Cracking a skill-specific interview, like one for Verify Insurance Information and Coding, requires understanding the nuances of the role. In this blog, we present the questions you’re most likely to encounter, along with insights into how to answer them effectively. Let’s ensure you’re ready to make a strong impression.

Questions Asked in Verify Insurance Information and Coding Interview

Q 1. Explain the process of verifying insurance eligibility.

Verifying insurance eligibility is the crucial first step in ensuring a patient receives the care they need without financial burden. It involves confirming that the patient’s insurance policy is active, covers the specific services requested, and determining the patient’s responsibility (copay, deductible, etc.).

The process typically begins by obtaining the patient’s insurance information, including their name, date of birth, policy number, and the insurance provider’s name. This information is then used to electronically query the payer’s system through a clearinghouse or directly using the payer’s website or portal. This query returns a response that confirms coverage, outlines benefit details, including any pre-authorization requirements, and provides information on patient cost-sharing responsibilities. It’s important to check for any referral requirements and the provider’s participation status within the plan’s network.

For example, imagine a patient presents for a knee surgery. Verifying their insurance allows the provider to confirm the surgery is covered, if pre-authorization is necessary, the patient’s copay amount, and the overall expected cost for the patient. This ensures the patient is adequately informed and prevents unexpected bills.

Q 2. What are the key components of a clean claim?

A clean claim is a claim that contains all the necessary information required for timely and accurate payment by the insurance payer. It’s like submitting a perfectly completed application – no missing pieces, everything in its place. A clean claim reduces administrative burden and ensures swift reimbursement.

- Accurate Patient Information: Correct name, date of birth, address, and insurance details.

- Valid Diagnostic and Procedural Codes: Precise ICD (International Classification of Diseases) codes for diagnoses and CPT (Current Procedural Terminology) codes for procedures, properly linked.

- Complete Billing Information: Correct provider information, National Provider Identifier (NPI), and Tax Identification Number (TIN).

- Appropriate Medical Documentation: Supporting medical records clearly justifying the services billed.

- Correct Place of Service (POS) Code: Indicates where the service was performed (e.g., hospital, doctor’s office).

Think of it as a puzzle – all pieces must fit together perfectly for the claim to be processed without issues. An incomplete or inaccurate claim can lead to delays and potential denials.

Q 3. Describe different types of insurance plans (e.g., HMO, PPO, POS).

Different insurance plans offer varying levels of access to healthcare providers and coverage options. Understanding these differences is vital for patient care and billing accuracy.

- HMO (Health Maintenance Organization): Usually requires choosing a primary care physician (PCP) who acts as a gatekeeper, referring patients to specialists within the network. Generally, the most cost-effective option but with limited out-of-network coverage.

- PPO (Preferred Provider Organization): Offers more flexibility; patients can see specialists without a referral, and out-of-network care is covered, though typically at a higher cost. Generally, more expensive than HMOs but with more provider choices.

- POS (Point of Service): A hybrid plan combining elements of HMO and PPO. Patients choose a PCP, but can see out-of-network providers for a higher cost-share.

The key difference lies in the level of network restrictions and the cost implications of utilizing in-network versus out-of-network providers.

Q 4. How do you handle denied claims?

Handling denied claims involves a systematic approach to investigate the reason for denial, appeal the decision if appropriate, and ensure timely resolution. The first step is reviewing the Explanation of Benefits (EOB) or remittance advice document to understand the reason for the denial. This might include missing information, incorrect coding, or the service being deemed not medically necessary. Then, based on the denial reason, appropriate actions can be taken.

For instance, if a claim is denied due to missing information, the missing documentation can be resubmitted. If the denial is due to an incorrect code, the code can be corrected, and a corrected claim resubmitted. In cases where a denial is due to medical necessity, a detailed appeal with supporting medical records and documentation might be necessary. Often, this process requires communication with the payer’s claims department. Keeping detailed notes throughout the appeal process is crucial for tracking progress and demonstrating a diligent effort to resolve the issue.

Q 5. What are some common reasons for claim denials?

Claim denials are common occurrences in healthcare billing, often stemming from preventable errors. Some frequent reasons include:

- Missing or Incorrect Information: Incomplete patient data, incorrect insurance information, or missing medical records.

- Incorrect or Missing Codes: Using wrong ICD or CPT codes, lacking supporting codes, or failing to appropriately link diagnoses and procedures.

- Lack of Pre-authorization: Failing to obtain necessary pre-authorization for specific services or procedures.

- Medical Necessity Issues: The payer deems the service or procedure not medically necessary based on the provided documentation.

- Duplicate Claims: Submitting the same claim multiple times.

- Billing Errors: Incorrect charges, incorrect modifiers, or errors in claim submission.

Proactive measures like diligent data entry, regular code updates, and consistent adherence to payer guidelines can minimize claim denials.

Q 6. What is the difference between ICD and CPT codes?

ICD and CPT codes are fundamental in healthcare billing, representing different aspects of patient care. They are like two sides of the same coin, both essential for accurate reimbursement.

- ICD (International Classification of Diseases) Codes: These codes classify diseases, injuries, and other health conditions. They describe *why* a patient is receiving care. For example, a diagnosis of pneumonia might receive an ICD code such as J18.9.

- CPT (Current Procedural Terminology) Codes: These codes describe medical, surgical, and diagnostic services performed by healthcare professionals. They describe *what* care is provided. For example, a chest X-ray might have a CPT code such as 71046.

In essence, ICD codes diagnose the problem, while CPT codes describe the treatments and procedures undertaken to address it. Both must be accurate and appropriately linked for a clean claim.

Q 7. Explain the importance of accurate coding in healthcare.

Accurate coding is paramount in healthcare for several crucial reasons:

- Accurate Reimbursement: Precise coding ensures providers receive appropriate payment for services rendered. Incorrect coding can lead to underpayment or denial of claims, impacting revenue.

- Data Integrity: Accurate codes contribute to the quality of healthcare data used for research, public health initiatives, and disease surveillance. Accurate coding helps paint a clearer picture of the health landscape.

- Regulatory Compliance: Correct coding ensures adherence to government regulations and guidelines, avoiding potential penalties and audits. Coding accuracy is fundamental for compliance.

- Patient Care: While seemingly indirect, accurate coding affects resource allocation; accurate data enables better healthcare planning and efficient resource distribution. In essence, it indirectly contributes to better care.

Think of it as the foundation of the healthcare financial system; without accurate coding, the entire structure could crumble.

Q 8. How do you stay up-to-date with coding changes and regulations?

Staying current in the ever-evolving landscape of insurance coding and regulations requires a multifaceted approach. I utilize several key strategies to ensure I’m always informed and compliant.

- Professional Organizations: Active membership in organizations like the American Academy of Professional Coders (AAPC) and the American Health Information Management Association (AHIMA) provides access to continuing education, webinars, and publications detailing the latest coding updates and regulatory changes. These resources often offer insights into the practical application of new rules.

- Industry Publications and Journals: I regularly read industry-specific publications and journals, such as Healthcare Finance and Modern Healthcare, which provide analyses of regulatory shifts and their impact on healthcare billing and coding practices. This helps me understand the ‘why’ behind the changes, not just the ‘what’.

- Government Websites: I routinely monitor the websites of relevant government agencies, including the Centers for Medicare & Medicaid Services (CMS) and the National Center for Health Statistics (NCHS), for updates to coding manuals, compliance guidelines, and regulatory announcements. This is the primary source for official information.

- Webinars and Conferences: Attending industry webinars and conferences allows for direct interaction with experts and peers, facilitating a deeper understanding of complex issues and best practices. Networking also provides valuable insights and perspectives.

- Continuing Education Courses: I actively pursue continuing education courses to maintain my certifications and stay abreast of changes in medical coding, billing, and insurance regulations. These courses ensure I’m prepared for audits and regulatory scrutiny.

This combined approach ensures that I remain proficient and compliant, minimizing the risk of errors and ensuring accurate insurance claims processing.

Q 9. How would you handle a discrepancy between the patient’s insurance information and the provider’s records?

Discrepancies between patient insurance information and provider records are a common challenge. My approach involves a systematic process to resolve these issues accurately and efficiently.

- Verification: I begin by carefully verifying the information provided by the patient against the information on file with the insurance carrier. This often involves using online insurance verification tools to access real-time eligibility and benefits information. I would double check for typos or incorrect data entry by comparing to the patient’s insurance card and any documents they provide.

- Clarification: If discrepancies exist, I initiate communication with the patient to clarify the differences. This may involve polite questioning such as, “I noticed a slight difference in your provided information compared to our records. Could you please verify your policy number and date of birth?” This ensures accuracy and avoids delays.

- Carrier Contact: If the discrepancy remains after speaking with the patient, I directly contact the insurance carrier’s provider services department. This involves clearly explaining the issue and working with them to resolve the conflict. I usually have a prepared summary of the patient information in case I need to communicate to clarify the discrepancies.

- Documentation: Thorough documentation of all steps taken, including dates, times, and communication details, is crucial. This documentation is essential for auditing purposes and to ensure compliance with HIPAA regulations. It allows us to see the history of attempts to resolve the discrepancy if it goes beyond initial steps.

- Resolution: The goal is to obtain accurate and updated insurance information before proceeding with claims submission. This ensures that claims are processed efficiently and payment is received promptly, minimizing revenue cycle delays. This may include updating the EHR and the patient’s chart.

This methodical approach ensures that the discrepancies are resolved effectively and efficiently, avoiding potential financial losses and regulatory issues. It also provides a clear audit trail for accountability.

Q 10. Describe your experience with different insurance payer systems.

My experience encompasses a wide range of insurance payer systems, both public and private. I’m familiar with the intricacies of various payers, including:

- Medicare and Medicaid: I have a deep understanding of Medicare’s Part A, Part B, and Part D billing requirements, including the specific coding guidelines and modifiers necessary for proper reimbursement. I’m also experienced in navigating the complexities of Medicaid eligibility and billing procedures, which vary significantly by state.

- Commercial Insurers: I have extensive experience with a variety of major commercial insurance carriers, including Aetna, UnitedHealthcare, Blue Cross Blue Shield, and Cigna. This experience includes understanding their specific claim submission requirements, electronic claim formats (e.g., 837), and payer-specific rules and regulations.

- HMOs, PPOs, and POS Plans: I possess a clear understanding of the differences between various types of managed care plans and the specific procedures for billing each type. This understanding is critical for ensuring timely claim adjudication.

- Workers’ Compensation and Auto Insurance: I am also familiar with the billing procedures specific to workers’ compensation and auto insurance claims, including the documentation and coding requirements unique to these types of claims. These claims often have different eligibility and payment procedures.

My experience enables me to adapt quickly to different payer systems and navigate their unique requirements, ensuring optimal claim processing and revenue cycle management.

Q 11. How do you prioritize tasks in a high-volume environment?

In high-volume environments, efficient task prioritization is critical. I use a combination of strategies to manage workload effectively:

- Urgency and Importance: I employ an Eisenhower Matrix (Urgent/Important) to categorize tasks. This helps me focus on high-impact, time-sensitive tasks while delegating or scheduling less critical ones. This allows me to address immediate issues while ensuring longer-term projects stay on track.

- Prioritization Based on Reimbursement: I prioritize tasks based on the potential impact on revenue. Tasks related to high-value claims or those at risk of denial are given precedence. Timely submission of these claims reduces the risk of delayed payments.

- Workflow Optimization: I identify and streamline repetitive tasks to improve efficiency. This might involve using automation tools or refining internal processes to reduce bottlenecks. For example, creating templates for frequently used documents can significantly reduce processing time.

- Time Management Techniques: I utilize time management techniques, such as the Pomodoro Technique, to maintain focus and avoid burnout. This ensures sustained productivity throughout the workday. Taking short breaks to maintain focus is important, as is a structured routine.

- Communication and Teamwork: Open communication with colleagues and supervisors is essential. This allows for effective collaboration, task delegation, and support when facing overwhelming workloads.

These strategies ensure that critical tasks are addressed promptly while maintaining overall productivity and preventing overwhelming stress in fast-paced environments.

Q 12. What is your experience with electronic health records (EHR) systems?

My experience with Electronic Health Records (EHR) systems is extensive. I am proficient in several leading EHR systems, including Epic, Cerner, and Meditech. My proficiency extends beyond basic data entry; I understand how EHRs are used for various tasks related to insurance verification and coding.

- Insurance Verification: I use EHR features for insurance verification to retrieve patient insurance information directly from the system, reducing manual data entry and minimizing the risk of errors. This often involves checking eligibility and benefits for the patient.

- Coding and Billing Integration: I am skilled at utilizing the coding and billing functions within the EHR systems. I understand how the EHR system is integrated into our billing software to streamline the claims process, such as generating claims from the information in the EHR system.

- Clinical Documentation Review: I have a working understanding of how to review clinical documentation within the EHR system to accurately code medical services. This ensures that the codes selected accurately reflect the services rendered.

- Reporting and Analytics: I understand how to use EHR reporting and analytics tools to identify trends, track key metrics, and improve processes related to insurance verification and coding. This can allow us to measure the efficiency and accuracy of the claims process.

My experience in EHR systems ensures seamless integration of insurance verification, coding, and billing processes, ultimately improving efficiency and accuracy.

Q 13. How do you ensure patient confidentiality when verifying insurance information?

Protecting patient confidentiality is paramount. I strictly adhere to HIPAA regulations and best practices when verifying insurance information.

- HIPAA Compliance: I am thoroughly familiar with HIPAA regulations and understand the implications of violating patient privacy. This includes appropriate disposal of documents containing patient information.

- Secure Systems: I only access patient information through secure, authorized channels, such as the EHR system or the insurance carrier’s website, using my secure login credentials. This limits access to only those individuals who are cleared to access such information.

- Access Limitations: I only access the minimum necessary patient information required for insurance verification. I do not access information unrelated to my tasks. This ensures that only necessary information is available.

- Password Protection: I maintain strong passwords and follow organizational policies regarding password security to protect sensitive patient data from unauthorized access. Passwords are regularly changed.

- Data Encryption: I understand the importance of data encryption and the role it plays in protecting patient information from unauthorized disclosure, both in transit and at rest. This safeguards the data from possible cyberattacks.

- Privacy Training: I regularly participate in HIPAA compliance training to stay updated on best practices and legal requirements for protecting patient information.

My commitment to patient privacy ensures that sensitive information is handled responsibly and ethically, in full compliance with all applicable regulations.

Q 14. Explain your experience with medical billing software.

My experience with medical billing software is extensive. I am proficient in several leading billing systems, including:

- Practice Management Software: I have worked with several practice management systems that manage patient demographics, scheduling, claims processing, and reporting. This allows for efficient management of the claims process.

- Claims Submission and Follow-up: I’m skilled in using billing software to submit claims electronically, track claim status, and follow up on denied or rejected claims. This ensures timely payment.

- Reporting and Analytics: I’m comfortable using the reporting and analytics features of billing software to monitor key metrics such as claim acceptance rates, days in accounts receivable, and payer performance. This allows us to improve our billing efficiency.

- Electronic Remittance Advice (ERA) Processing: I am experienced in processing ERAs to ensure accurate posting of payments and identification of potential discrepancies. This minimizes billing errors.

My proficiency in medical billing software translates to streamlined workflows, reduced errors, and improved revenue cycle management. I understand how to use this software to efficiently manage claims and ensure prompt reimbursement.

Q 15. How do you handle difficult patients or providers?

Handling difficult patients or providers requires a combination of empathy, clear communication, and adherence to professional boundaries. I approach each interaction with a focus on active listening and understanding their perspective, even if I disagree with their approach. For example, if a provider is upset about a claim denial, I calmly explain the reason for the denial, referencing the specific policy guidelines and any relevant documentation. If a patient is frustrated with the insurance process, I provide clear, concise explanations, and offer to assist them in navigating the system. If the situation escalates, I utilize de-escalation techniques, maintaining a calm and professional demeanor, and if necessary, involve a supervisor for support. Ultimately, maintaining a respectful and professional attitude while clearly communicating relevant information is crucial for resolving conflicts effectively.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Don’t miss out on holiday savings! Build your dream resume with ResumeGemini’s ATS optimized templates.

Q 16. What is your experience with appeals and reconsideration processes?

I have extensive experience with appeals and reconsideration processes, having successfully navigated numerous situations involving denied claims. My approach starts with a thorough review of the denied claim, focusing on the reason for denial. I then carefully gather all supporting documentation, such as medical records, physician notes, and any prior authorizations. For instance, if a claim was denied due to a lack of medical necessity, I would meticulously gather evidence showing the necessity of the procedure or treatment. I ensure the documentation precisely aligns with the insurance company’s guidelines and requirements, often contacting the provider’s office to obtain any missing information. The appeal or reconsideration is then submitted meticulously, with clear explanations and supporting evidence. Throughout the process, I meticulously track the appeal’s status and maintain consistent communication with both the provider and the insurance company to ensure a timely resolution.

Q 17. Describe a time you identified a coding error. How did you resolve it?

In one instance, I identified a coding error when reviewing a claim for a complex surgical procedure. The initial code submitted was for a less extensive procedure than what was actually performed, which would have resulted in significantly lower reimbursement. I noticed the discrepancy while comparing the procedure description in the medical record to the submitted code using the appropriate coding manuals (e.g., CPT, ICD). Specifically, the surgeon’s notes detailed the use of a specific surgical technique that wasn’t reflected in the originally assigned code. To resolve this, I carefully reviewed the medical record and consulted the current procedural terminology (CPT) and International Classification of Diseases (ICD) coding manuals to identify the correct code that accurately reflected the procedure performed. I then collaborated with the billing department to submit a corrected claim with the appropriate codes and supporting documentation, resulting in proper reimbursement for the provider.

Q 18. What is your understanding of HIPAA regulations?

My understanding of HIPAA regulations is comprehensive. I am well-versed in the Privacy Rule, which protects the privacy and security of Protected Health Information (PHI), and the Security Rule, which sets national standards for securing electronic protected health information (ePHI). This includes understanding the requirements for obtaining authorization, disclosing PHI, and maintaining the confidentiality of patient information. For instance, I understand the limitations on discussing patient information with unauthorized individuals, and I am meticulous in adhering to strict protocols regarding access, use, and disclosure of PHI. I am also aware of the penalties for HIPAA violations and the importance of maintaining compliance at all times. In my daily work, this translates into ensuring all patient interactions and data handling procedures comply with these standards.

Q 19. What are your strengths and weaknesses in this area?

My strengths lie in my meticulous attention to detail, my analytical skills, and my proficiency in medical coding and insurance verification. I am adept at identifying and resolving coding errors, ensuring accurate claim submissions, and navigating complex insurance policies. I also possess excellent communication skills, enabling me to effectively interact with patients and providers. A weakness I am actively working on is delegation. While I am capable of handling a large volume of work independently, I sometimes struggle to effectively delegate tasks to others. To mitigate this, I am consciously practicing assigning tasks strategically and providing clear instructions and support to my colleagues.

Q 20. How do you handle stressful situations in a fast-paced environment?

I thrive in fast-paced environments, remaining calm and organized even under pressure. My approach to stressful situations involves prioritizing tasks, breaking down complex issues into smaller, manageable steps, and focusing on one task at a time. For example, during peak periods, I use a system of task management to ensure efficiency. I also practice mindfulness techniques to manage stress levels and maintain focus. If I encounter an insurmountable problem, I proactively seek guidance from my supervisor or colleagues, ensuring collaboration and a timely solution.

Q 21. Describe your problem-solving skills related to insurance verification and coding.

My problem-solving skills in insurance verification and coding are highly developed. I employ a systematic approach, starting with clearly defining the problem. For example, if a claim is denied, I systematically investigate the reason for denial, checking for inaccuracies in coding, missing documentation, or any policy discrepancies. I then gather all the relevant information, including medical records, insurance policies, and coding manuals. I analyze this information, identifying potential solutions. This may involve correcting coding errors, obtaining additional documentation, or appealing the denial. Once a solution is identified, I implement it, documenting each step of the process. Finally, I evaluate the outcome, ensuring the problem is resolved and lessons learned are applied to future situations.

Q 22. What is your experience with different types of medical procedures and their corresponding codes?

My experience encompasses a wide range of medical procedures, from routine check-ups to complex surgical interventions. I’m proficient in translating these procedures into their corresponding Current Procedural Terminology (CPT) and Healthcare Common Procedure Coding System (HCPCS) codes. This involves understanding the nuances of each code, including modifiers that reflect specific circumstances. For instance, I can differentiate between a simple and complex wound repair (CPT codes 12001-12002 vs. 12031-12032), and understand how to code for different types of anesthesia (using CPT and HCPCS modifiers).

- Example: A patient undergoing a laparoscopic cholecystectomy (removal of the gallbladder) would require the appropriate CPT code for the procedure itself, along with codes for anesthesia and any other services rendered.

- Example: A patient with a wound needing debridement before closure would require different CPT codes compared to one that only needs direct closure. I understand the importance of selecting the most precise code to accurately reflect the service provided.

Q 23. What software or tools are you proficient in for verifying insurance information and coding?

My proficiency spans several software applications critical for insurance verification and coding. I’m highly skilled in using electronic health record (EHR) systems like Epic and Cerner to access patient information and generate claims. I’m also adept at using billing software such as Availity and Change Healthcare to submit claims electronically and track their status. Additionally, I utilize various coding software to verify code accuracy and compliance with regulatory requirements. This includes using online resources to confirm the most current codes and industry guidelines. Finally, I’m comfortable using spreadsheet software like Microsoft Excel for data analysis and reporting.

Q 24. How familiar are you with various billing and coding compliance regulations?

I possess a thorough understanding of HIPAA (Health Insurance Portability and Accountability Act), ICD-10 (International Classification of Diseases, 10th Revision), CPT, and HCPCS coding guidelines. My knowledge extends to the nuances of payer-specific requirements, which often vary widely. I understand the implications of incorrect coding, including potential audits, fines, and denials. For example, I am familiar with the Centers for Medicare & Medicaid Services (CMS) guidelines and the implications of upcoding and downcoding.

- Example: I know the importance of using the correct ICD-10 code to accurately reflect the patient’s diagnosis. Miscoding can lead to inaccurate reimbursement and potentially violate compliance rules.

- Example: I understand the specific requirements for coding procedures under different insurance plans, including Medicare, Medicaid, and commercial payers.

Q 25. Explain your experience with audits related to insurance claims and coding practices.

I have actively participated in several internal and external audits, focusing on insurance claim accuracy and coding practices. These audits typically involve a thorough review of medical records, claims data, and coding documentation to identify areas of potential improvement and ensure compliance. My role during audits involved data extraction, analysis, and identification of areas requiring corrective action. I am adept at resolving discrepancies and providing detailed reports summarizing findings and recommendations.

- Example: During a recent audit, I identified a pattern of incorrect coding for a specific procedure. By analyzing the data, I pinpointed the root cause and implemented a training program to address the issue, preventing future errors.

- Example: I have experience with preparing responses to auditor queries and providing supporting documentation to demonstrate the accuracy of coding and billing practices.

Q 26. How do you ensure the accuracy and completeness of insurance data?

Ensuring the accuracy and completeness of insurance data is paramount. My approach involves a multi-step verification process. This starts with verifying patient information against insurance databases to confirm eligibility and coverage. I meticulously review policy details, including benefits, deductibles, and co-pays. I use multiple sources to confirm the information, including direct communication with insurance providers when necessary, and document all verification steps thoroughly. This comprehensive approach ensures accurate claim submissions and minimizes denials.

- Example: Before submitting a claim, I verify the patient’s insurance coverage, including their group number, ID number, and effective dates. I cross-reference this information with the patient’s provided documentation to ensure consistency.

- Example: If I encounter conflicting information, I actively investigate by contacting the insurance provider directly to clarify details before submitting the claim.

Q 27. What strategies do you use to improve efficiency in insurance verification and coding?

Improving efficiency in insurance verification and coding requires a strategic approach. I utilize automated tools whenever possible, leveraging EHR and billing system features for pre-authorization and claim submission. I maintain well-organized electronic files and employ streamlined workflows, including using templates for common procedures and diagnoses to reduce manual data entry. I also stay updated on coding guidelines and payer requirements to minimize the need for corrections and resubmissions. Continuous professional development is crucial for enhancing efficiency and staying abreast of industry changes.

Q 28. Describe a challenging insurance verification or coding situation you’ve encountered and how you resolved it.

One particularly challenging situation involved a patient with complex medical history and multiple insurance plans. The coordination of benefits was complicated, with each plan having different coverage limitations and requiring specific documentation. I meticulously researched the requirements of each plan, using online resources and direct communication with insurance representatives. Through careful review of the patient’s medical records and meticulous documentation, I successfully navigated the complexities and submitted accurate claims, resulting in appropriate reimbursement from both payers. The key to resolution was detailed documentation and persistent communication to ensure complete and accurate information.

Key Topics to Learn for Verify Insurance Information and Coding Interview

- Understanding Insurance Terminology: Mastering key terms like EOBs (Explanation of Benefits), COB (Coordination of Benefits), and different insurance plan types (PPO, HMO, etc.) is crucial for effective verification.

- Data Entry and Accuracy: Practice efficient and accurate data entry techniques. Understand the implications of errors and how to prevent them through double-checking and validation methods.

- Insurance Verification Workflow: Familiarize yourself with the step-by-step process of verifying insurance, from initial patient information gathering to final confirmation of coverage and benefits.

- Coding and Billing Procedures: Understand the basics of medical coding (e.g., CPT, ICD) and how they relate to insurance claims processing. Learn how to identify potential coding errors and their impact.

- Electronic Health Records (EHR) Systems: Gain proficiency in navigating EHR systems to access and interpret patient insurance information. Understand how different systems may present data.

- Problem-solving and Critical Thinking: Develop your ability to identify and resolve discrepancies in insurance information, handle denials, and troubleshoot issues efficiently.

- Regulatory Compliance: Understand relevant HIPAA regulations and other compliance requirements related to handling protected health information (PHI) and insurance data.

- Payer Specific Guidelines: Research common insurance payers in your region and understand their specific requirements and processes for claim submission and verification.

Next Steps

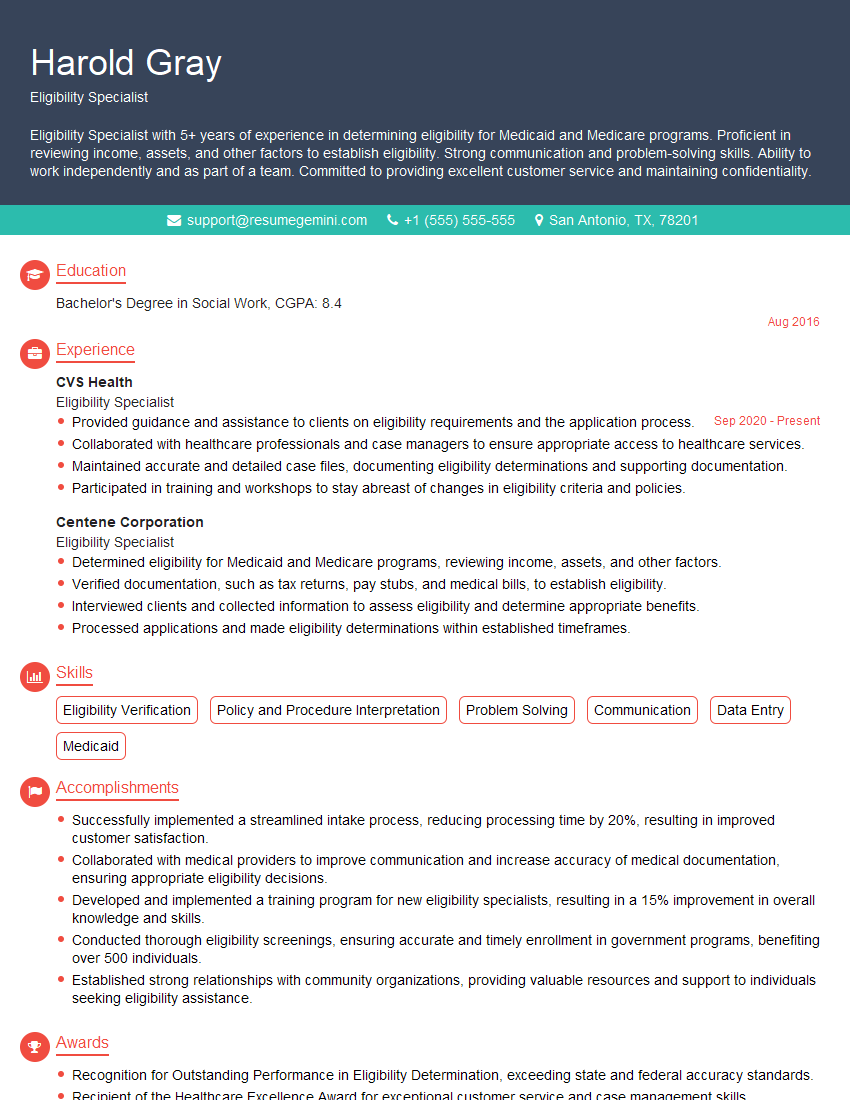

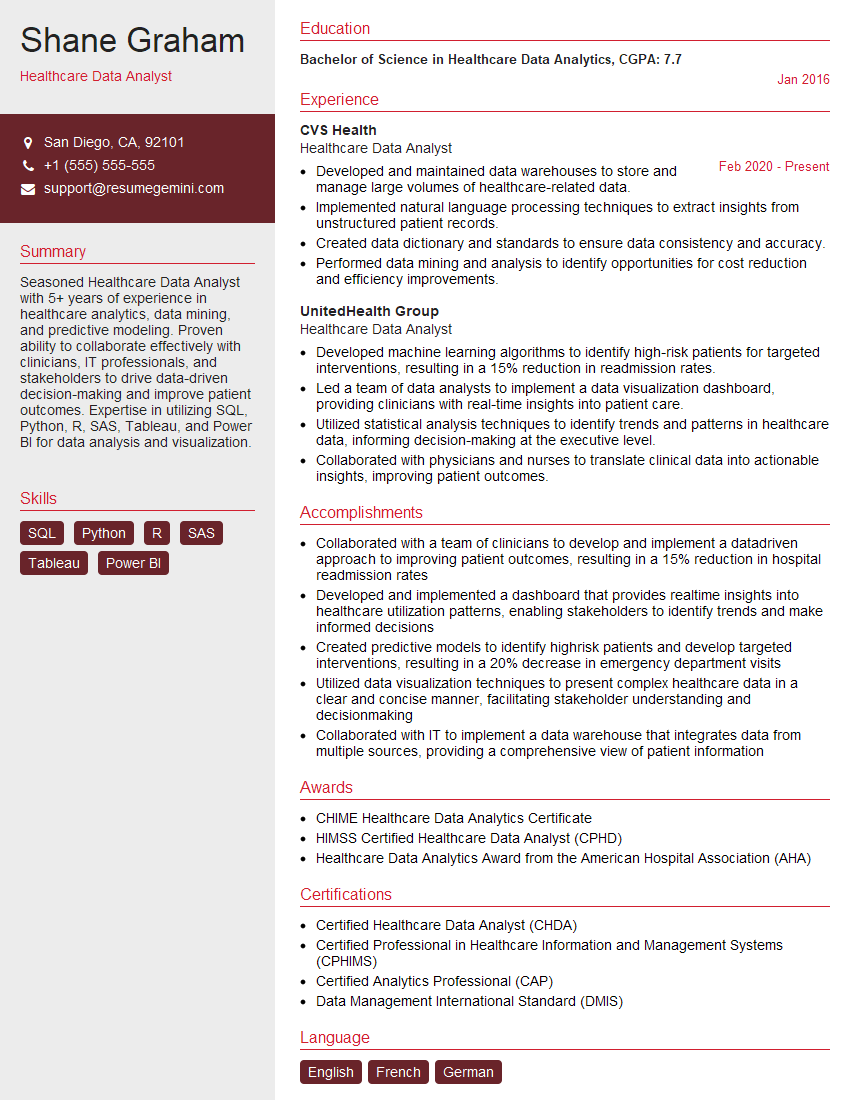

Mastering Verify Insurance Information and Coding skills significantly enhances your marketability and opens doors to rewarding careers in healthcare administration and insurance processing. A strong understanding of these concepts demonstrates professionalism, attention to detail, and a commitment to accuracy – highly valued qualities in this field. To maximize your job prospects, focus on crafting an ATS-friendly resume that highlights your skills and experience effectively. ResumeGemini is a trusted resource that can help you build a professional and impactful resume. Examples of resumes tailored to Verify Insurance Information and Coding are available to guide you through the process.

Explore more articles

Users Rating of Our Blogs

Share Your Experience

We value your feedback! Please rate our content and share your thoughts (optional).

What Readers Say About Our Blog

hello,

Our consultant firm based in the USA and our client are interested in your products.

Could you provide your company brochure and respond from your official email id (if different from the current in use), so i can send you the client’s requirement.

Payment before production.

I await your answer.

Regards,

MrSmith

hello,

Our consultant firm based in the USA and our client are interested in your products.

Could you provide your company brochure and respond from your official email id (if different from the current in use), so i can send you the client’s requirement.

Payment before production.

I await your answer.

Regards,

MrSmith

These apartments are so amazing, posting them online would break the algorithm.

https://bit.ly/Lovely2BedsApartmentHudsonYards

Reach out at [email protected] and let’s get started!

Take a look at this stunning 2-bedroom apartment perfectly situated NYC’s coveted Hudson Yards!

https://bit.ly/Lovely2BedsApartmentHudsonYards

Live Rent Free!

https://bit.ly/LiveRentFREE

Interesting Article, I liked the depth of knowledge you’ve shared.

Helpful, thanks for sharing.

Hi, I represent a social media marketing agency and liked your blog

Hi, I represent an SEO company that specialises in getting you AI citations and higher rankings on Google. I’d like to offer you a 100% free SEO audit for your website. Would you be interested?