Warning: search_filter(): Argument #2 ($wp_query) must be passed by reference, value given in /home/u951807797/domains/techskills.interviewgemini.com/public_html/wp-includes/class-wp-hook.php on line 324

Every successful interview starts with knowing what to expect. In this blog, we’ll take you through the top Material Procurement and Inventory Management interview questions, breaking them down with expert tips to help you deliver impactful answers. Step into your next interview fully prepared and ready to succeed.

Questions Asked in Material Procurement and Inventory Management Interview

Q 1. Explain the difference between MRP and MRP II.

Material Requirements Planning (MRP) and Manufacturing Resource Planning (MRP II) are both inventory management systems, but MRP II is a significant evolution of MRP. Think of MRP as a basic recipe, while MRP II is a complete cookbook.

MRP focuses primarily on scheduling and managing the procurement of raw materials to meet production demands. It uses a bill of materials (BOM) and a master production schedule (MPS) to calculate the required quantities of each component needed for each product at each stage of production. It’s reactive, mainly addressing the ‘what’ and ‘when’ of materials needed.

MRP II expands upon MRP by incorporating broader business functions. It’s a holistic approach, integrating production planning, inventory control, capacity planning, and even financial planning. It helps answer ‘what’, ‘when’, and ‘how’ to optimize overall production processes. This integrated approach gives managers a much clearer view of the entire enterprise and allows for better resource allocation and decision-making. For instance, MRP II might consider machine availability and workforce capacity when scheduling production, whereas MRP would only focus on material availability.

In essence, MRP is a subset of MRP II. MRP II provides a much more comprehensive and integrated approach to production and resource management.

Q 2. Describe your experience with various inventory control methods (e.g., FIFO, LIFO, JIT).

I have extensive experience with various inventory control methods, each with its own strengths and weaknesses, depending on the context.

- FIFO (First-In, First-Out): This method assumes that the oldest items are sold first. It’s straightforward and minimizes the risk of obsolescence, especially for perishable goods. For example, in a grocery store, FIFO ensures that milk expiring soon is sold before newer stock. However, it can lead to higher costs if prices are rising, as the cost of goods sold is based on older, potentially cheaper, prices.

- LIFO (Last-In, First-Out): LIFO operates on the principle that the newest items are sold first. It’s beneficial during inflationary periods because it increases the cost of goods sold, thus lowering taxable income. However, it can lead to difficulties in valuation of inventory and might not be suitable for all industries. Imagine a hardware store selling nails; LIFO might obscure the actual cost of older stock.

- JIT (Just-In-Time): This system aims to minimize inventory by ordering materials only when they are needed for production. It’s highly efficient when implemented correctly, reducing storage costs and minimizing waste. However, it requires exceptionally reliable suppliers and sophisticated forecasting to avoid production disruptions due to delays. A car manufacturer relying on JIT for components would be severely impacted by even a minor supplier issue.

The choice of method depends heavily on factors like product lifespan, price volatility, supplier reliability, and storage capacity. Often, a combination of methods or a hybrid approach is the most effective strategy.

Q 3. How do you manage supplier relationships to ensure timely delivery and quality?

Managing supplier relationships is crucial for ensuring timely delivery and high-quality materials. I approach this strategically, focusing on building long-term partnerships rather than simply transactional relationships.

My strategies include:

- Strategic Supplier Selection: Thorough due diligence is paramount. This involves evaluating potential suppliers based on criteria such as financial stability, production capabilities, quality control processes, and ethical practices. We conduct site visits and audits to verify claims.

- Collaborative Communication: Open and regular communication is key. We maintain consistent dialogue with our suppliers, sharing forecasts, addressing concerns promptly, and fostering a sense of mutual trust. This might involve regular meetings or dedicated communication channels.

- Performance Monitoring: We establish key performance indicators (KPIs) such as on-time delivery, defect rates, and lead times. Regular performance reviews help to identify areas for improvement and reinforce expectations. Performance-based incentives can motivate suppliers to improve.

- Risk Management: Diversifying our supplier base mitigates risks associated with single-source dependency. We also develop contingency plans to address potential supply chain disruptions.

Building strong relationships ensures that we have reliable partners who are invested in our mutual success.

Q 4. What metrics do you use to measure the effectiveness of your procurement strategies?

Measuring the effectiveness of procurement strategies requires a comprehensive set of metrics. I use a combination of quantitative and qualitative indicators to gain a holistic view.

- Cost Savings: This tracks the reduction in procurement costs compared to previous periods or industry benchmarks. This can be measured as a percentage or a specific dollar amount.

- On-Time Delivery: This metric measures the percentage of orders delivered on or before the agreed-upon date. A high percentage indicates efficient supply chain management.

- Inventory Turnover: This indicates how efficiently inventory is managed, showing the number of times inventory is sold and replenished during a specific period. A higher turnover rate generally reflects better inventory management.

- Supplier Performance: Metrics such as defect rates, lead times, and responsiveness are tracked to assess supplier reliability and quality.

- Quality Control: Measures the percentage of defective materials received, indicating the effectiveness of quality control processes during procurement.

- Lead Time Reduction: Tracking lead times helps us to identify areas for improvement in the procurement cycle, enabling faster order fulfillment.

Regularly reviewing these metrics, along with qualitative feedback from internal stakeholders, helps refine procurement strategies and ensure continuous improvement.

Q 5. How do you handle unexpected supply chain disruptions?

Unexpected supply chain disruptions are inevitable. My approach is proactive and multi-faceted:

- Early Warning Systems: We monitor various sources of information (news, industry reports, supplier communication) to identify potential disruptions early on. This allows us to react before significant impact occurs.

- Risk Assessment and Mitigation: Regularly assessing potential risks, including natural disasters, geopolitical events, and supplier financial instability, allows us to develop appropriate mitigation strategies, such as diversifying suppliers or maintaining safety stock.

- Contingency Planning: We develop alternative sourcing strategies, including identifying backup suppliers for critical components. These plans are regularly reviewed and updated.

- Collaboration and Communication: Maintaining open and transparent communication with suppliers, customers, and internal teams is vital during disruptions. Collaboration is key to finding solutions and minimizing negative impacts.

- Flexible Production Schedules: Our production plans are designed to be adaptable, allowing us to adjust schedules based on availability of materials. This might involve prioritizing critical products or exploring alternative production methods.

By integrating these steps into our processes, we can effectively respond to disruptions, minimizing their impact on operations and customer satisfaction.

Q 6. Describe your experience with negotiating contracts with suppliers.

Negotiating contracts with suppliers requires a strategic approach that balances value, risk, and long-term relationships.

My approach involves:

- Preparation: Thorough market research is crucial to understand pricing trends and competitor offerings. I also define our requirements clearly, including quality specifications, delivery timelines, and payment terms.

- Relationship Building: I aim to build rapport with suppliers, fostering trust and mutual respect. This helps in achieving mutually beneficial agreements.

- Value Engineering: Collaborating with suppliers to identify opportunities for cost reduction without compromising quality or performance is essential. This demonstrates a commitment to mutual success.

- Win-Win Negotiations: The goal is to reach an agreement that benefits both parties. This involves effective communication, compromise, and a focus on shared goals.

- Contract Review: Meticulously reviewing and understanding all clauses and legal aspects of the contract is vital. This includes specifying penalties for non-performance and clearly defining responsibilities.

Successfully negotiating contracts requires a blend of strong negotiation skills, market knowledge, and a collaborative mindset.

Q 7. What software or systems have you used for procurement and inventory management?

Throughout my career, I’ve worked with various software and systems for procurement and inventory management. My experience includes:

- SAP ERP: I’ve extensively used SAP’s procurement and inventory management modules, including MM (Materials Management) and PP (Production Planning). This system provides a comprehensive suite of tools for managing the entire procurement lifecycle, from sourcing to payment.

- Oracle Cloud SCM: I’ve utilized Oracle’s cloud-based supply chain management solutions for streamlined procurement and inventory control. Its advanced analytics and reporting features provided valuable insights into our supply chain processes.

- Microsoft Dynamics 365: My experience includes utilizing Dynamics 365 for supply chain management, offering robust functionalities for procurement, inventory optimization, and warehouse management.

- Specialized Procurement Platforms: I have also worked with various specialized procurement platforms, including Ariba and Coupa, for sourcing, contract management, and supplier relationship management.

The choice of system depends on the specific needs of the organization and its size. However, my experience with these systems has equipped me with the skills to effectively manage and utilize any procurement and inventory management software.

Q 8. How do you forecast demand to optimize inventory levels?

Accurate demand forecasting is the cornerstone of effective inventory management. It allows us to optimize stock levels, minimizing storage costs and preventing stockouts while avoiding excess inventory that ties up capital and risks obsolescence. My approach involves a multi-faceted strategy combining different forecasting methods.

Time Series Analysis: This involves analyzing historical sales data to identify trends, seasonality, and cyclical patterns. Techniques like moving averages, exponential smoothing, and ARIMA models can be employed depending on the data’s characteristics and complexity. For example, I might use exponential smoothing for a product with relatively stable demand and incorporate seasonality factors for items with predictable seasonal peaks, like swimwear in summer.

Causal Forecasting: This method considers external factors that influence demand, such as economic indicators, marketing campaigns, or competitor actions. Regression analysis is a common tool here. For instance, if a new competitor launches a similar product, I’d adjust my forecast downwards to reflect potential market share loss.

Qualitative Forecasting: This incorporates expert opinions and market research to supplement quantitative data. Methods like Delphi technique or market surveys can be valuable, particularly for new products or in situations with limited historical data. A new product launch, for example, may necessitate relying more heavily on market research and expert sales projections.

Collaborative Forecasting: This involves actively engaging with sales, marketing, and operations teams to gather insights and improve forecast accuracy. Regular meetings and shared dashboards facilitate this process. It is through open communication and collaboration that we fine-tune our projections.

Ultimately, the best approach often involves a combination of these methods, weighted according to the specific product and its market dynamics. Regularly reviewing and refining the forecasting models is crucial to maintaining accuracy.

Q 9. Explain your process for identifying and mitigating risks in the supply chain.

Supply chain risk mitigation is a proactive, multi-step process. Identifying and addressing potential disruptions is essential for maintaining business continuity and profitability. My approach starts with a thorough risk assessment.

Risk Identification: This involves systematically identifying potential risks across the entire supply chain. We use a combination of techniques, including brainstorming sessions, SWOT analysis, and reviewing historical data to pinpoint vulnerabilities. Common risks include supplier disruptions, geopolitical instability, natural disasters, and logistical bottlenecks.

Risk Assessment: Once identified, risks are assessed based on their likelihood and potential impact. A risk matrix helps to prioritize risks, focusing on those with the highest potential for significant disruption. For example, a supplier’s plant fire may have a high impact and low likelihood, while a port strike might have both high impact and high likelihood.

Risk Mitigation Strategies: Based on the assessment, we develop mitigation strategies. These might include:

- Diversification of Suppliers: Reducing reliance on a single supplier mitigates the risk of a single point of failure.

- Inventory Buffering: Holding safety stock for critical items helps cushion against supply disruptions.

- Developing Contingency Plans: Having alternative suppliers or logistics routes in place ensures continued operation during unexpected events.

- Negotiating contracts with strong terms: Include clauses ensuring timely deliveries and penalties for breaches.

Monitoring and Review: The entire process is continuously monitored and reviewed. We regularly track key performance indicators (KPIs) and adjust our strategies as needed. Regular supply chain audits, too, help to uncover potential problems and ensure compliance with our standards.

By employing this structured approach, we aim to anticipate and minimize the impact of potential supply chain disruptions.

Q 10. How do you ensure compliance with relevant regulations and standards (e.g., ISO)?

Compliance is paramount in material procurement and inventory management. We adhere to relevant regulations and standards, such as ISO 9001 (Quality Management), ISO 14001 (Environmental Management), and industry-specific regulations pertaining to safety, ethical sourcing, and environmental protection. Our compliance program encompasses several key areas:

Policy and Procedure Development: We have comprehensive policies and procedures in place to govern all aspects of procurement and inventory management, ensuring alignment with relevant standards and regulations. These are regularly reviewed and updated to reflect changes in legislation or best practices.

Supplier Audits: We conduct regular audits of our suppliers to ensure they meet our standards for quality, environmental performance, and ethical labor practices. These audits verify compliance with our codes of conduct and relevant certifications.

Documentation and Traceability: We maintain meticulous records of all procurement activities, including supplier information, purchase orders, inspection reports, and delivery documentation. This ensures complete traceability of materials from origin to finished product.

Training and Awareness: Our team receives regular training on relevant regulations and standards, ensuring everyone understands their responsibilities and the importance of compliance.

Continuous Improvement: We actively seek to improve our compliance program through internal audits, management reviews, and corrective actions.

Compliance is not merely a checklist; it’s an integral part of our operational culture. It builds trust with customers, reduces risk, and enhances our reputation.

Q 11. Describe your experience with implementing new procurement or inventory management systems.

I have extensive experience implementing new procurement and inventory management systems. In a previous role, I led the transition from a legacy system to a cloud-based Enterprise Resource Planning (ERP) solution. This involved several crucial steps:

Needs Assessment: We started with a thorough assessment of our existing processes and identified the gaps and inefficiencies the new system would address. This involved interviews with stakeholders across the organization.

System Selection: We evaluated several ERP solutions based on criteria like functionality, scalability, integration capabilities, and cost. We involved key stakeholders in the selection process to ensure alignment with our needs.

Data Migration: Migrating data from the legacy system to the new ERP was a complex undertaking. We developed a detailed migration plan, including data cleansing and validation steps to ensure data integrity.

System Configuration and Testing: We configured the system to match our specific business processes. This was followed by rigorous testing to ensure all functionalities were working correctly and all integrations were seamlessly functioning.

Training and Rollout: We provided comprehensive training to all users on the new system. The rollout was phased to minimize disruption and ensure a smooth transition.

Post-Implementation Support: After the rollout, we continued to provide support and address any issues that arose. We also monitored key performance indicators (KPIs) to evaluate the system’s effectiveness and make adjustments as needed. This involved regular system monitoring and ongoing user feedback sessions.

The successful implementation resulted in significant improvements in efficiency, accuracy, and cost savings. The new system provided real-time visibility into inventory levels, reduced lead times, and streamlined the entire procurement process.

Q 12. How do you manage inventory obsolescence and waste?

Managing inventory obsolescence and waste is crucial for maintaining profitability and optimizing inventory levels. My strategy involves a multi-pronged approach:

Demand Forecasting Accuracy: As discussed earlier, accurate demand forecasting is paramount. Minimizing forecast errors reduces the risk of overstocking, which can lead to obsolescence.

Inventory Classification: Categorizing inventory items based on their value and demand (e.g., ABC analysis) helps prioritize management efforts. High-value, slow-moving items require closer monitoring to prevent obsolescence.

Regular Stock Rotation: Implementing a FIFO (First-In, First-Out) system ensures that older items are used first, reducing the risk of spoilage or obsolescence. Proper storage conditions also play a crucial role in reducing waste.

Obsolescence Tracking: Regularly reviewing slow-moving and near-expiry items identifies potential obsolescence risks. This allows for timely interventions like price reductions, repurposing, or disposal.

Supplier Collaboration: Working closely with suppliers to manage lead times and ensure timely delivery can help prevent excess inventory buildup.

Disposal Procedures: Having clear procedures for disposing of obsolete or damaged inventory minimizes environmental impact and avoids unnecessary costs.

By proactively addressing these aspects, we minimize waste and maximize the return on investment in inventory.

Q 13. What is your experience with analyzing inventory data to identify trends and opportunities for improvement?

Data analysis is fundamental to effective inventory management. I regularly analyze inventory data to identify trends and opportunities for improvement. My approach involves several steps:

Data Collection and Cleaning: This involves gathering data from various sources, such as ERP systems, purchase orders, and sales records. Data cleansing ensures accuracy and reliability of the analysis.

Descriptive Statistics: I use descriptive statistics, such as averages, standard deviations, and percentiles, to summarize key inventory metrics and identify outliers. For example, I might look at average inventory levels, days of inventory on hand, and stock turnover rates to identify products with excessive or low stock levels.

Trend Analysis: I use time series analysis techniques to identify patterns and trends in inventory levels and demand. This allows me to anticipate future needs and adjust inventory strategies accordingly. This might reveal seasonal variations or an overall upward or downward trend in demand.

Root Cause Analysis: When identifying anomalies, root cause analysis helps determine underlying issues causing these variances. For example, a sudden spike in inventory of a certain part might indicate a production issue or a forecasting error.

Regression Analysis: I use regression analysis to identify the relationship between various factors and inventory levels. This can help understand the impact of external factors and make more informed decisions.

Data Visualization: Visualizing data through charts and graphs helps to communicate insights effectively and identify key areas for improvement. Dashboards displaying key inventory metrics and trends are used to track progress and monitor performance.

By combining these analytical techniques, I can identify areas for optimization, such as adjusting safety stock levels, improving forecasting accuracy, or streamlining procurement processes. This data-driven approach ensures continuous improvement in inventory management.

Q 14. How do you prioritize competing demands in procurement?

Prioritizing competing demands in procurement requires a structured approach. It’s about balancing urgency, importance, and long-term strategic goals. My process involves:

Demand Prioritization Matrix: Creating a matrix to assess the urgency and importance of each demand. High-urgency, high-importance items take precedence. This helps categorize requests visually based on their impact on operations and customer satisfaction. Examples of high-priority requests might be critical production components for an urgent customer order or essential safety equipment for plant operations.

Cost-Benefit Analysis: Evaluating the cost and benefits of fulfilling each demand helps justify prioritization decisions. This may involve comparing the opportunity cost of delaying a less crucial order to the potential penalties or lost revenue from delaying a high-priority order.

Supplier Relationships: Maintaining strong relationships with key suppliers can improve responsiveness and enable prioritization of critical orders. This includes open communication and consistent ordering patterns.

Negotiation and Collaboration: When facing competing demands, open communication and collaboration with stakeholders is essential. This could involve negotiating with suppliers for expedited delivery or adjusting internal schedules to accommodate high-priority items.

Regular Review: The prioritization process is dynamic. It necessitates regular review to adjust priorities based on changing circumstances and new information. This proactive monitoring ensures optimal resource allocation and avoids potential bottlenecks.

By employing a structured approach that takes into consideration urgency, strategic importance, and cost-benefit analysis, we can effectively prioritize competing demands in procurement, ensuring the smooth flow of materials while aligning with overall business goals.

Q 15. Explain your understanding of different procurement strategies (e.g., strategic sourcing, competitive bidding).

Procurement strategies are the methods used to acquire goods and services. Different strategies are chosen based on factors like the complexity of the item, market conditions, and the organization’s risk tolerance. Here are a few key examples:

- Strategic Sourcing: This is a long-term approach focusing on building strong relationships with key suppliers. It involves a thorough analysis of the supply market, identifying preferred suppliers based on factors such as quality, reliability, and cost-effectiveness. For example, a company might choose a single supplier for a critical component, ensuring consistent quality and timely delivery, even if it means paying a slightly higher price. This minimizes disruption and enhances long-term value.

- Competitive Bidding: This involves inviting multiple suppliers to submit bids for the same goods or services. This promotes competition and drives down prices. However, it’s critical to establish clear specifications and evaluation criteria to ensure fair comparison. Imagine a construction company needing concrete – they’d send out requests for proposals (RFPs) to multiple suppliers to get the best price while meeting quality standards.

- Negotiation: Direct negotiation with a single supplier, commonly used when the product or service is highly specialized or complex, or when long-term relationships are important. This approach focuses on collaborative problem-solving and mutually beneficial agreements. For instance, a tech company developing a unique software might negotiate a customized contract with a specialized development firm.

- Blanket Orders: These are long-term agreements for regularly needed items with pre-defined terms and pricing. It simplifies the purchasing process and can improve efficiency by removing the need for frequent re-ordering. Think of a restaurant regularly ordering produce from a local farmer; they might use a blanket order agreement to streamline the supply chain.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. Describe a time you had to resolve a conflict with a supplier. How did you handle it?

In a previous role, we experienced delays from a crucial supplier impacting our production schedule. Initial communication was strained, with the supplier blaming unforeseen circumstances and us citing breach of contract.

My approach was to move beyond blame and focus on collaborative problem-solving. I started by actively listening to their concerns, acknowledging the challenges they faced, and building rapport. We then jointly reviewed the contract, identified the specific points of contention, and explored potential solutions. Ultimately, we agreed on a revised delivery schedule with compensation for the delays incorporated. This involved clear communication, mutual understanding, and a willingness to compromise. The relationship recovered and improved significantly after the issue was resolved. This experience highlighted the importance of proactive communication and collaborative negotiation in supplier relationship management.

Q 17. How do you manage inventory in a rapidly changing market?

Managing inventory in a rapidly changing market requires agility and a proactive approach. Traditional inventory management methods often struggle to keep up with rapid shifts in demand. Here’s how I would approach it:

- Demand Forecasting: Implement sophisticated forecasting techniques, such as exponential smoothing or machine learning algorithms, to predict demand fluctuations more accurately. These methods consider historical data, seasonality, and market trends to provide more precise forecasts.

- Agile Inventory Control: Move away from large safety stock levels towards a more responsive approach. Use techniques like just-in-time (JIT) inventory, where materials are delivered only as needed, reducing storage costs and minimizing waste. This approach, while demanding, helps mitigate the risks associated with fluctuating demand.

- Supply Chain Visibility: Invest in real-time supply chain monitoring to obtain better insights into supply disruptions, delays, and changing market conditions. This allows for timely intervention and proactive adjustments to inventory levels.

- Vendor Collaboration: Develop strong relationships with suppliers, enabling quick reactions to market changes. This can include collaborative forecasting, shared risk assessment, and flexible contract terms.

- Data-Driven Decision Making: Regularly analyze inventory data, sales figures, and market trends to identify patterns and inform decision-making. This helps refine forecasting models and fine-tune inventory levels.

Q 18. What is your experience with lean manufacturing principles?

Lean manufacturing principles focus on eliminating waste and maximizing efficiency throughout the entire production process. My experience includes implementing several lean initiatives, including:

- 5S Methodology: Implemented 5S (Sort, Set in Order, Shine, Standardize, Sustain) to organize and optimize the warehouse layout, leading to improved efficiency in material handling and reduced searching time.

- Kaizen Events: Participated in several Kaizen events, focused on process improvement and waste reduction. These collaborative workshops helped identify and eliminate bottlenecks in the procurement process. For example, a Kaizen event helped streamline our approval process for new suppliers, reducing processing times significantly.

- Value Stream Mapping: Utilized value stream mapping to visualize the entire procurement process, identifying areas of inefficiency and waste. This visualization aided in prioritizing improvement initiatives.

- Kanban Systems: Implemented Kanban systems for certain inventory items to optimize inventory levels and trigger timely replenishment based on actual demand, reducing storage costs and avoiding stockouts.

These lean principles have directly contributed to cost savings, improved quality, and increased on-time delivery.

Q 19. How do you ensure the accuracy of inventory data?

Ensuring accurate inventory data is crucial for effective inventory management. My approach involves a multi-faceted strategy:

- Cycle Counting: Regularly conduct cycle counting, verifying inventory levels against the system records. This helps identify discrepancies early on.

- Inventory Management System (IMS): Utilize a robust IMS with features like barcode scanning and RFID tracking to automate data collection and reduce manual errors. Regular system maintenance and updates are essential.

- Regular Reconciliation: Periodically reconcile inventory records with physical inventory counts to identify and correct any discrepancies. Discrepancies should be investigated and root causes addressed.

- Employee Training: Provide thorough training to staff involved in inventory handling and data entry to minimize human errors. Clear procedures and standardized practices are key.

- Data Validation: Implement data validation rules in the IMS to prevent data entry errors, such as incorrect quantities or item numbers.

Q 20. How do you measure the return on investment (ROI) of your procurement strategies?

Measuring the ROI of procurement strategies requires a clear understanding of both costs and benefits. I use a combination of metrics to assess ROI:

- Cost Savings: Calculate the reduction in procurement costs achieved through a particular strategy. This could include lower material prices, reduced transportation costs, or lower administrative expenses.

- Inventory Reduction: Measure the decrease in inventory holding costs, such as storage, insurance, and obsolescence. This directly reflects the efficiency of the procurement strategy.

- Improved Efficiency: Track improvements in lead times, order fulfillment rates, and overall procurement cycle times. Faster and more efficient procurement processes translate to increased profitability.

- Quality Improvements: Assess the impact on product quality and defect rates. Higher quality products translate to reduced waste and increased customer satisfaction.

- Supplier Performance: Monitor supplier performance metrics, such as on-time delivery, quality of materials, and responsiveness. Strong supplier relationships are vital for a successful procurement strategy.

By combining these metrics, I can build a comprehensive picture of the ROI and demonstrate the value of the implemented procurement strategies.

Q 21. Explain your experience with different types of procurement contracts.

My experience encompasses various procurement contract types, each suited to different circumstances:

- Purchase Orders (POs): These are the most common type, used for single or short-term purchases. They clearly define quantities, pricing, delivery terms, and payment conditions.

- Blanket Orders: As previously mentioned, these are long-term agreements for regularly needed items, establishing pre-defined terms and pricing, simplifying the ordering process.

- Long-Term Agreements (LTAs): These are strategic agreements with key suppliers for a longer period (often several years) to secure supply and stabilize prices. They often include volume commitments and price escalation clauses.

- Frame Agreements: These establish a framework for future orders, specifying general terms and conditions, while individual orders are placed within this framework.

- Cost-Plus Contracts: These stipulate that the supplier’s costs plus a predetermined profit margin will determine the final price. This is useful for projects with uncertain costs or where the supplier needs to absorb some risks.

Selecting the appropriate contract type depends on factors like the complexity of the goods or services, the length of the relationship, and the level of risk involved. It’s crucial to carefully negotiate terms and conditions to protect the organization’s interests.

Q 22. Describe your experience with using data analytics to improve procurement and inventory management.

Data analytics is crucial for optimizing procurement and inventory management. I’ve used various techniques to improve efficiency and reduce costs. For instance, I leveraged predictive modeling to forecast demand more accurately, minimizing stockouts and excess inventory. This involved analyzing historical sales data, seasonality, market trends, and even external factors like economic indicators. The model, built using tools like R or Python with libraries such as pandas and scikit-learn, generated forecasts with significantly improved accuracy compared to traditional methods. Further, I employed ABC analysis to categorize inventory based on value and consumption rate, allowing for targeted inventory control strategies. High-value items (A items) received more stringent monitoring, while lower-value items (C items) had simpler management processes. This significantly improved inventory turnover and reduced storage costs. Finally, I used data visualization dashboards to monitor key performance indicators (KPIs) like inventory turnover rate, carrying costs, and procurement lead times, enabling proactive identification and resolution of potential issues.

For example, in a previous role, by implementing these analytics-driven strategies, we reduced our inventory carrying costs by 15% and improved our order fulfillment rate by 10% within six months.

Q 23. How do you collaborate effectively with other departments (e.g., production, sales)?

Effective collaboration across departments is essential for smooth operations. I believe in open communication, proactive information sharing, and collaborative problem-solving. With production, I work closely to understand their material requirements planning (MRP) data, ensuring timely procurement of necessary materials to avoid production delays. Regular meetings and joint planning sessions are crucial for this. With sales, I collaborate to forecast future demand based on sales projections, enabling me to optimize inventory levels and avoid stockouts. This often involves attending sales strategy meetings and incorporating sales forecasts into the demand planning process. In both cases, I use collaborative software tools like project management platforms to track progress, share information and documents, and ensure transparent communication.

For example, in one project, I worked with the sales team to analyze historical sales data and market trends, resulting in a more accurate demand forecast. This allowed us to reduce excess inventory by 12% and prevent potential stockouts during a period of high demand.

Q 24. How do you handle discrepancies between inventory records and physical counts?

Discrepancies between inventory records and physical counts are a common challenge. My approach involves a systematic investigation to identify the root cause. This starts with a thorough reconciliation process, comparing the discrepancies to identify patterns or anomalies. Possible causes include data entry errors, theft, damage, or inaccurate stocktaking procedures. I then implement corrective actions. This could involve improving data entry processes, enhancing security measures, implementing regular cycle counting to minimize the impact of large annual physical inventory counts, or refining stocktaking methodologies with barcode scanning and inventory management software.

For instance, during a physical inventory count, I discovered a significant discrepancy in a particular warehouse. Through investigation, we found that a new employee was not properly trained in the inventory management system, leading to frequent data entry errors. We immediately implemented additional training and updated our data entry procedures, which resolved the issue and prevented future discrepancies.

Q 25. What is your approach to continuous improvement in procurement and inventory management?

Continuous improvement is a cornerstone of effective procurement and inventory management. My approach focuses on a Plan-Do-Check-Act (PDCA) cycle. I regularly review KPIs such as inventory turnover rate, carrying costs, and procurement lead times, identifying areas for improvement. I then implement changes (Do), monitor their impact (Check), and adjust accordingly (Act). This includes exploring new technologies, such as RFID or blockchain for enhanced inventory tracking and management. It also involves benchmarking against industry best practices and seeking opportunities for supplier collaboration to streamline the supply chain.

For example, by implementing a new warehouse management system (WMS), we were able to improve our inventory accuracy by 8% and reduce picking errors by 10%. The WMS provided real-time inventory visibility, facilitated better warehouse organization, and enhanced our overall operational efficiency.

Q 26. Explain your understanding of total cost of ownership (TCO).

Total Cost of Ownership (TCO) is a critical concept that encompasses all direct and indirect costs associated with acquiring, using, and disposing of an item or service throughout its entire lifecycle. It goes beyond the initial purchase price to include costs like transportation, storage, maintenance, repairs, and disposal. Understanding TCO is crucial for making informed procurement decisions. It allows businesses to move beyond simply focusing on the lowest initial price, as this can often overlook significant hidden costs later on. By considering the TCO, organizations can make more strategic decisions that optimize their overall spending.

Imagine comparing two pieces of equipment. One might have a lower initial price, but higher maintenance costs and shorter lifespan. A TCO analysis would highlight that the seemingly cheaper option might actually be more expensive in the long run.

Q 27. How do you balance cost optimization with service level requirements?

Balancing cost optimization with service level requirements is a delicate act. My approach involves a thorough understanding of the business needs and customer expectations. It’s not simply about finding the cheapest option; it’s about finding the most cost-effective solution that still meets the required service levels. Techniques like safety stock optimization, vendor managed inventory (VMI), and strategic sourcing are employed to achieve this balance. Safety stock helps mitigate the risk of stockouts, but excessive safety stock increases carrying costs. VMI allows suppliers to manage inventory levels based on real-time demand data, leading to reduced inventory holding costs for the buyer. Strategic sourcing focuses on identifying and selecting suppliers who can offer both competitive pricing and reliable delivery, ensuring both cost savings and consistent supply.

In one instance, we implemented VMI with a key supplier, resulting in a 10% reduction in inventory carrying costs while maintaining a 98% order fulfillment rate. This demonstrated that a collaborative approach, focused on understanding both cost and service implications, can lead to substantial benefits.

Key Topics to Learn for Material Procurement and Inventory Management Interview

- Sourcing and Procurement Strategies: Understanding different sourcing methods (e.g., global sourcing, single sourcing, multiple sourcing), supplier selection criteria, negotiation techniques, and contract management.

- Inventory Control Techniques: Applying methods like ABC analysis, EOQ (Economic Order Quantity), and safety stock calculations to optimize inventory levels and minimize costs. Practical application: Analyzing inventory data to identify slow-moving items and suggest strategies for disposal or improved sales.

- Demand Forecasting and Planning: Utilizing forecasting models to predict future demand, incorporating seasonality and trend analysis for accurate procurement planning. Practical application: Developing a forecast for raw materials needed for a new product launch.

- Inventory Management Systems (IMS): Familiarity with various IMS software and their applications in tracking inventory, managing orders, and generating reports. Understanding the benefits and challenges of different systems (ERP integration, etc.).

- Supply Chain Risk Management: Identifying and mitigating potential disruptions in the supply chain, such as supplier delays, natural disasters, or geopolitical instability. Practical application: Developing contingency plans to address potential supply chain disruptions.

- Cost Management and Optimization: Implementing strategies to reduce procurement costs, negotiate better prices with suppliers, and minimize inventory holding costs. Practical application: Analyzing cost data to identify areas for improvement in the procurement process.

- Quality Control and Assurance: Implementing procedures to ensure the quality of procured materials meets specifications and standards. Understanding quality control methodologies and their integration with the procurement process.

- Logistics and Transportation Management: Understanding the principles of efficient logistics and transportation to ensure timely delivery of materials. Practical application: Optimizing delivery routes and schedules to reduce transportation costs and delivery times.

- Data Analysis and Reporting: Utilizing data analysis tools to track key performance indicators (KPIs) related to procurement and inventory management, and presenting findings to stakeholders. Creating insightful reports to support decision-making.

- Ethical Considerations in Procurement: Understanding and adhering to ethical guidelines and regulations in procurement practices, ensuring fair and transparent processes.

Next Steps

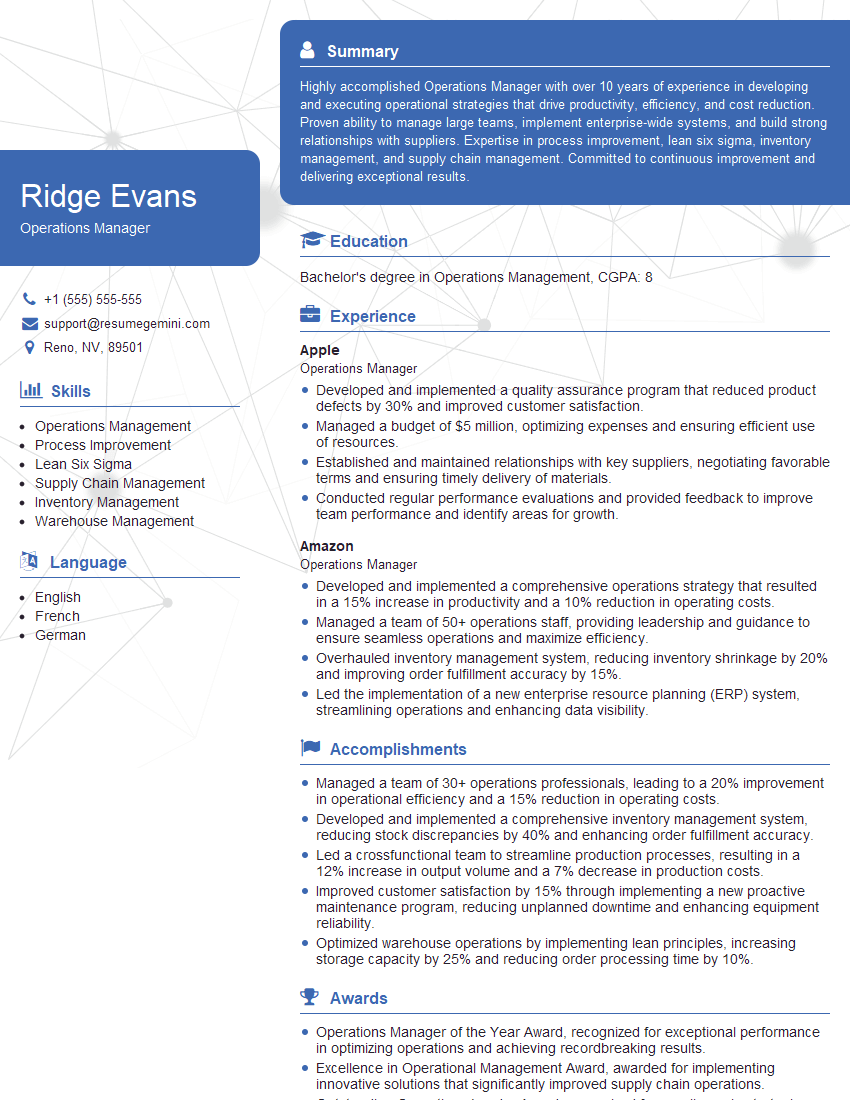

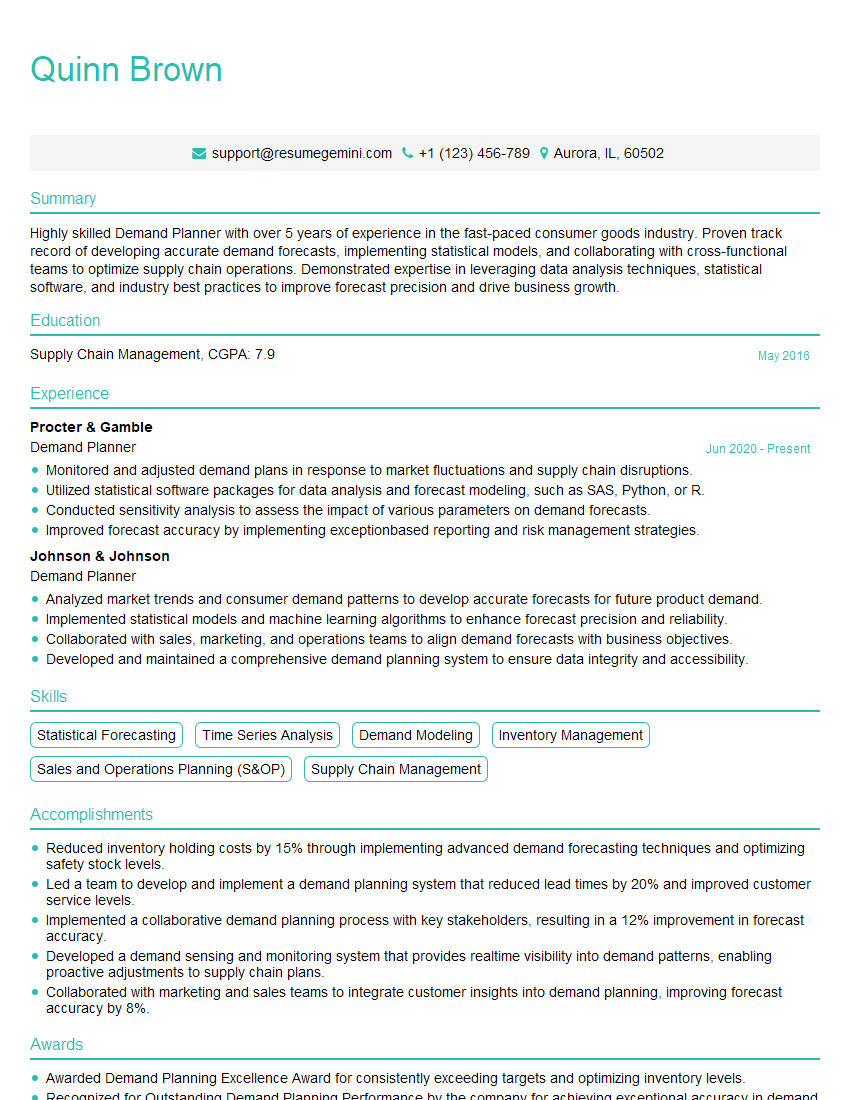

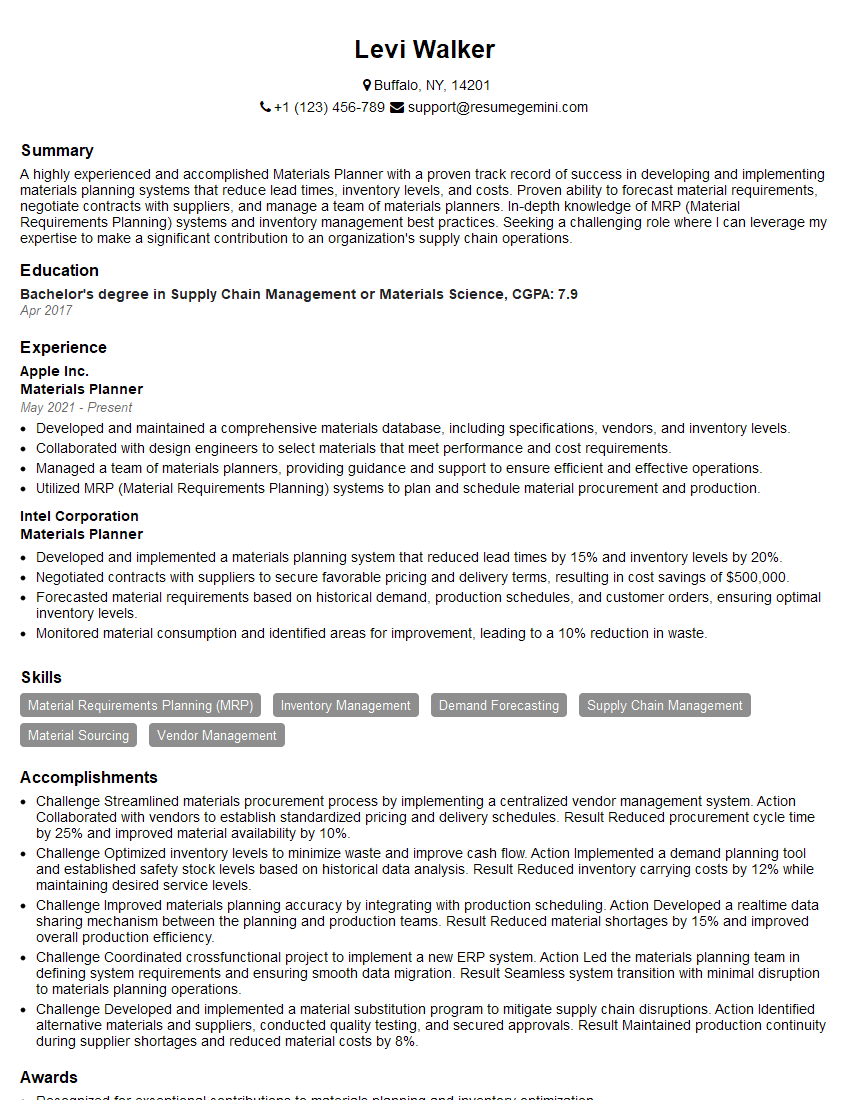

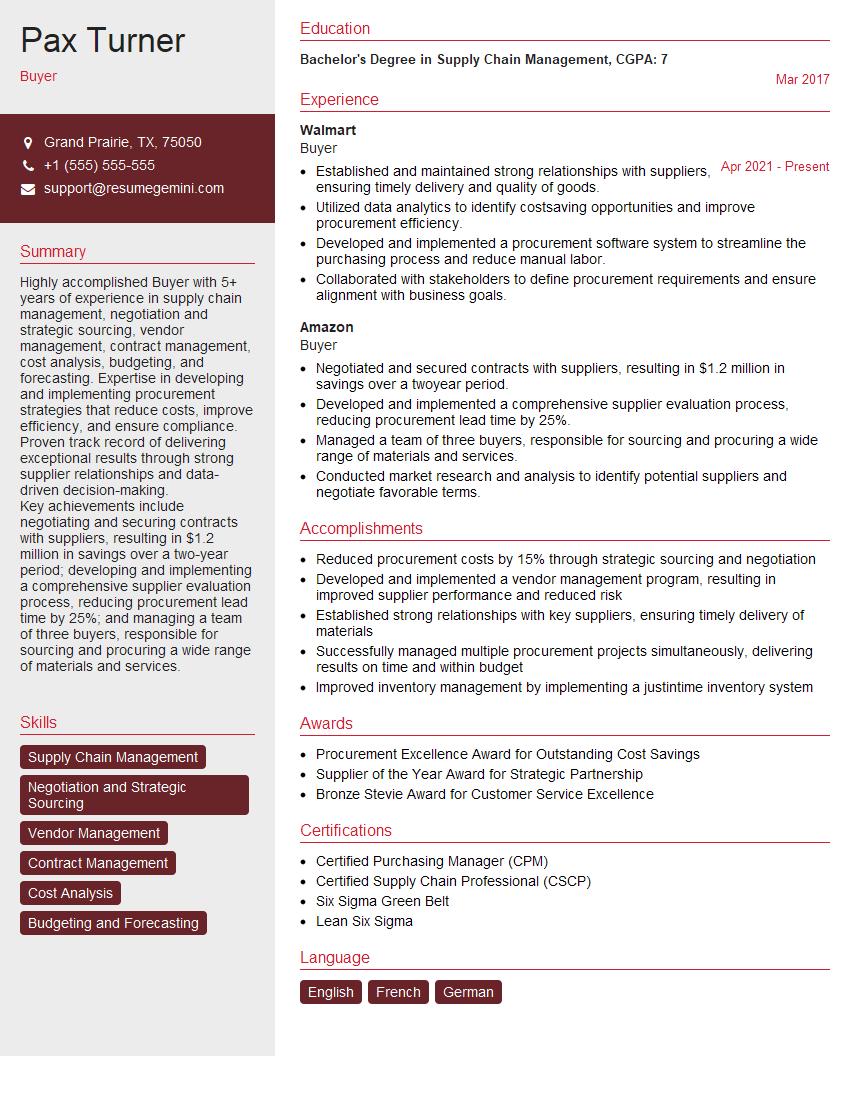

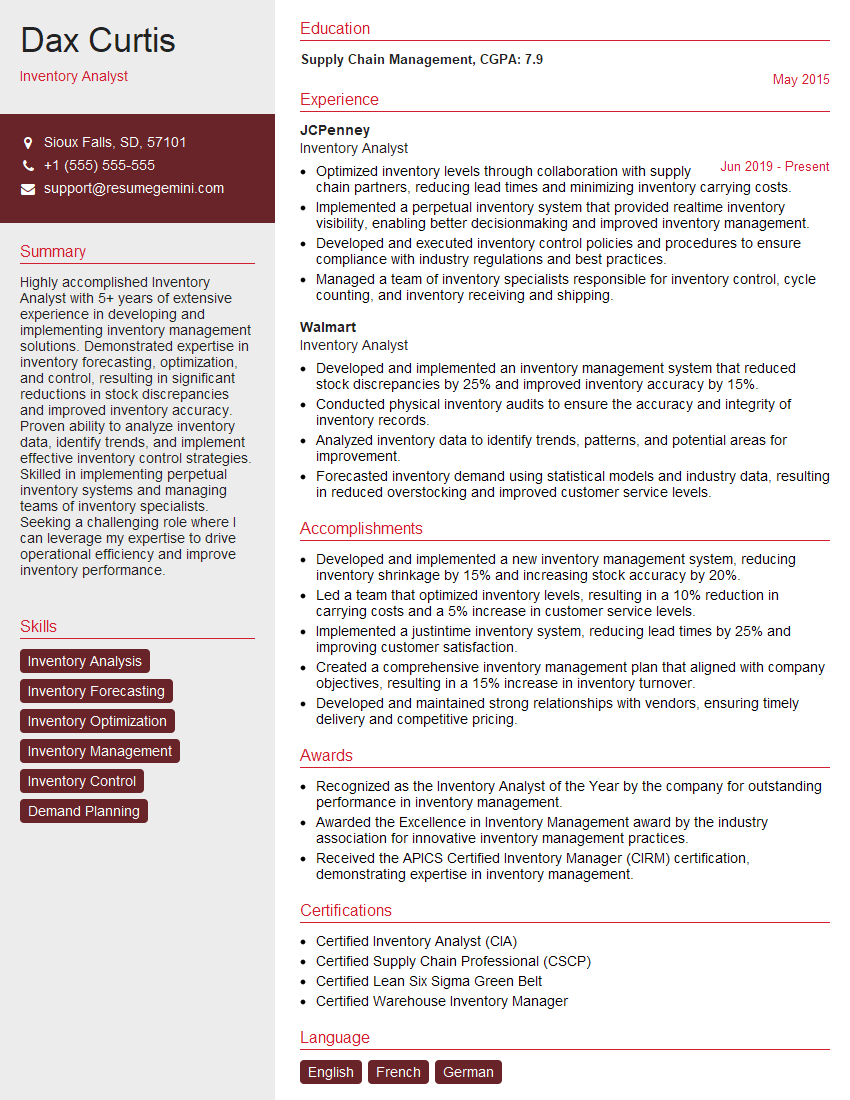

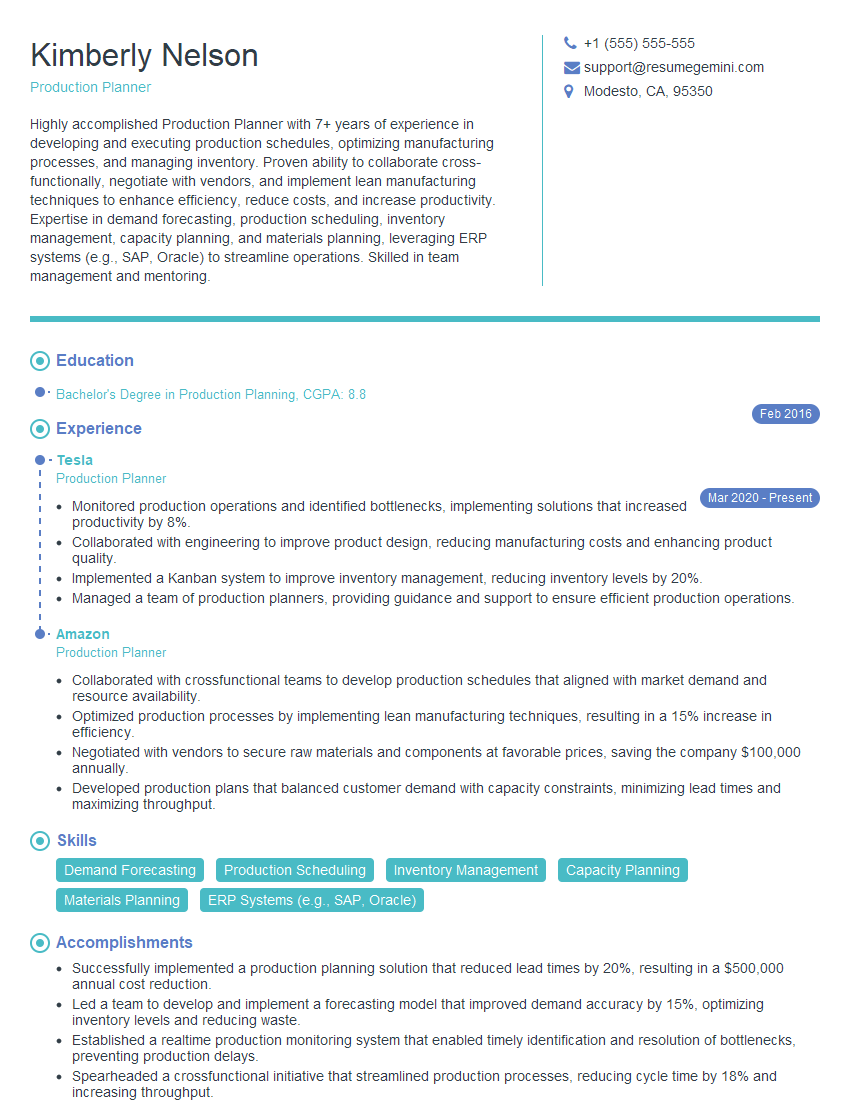

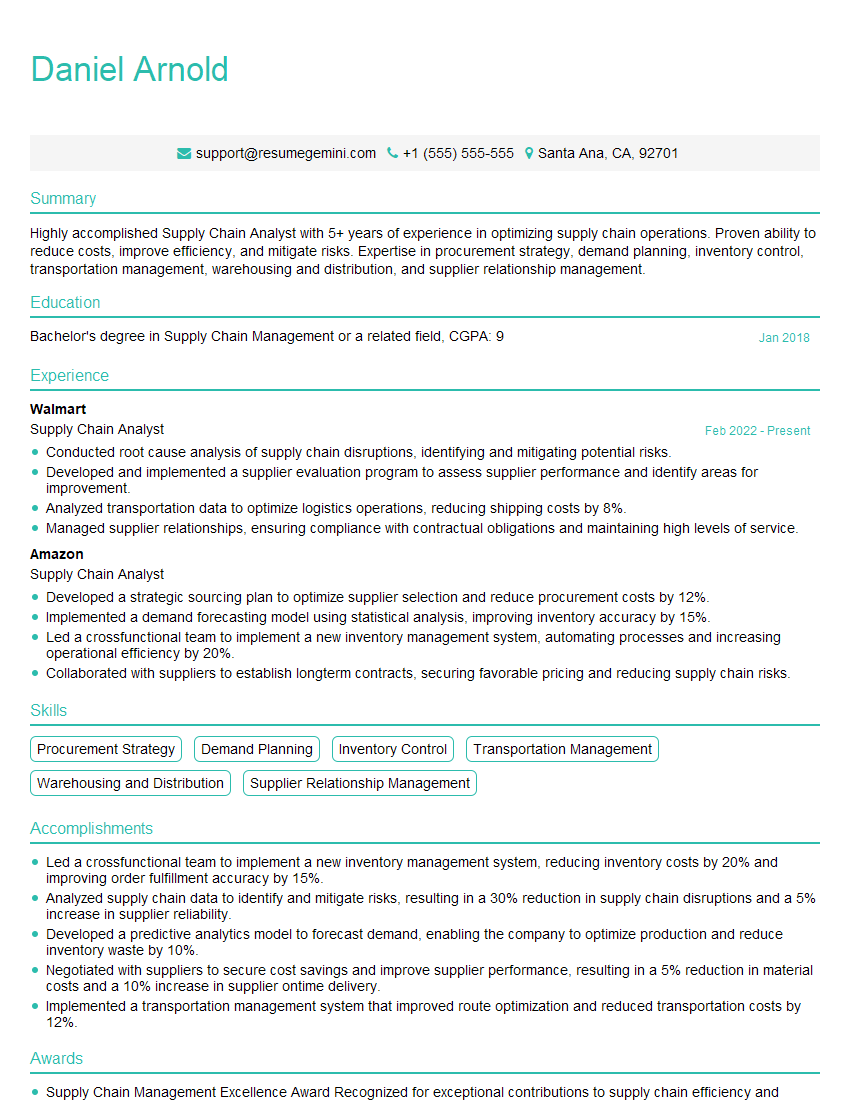

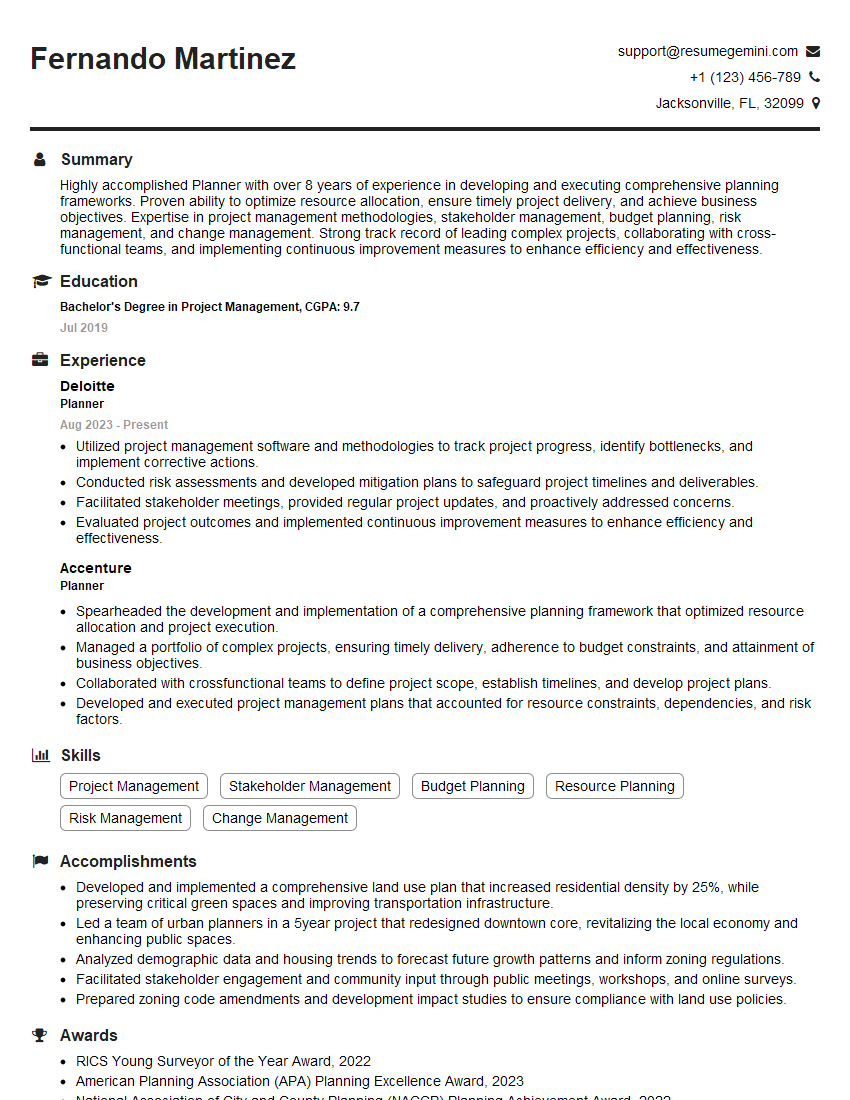

Mastering Material Procurement and Inventory Management is crucial for career advancement in operations, supply chain, and logistics. A strong understanding of these concepts opens doors to leadership roles and higher earning potential. To significantly boost your job prospects, create an ATS-friendly resume that highlights your skills and experience effectively. ResumeGemini is a trusted resource to help you build a professional and impactful resume that gets noticed. We provide examples of resumes tailored to Material Procurement and Inventory Management to guide you through the process.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

Hi, I represent a social media marketing agency that creates 15 engaging posts per month for businesses like yours. Our clients typically see a 40-60% increase in followers and engagement for just $199/month. Would you be interested?”

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?