the business. My approach is always polite and professional. First, I would calmly verify the card details again, ensuring there are no typos. Then, I check for sufficient funds by confirming the card’s validity and available credit with the customer.

Common reasons for declined cards include insufficient funds, incorrect card information, security measures, or expired cards. Depending on the reason, I’d offer alternative payment methods like cash, another credit card, or a debit card. I’d also clearly explain the reason for the decline to the customer without disclosing sensitive information. It’s essential to maintain a friendly and helpful demeanor throughout the process, ensuring the customer feels respected and understood. I also document the declined transaction according to company policy, noting the reason for the decline and any actions taken.

Q 11. What is your understanding of PCI DSS compliance?

PCI DSS (Payment Card Industry Data Security Standard) compliance is critical for protecting customer credit card information. It’s a set of security standards designed to ensure that ALL companies that accept, process, store or transmit credit card information maintain a secure environment. My understanding encompasses the key principles of PCI DSS, including secure network configuration, access control, information security policies, and regular security assessments.

I know that non-compliance can lead to severe penalties, including hefty fines and potential legal repercussions. My experience involves working in environments that prioritize PCI DSS compliance, such as using encryption for card data, regularly updating security software, and participating in security awareness training. Essentially, I understand the importance of following these standards to prevent data breaches and protect sensitive customer information.

Q 12. Describe your experience with handling refunds and returns.

Handling refunds and returns involves careful attention to detail and adherence to company policies. First, I’d verify the purchase, ensuring it aligns with the return policy. I need to check the condition of the returned goods and confirm that the customer has the necessary proof of purchase, such as a receipt or order confirmation.

Once verified, I’d process the refund following established procedures – this could involve initiating a refund through the POS system, issuing a cash refund, or processing a credit back to the original payment method. Accurate record-keeping is vital. I would meticulously document the transaction, including the reason for the return, the method of refund, and the amount refunded. If the return involves a damaged or defective product, I’d follow additional procedures as outlined by the company’s return policy, possibly involving a replacement or additional customer service steps.

Q 13. How do you ensure accuracy when counting cash?

Accuracy in cash handling is paramount. I use a systematic approach. First, I would start by organizing the cash by denomination (e.g., separating bills into ones, fives, tens, twenties, etc., and coins into their respective denominations). I then perform a count using a cash counting machine if available, which significantly enhances efficiency and accuracy. If a machine is unavailable, I’d meticulously count each denomination multiple times to minimize errors.

For manual counting, I often use a counting tray to help keep the bills organized and avoid mistakes. I also regularly cross-check my counts to verify accuracy. A common technique is to count the cash twice, using different counting methods if possible. Finally, I meticulously record all cash transactions in a log, ensuring it matches the actual cash count. This thorough process helps prevent discrepancies and ensures financial accountability.

Q 14. How do you handle counterfeit currency?

Encountering counterfeit currency can be a serious issue. My training equips me to identify potentially counterfeit bills and coins using established techniques. I’d first look for tell-tale signs, such as unusual texture, color variations, or inconsistent printing quality compared to genuine currency. If I suspect a bill or coin is counterfeit, I would discreetly set it aside, and I would not overtly reject it in front of the customer.

I’d then use an ultraviolet light or a counterfeit detection pen to further verify its authenticity. Following company policy, I would then inform a manager or supervisor of the situation. Our store may have specific procedures for handling this, such as contacting the authorities or following a documented reporting process. The key is to handle the situation with professionalism and discretion to avoid causing any unnecessary issues or upsetting the customer.

Q 15. How do you maintain a secure work environment to protect cash and card information?

Maintaining a secure environment for cash and card transactions is paramount. It’s about implementing a layered security approach, combining physical and procedural safeguards.

- Physical Security: This involves secure storage for cash – ideally a fireproof and tamper-evident safe – and limiting access to only authorized personnel. We should also have well-lit areas, CCTV surveillance, and possibly even alarm systems to deter theft. For card information, point-of-sale (POS) systems should be physically protected from tampering, and all data should be encrypted both in transit and at rest.

- Procedural Security: This focuses on establishing clear protocols for handling cash and cards. This includes regular cash counts and reconciliation, using secure payment processing systems that adhere to PCI DSS (Payment Card Industry Data Security Standard) guidelines, and promptly shredding sensitive documents. Employees should be trained on secure handling procedures, including not leaving cash unattended and following strict data privacy protocols. Regular audits and employee background checks also play a crucial role.

- Technology Security: Implementing strong password policies, using firewalls and anti-virus software, and regularly updating software on all POS systems and computers are essential. Employing EMV (Europay, MasterCard, and Visa) compliant terminals protects against counterfeit credit cards, and using tokenization helps to minimize the risk of data breaches by replacing sensitive card information with unique identifiers.

Think of it like protecting a valuable item – multiple layers of security are needed to ensure it stays safe.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What is your experience with different POS systems (e.g., Square, Shopify)?

I have extensive experience with various POS systems, including Square, Shopify, and Clover. Each platform offers unique features and functionalities, catering to different business needs and sizes.

- Square: I’ve used Square extensively for its user-friendly interface and ease of integration with other business tools. Its mobile processing capability is excellent for businesses on the go, and its reporting features are helpful for tracking sales and managing finances.

- Shopify: My experience with Shopify is primarily focused on its e-commerce capabilities. While it handles payments through various integrated gateways, the focus is less on the direct point-of-sale transaction and more on online order fulfillment and inventory management. I’m comfortable managing the payment processing aspects within its ecosystem, ensuring secure transactions and accurate financial reporting.

- Clover: I’ve worked with Clover systems in larger retail settings, appreciating its ability to handle high transaction volumes and its integration with inventory management systems. Its robust reporting and analytics capabilities are advantageous for business analysis and decision-making.

My proficiency extends beyond just basic operation; I’m adept at troubleshooting technical issues, configuring settings for optimal performance, and customizing the system to meet specific business requirements.

Q 17. Explain the importance of daily reconciliation of transactions.

Daily reconciliation is crucial for maintaining accurate financial records, detecting errors, and preventing fraud. It’s the process of comparing the day’s transactions recorded by the POS system with the actual cash and credit card receipts.

Imagine a bakery: at the end of the day, the cashier counts the cash in the till. This amount should match the sum of all cash sales recorded by the POS system. Similarly, the total of all credit card transactions processed by the POS system should match the amount deposited in the business’s bank account. Discrepancies trigger an investigation to identify and correct any errors, be it a simple input mistake or a more serious issue like theft or fraud.

The benefits are significant: accurate financial statements, improved inventory management, early detection of potential problems, and strengthened internal controls. It’s a simple yet highly effective risk mitigation strategy.

Q 18. How do you prioritize customer service while efficiently processing transactions?

Prioritizing customer service while efficiently processing transactions is a matter of balancing speed and courtesy.

- Efficiency: Familiarity with the POS system is key. Knowing keyboard shortcuts and efficiently handling various payment methods speeds up the process. Organizing the workspace to minimize unnecessary movements also helps.

- Courtesy: A friendly greeting, clear communication about the transaction, and thanking the customer go a long way. Addressing any customer questions patiently and professionally shows respect for their time.

- Problem-Solving: Being prepared to handle unexpected situations, such as card declines or technical glitches, with grace and a solution-oriented approach is crucial.

For example, if a card is declined, I calmly offer alternative payment options, avoiding any accusatory language. If there’s a system outage, I apologize for the inconvenience and explain the situation honestly. The aim is to make the experience as smooth as possible, regardless of any challenges.

Q 19. How do you handle discrepancies between cash and credit card totals?

Discrepancies between cash and credit card totals require a methodical approach.

- Review the POS records: Check for any missing or incorrect entries. Look for voided transactions or refunds that might not be properly accounted for. Verify that all transactions have been correctly categorized.

- Recount the cash: Perform a meticulous recount of the cash on hand. Look for any counterfeit bills.

- Verify credit card deposits: Compare the POS-recorded credit card totals with the actual bank deposit. Ensure all deposits have been properly processed and accounted for.

- Investigate discrepancies: If discrepancies remain after the above steps, investigate potential causes. This could involve reviewing security footage, interviewing employees, or checking for any signs of theft or fraud.

- Document findings: Meticulously document all findings and actions taken. This documentation is essential for both internal auditing and external reporting purposes.

This systematic approach ensures thorough investigation and appropriate resolution.

Q 20. Describe a situation where you had to resolve a complex transaction issue.

In a previous role, we experienced a major system outage during a peak shopping period. The POS system crashed, leaving us unable to process transactions electronically.

I immediately switched to manual processing, using a backup system of paper receipts and a calculator to record sales. I calmly reassured customers, explaining the situation and assuring them their transactions would be processed. I also prioritized customers with time-sensitive needs. Following the outage, I carefully reconciled the manual transactions with the later restored electronic records, ensuring accuracy. The situation highlighted the importance of having backup systems and strong communication skills in handling unexpected events.

Q 21. How do you stay up-to-date on changes in payment processing regulations?

Staying updated on payment processing regulations is critical for compliance and minimizing risks.

- Industry Publications: I regularly read publications such as those from the PCI Security Standards Council, and follow updates from major card networks (Visa, Mastercard, American Express, Discover).

- Professional Development: I participate in webinars and workshops on payment processing and compliance. These events often provide insights into emerging trends and regulatory changes.

- Regulatory Websites: I regularly check the websites of relevant regulatory bodies for updates on laws and guidelines.

- Compliance Software: Many POS systems and payment processors offer compliance tools and resources to help businesses stay updated and ensure their systems are compliant.

Staying informed is not just about meeting legal requirements, but also about protecting the business from potential financial and reputational damage resulting from non-compliance.

Q 22. What strategies do you use to minimize errors in cash handling?

Minimizing errors in cash handling requires a multi-faceted approach focusing on accuracy, diligence, and procedural consistency. Think of it like a carefully choreographed dance – each step must be precise.

Counting Twice: Always count the cash twice – once when received from the customer and again when placing it in the till. This simple double-check catches many mistakes.

Organized Till: Maintain a well-organized cash till with clearly designated compartments for different denominations. This prevents confusion and miscounting.

Using Technology: Cash registers and POS systems automate much of the counting process, reducing human error. Regularly reconcile the cash drawer with the system’s records.

Regular Audits: Conduct regular cash audits to compare the physical cash on hand with recorded transactions. This helps identify discrepancies early and prevents larger problems.

Team Training: Thorough training for all staff on proper cash handling procedures is critical. Consistent training helps everyone follow the same best practices.

For example, in my previous role, we implemented a ‘blind count’ system where one team member counted the cash while another independently verified the amount. This significantly reduced discrepancies.

Q 23. Describe your experience with processing various types of payment transactions (e.g., checks, gift cards).

Throughout my career, I’ve processed a wide range of payment types. Handling diverse payment methods requires adaptability and attention to detail, much like being a chef who can skillfully prepare different dishes.

Checks: I’m proficient in verifying check details (date, amount, signature, proper endorsement), ensuring funds are available, and processing them according to company policy. This includes recording check numbers and the payer’s information for reconciliation.

Gift Cards: I have experience activating, verifying balances, and processing transactions with various gift card systems. Understanding how to handle declined cards or insufficient funds is key.

Credit/Debit Cards: I’m adept at using POS systems to securely process credit and debit card transactions, adhering to PCI DSS standards to protect sensitive customer data. This includes swiping, inserting, or using contactless payment methods.

Cash: As discussed earlier, I employ rigorous techniques to ensure accurate cash handling, reducing errors and promoting efficient transactions.

One memorable experience involved a customer presenting a check from a foreign bank. I carefully examined the check and contacted the bank to verify its authenticity before processing the transaction. This prevented potential fraud.

Q 24. How do you ensure the confidentiality of customer payment information?

Protecting customer payment information is paramount. It’s like safeguarding a valuable treasure – our responsibility is to keep it secure. My approach to confidentiality encompasses several key strategies.

PCI DSS Compliance: I strictly adhere to Payment Card Industry Data Security Standard (PCI DSS) regulations. This involves secure handling of credit card data, regular system updates, and employee training on data protection protocols.

Data Encryption: I utilize POS systems and payment gateways that encrypt sensitive payment data, minimizing the risk of unauthorized access.

Secure Data Storage: I ensure that all sensitive payment data is stored securely, using encrypted databases and access control measures, preventing unauthorized access.

Limited Access: Only authorized personnel have access to sensitive payment information, limiting potential breaches. This principle aligns with the ‘need-to-know’ basis.

Data Disposal: I follow procedures for the secure disposal of sensitive documents, including shredding or secure electronic deletion.

My experience includes working with systems that automatically tokenize credit card data, replacing sensitive information with a unique identifier, further strengthening security.

Q 25. What steps would you take if you suspected fraudulent activity?

Suspecting fraudulent activity requires immediate and decisive action. It’s like detecting a smoke alarm – a prompt response is critical.

Review Transaction Details: I would carefully examine the transaction for any inconsistencies, such as unusually large amounts, unusual purchase patterns, or discrepancies between the customer’s identification and the card details.

Contact Management/Security: I would immediately inform my supervisor or the designated fraud prevention team about my suspicions, providing them with all relevant transaction details.

Follow Company Protocol: I would carefully follow company protocol for handling suspected fraud, including the procedures for reporting, investigation, and potential reversal of the transaction.

Document Everything: I would meticulously document all actions taken, including the time, date, details of the suspected fraudulent activity, and steps taken to address it.

Preserve Evidence: If possible, I would preserve any evidence related to the suspicious transaction, such as the original credit card slip or transaction record.

In a past situation, I detected a potential counterfeit bill. I followed protocol, contacting the manager and alerting security. The bill was confiscated, and the situation was handled swiftly and professionally.

Q 26. How would you handle a situation where a customer is unhappy with a transaction?

Handling an unhappy customer requires empathy, patience, and a problem-solving approach. It’s akin to being a skilled mediator, aiming for a peaceful resolution.

Listen Empathetically: First, I would listen carefully to the customer’s concerns, allowing them to fully express their dissatisfaction without interruption.

Acknowledge Their Feelings: I would acknowledge their feelings and validate their concerns, even if I don’t fully agree with their perspective.

Offer a Solution: I would offer a fair and reasonable solution to address the problem, such as a refund, exchange, or store credit, depending on the situation and company policy.

Follow Up: If necessary, I would follow up with the customer to ensure they are satisfied with the resolution. This could involve a phone call or email.

Maintain Professionalism: Throughout the process, I would maintain a professional and courteous demeanor, even if the customer is being unreasonable.

For instance, I once had a customer who was upset because of a pricing error. After verifying the error, I offered a full refund and a discount on their next purchase, which helped defuse the situation and maintain a positive customer relationship.

Q 27. What is your understanding of different transaction fees and charges?

Understanding transaction fees and charges is essential for accurate record-keeping and financial reporting. It’s like understanding the ingredients in a recipe—each component contributes to the final outcome.

Merchant Fees (Credit/Debit Cards): These are percentages charged by payment processors for each transaction. These fees vary depending on the card type (e.g., Visa, Mastercard), transaction type (e.g., swipe, keyed-in), and the processing agreement.

Interchange Fees: These are fees paid by the merchant’s acquiring bank to the card network (Visa, Mastercard) and the issuing bank (the bank that issued the customer’s card).

Assessment Fees: These are fees charged by the card networks themselves.

Gateway Fees: If using a payment gateway, there might be additional fees for using their services to process online transactions.

Chargeback Fees: These are fees incurred when a customer disputes a transaction, and the bank refunds the customer’s money. This is why preventing fraud is so critical.

Knowing these different components allows me to accurately calculate the net revenue from sales and prepare accurate financial reports. It also enables me to identify areas where we can optimize processing fees.

Q 28. Describe your experience with using a cash register or POS system.

I’m highly proficient in using cash registers and POS systems. They’re essential tools for efficient and accurate transaction processing – the backbone of any retail operation.

Cash Register Operation: I’m skilled in operating various types of cash registers, including inputting sales data, processing payments (cash, checks, cards), issuing receipts, and balancing the cash drawer at the end of the day or shift.

POS System Proficiency: I possess extensive experience using various POS systems, including their functionalities for inventory management, sales tracking, customer relationship management (CRM), and reporting.

Software Navigation: I can navigate different POS software interfaces with ease, adeptly handling transactions, managing returns and refunds, and resolving system errors.

Hardware Familiarity: I’m familiar with common POS hardware components such as card readers, barcode scanners, receipt printers, and touchscreen displays.

Data Entry Accuracy: I consistently demonstrate accuracy in data entry, reducing errors and ensuring accurate sales and inventory records.

In my previous role, I helped train new staff on using our POS system, including efficient keyboard shortcuts and troubleshooting common issues. This ensured that all team members were highly productive and could effectively assist customers.

Key Topics to Learn for Handling Cash and Credit Card Transactions Interview

- Cash Handling Procedures: Understanding proper cash register operation, balancing procedures, and safe deposit practices. Practical application: Accurately counting and recording cash transactions, identifying and resolving discrepancies.

- Credit and Debit Card Processing: Knowledge of POS systems, swipe/chip/contactless payment methods, and secure transaction protocols. Practical application: Processing customer payments efficiently and securely, understanding authorization codes and transaction approvals.

- Fraud Prevention and Detection: Recognizing fraudulent transactions, understanding security measures like CVV codes and signature verification. Practical application: Identifying suspicious activity and following established procedures to prevent losses.

- Customer Service in Transactions: Handling customer inquiries regarding payments, resolving issues efficiently and professionally. Practical application: Providing excellent customer service while ensuring secure transaction completion.

- Balancing and Reconciliation: Performing end-of-day reconciliation of cash and credit card transactions, identifying and correcting discrepancies. Practical application: Ensuring accuracy in financial reporting and minimizing potential losses.

- Data Security and Compliance: Adhering to PCI DSS (Payment Card Industry Data Security Standard) and other relevant regulations. Practical application: Protecting sensitive customer data and maintaining compliance with industry standards.

- Troubleshooting Technical Issues: Addressing common technical issues with POS systems, card readers, and payment terminals. Practical application: Quickly resolving technical problems to minimize disruption to service.

Next Steps

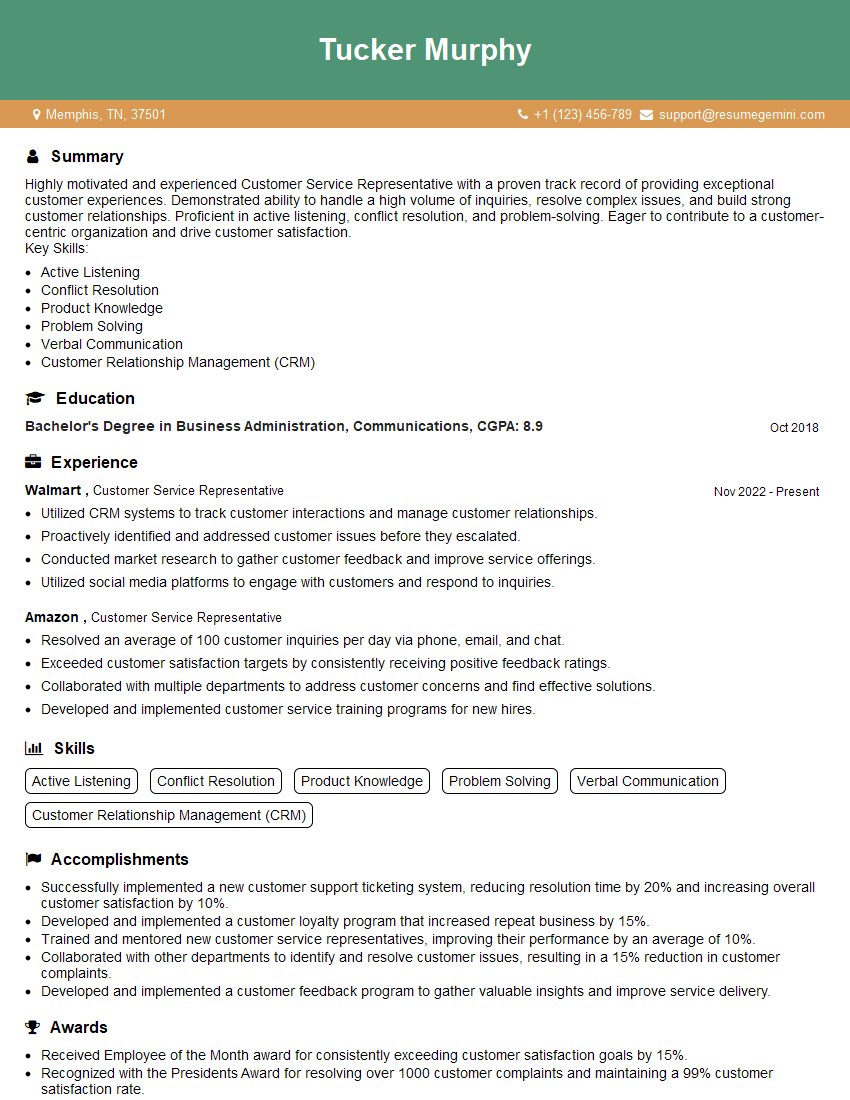

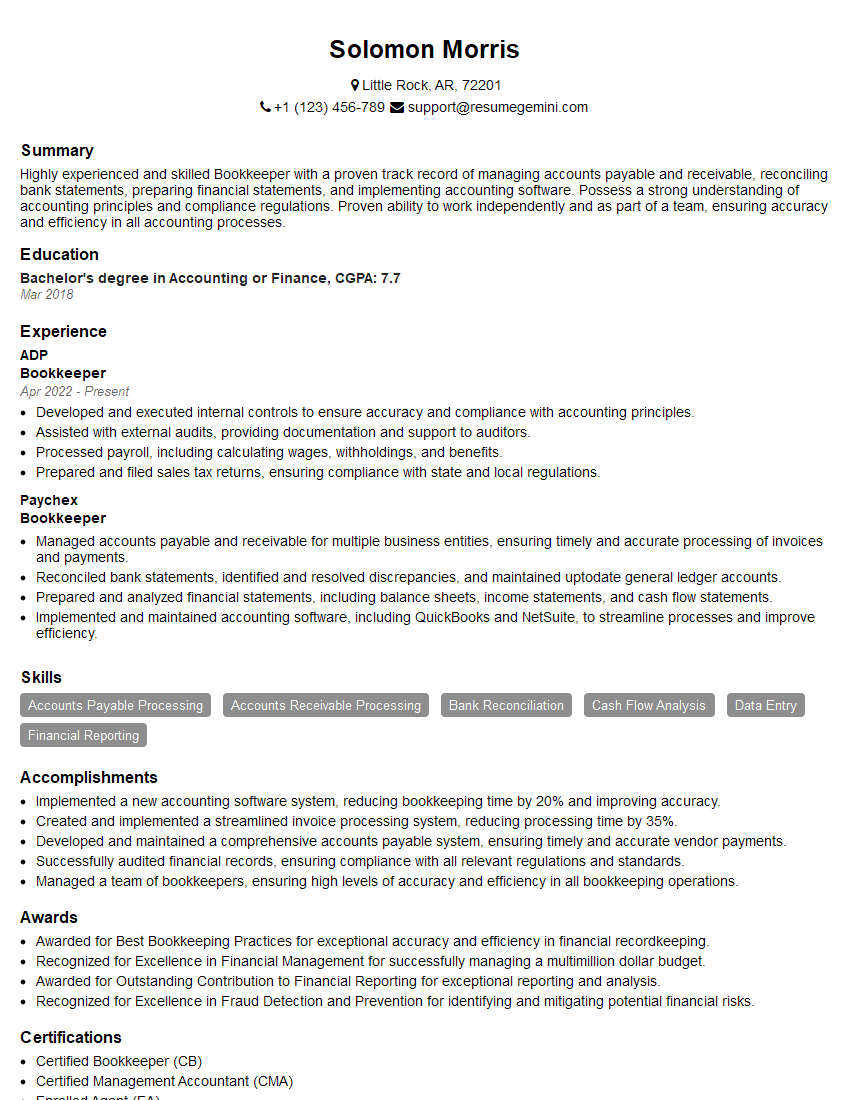

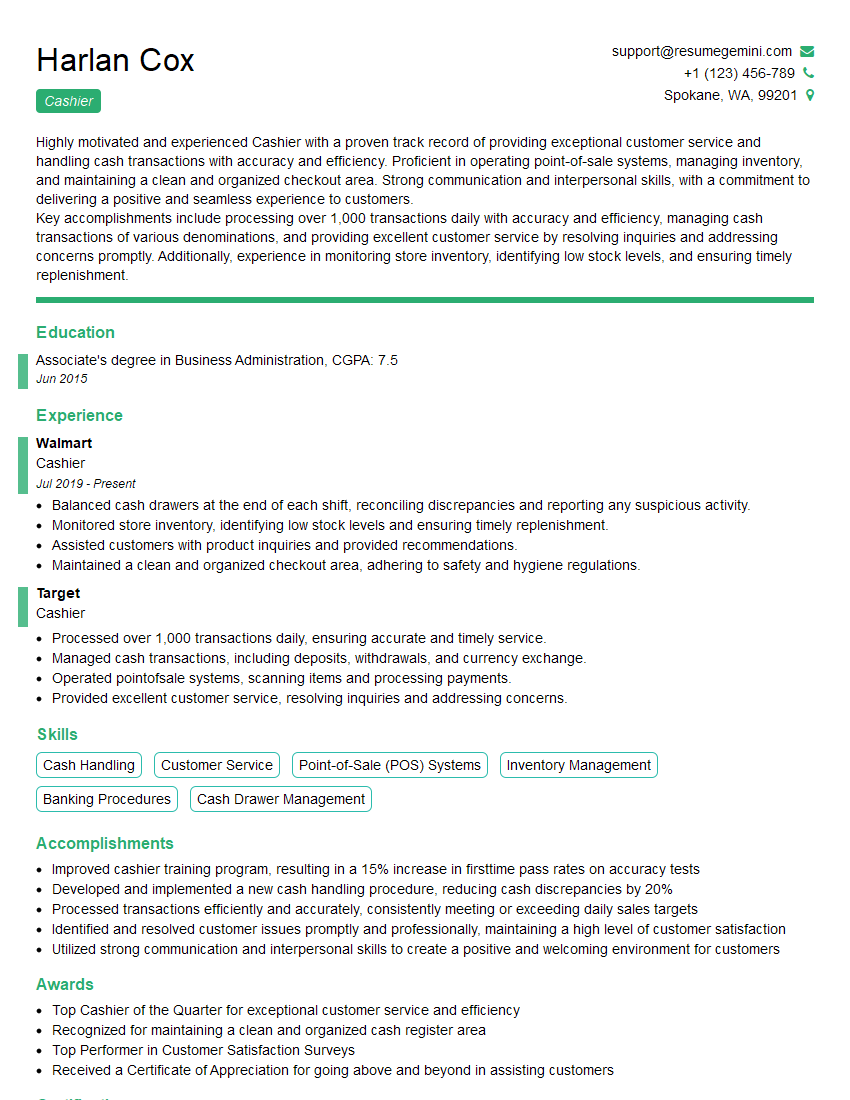

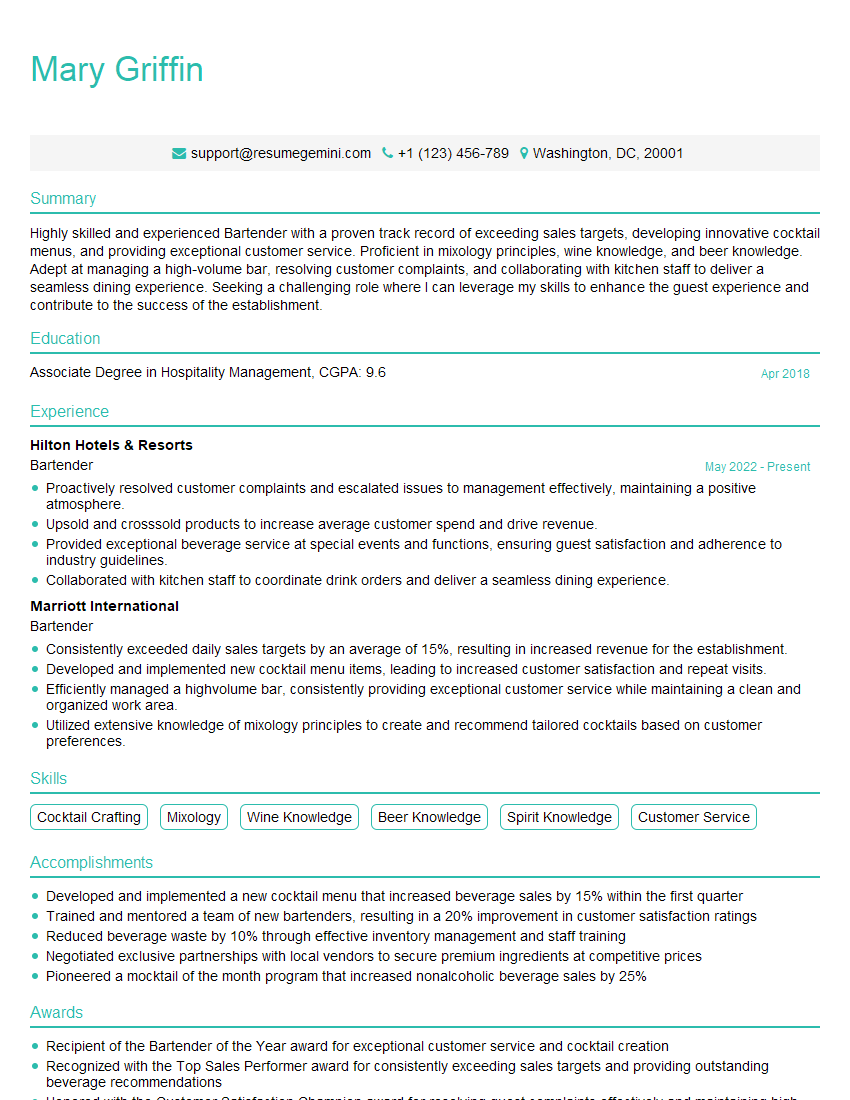

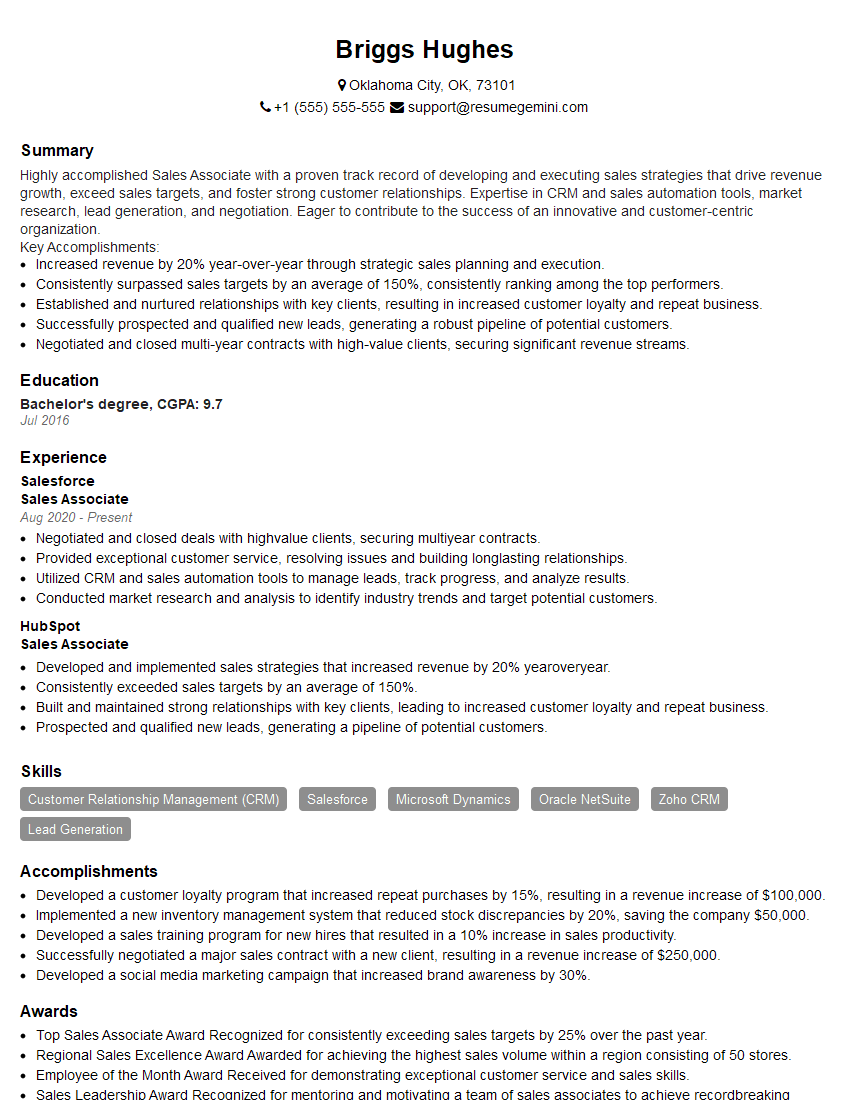

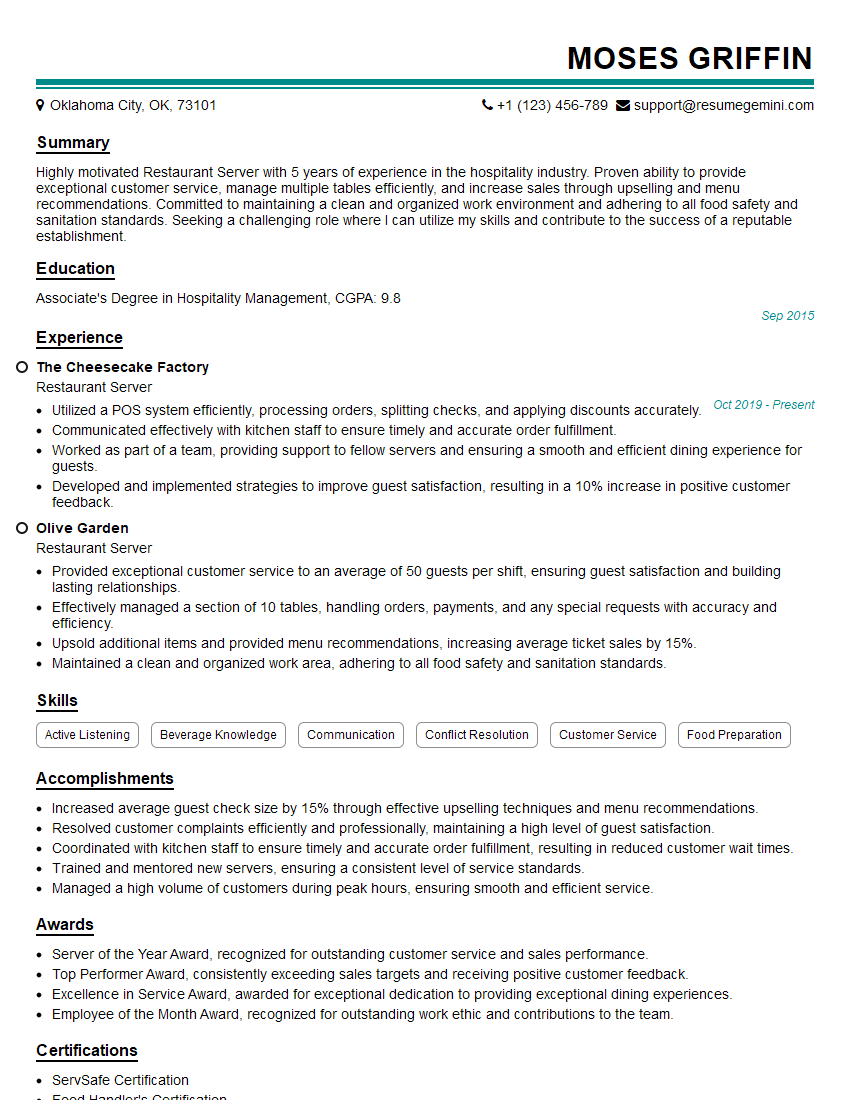

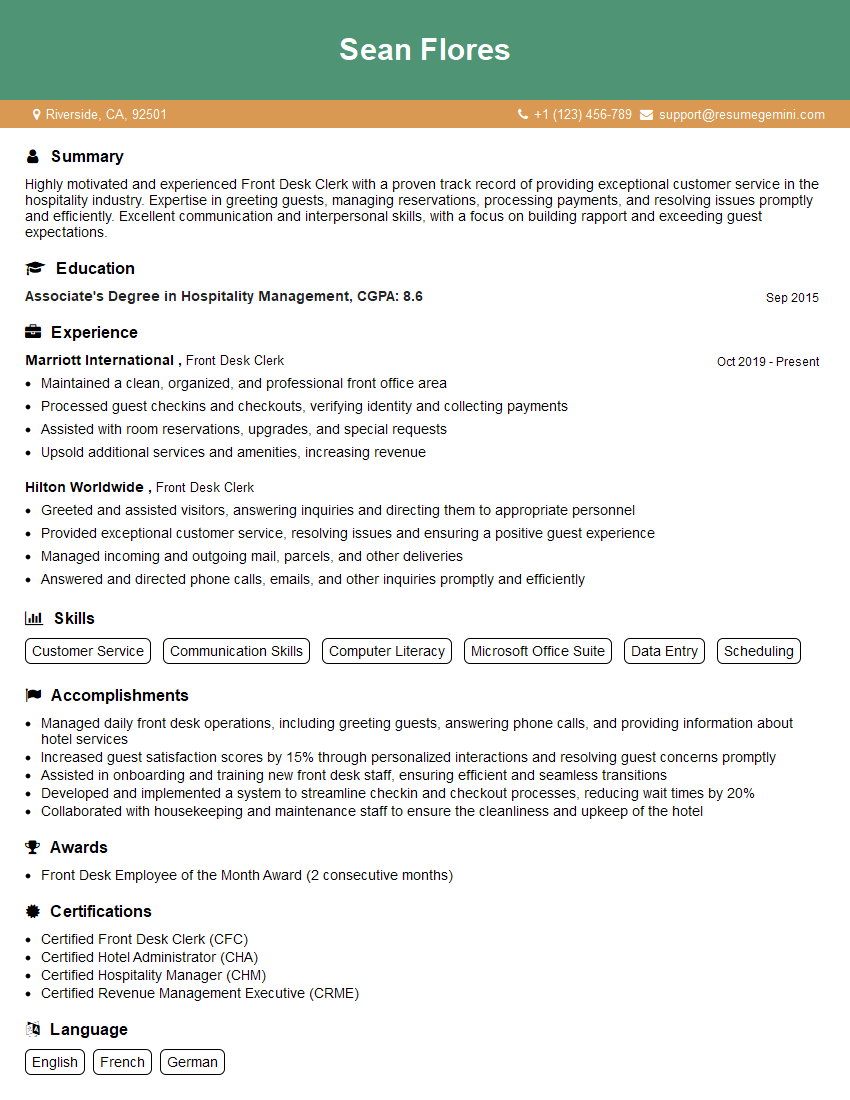

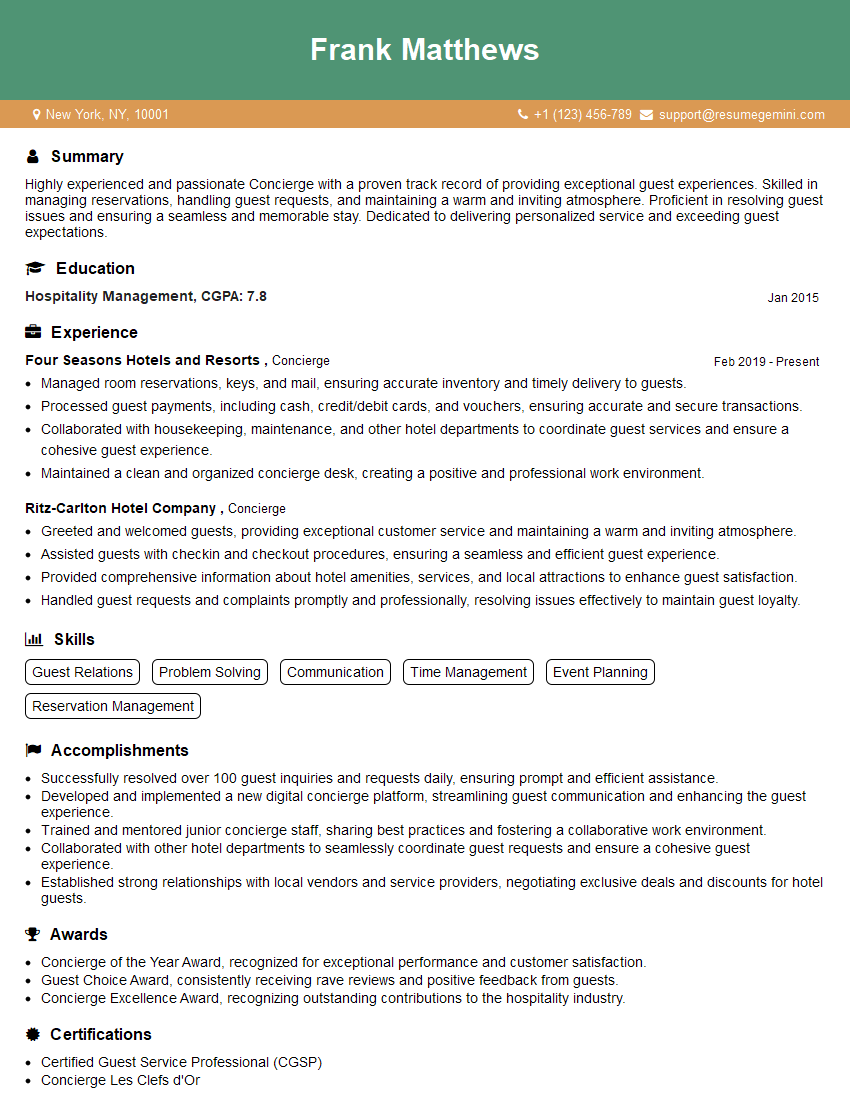

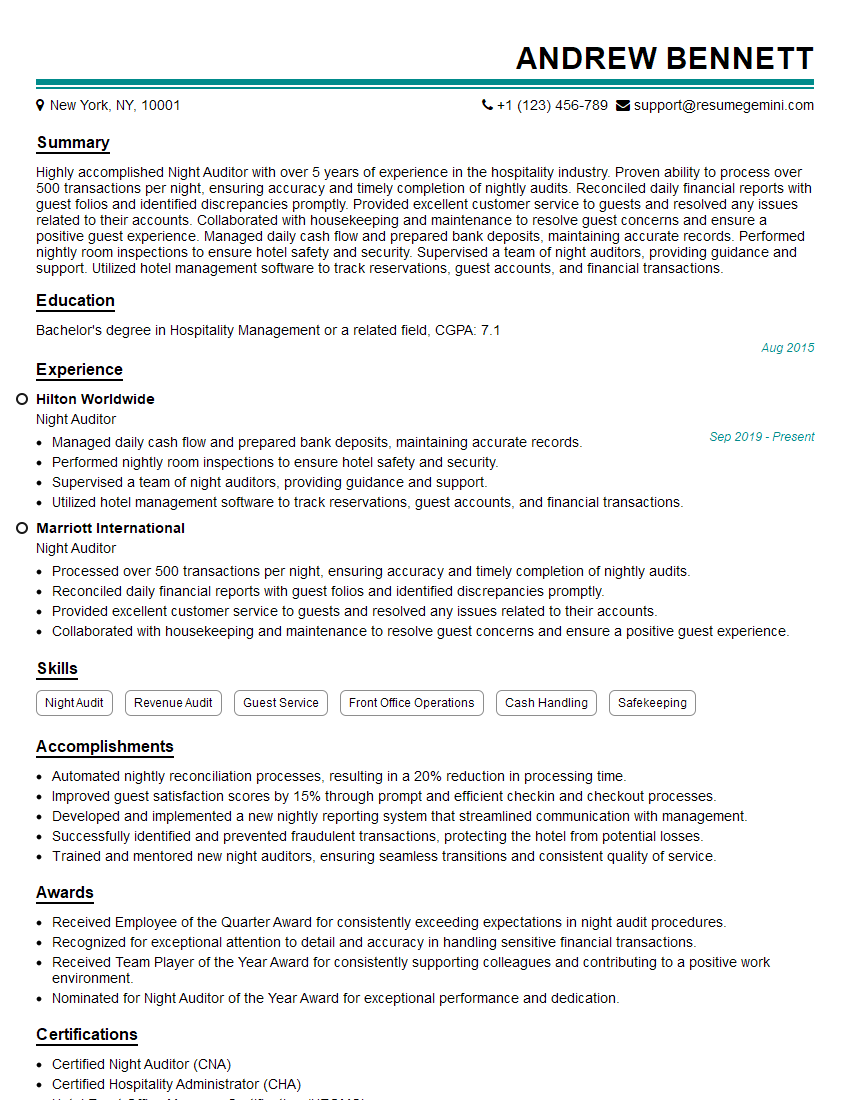

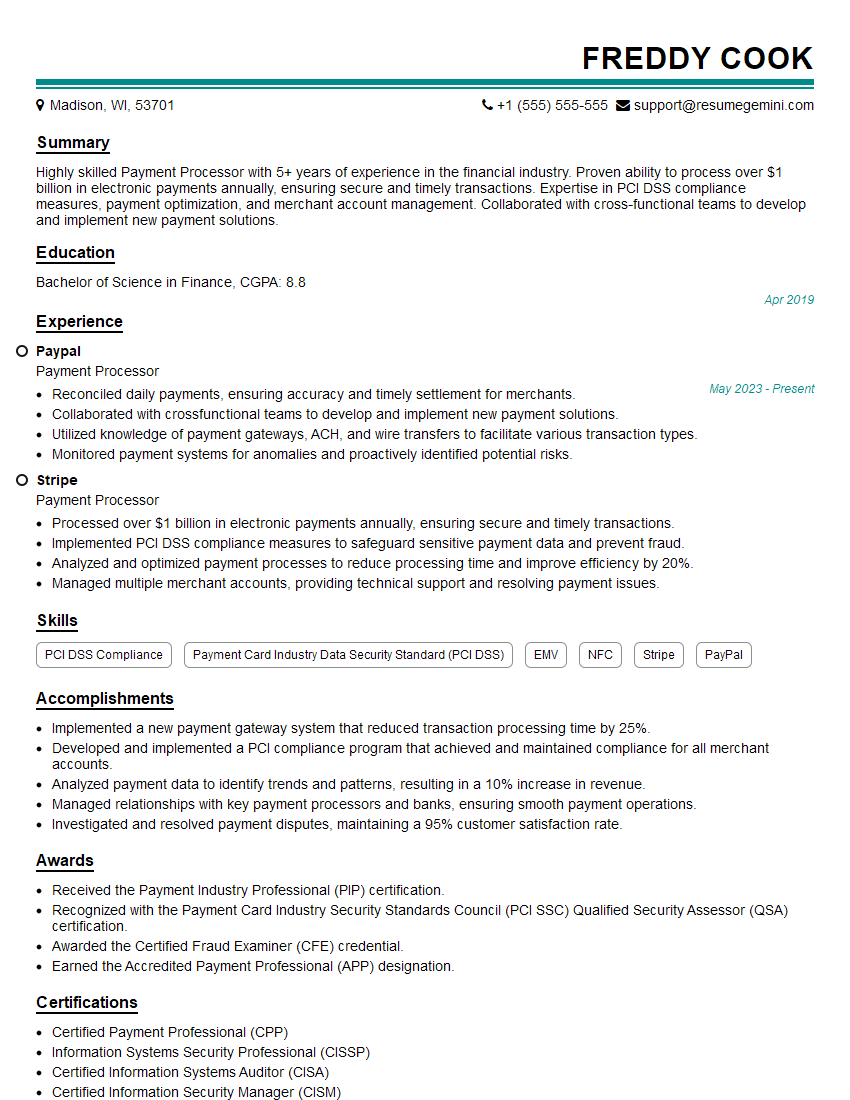

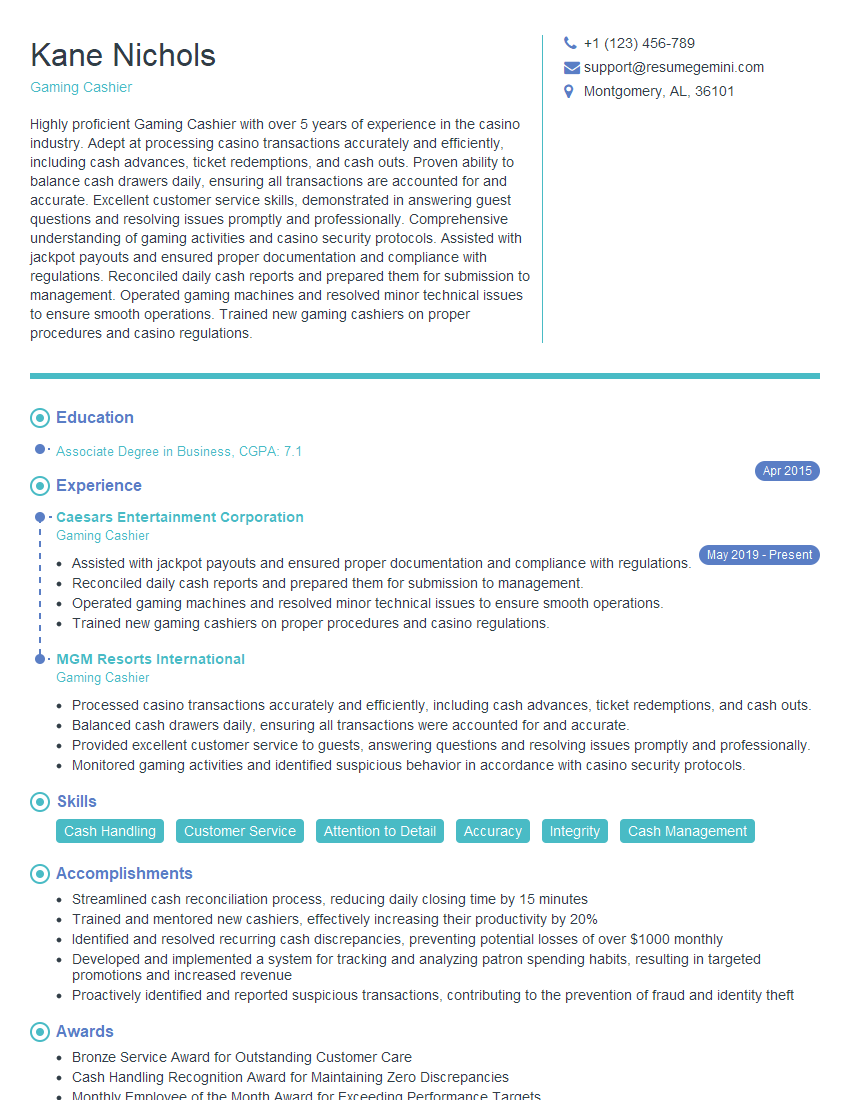

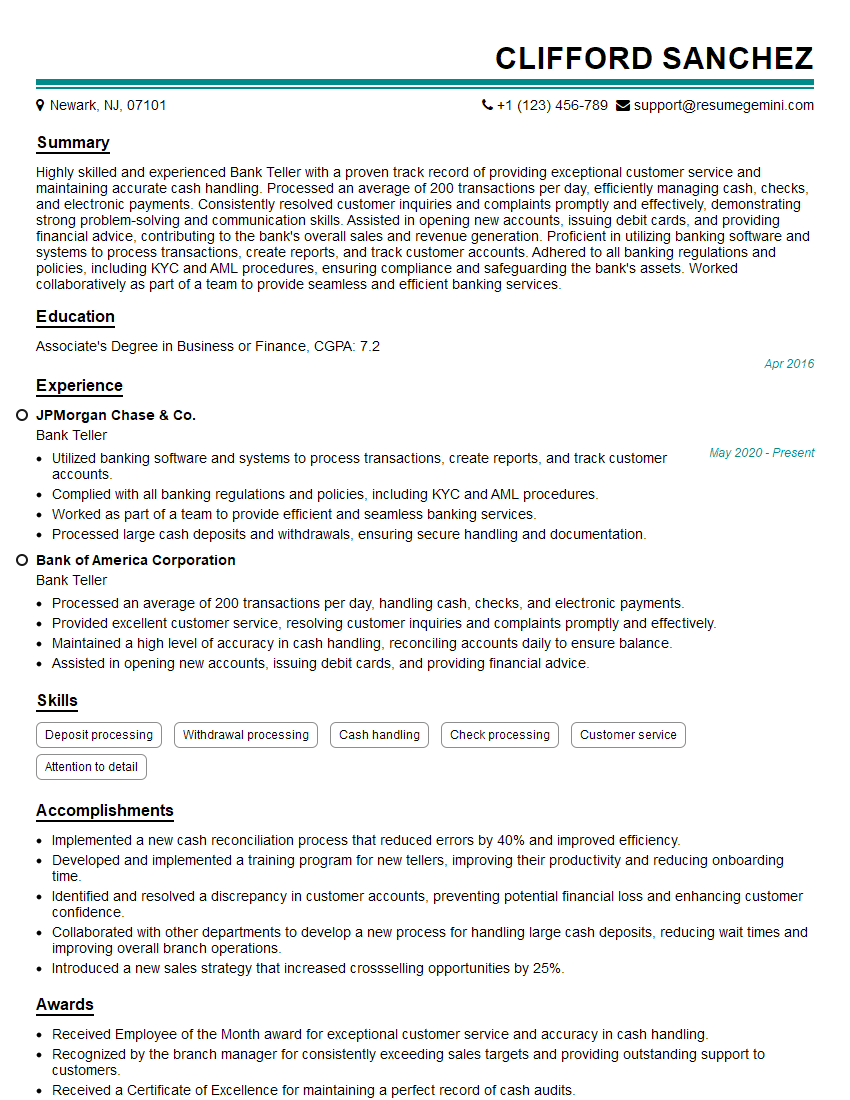

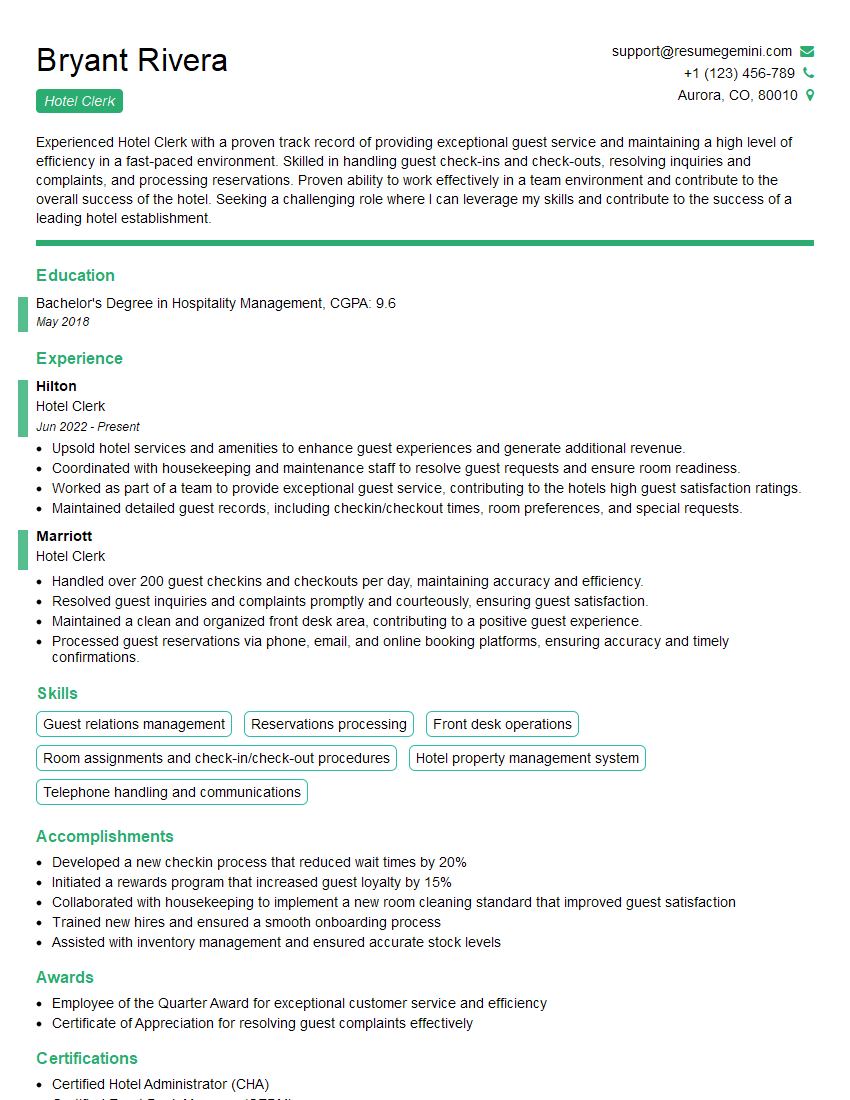

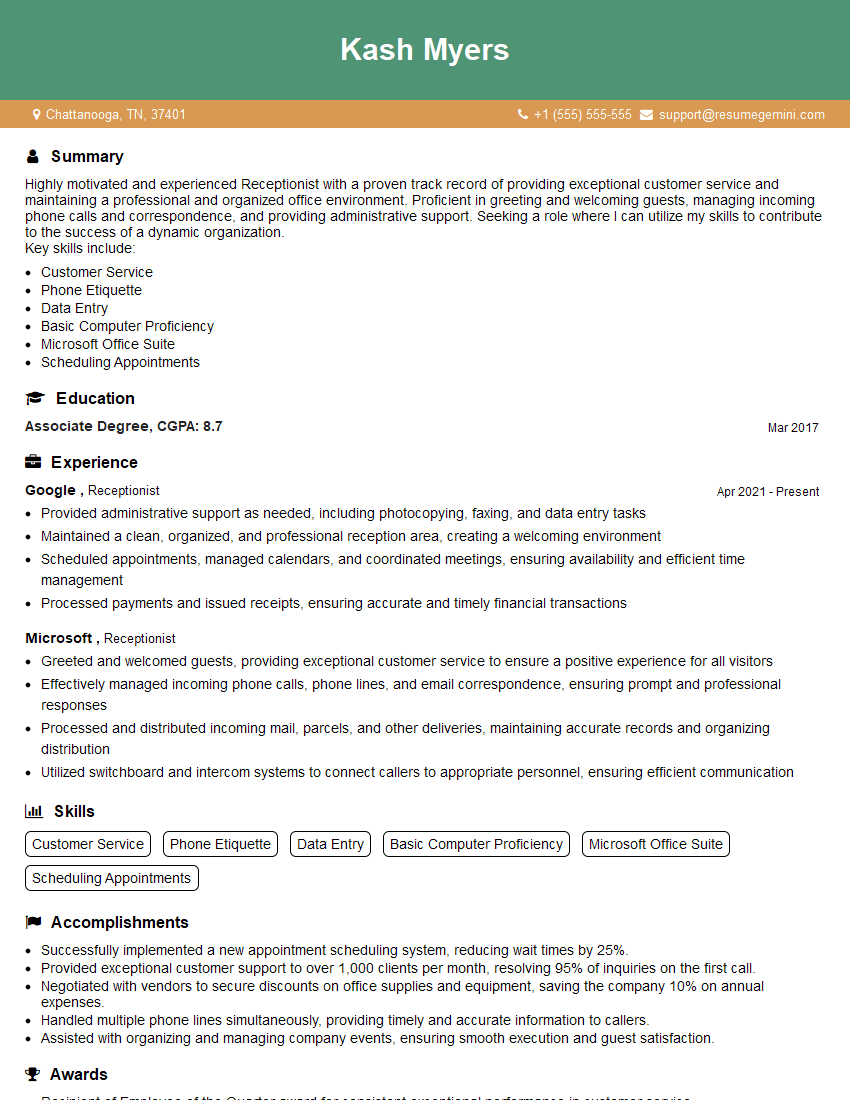

Mastering cash and credit card transaction handling is crucial for career advancement in retail, hospitality, and many other industries. It demonstrates your reliability, accuracy, and commitment to financial security. To significantly improve your job prospects, crafting an ATS-friendly resume is essential. ResumeGemini can help you build a powerful resume that highlights your skills and experience effectively, increasing your chances of landing your dream job. Examples of resumes tailored to Handling Cash and Credit Card Transactions are available within ResumeGemini to guide your creation.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I represent a social media marketing agency that creates 15 engaging posts per month for businesses like yours. Our clients typically see a 40-60% increase in followers and engagement for just $199/month. Would you be interested?”

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?